Are you feeling a bit overwhelmed by a tax inquiry letter you received? You're certainly not alone, as many taxpayers face similar concerns and questions. In this article, we'll provide you with a helpful letter template to respond to such inquiries effectively and confidently. So, if you're ready to tackle this challenge head-on, keep reading to discover how to craft the perfect response!

Clear identification of recipient and sender.

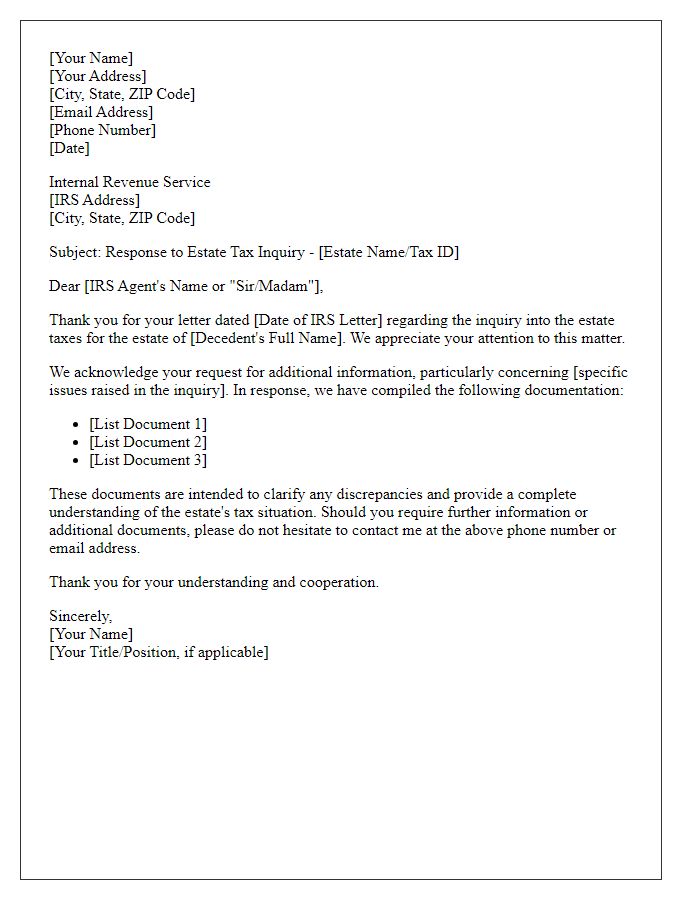

A tax inquiry often requires a formal response that includes clear details regarding both the sender and the recipient. The sender, such as John Smith, may be identified with a full name, address, and contact information. The recipient, such as the Internal Revenue Service (IRS), should be clearly titled as the Department of Treasury, IRS, with their respective mailing address. This identification ensures that the correspondence is directed appropriately. Including a date at the top signifies when the response was crafted, establishing a timeline for the inquiry process. Reference numbers from the original inquiry provide additional clarity and allow for efficient tracking of the correspondence between the parties involved.

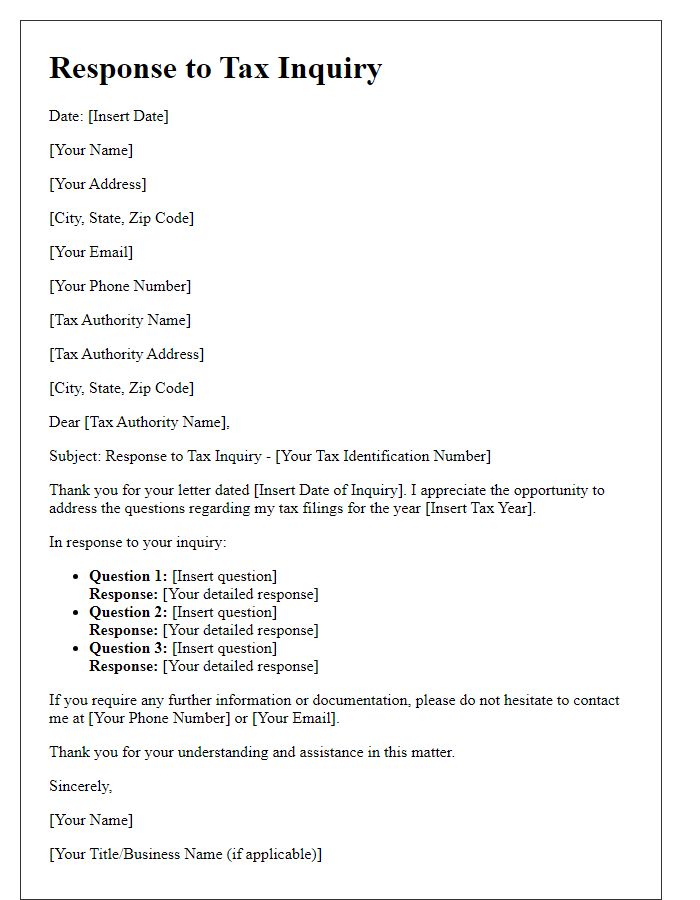

Specific reference to the inquiry (e.g., case number).

A tax inquiry letter regarding discrepancies in reported income can lead to issues with the Internal Revenue Service (IRS). The case number, such as 123456789, allows for accurate tracking of the inquiry within the IRS database. Corresponding documents, including tax returns from the relevant year, help clarify any misunderstandings. Communication may involve supporting evidence, such as W-2 forms or 1099 statements, to substantiate claims made about income. Timely responses, typically within 30 days of receiving the inquiry, are crucial to prevent penalties or further complications, ensuring compliance with federal guidance and regulations.

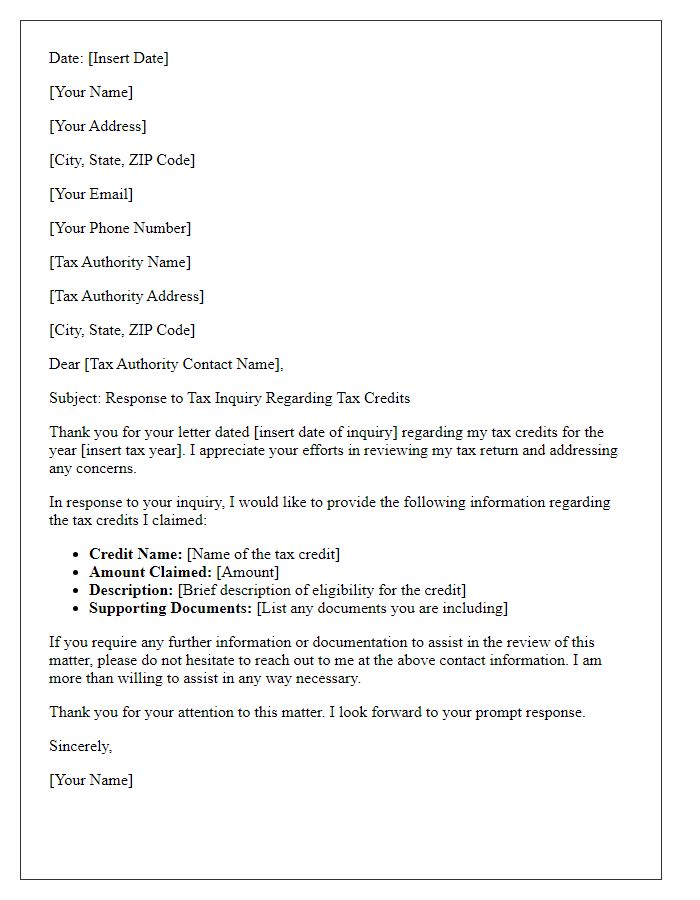

Concise response to each inquiry point.

Tax inquiries can arise from various authorities, often requesting clarification on financial records or specific deductions. Each inquiry should be addressed separately, detailing the relevant documents or explanations. Regarding income discrepancies, provide supporting documentation such as W-2 forms from employers and 1099 forms from freelance work. For deductions claimed, reference Schedule A to validate itemized expenses, ensuring to highlight receipts or other documentation for significant amounts. For any penalties incurred, outline the rationale for any errors and reference IRS guidelines regarding reasonable cause. Address date-sensitive inquiries with accurate timestamps from previous tax filings, including amendments made if necessary, confirming compliance with reporting requirements.

Inclusion of supporting documents or evidence.

In response to a tax inquiry, the inclusion of supporting documents is crucial for substantiating claims made in tax filings. Essential documents include official tax returns (Form 1040, or others specific to the jurisdiction), W-2 forms (wage and tax statements issued by employers), and 1099 forms (for independent contractor income). Additional evidence may encompass bank statements (to verify income deposits), receipts (for deductible expenses), and expense reports (to demonstrate business-related costs). Proper organization of these documents helps clarify financial situations for tax authorities, ensuring transparent communication and expediting the inquiry process. Providing these records may also aid in resolving any discrepancies efficiently.

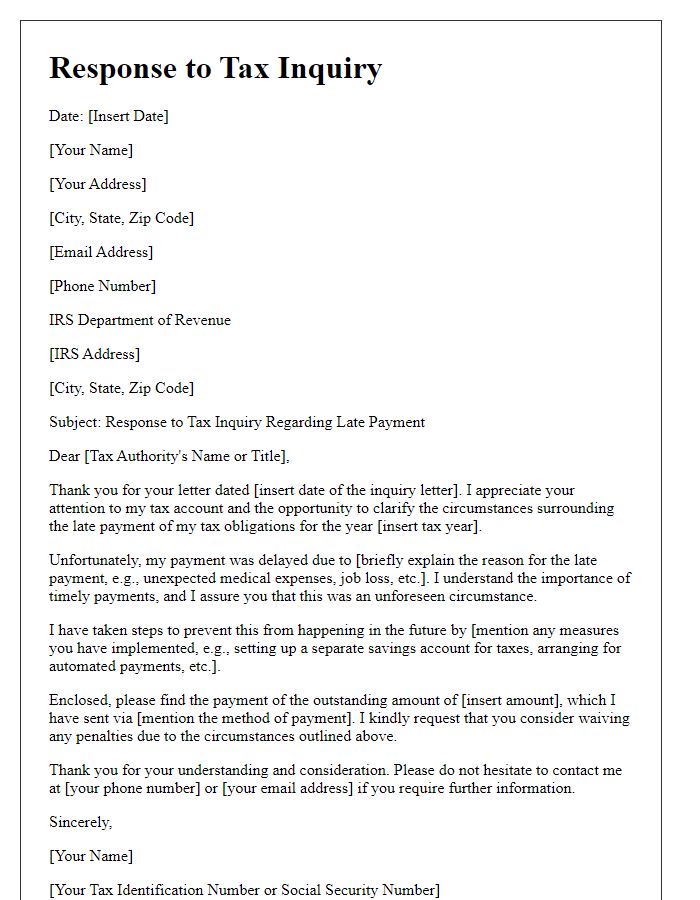

Contact information for further assistance or clarification.

Tax inquiries often arise from specific circumstances related to individual or business tax filings. For further assistance or clarification regarding your tax inquiry, please refer to the contact information provided by the relevant tax authority. For example, the Internal Revenue Service (IRS) in the United States typically offers support through their helpline, available at 1-800-829-1040. This number connects you to knowledgeable representatives who can assist with inquiries about federal tax obligations. Additionally, many state tax agencies, like the California Franchise Tax Board, provide dedicated lines for taxpayer communication. Their website also offers extensive resources, including FAQs and instructional guides, to address common questions about tax obligations, deductions, and credits. Ensure that all correspondence includes your Tax Identification Number (TIN) or Social Security Number (SSN) to facilitate efficient processing of your inquiry.

Letter Template For Response To Tax Inquiry Letter Samples

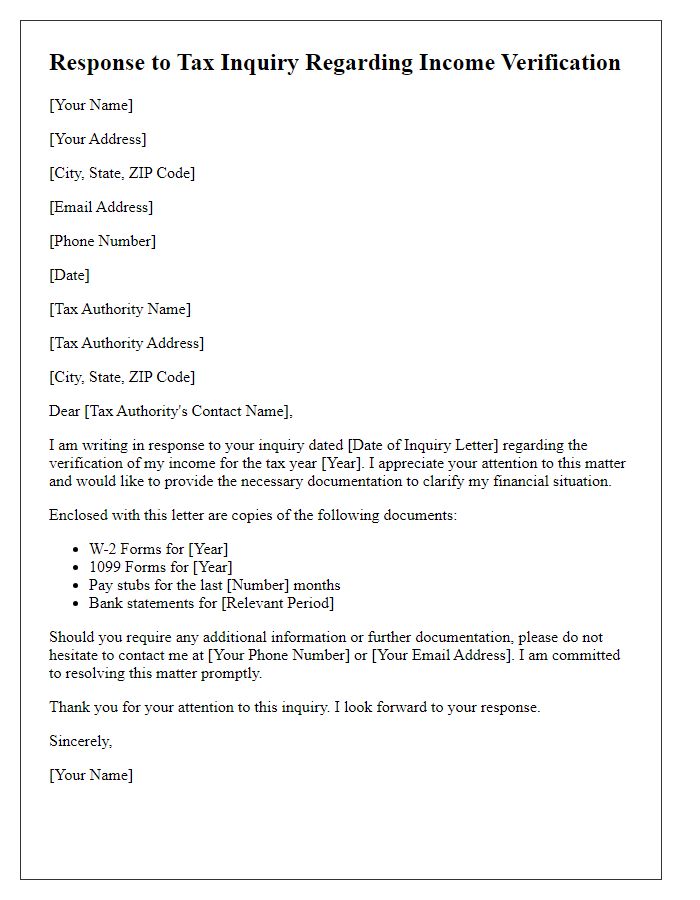

Letter template of response to tax inquiry letter regarding income verification

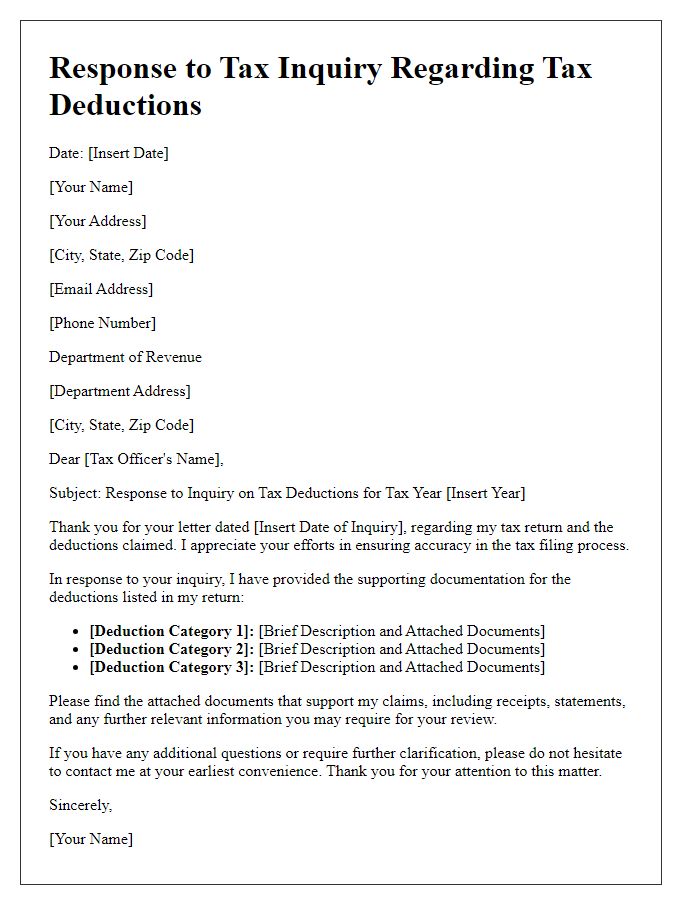

Letter template of response to tax inquiry letter regarding tax deductions

Letter template of response to tax inquiry letter for self-employed individuals

Letter template of response to tax inquiry letter addressing audit queries

Letter template of response to tax inquiry letter pertaining to foreign income

Comments