Navigating the complexities of foreign tax credits can feel overwhelming, especially when it comes to the necessary documentation. This letter template simplifies the process, ensuring you provide the right information to claim the credits you deserve. By clarifying your financial situation and detailing your foreign income, you can make your tax filing smoother and more efficient. Ready to tackle your foreign tax credit documentation with confidence? Keep reading to discover how this template can help!

Taxpayer Identification Information

Taxpayer identification information plays a crucial role in the foreign tax credit documentation process. This includes details such as the Taxpayer Identification Number (TIN), a unique nine-digit number assigned by the Internal Revenue Service (IRS) used for tracking tax obligations in the United States. Additionally, individuals must include their full legal name as it appears on the tax return along with their address, which can be a residential or mailing address. For entities, such as corporations or partnerships, including the Employer Identification Number (EIN) is critical for proper identification. Accurate taxpayer identification is essential for ensuring compliance with IRS regulations and facilitating the credit process for taxes paid to foreign governments.

Detailed Foreign Income Report

A detailed foreign income report is essential for individuals seeking to claim the Foreign Tax Credit (FTC), which mitigates the risk of double taxation on overseas earnings. This report must include specific financial documents such as foreign bank statements, tax returns from countries like Canada or Germany, and income statements detailing wages, dividends, or rental income exceeding $600. Accurate reporting of foreign income sources is crucial; for instance, income from sources in Brazil must adhere to their local currency regulations and converted accurately to USD at the prevailing exchange rate for the tax year. Compliance with IRS Form 1116 guidelines ensures correct calculation of foreign taxes paid and eligibility for the credit. Additionally, supporting documents should include a summary spreadsheet outlining total foreign income, taxes paid, and dates for transparency and verification during tax assessment.

Foreign Taxes Paid Documentation

Foreign tax credit documentation is essential for individuals and businesses claiming a credit for taxes paid to foreign governments. This process involves submitting detailed records of foreign income taxes, such as withholding tax from dividends or interest earned in countries like Canada or Germany. To illustrate, individuals must maintain accurate documentation confirming payments, which usually includes bank statements and tax forms from the foreign government, indicating the amount of tax withheld (often around 15-30% depending on treaties). These records are vital for claims on IRS Form 1116, as they provide proof of taxes paid and help determine eligibility for potential tax credits, ultimately reducing U.S. tax liability and promoting compliance with foreign tax obligations.

Credit Calculation Methodology

A foreign tax credit enables taxpayers to reduce their U.S. tax liability based on taxes paid to foreign governments, preventing double taxation on income. The credit calculation methodology includes systematic steps, beginning with reporting total foreign income, which may include wages, dividends, or interest earned, often listed on tax forms like Schedule 1 and Form 1116. Taxpayers must determine qualifying foreign taxes (for instance, income taxes paid to countries such as Canada or Germany) that may be deducted, ensuring compliance with IRS regulations established in the Tax Cuts and Jobs Act of 2017. The next step involves calculating the allowable credit, which is limited to the proportion of foreign income relative to total income, using a three-part formula based on the taxpayer's specific income brackets. Documentation, such as tax receipts from foreign governments, income statements, and conversion rates (potentially fluctuating daily based on the forex market), is crucial for substantiating claims, aiding in audit protection, and ensuring accurate reporting.

Compliance with Tax Regulations

In the realm of international finance, maintaining compliance with tax regulations is essential for individuals and corporations participating in cross-border activities. The Foreign Tax Credit (FTC) enables taxpayers to reduce double taxation on income earned in foreign jurisdictions, such as Germany or Japan, by allowing a credit for taxes paid to foreign governments on that income. Taxpayers must diligently gather documentation, including Form 1116 for individuals or Form 1118 for corporations, along with proof of foreign taxes paid, such as tax receipts or withholding statements. The IRS requires accurate reporting and substantiation to ensure eligibility for the credit while adhering to regulations outlined in the Internal Revenue Code. Due diligence on record-keeping and timely filing is crucial, given the significant penalties associated with non-compliance, which can involve fines or increased scrutiny during audits.

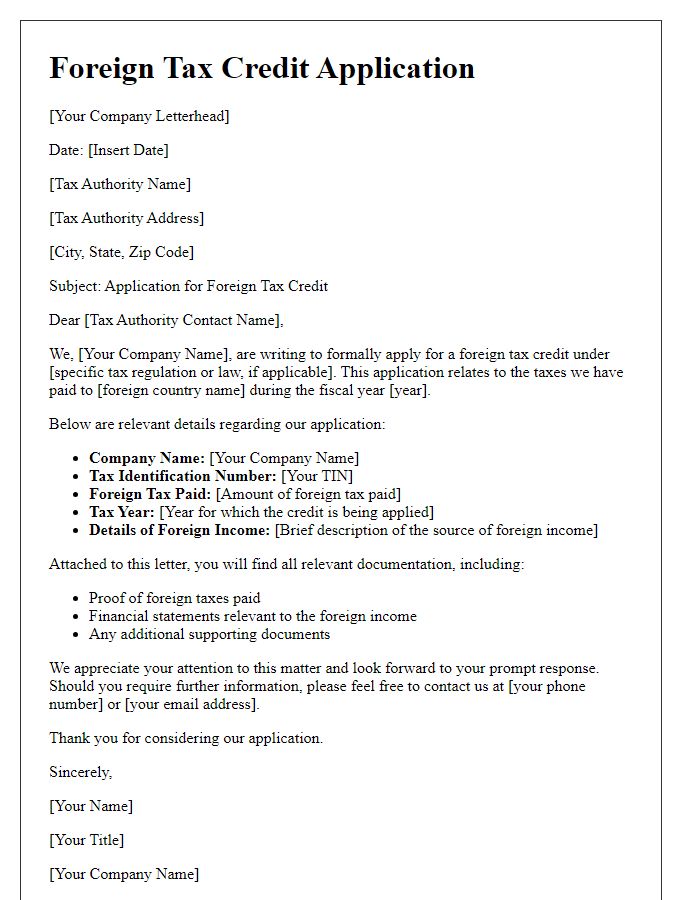

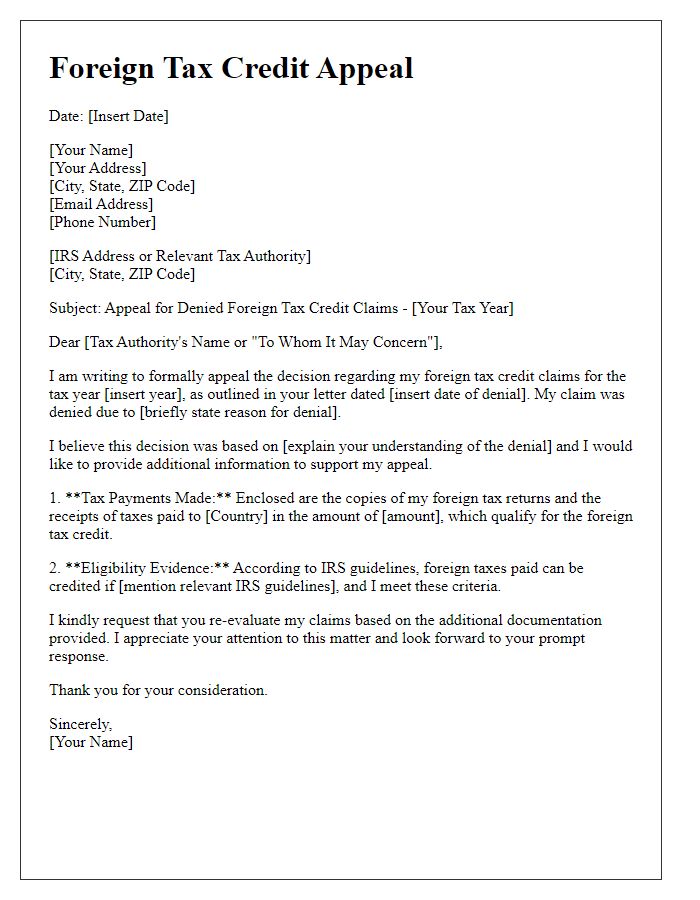

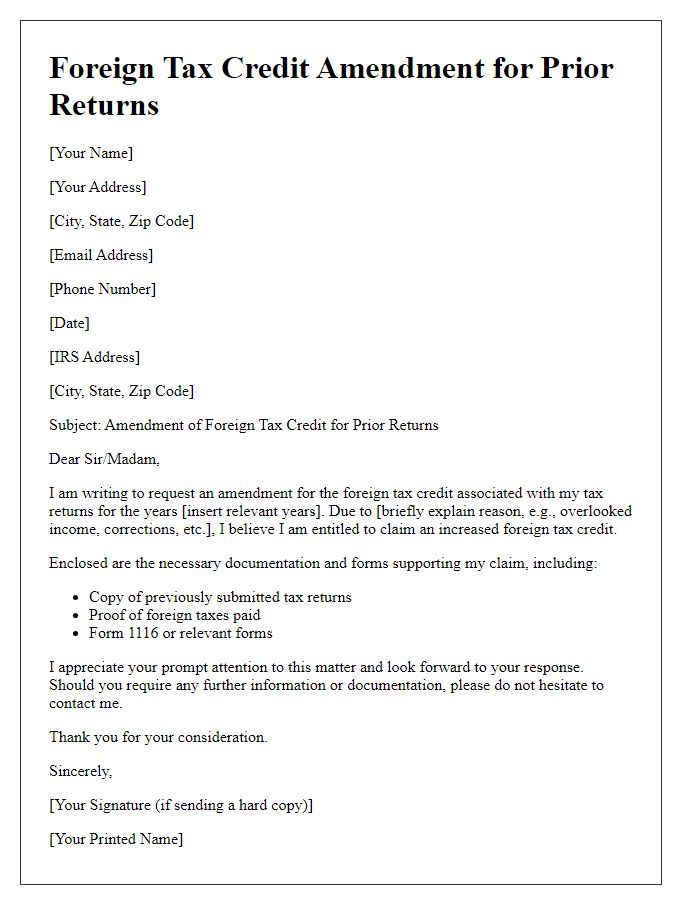

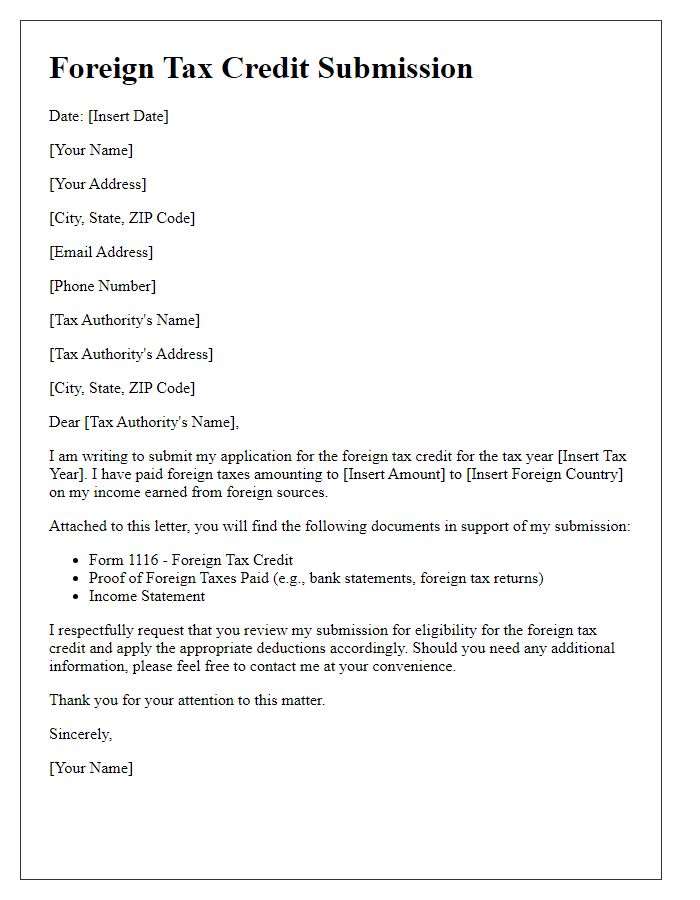

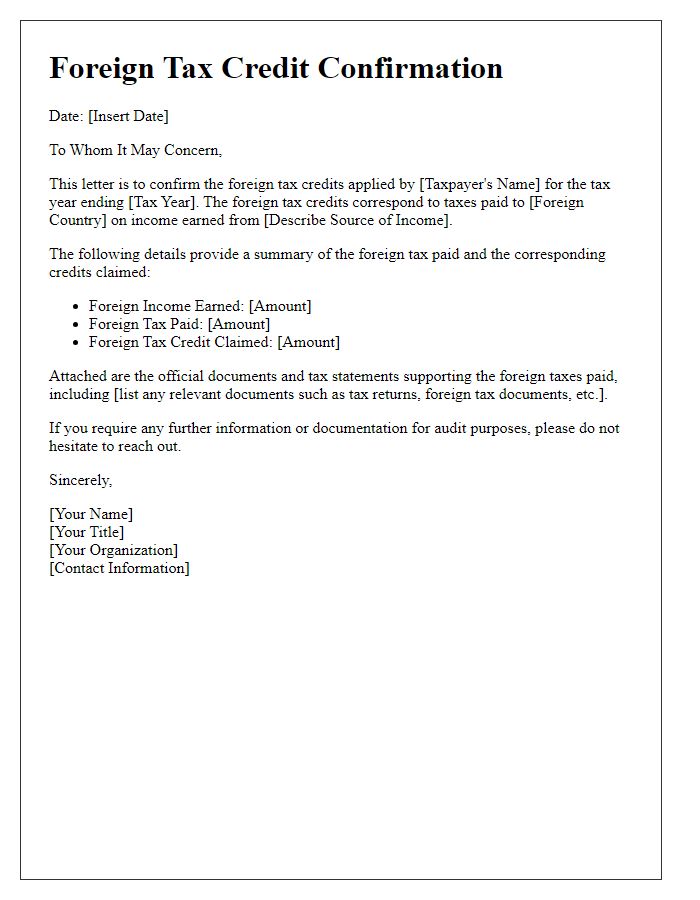

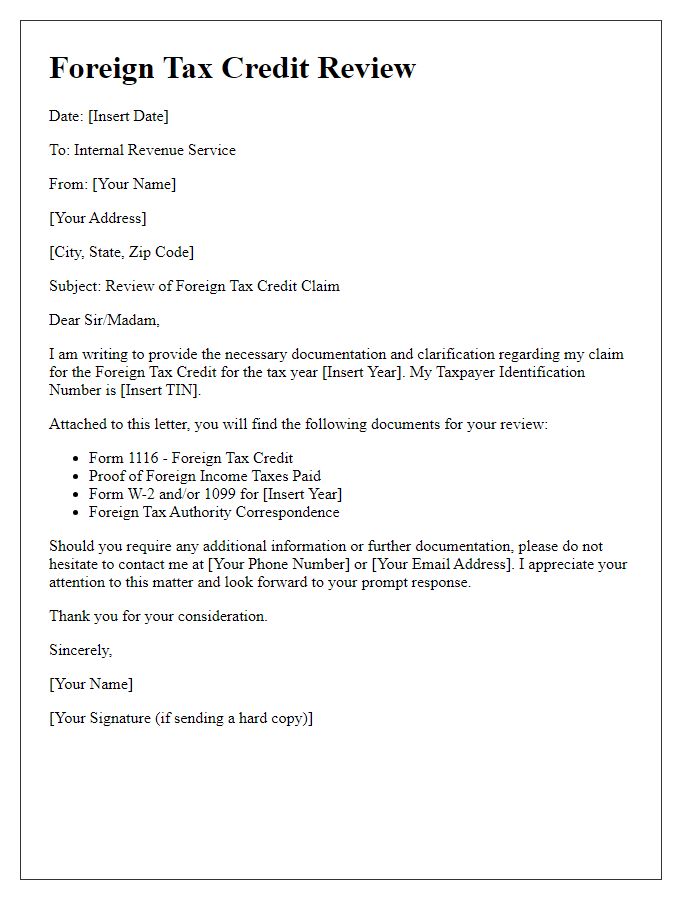

Letter Template For Foreign Tax Credit Documentation Samples

Letter template of foreign tax credit inquiry for additional documentation.

Letter template of foreign tax credit explanation for reporting purposes.

Letter template of foreign tax credit clarification for tax professionals.

Comments