If you're feeling the weight of unexpected tax penalties, you're not alone. Many individuals find themselves in similar situations, whether due to missed deadlines or unforeseen circumstances. Fortunately, there's a possibility to appeal for a waiver, and a well-crafted letter can make all the difference. Read on to discover how to effectively communicate your request and increase your chances of success!

Formal Salutation

Tax penalties can impose significant financial burdens on individuals and businesses, often stemming from late payments or filing errors. For example, the Internal Revenue Service (IRS) in the United States may impose penalties of up to 25% on unpaid taxes. Taxpayers often seek waivers for these penalties under specific provisions, such as first-time penalty abatement, which allows eligible individuals a one-time opportunity to eliminate penalties due to a clean compliance history. Additionally, state tax authorities, like the California Franchise Tax Board, have their own regulations and guidelines for penalty waiver requests, which vary across jurisdictions. Effective documentation of circumstances, including financial hardship or administrative errors, is essential for a successful appeal process.

Clear Subject Line

Tax penalties can create unexpected financial burdens for individuals and businesses. In situations where taxpayers experience genuine hardship or misunderstanding of tax obligations, seeking a waiver can provide relief. Engaging with the Internal Revenue Service (IRS) or local tax authorities may involve submitting a formal request. This request should detail specific circumstances such as unexpected medical expenses, natural disasters impacting income, or lack of awareness regarding filing deadlines. Providing supporting documentation, like medical bills or financial records from significant events, strengthens the case for waiver consideration. A clear and concise approach in the request can increase the likelihood of a favorable response from tax officials.

Detailed Explanation of Circumstances

When seeking a waiver for tax penalties, individuals may find themselves in challenging situations such as unforeseen medical emergencies, natural disasters, or significant financial hardship, which can impede timely tax payments. For instance, the devastating impact of Hurricane Katrina in 2005 caused immense disruption, leading to delayed filing for many residents in New Orleans. The Internal Revenue Service (IRS) offers penalty relief policies applicable in specific circumstances, including First Time Abate (FTA) for taxpayers with a clean compliance history, allowing relief from certain penalties. Key documentation such as medical records, legal notices, or disaster declarations strengthens the case for consideration by tax authorities, ensuring a comprehensive understanding of the taxpayer's exceptional situation. In essence, effectively communicating the unique challenges faced and providing supporting evidence is crucial in persuading tax authorities to grant relief from penalties.

Polite Request for Penalty Waiver

Numerous taxpayers occasionally encounter situations that lead to unexpected tax penalties, particularly in the United States, where the Internal Revenue Service (IRS) imposes fines for late payments or non-filing. For instance, penalties can reach 5% of unpaid taxes per month, with a maximum of 25%. Taxpayers might seek a waiver of these penalties as a remedy for honest mistakes, serious illness, or unexpected hardships, illustrating the importance of maintaining open communication channels with tax authorities. A well-articulated request for consideration can potentially provide relief, especially when accompanied by supporting documents showing evidence of the mitigating circumstances. Taxpayers should ensure their account is up to date and demonstrate a history of compliance to strengthen their appeal, thereby increasing the chances of a favorable response.

Supporting Documentation Mention

Tax penalty waivers can greatly alleviate financial burdens for individuals and businesses facing challenges. In cases like this, taxpayers must provide supporting documentation, such as proof of timely payments, notice of financial hardships, or evidence of extenuating circumstances. Important documents may include tax returns, payment history statements, and correspondence from tax authorities like the Internal Revenue Service (IRS). Clear communication of reasons for the request, such as medical emergencies or natural disasters, can enhance the credibility of the appeal. Accuracy in detail submission aids in the review process and may increase the likelihood of a favorable outcome.

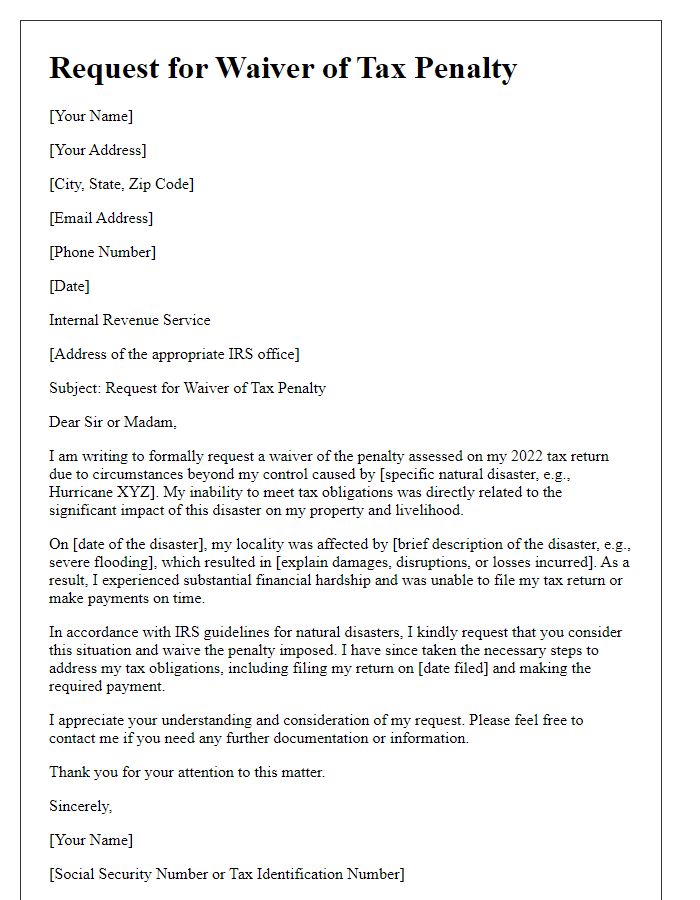

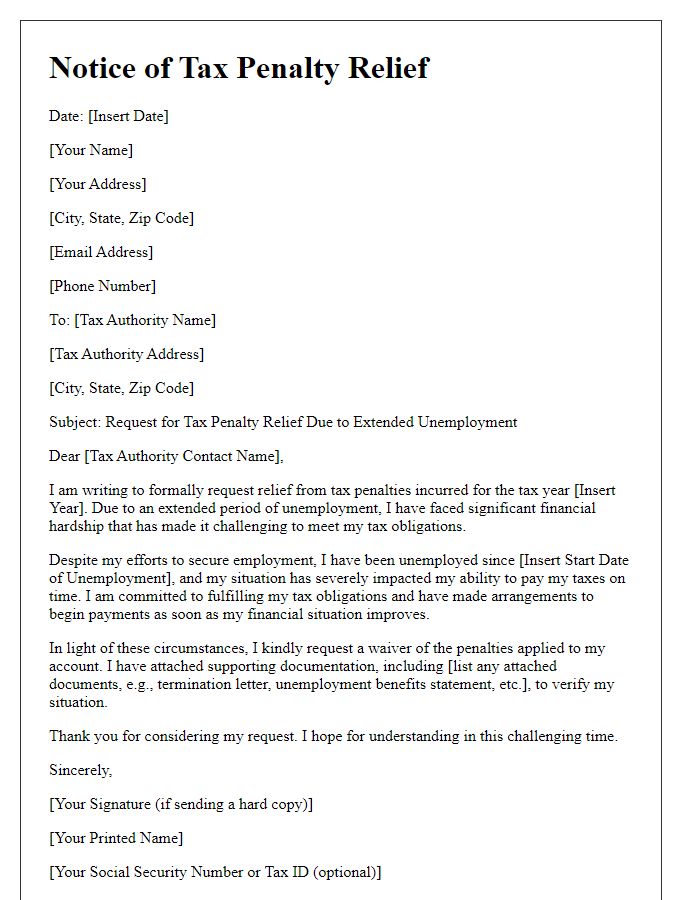

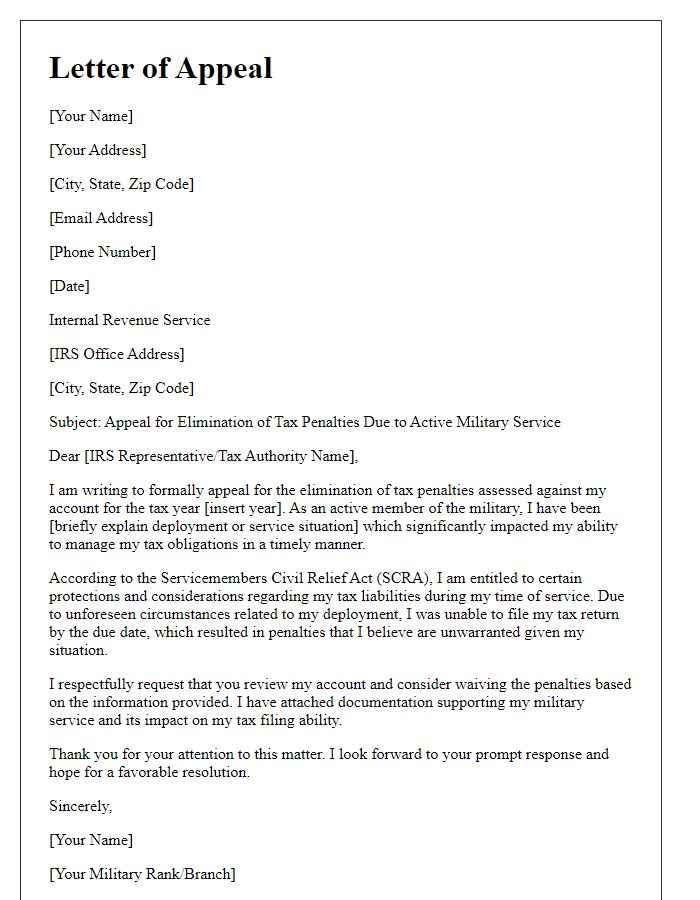

Letter Template For Request To Waive Tax Penalties Samples

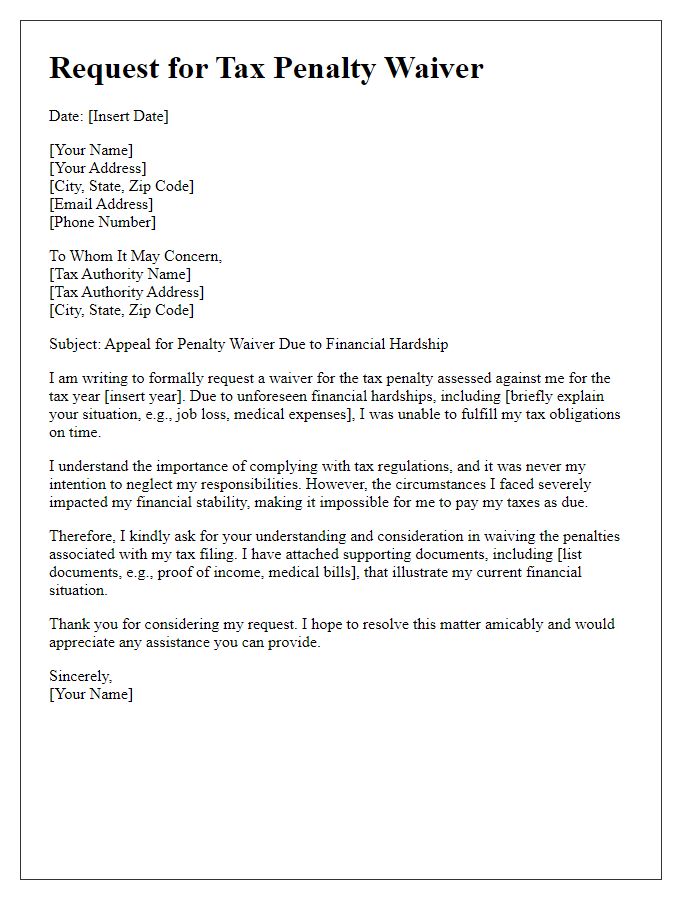

Letter template of appeal for tax penalty waiver due to financial hardship

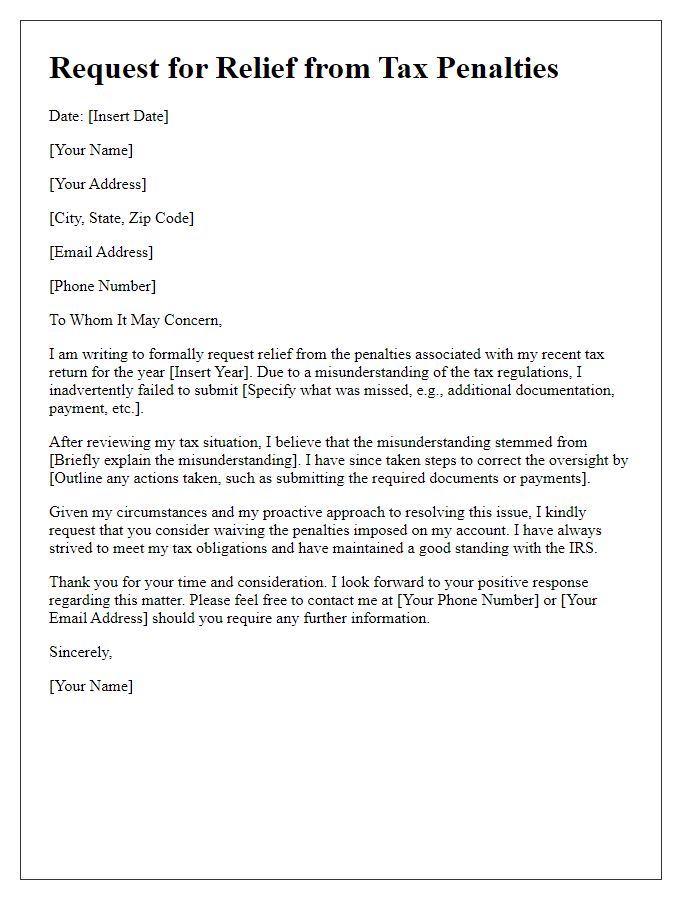

Letter template of request for relief from tax penalties based on misunderstanding

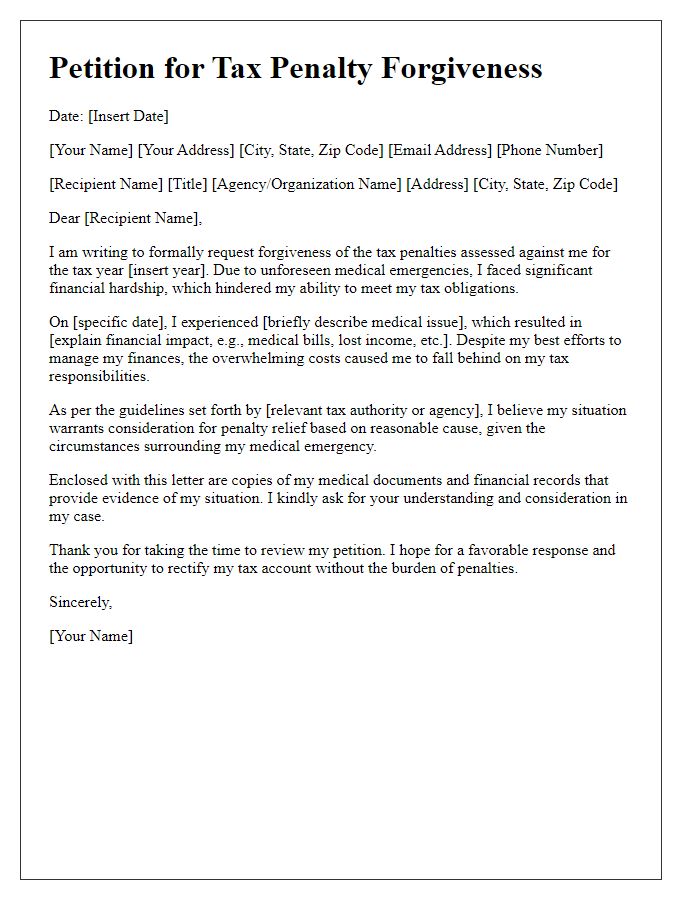

Letter template of petition for tax penalty forgiveness due to medical emergencies

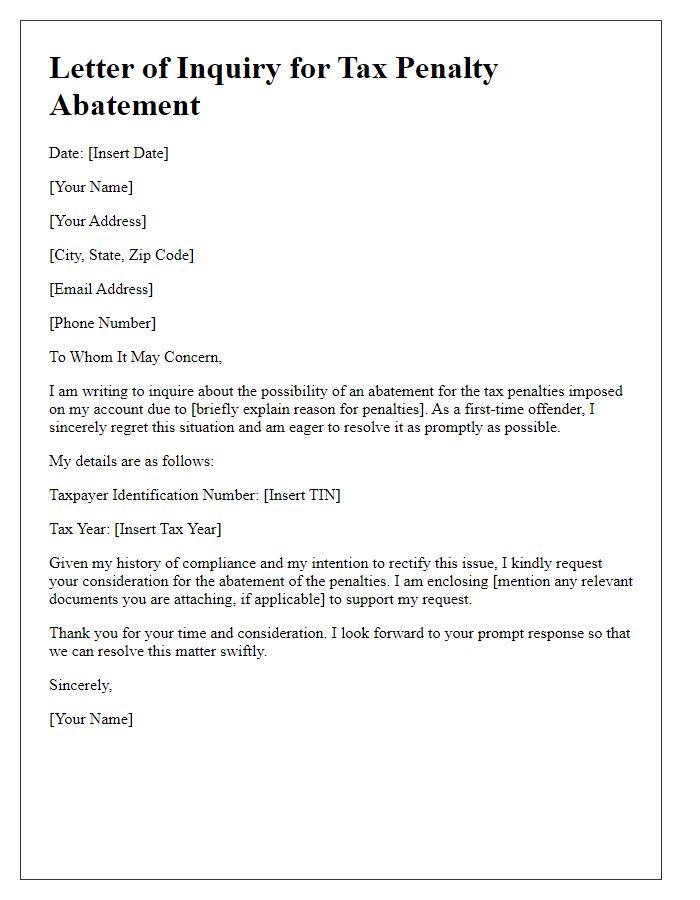

Letter template of inquiry for tax penalty abatement for first-time offenders

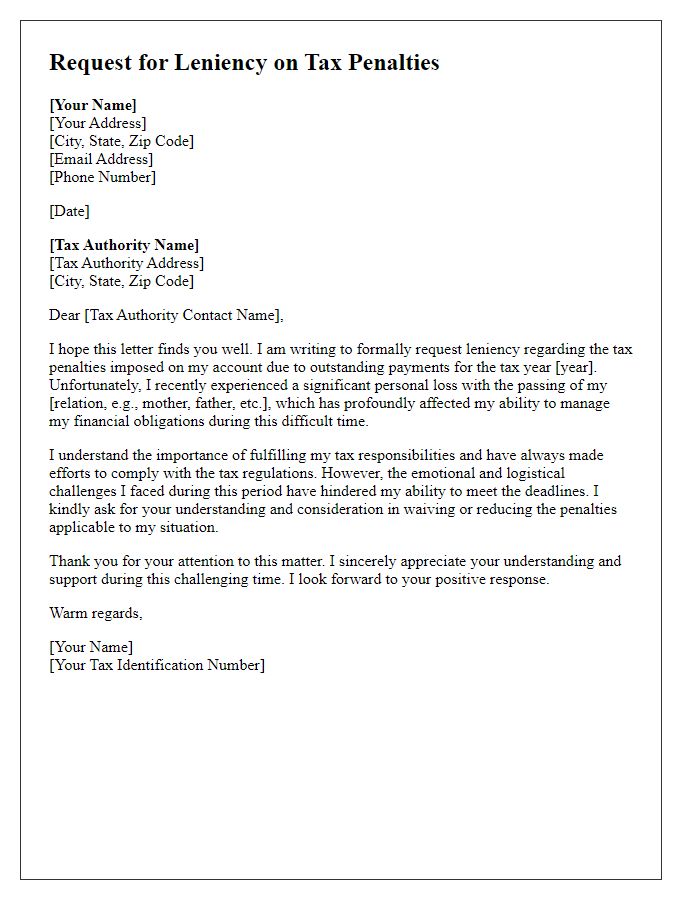

Letter template of request for leniency on tax penalties due to bereavement

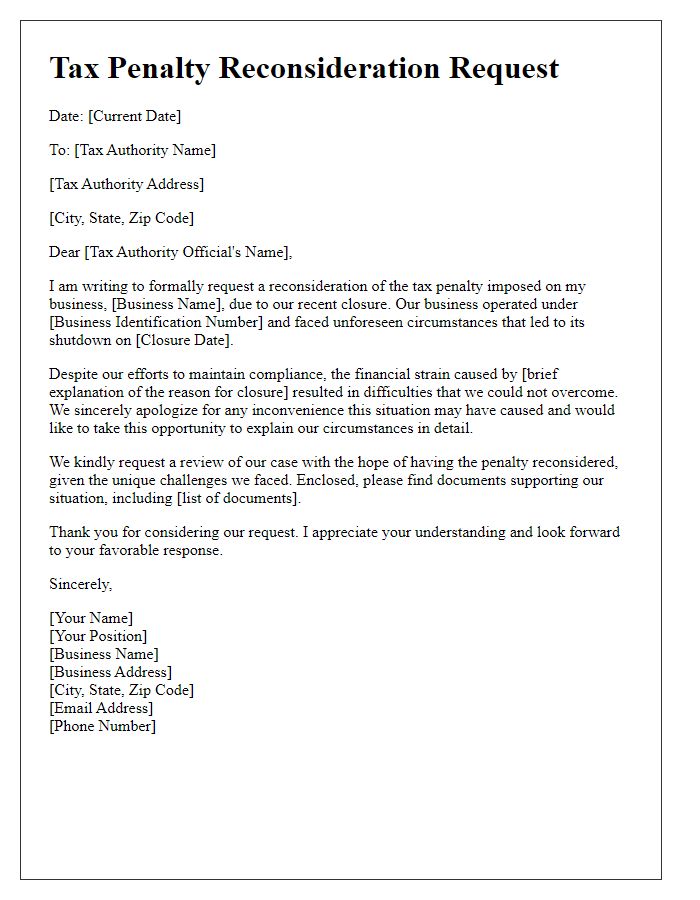

Letter template of submission for tax penalty reconsideration for business closure

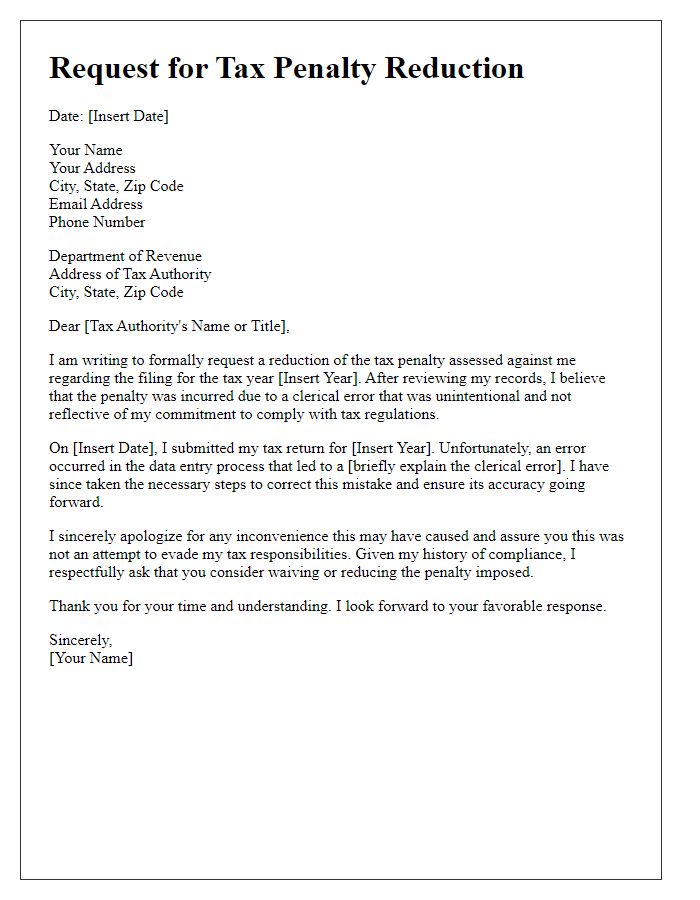

Letter template of argument for tax penalty reduction due to clerical error

Letter template of explanation for tax penalty waiving request citing natural disaster

Letter template of notice for tax penalty relief due to extended unemployment

Comments