Are you feeling overwhelmed by tax arrears? You're not alone, and the good news is there are ways to manage your situation effectively. In this article, we'll explore how to craft a compelling letter proposing a payment plan that addresses your tax debt while keeping your finances on track. So, let's dive in and discover how you can take control of your tax situation today!

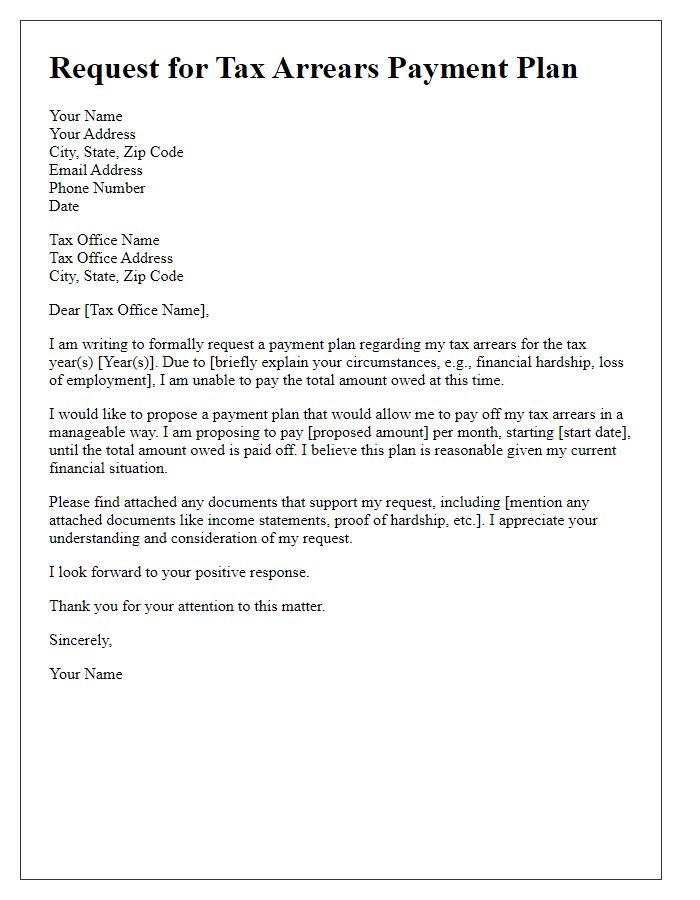

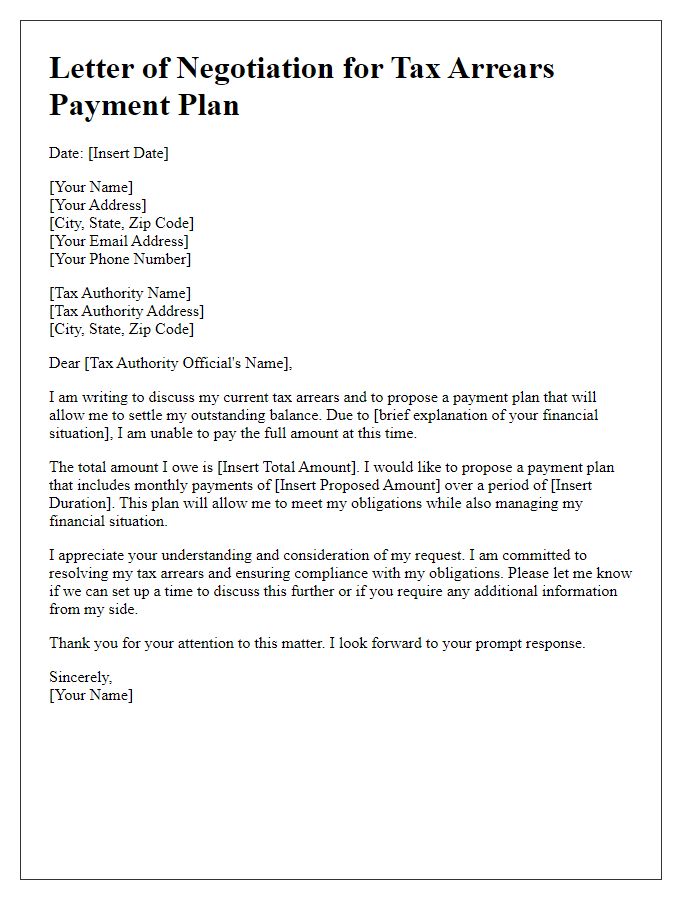

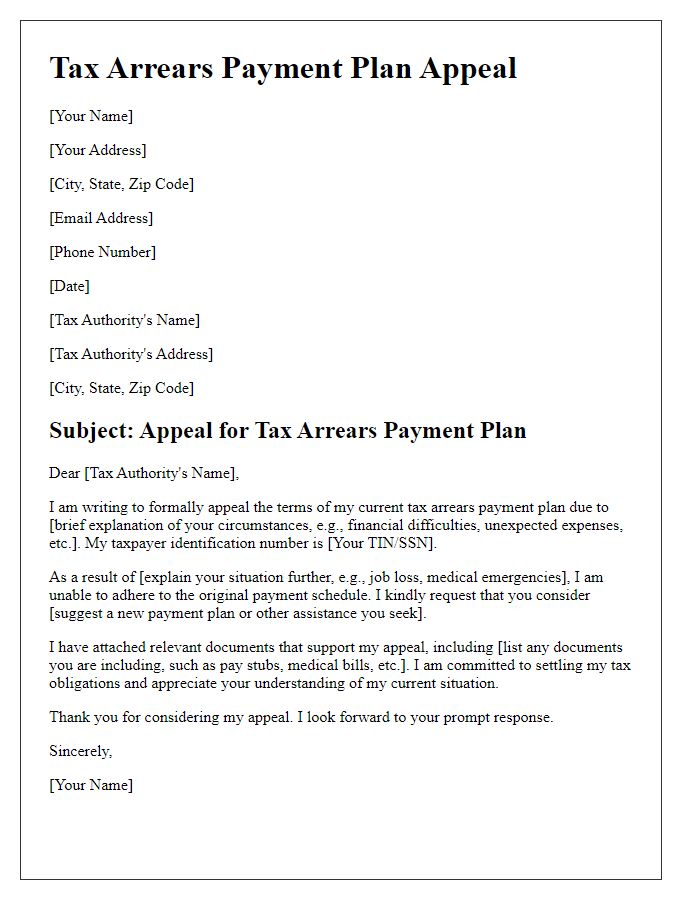

Taxpayer Information

A tax arrears payment plan proposal is a formal request from individuals or businesses facing difficulties in settling their outstanding tax obligations to a governmental tax authority, such as the Internal Revenue Service (IRS) in the United States. This proposal typically includes essential taxpayer information like the individual's full name, tax identification number (such as a Social Security Number or Employer Identification Number), and contact information, including a current address and phone number. Additionally, the taxpayer may need to provide detailed information regarding their current financial situation, including income, expenses, and any extenuating circumstances that have contributed to their financial difficulties. Providing this comprehensive information helps the tax authority assess the taxpayer's ability to repay the owed amount and determine a feasible payment plan tailored to their financial circumstances.

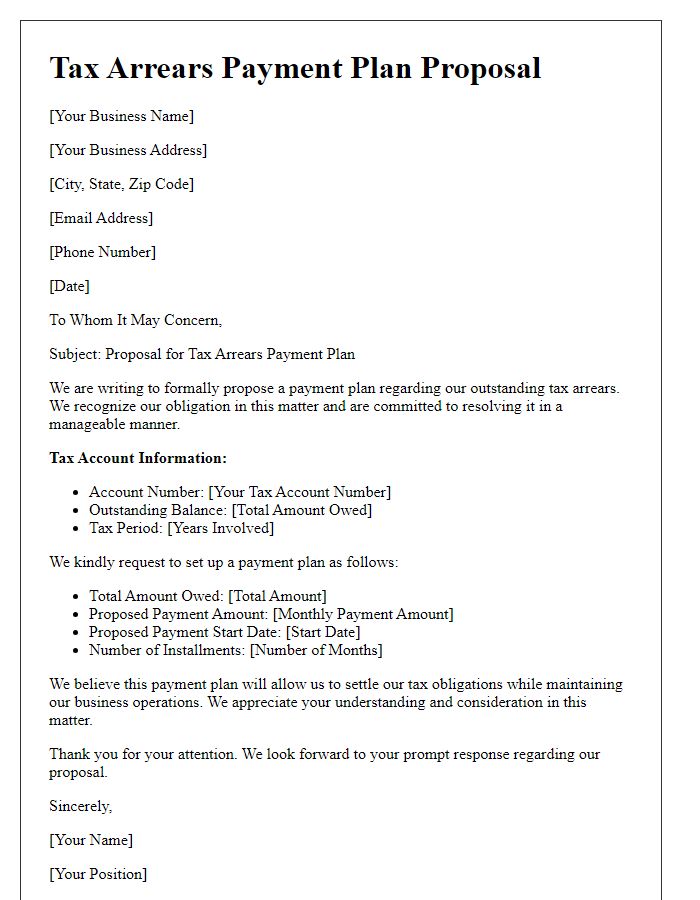

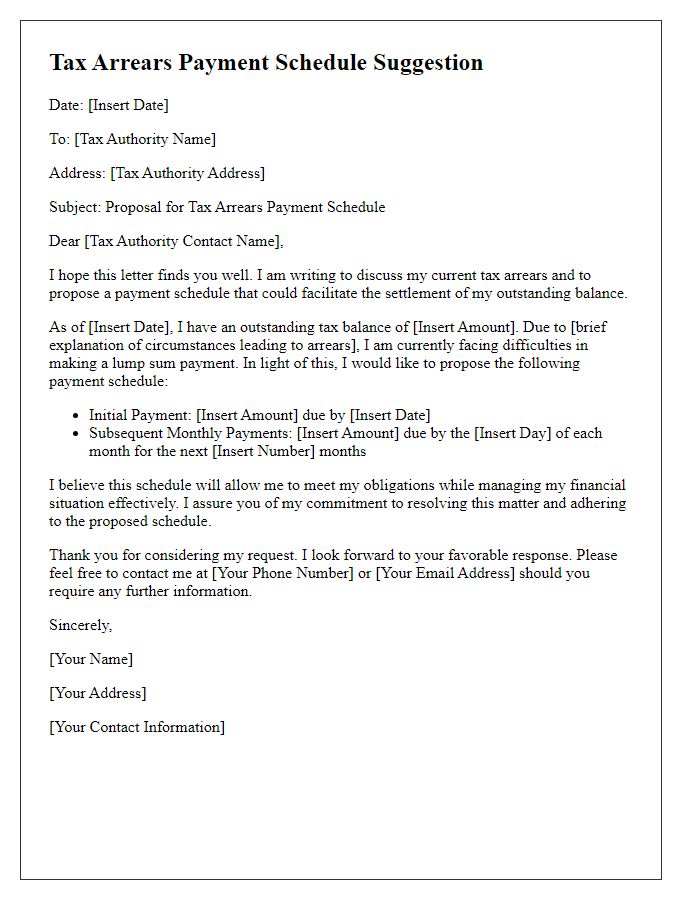

Tax Debt Details

Tax debts can accumulate rapidly, often exceeding thousands of dollars without timely payments. Tax Installment Agreements (IAs) usually grant taxpayers extended timelines to settle debts, potentially spanning several months or years. The Internal Revenue Service (IRS) typically allows payments as low as $25 per month, depending on total liability and financial status. For example, a tax debt of $10,000 might involve a 24-month plan, resulting in monthly payments of approximately $416. Applicable interest and penalties can increase the total owed, making it crucial to communicate clearly with the taxing authority, such as the IRS or local tax offices. Documentation, including recent income statements and expense records, plays a vital role in negotiating payment terms and ensuring compliance with regulations.

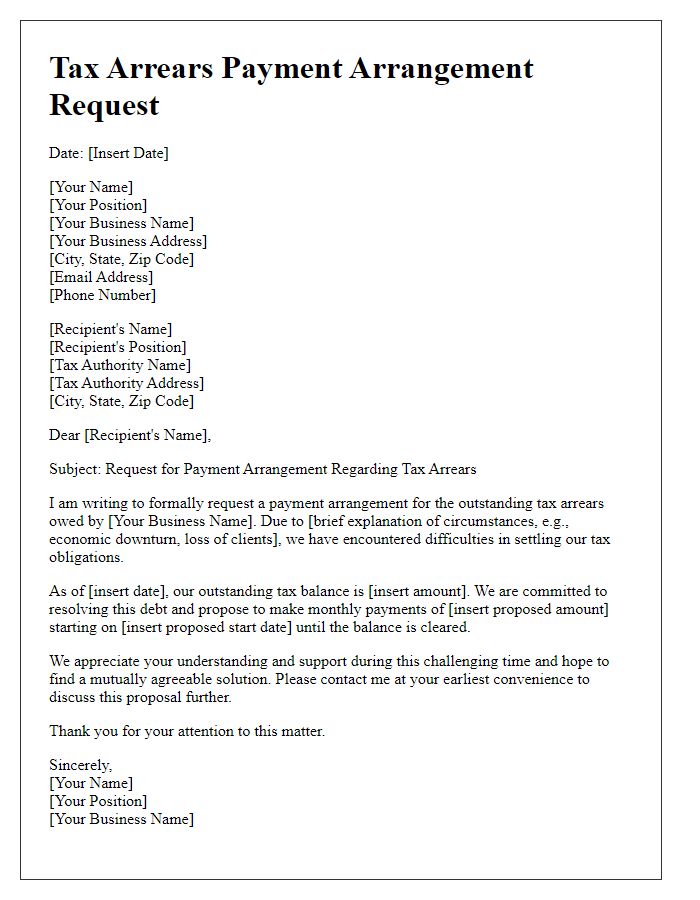

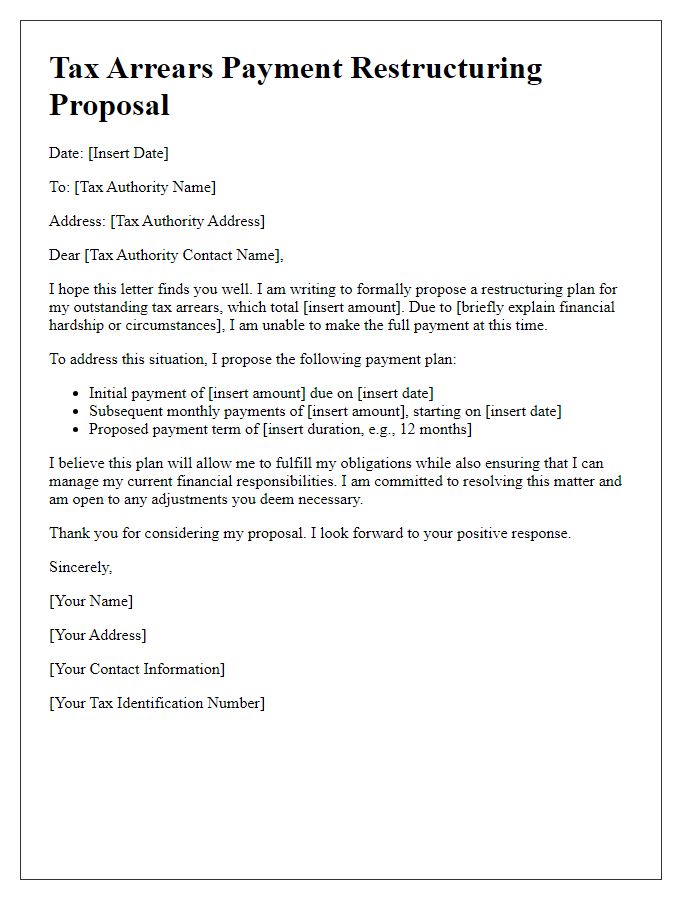

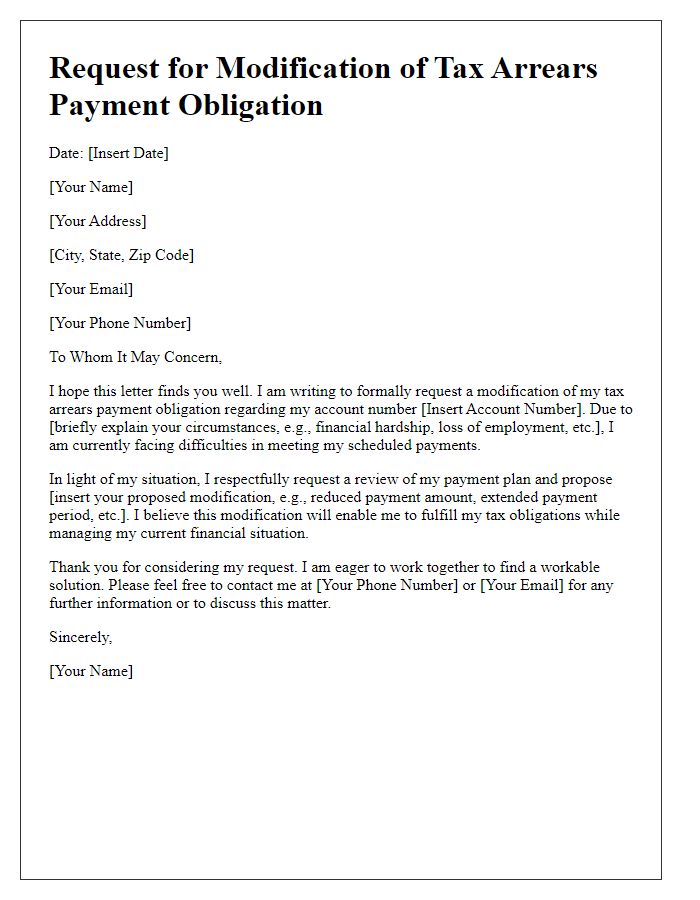

Proposed Payment Plan Terms

A proposed payment plan for tax arrears outlines structured terms to resolve outstanding tax liabilities. Specific monthly payments are determined based on the total amount owed, income level, and cost of living factors. The length of the payment plan can range from 12 to 60 months, allowing for flexibility. Key terms often include an initial payment made upon agreement, followed by consistent monthly installments. Additionally, a clause detailing potential penalties or interest on late payments provides a clear understanding of consequences. Documenting each term is essential for compliance and accountability with tax authorities, such as the Internal Revenue Service (IRS) in the United States or local government agencies.

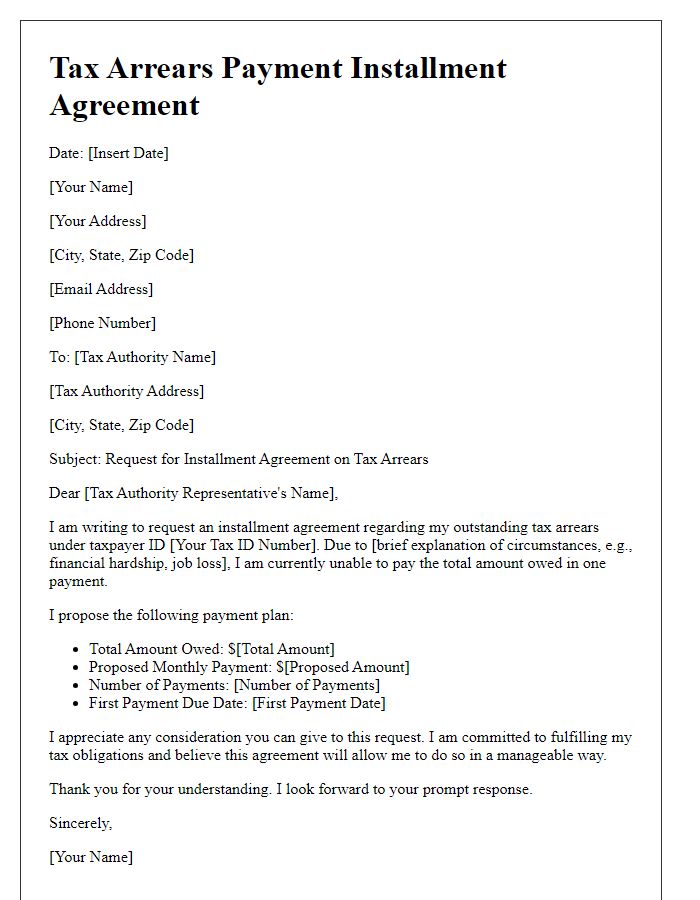

Justification of Proposal

A tax arrears payment plan proposal aims to address outstanding liabilities owed to revenue authorities, specifically local, state, or federal agencies. The justification for this proposal stems from the financial impact of historical events, such as the 2020 global pandemic, which has significantly disrupted economic stability for many individuals and businesses. High unemployment rates, peaking at 14.8% in April 2020 in the United States, have resulted in decreased disposable income for taxpayers. The proposal outlines a structured repayment plan that could involve monthly installments over a specified duration, accommodating the financial constraints faced by taxpayers. Additionally, the plan may incorporate interest rate reductions or penalties mitigations, which could incentivize prompt compliance and ultimately enhance the overall revenue collection for the government. This approach promotes fiscal responsibility while ensuring that taxpayers are not overwhelmed, contributing to recovery efforts in post-pandemic economies.

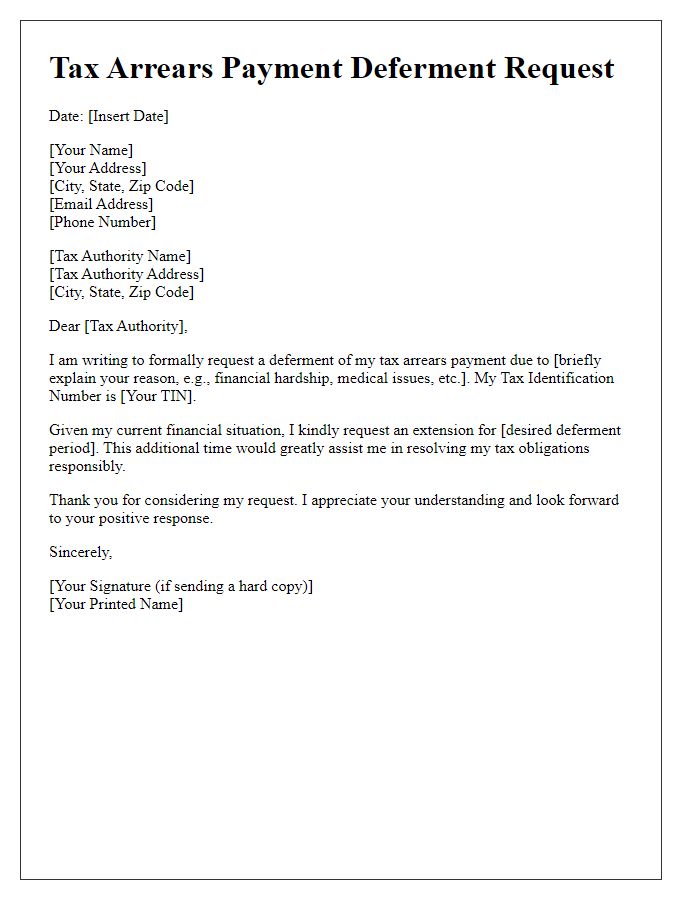

Contact Information

Proposing a tax arrears payment plan requires highlighting crucial details. Effective communication is essential to ensure clarity. Key components include full name, physical address, email address, and phone number. Identifying the tax authority, such as the Internal Revenue Service (IRS) in the United States, adds context. Specifying the amount owed, including penalties and interest accrued over time, emphasizes the seriousness of the situation. Including relevant tax identification numbers (such as Social Security Number or Employer Identification Number) ensures that the proposal is easily associated with the correct account. Finally, detailing proposed payment amounts, frequency, and duration conveys a structured approach to resolving the debt.

Comments