Are you navigating the often intricate process of appealing a corporate tax refund? It can feel overwhelming, but you're not alone in this journey. In this article, we'll break down the essential steps and provide you with a comprehensive letter template to simplify your submission. So, grab a cup of coffee and let's dive deeper into how you can successfully submit your corporate tax refund appeal!

Clear Subject Line

The corporate tax refund appeal process involves submitting a structured document to the appropriate tax authority, including details regarding the company's financial position. The appeal should clearly state the refund amount, which can be substantial, indicating the specific tax year (e.g., 2021) in question. In addition, relevant supporting documentation, such as previous tax returns, adjusted financial statements, and evidence of overpayment (which may include receipts and bank statements), must be included. The company must ensure that the appeal is submitted within the statutory time limits, typically ranging from 30 to 90 days following the denial of the initial refund request. Accurate completion of forms and precise adherence to guidelines provided by the tax authority, such as the Internal Revenue Service in the United States, is crucial for a successful appeal outcome.

Company Details and Tax Identification

A corporate tax refund appeal submission requires meticulous documentation and accurate presentation of company details. Essential elements include the company's legal name, registered address, and Tax Identification Number (TIN) to ensure correct identification in governmental records. Accurate record-keeping influences refund evaluation, aligned with local regulations from the Internal Revenue Service (IRS) or relevant tax authority, which govern corporate tax expenditures and entitlements. Furthermore, inclusion of specific tax periods in question and supporting financial documents, such as previously filed tax returns and refund request forms, enhances the appeal's credibility. Effective communication of these components facilitates the prompt processing of the tax refund inquiry.

Specific Tax Period and Amount

Corporate tax refund appeals require precision and clarity in communication. Each submission must include critical details such as the specific tax period, typically defined by the filing dates and relevant tax codes, and the exact amount being contested for refund, which should reference prior payment records. The appeal should address the taxing authority, ensuring to include the company's unique identification number (such as EIN in the United States), clearly marking the subject of the appeal. Supporting documentation, such as filed tax returns for that specific period, payment receipts, and correspondence with tax professionals, should accompany the appeal to substantiate the claim. Moreover, factual errors made by the tax authority, discrepancies identified during audits, and changes in tax legislation should be emphasized to strengthen the case for a refund. This methodical approach enhances the possibility of favorable outcomes in refund requests.

Reason for Refund Appeal

Filing a corporate tax refund appeal requires clear articulation of the reasons for the appeal submission. When a corporation, such as XYZ Corp based in New York City, seeks a refund from the Internal Revenue Service (IRS), it often cites specific grounds including overpayment, miscalculation of deductions, or eligibility for tax credits. For instance, discrepancies in reported income from 2022 may reveal that XYZ Corp overpaid by $50,000 due to an erroneous calculation of allowable business expenses. Additionally, if new information, such as a federal tax credit for renewable energy investments, becomes available post-filing, it can further substantiate the refund appeal. Precise documentation, including amended returns and supplementary financial statements, will bolster the legitimacy of the claim, ensuring that the IRS comprehensively reviews the request for a corporate tax refund.

Supporting Documentation List

The corporate tax refund appeal submission requires a comprehensive list of supporting documentation to substantiate the claim. Essential items include the original filed tax returns (Form 1120 for corporations), detailing the financial performance over the fiscal year, and any amended returns that highlight adjustments made to calculations. Invoices and receipts related to deductible expenses must be included, offering proof of outflows that reduce taxable income. It is crucial to provide records of payments made to the IRS, including canceled checks or bank statements, demonstrating the amounts already remitted. Relevant correspondence with the tax authority relating to previous inquiries or assessments should also be attached, which might elucidate the reasons for the refund request. Finally, any legal documents or court rulings (if applicable) that bear on the tax dispute should accompany the submission, ensuring a robust appeal that stands up to scrutiny.

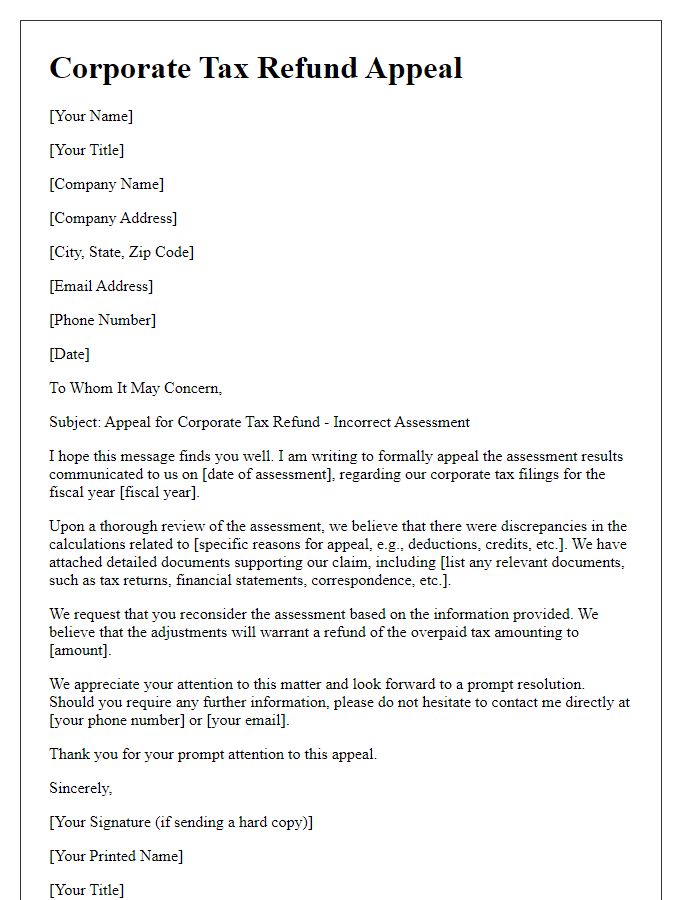

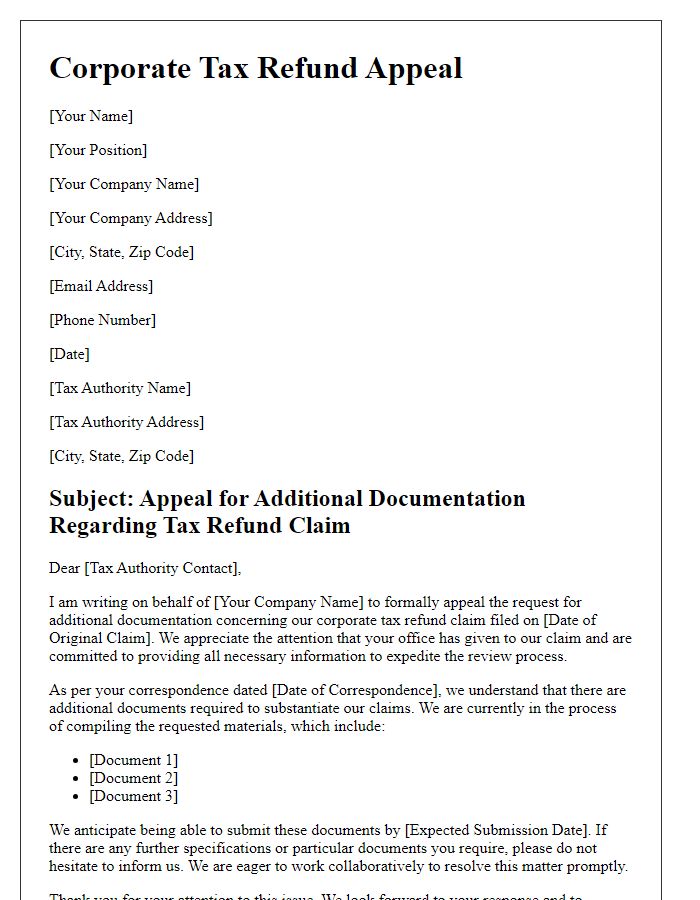

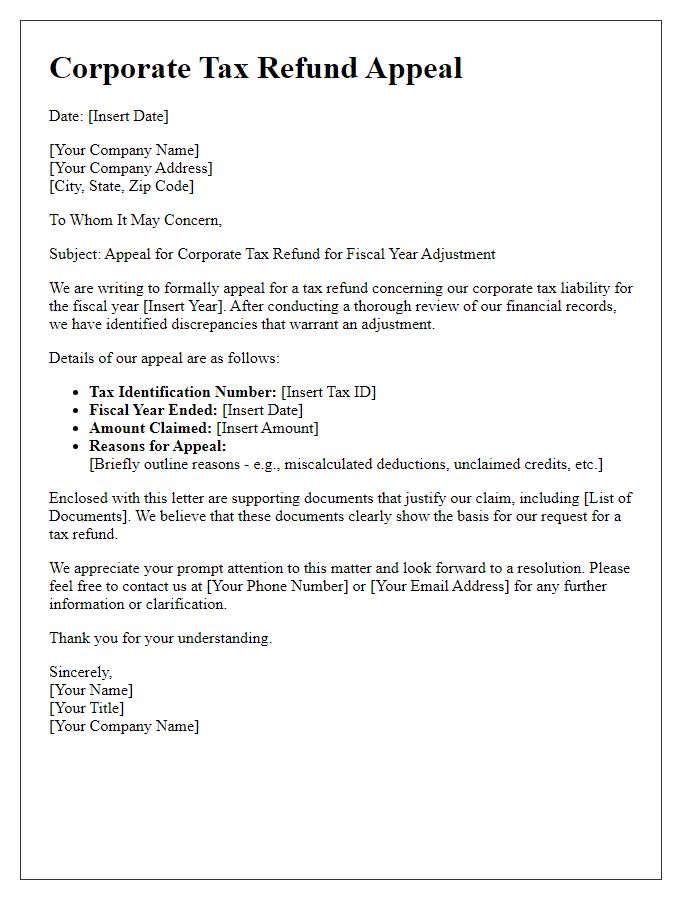

Letter Template For Corporate Tax Refund Appeal Submission Samples

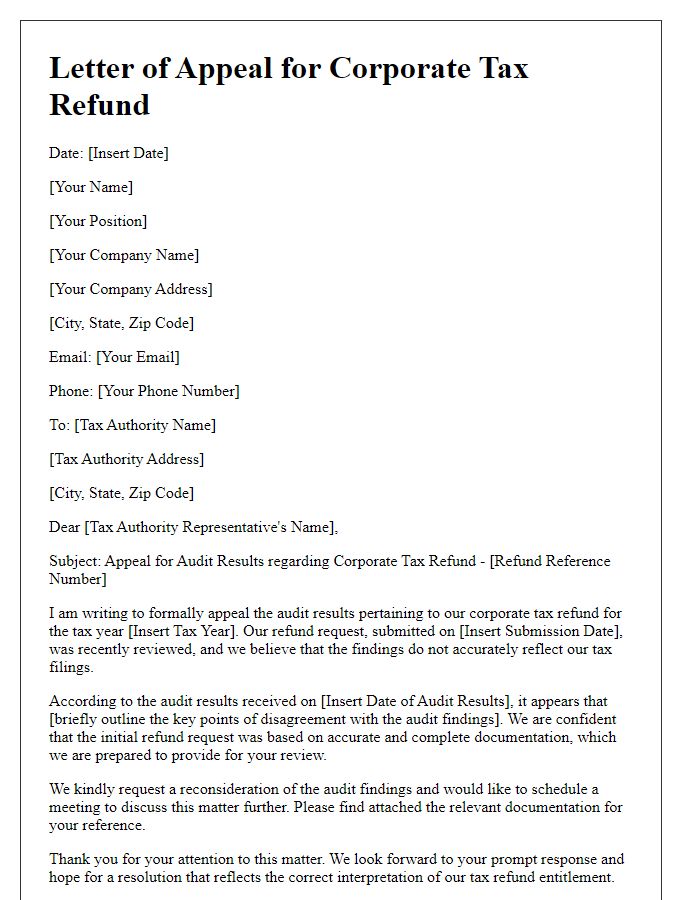

Letter template of corporate tax refund appeal for incorrect assessment.

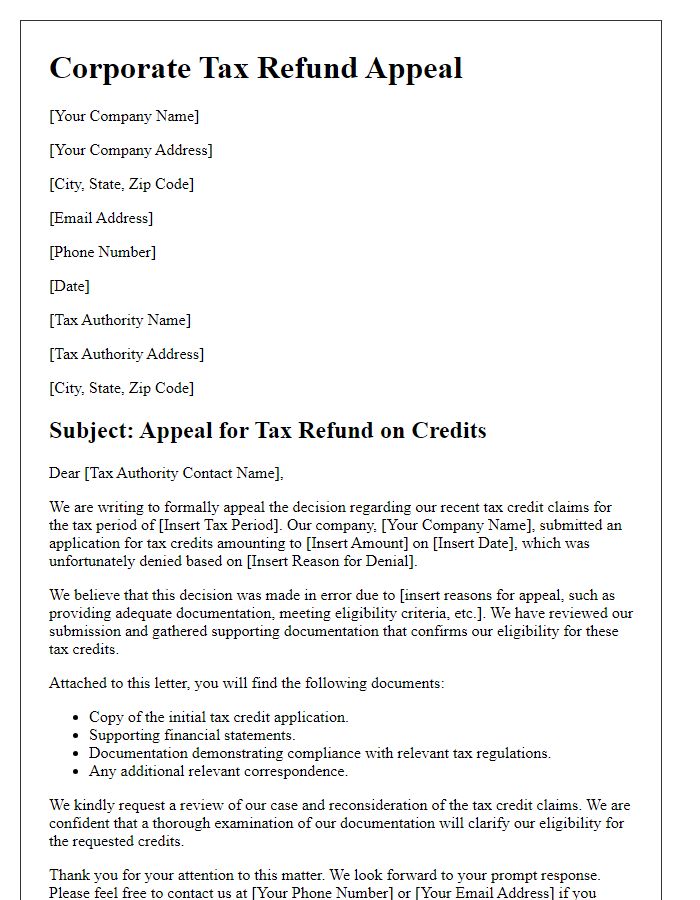

Letter template of corporate tax refund appeal for additional documentation.

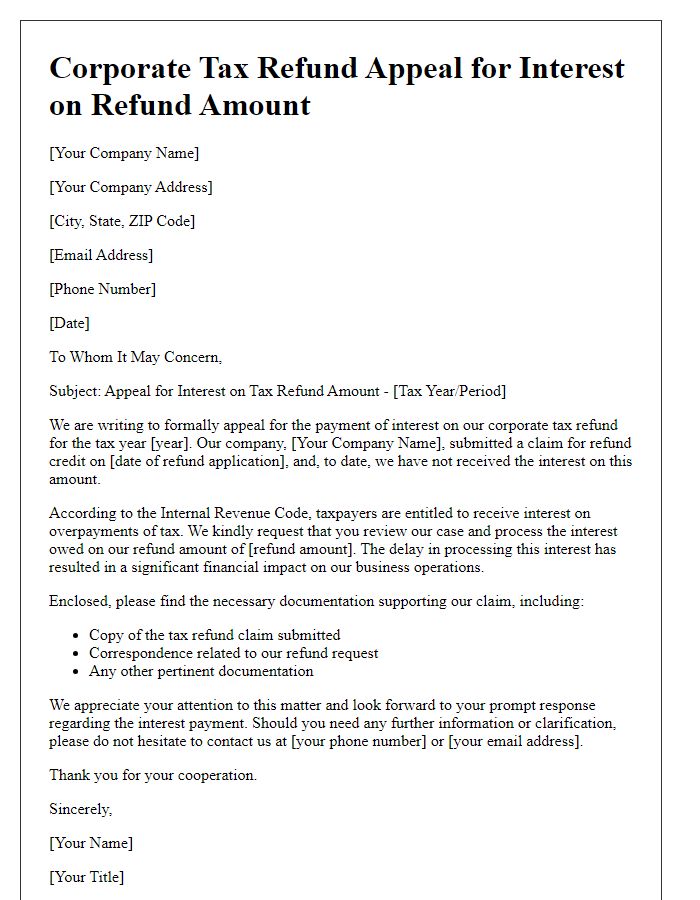

Letter template of corporate tax refund appeal for fiscal year adjustment.

Comments