Are you a pensioner wondering if you qualify for tax exemption? Navigating the intricacies of tax regulations can feel overwhelming, but understanding your rights and benefits is crucial. In this article, we'll break down the key points regarding pensioner tax exemptions and offer a straightforward letter template to help you get the verification you need. So, let's dive in and simplify this process together!

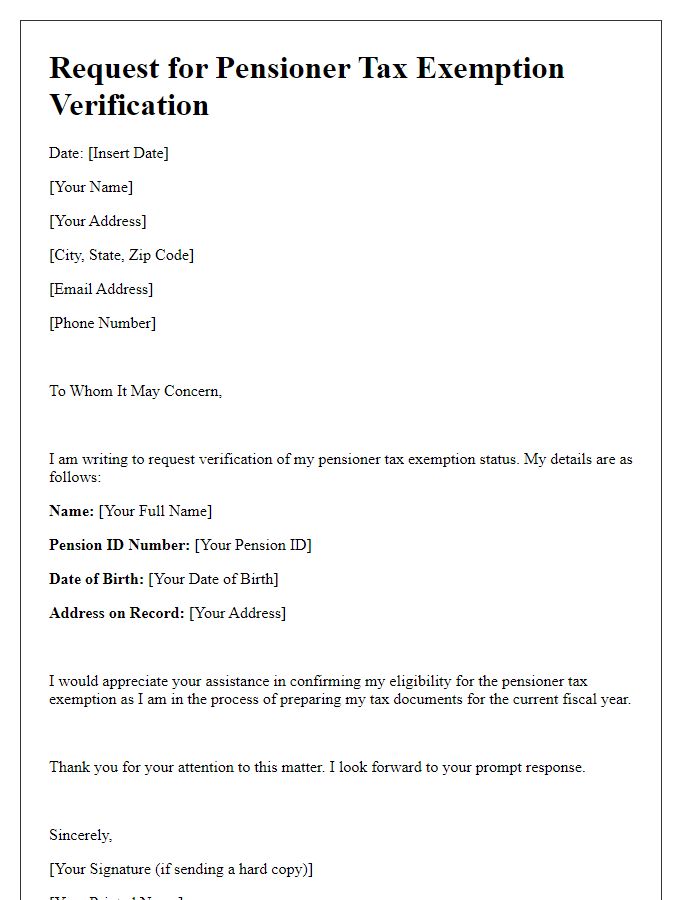

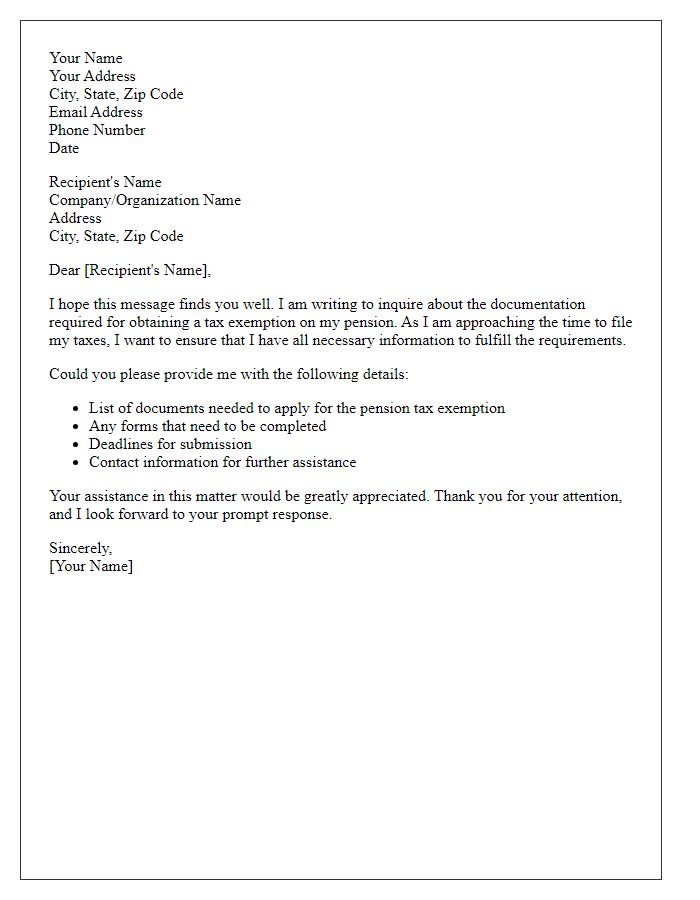

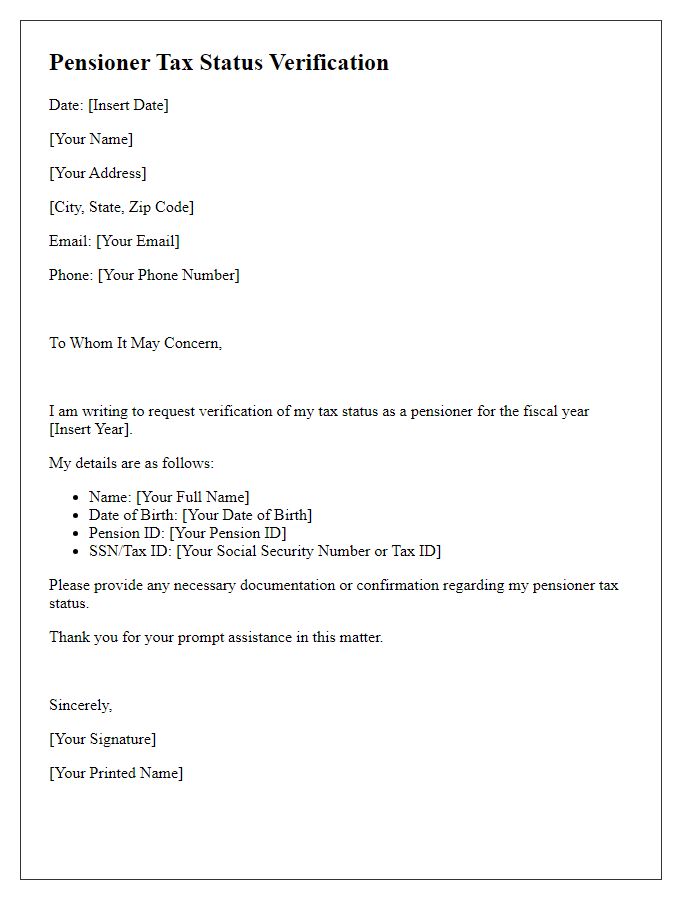

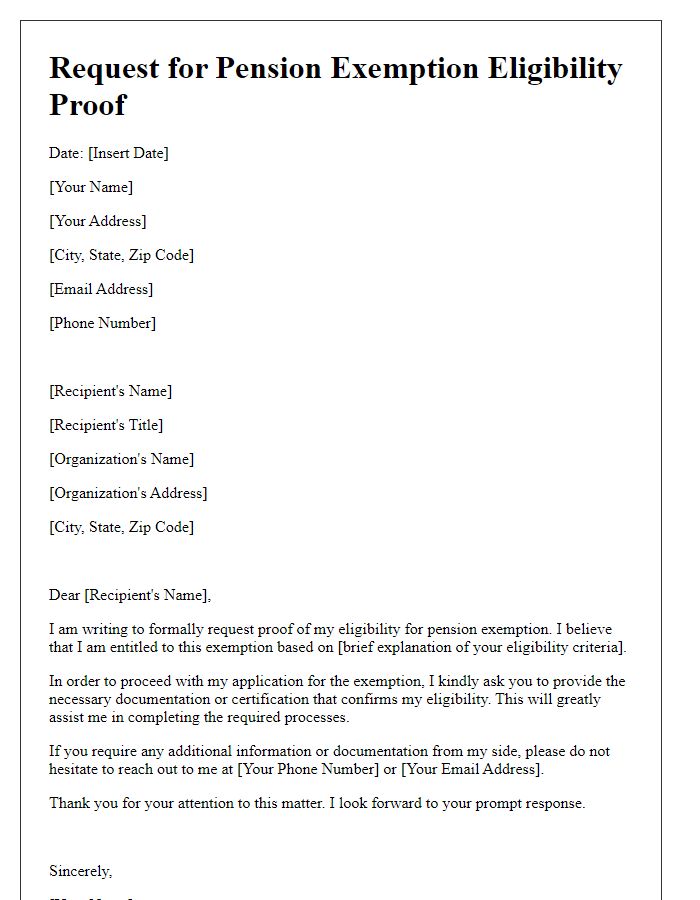

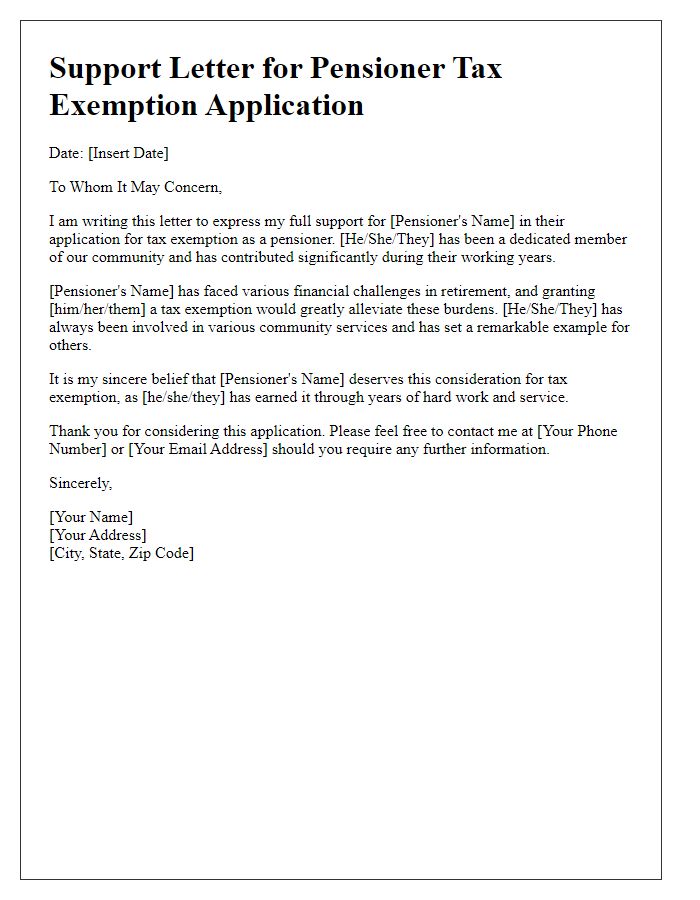

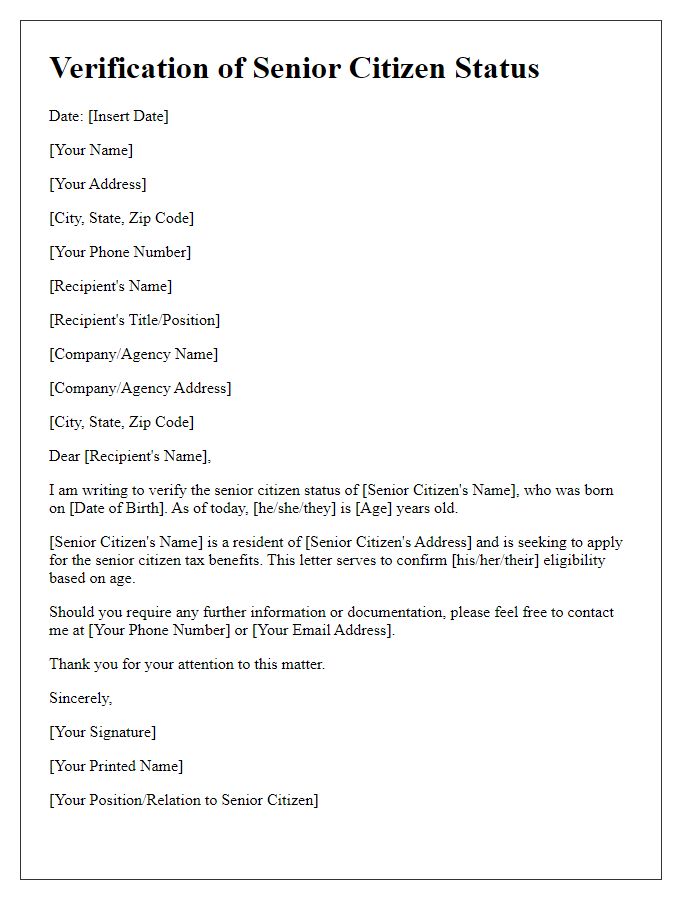

Recipient and sender information

Pensioner tax exemption verification requires accurate documentation showcasing the recipient's status. A letter detailing the recipient's full name, mailing address, and tax identification number should be included. Additionally, the sender's information must be clearly stated, including sender's name, position (if applicable), organization name (if applicable), contact number, and return address. Proper formatting and respectful language enhance the letter's credibility, ensuring clear communication of the request for verification of tax exemption eligibility for the pensioner.

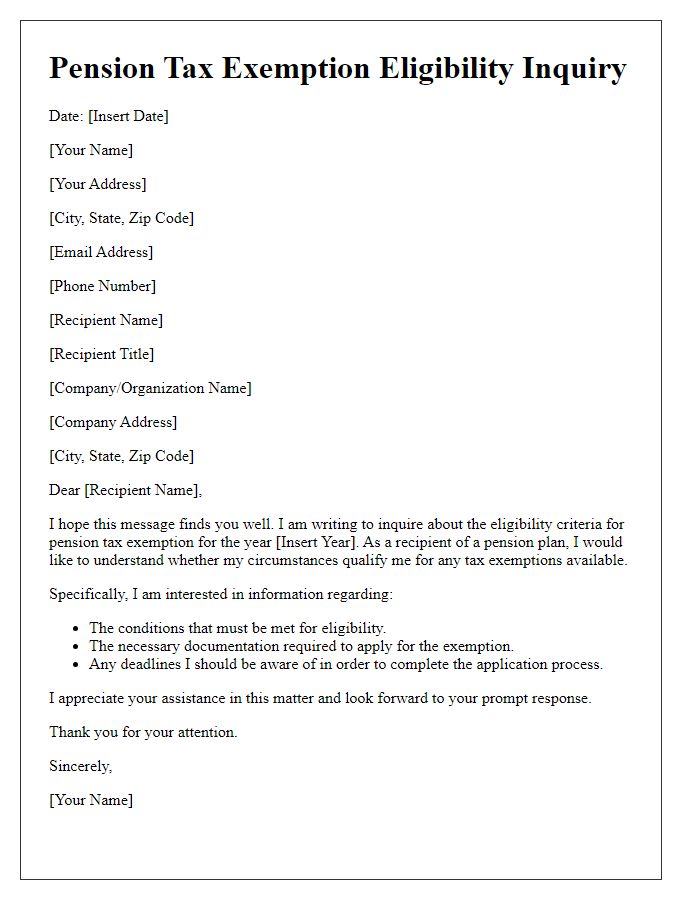

Subject line and reference number

Pensioner tax exemption verification requests can involve specific formats and references, typically including subject lines and reference numbers for tracking. A subject line could read "Request for Pensioner Tax Exemption Verification" followed by an assigned reference number, such as "Reference: PT-EXEM-2023-001." These identifiers help streamline communication and ensure queries related to pensioner tax exemptions are processed efficiently within the designated financial or governmental department. Adding precise reference numbers assists staff in locating relevant files or cases swiftly during the verification process.

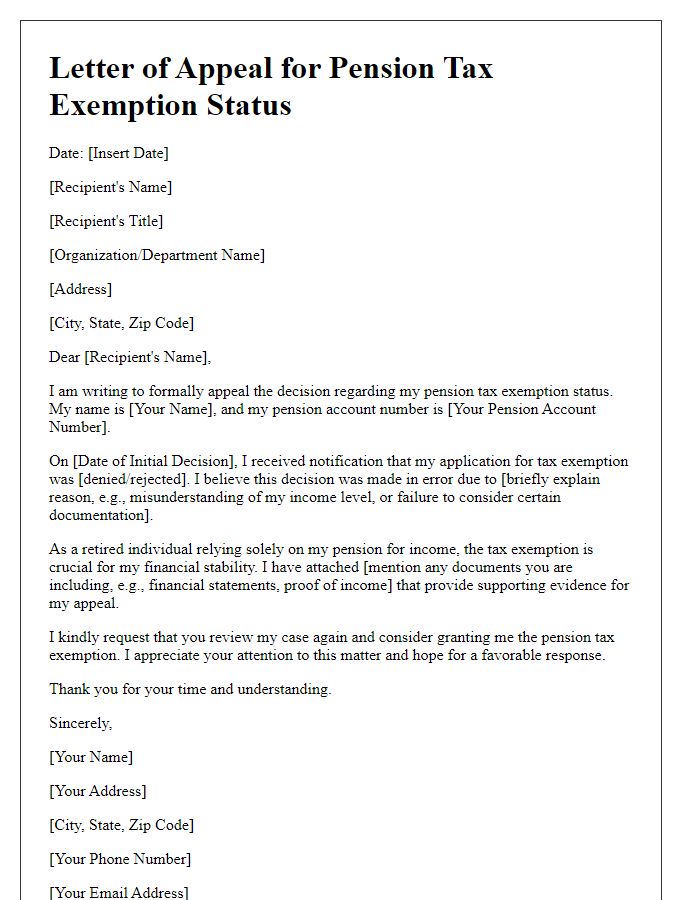

Pensioner details and tax exemption status

Pensioners in need of tax exemption verification must provide essential documentation, including their Pension Identification Number (PIN) and proof of age (usually a government-issued ID). Current regulations from the Internal Revenue Service (IRS) outline that individuals aged 65 and older may qualify for specific tax deductions and exemptions depending on their income level. Relevant forms such as the IRS Form 1040 and Schedule A (for itemized deductions) are often required for the exemption claim process. Moreover, state-specific regulations can lead to additional local tax benefits for pensioners, varying substantially by state, with some regions like Florida and Texas having no state income tax, thereby benefitting pensioners financially. Documentation must be submitted to the appropriate tax authorities before the deadline, typically April 15, to ensure compliance and avoid penalties.

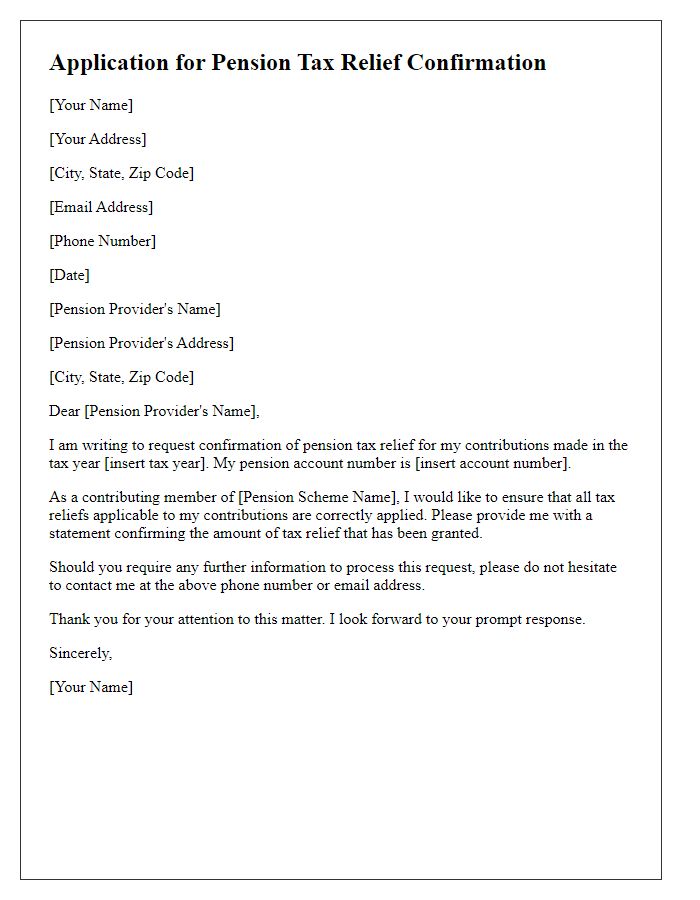

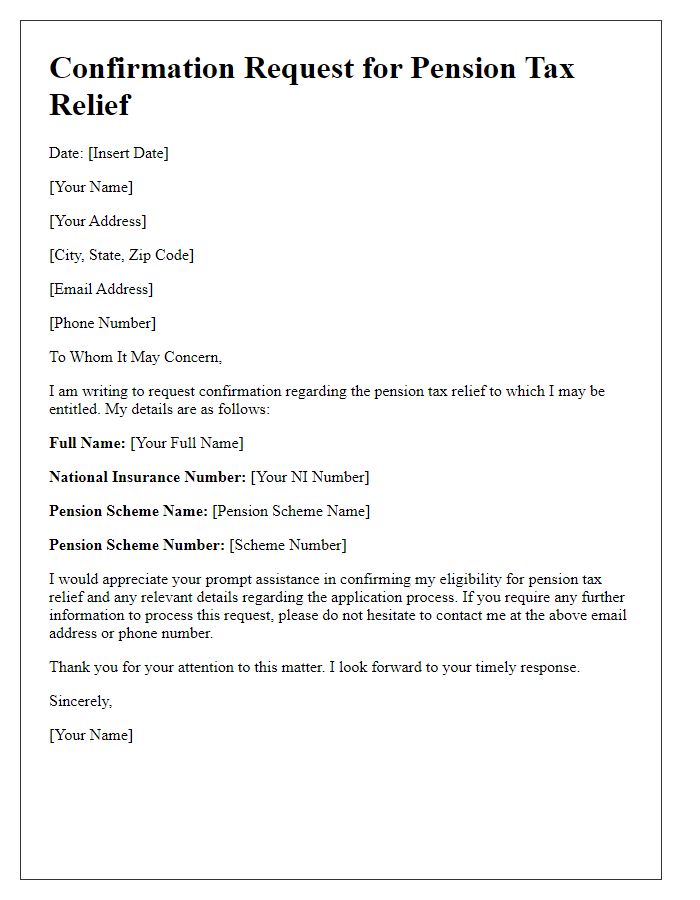

Required documentation and evidence

Pensioner tax exemption verification requires specific documentation to confirm eligibility. Essential documents include proof of identity such as a government-issued photo ID (Passport, National ID card) and proof of pension income, which may take the form of pension statements or letters from the pension provider detailing annual income amounts. Additional evidence includes tax returns from the previous year, demonstrating income levels. Utility bills or bank statements can serve as proof of residence, further confirming the current living situation. Furthermore, any relevant correspondence from tax authorities outlining exemption criteria or previous approvals should be included to support the application. Each document must be current, clearly legible, and contain identifiable information to facilitate the verification process.

Contact information for further inquiries

Pensioner tax exemption verification often requires submitting specific documents to tax authorities. Essential documents include proof of age, pension statements, income statements, and residency evidence. Pensioners, typically individuals aged 65 years and older, may seek tax relief to ease financial burdens. Contact information such as local tax office phone numbers, email addresses, or website links allows pensioners to clarify requirements or resolve issues efficiently. Tax incentives can differ significantly by region, making local knowledge crucial for pensioners seeking applicable benefits.

Comments