Have you ever felt overwhelmed by the financial aspects of buying a home? Understanding closing costs can seem daunting, but it's essential for any prospective buyer to grasp these crucial expenses. These costs include various fees associated with securing your mortgage and finalizing the purchase, which can add up to a significant sum. Ready to demystify closing costs and feel more confident in your home-buying journey? Read on for a detailed breakdown!

Breakdown of Closing Costs

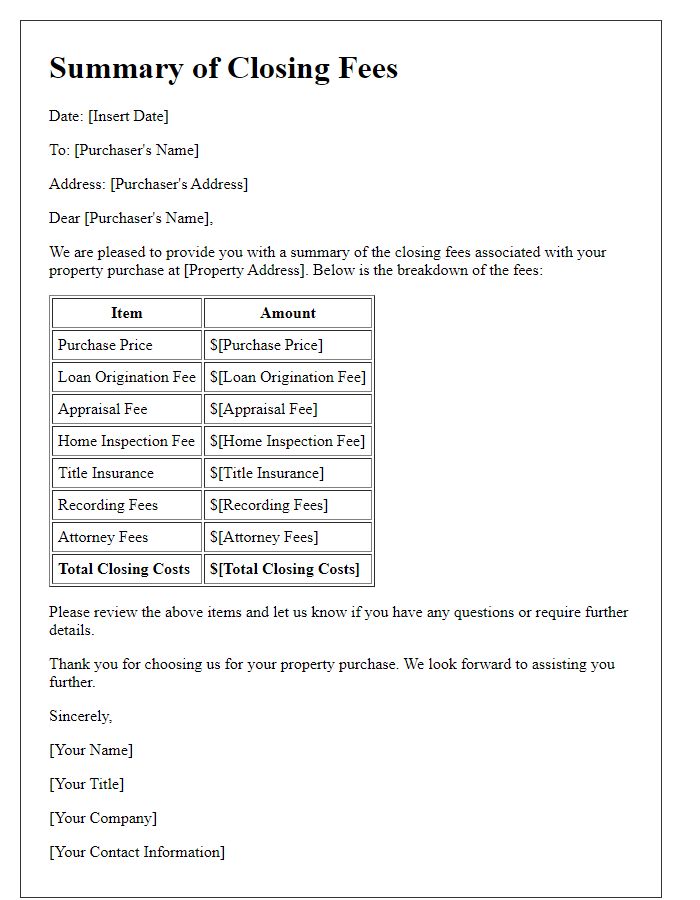

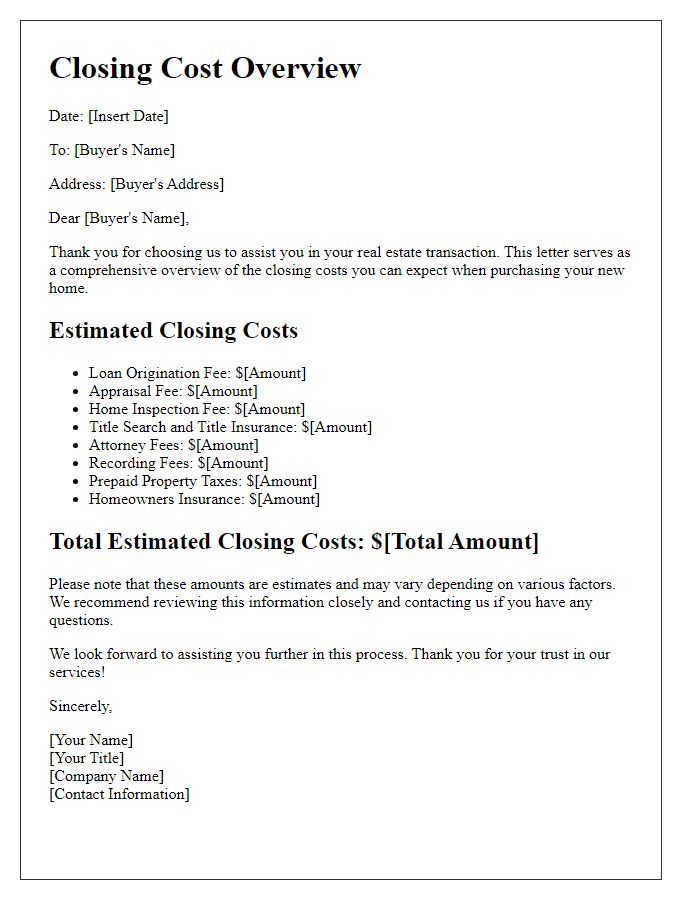

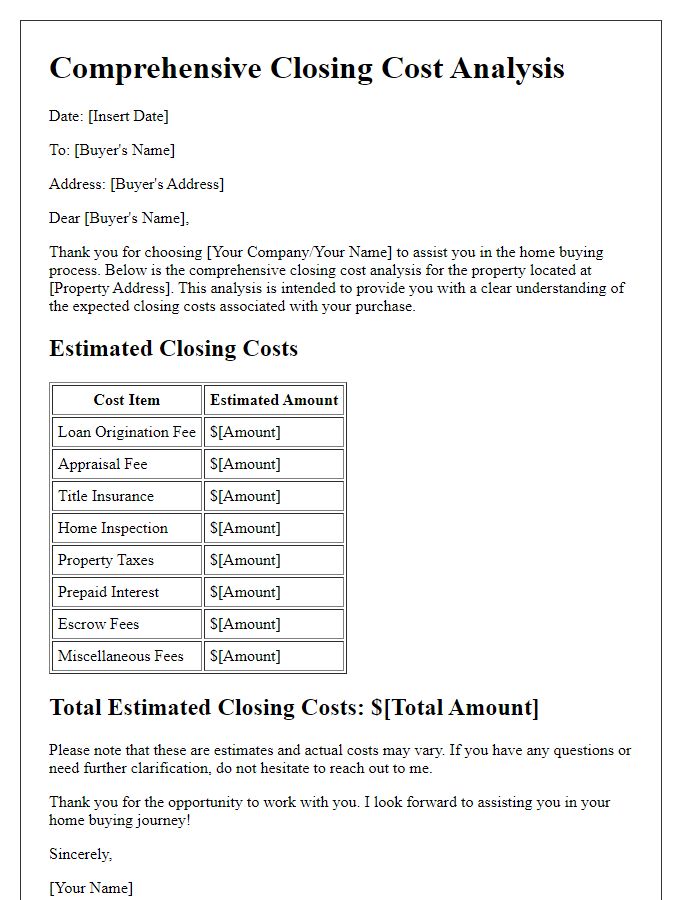

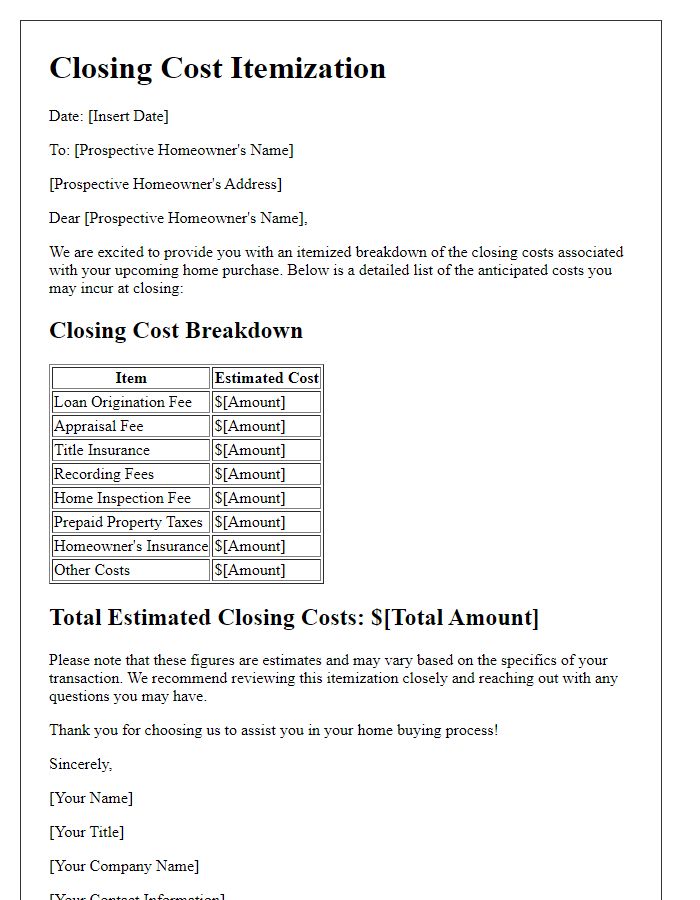

Closing costs represent the fees incurred during the finalization of a real estate transaction, typically ranging from 2% to 5% of the home's purchase price. These costs encompass various fees associated with the transfer of property ownership. Common components include title insurance (often around $1,000 for average properties), appraisal fees (approximately $300 to $500), inspections (which can range from $200 to $1,000 depending on the property's condition and size), and lender fees (averaging 1% of the loan amount). Additionally, there may be recording fees for filing the deed, which can vary by county, usually between $50 and $250. Prepaid items like homeowners insurance, property taxes, and mortgage interest often add to the closing costs, requiring careful budget planning. Overall, understanding these details can help buyers anticipate expenses and streamline the closing process.

Payment Instructions and Deadlines

Closing costs represent the fees and expenses associated with finalizing the purchase of a property, typically ranging between 2% to 5% of the home's purchase price. Buyers should be aware that these costs, including title insurance, appraisal fees, and attorney fees, must be settled before ownership transfer can occur. Payment instructions will vary by location, but commonly involve a certified check or wire transfer to the closing agent or escrow company responsible for handling the transaction. Deadlines for these payments are usually set a few days prior to the scheduled closing date, ensuring all funds are available at the closing table. Buyers should closely review their closing disclosure documents for specific payment amounts and deadlines to avoid delays in the home buying process.

Contact Information for Queries

Closing costs represent a significant financial aspect in real estate transactions, typically ranging between 2% to 5% of the home purchase price. These costs encompass various fees, including appraisal fees, title insurance, attorney fees, and mortgage insurance. Buyers need to be aware that, for a $300,000 property, closing costs can amount to $6,000 to $15,000. Additionally, certain costs may vary by location, influenced by state-specific regulations, like transfer taxes or local assessments. Understanding this financial obligation allows buyers to budget effectively and enables smoother transactions during the closing process. Proper communication of these details is essential for clarity and financial preparedness.

Explanation of Escrow Process

The escrow process represents a crucial phase in real estate transactions, ensuring secure handling of funds and property transfer. During this process, which often spans several weeks, a neutral third party (the escrow agent) takes custody of the buyer's earnest money deposit and the seller's property title documents. This agent, typically a title company or a specialized escrow service, facilitates communication between the buyer, seller, and various stakeholders, such as lenders or inspectors. Notable steps include document review (including terms in the purchase agreement), verification of funds, and coordination of inspections (often conducted by certified professionals). As conditions of the purchase agreement are met, the closing date is scheduled. Upon successful completion of the process, the escrow agent disburses the funds to the seller and records the title transfer to the buyer with the county recorder's office. Understanding this process assists buyers in anticipating closing costs, which often encompass fees for services including title insurance and escrow fees.

Summary of Legal Disclosures

Understanding closing costs is crucial for homebuyers, as these expenses can significantly impact the overall financial transaction during the home purchasing process. Typical closing costs range from 2% to 5% of the home's purchase price, covering various fees such as loan processing costs, title insurance, and recording fees. Each state, including California, Texas, and Florida, may impose different regulations and additional charges, which can further influence the total amount due at closing. Buyers should expect to receive a detailed Closing Disclosure three days before finalizing the purchase, outlining all costs involved, including taxes, home insurance, and escrow account contributions. It is essential to review this document closely to ensure understanding and preparedness for the financial commitment ahead.

Letter Template For Closing Cost Explanation To Buyers Samples

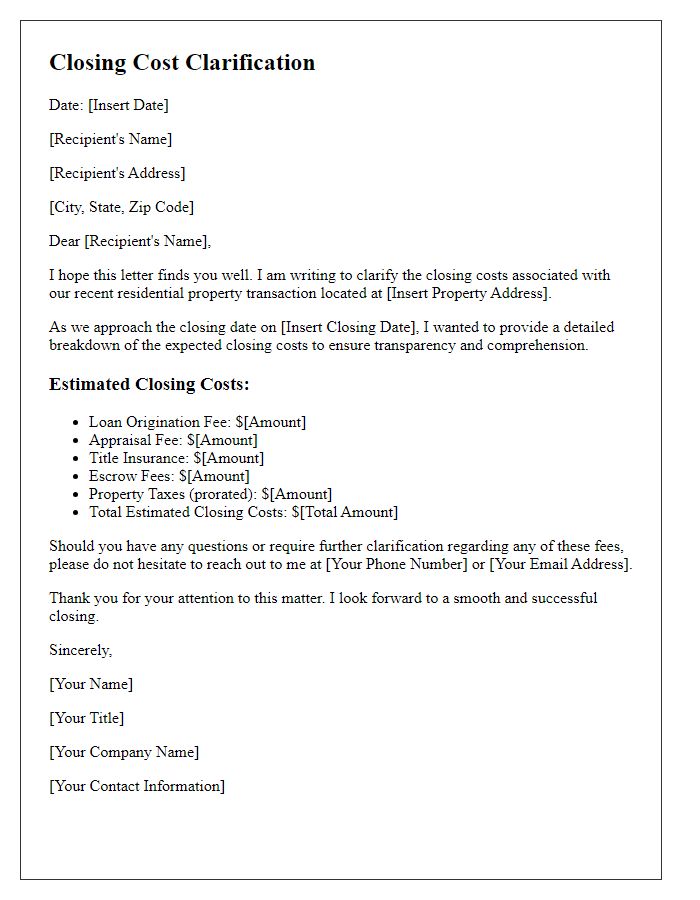

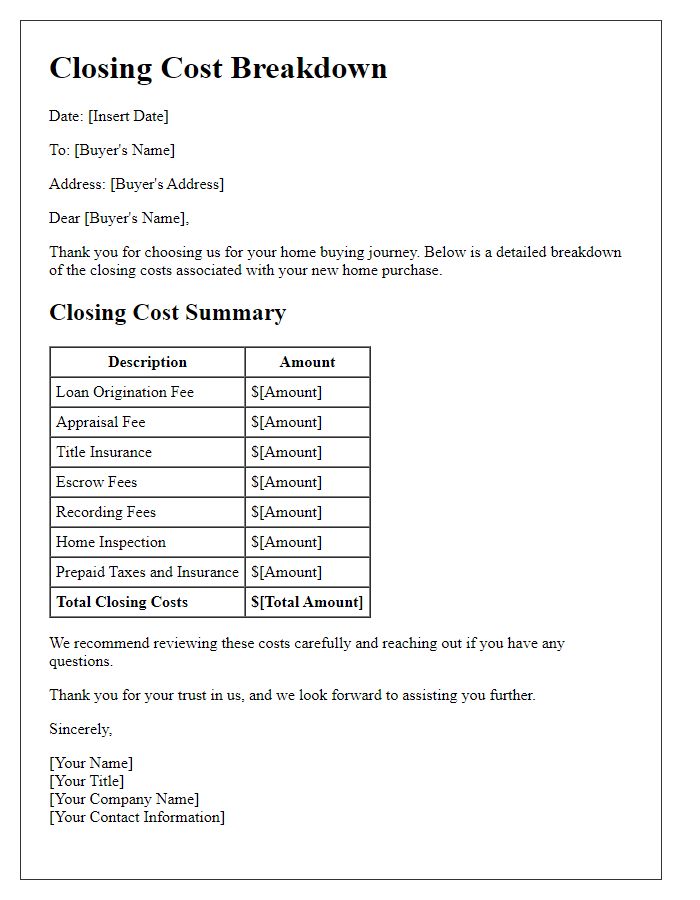

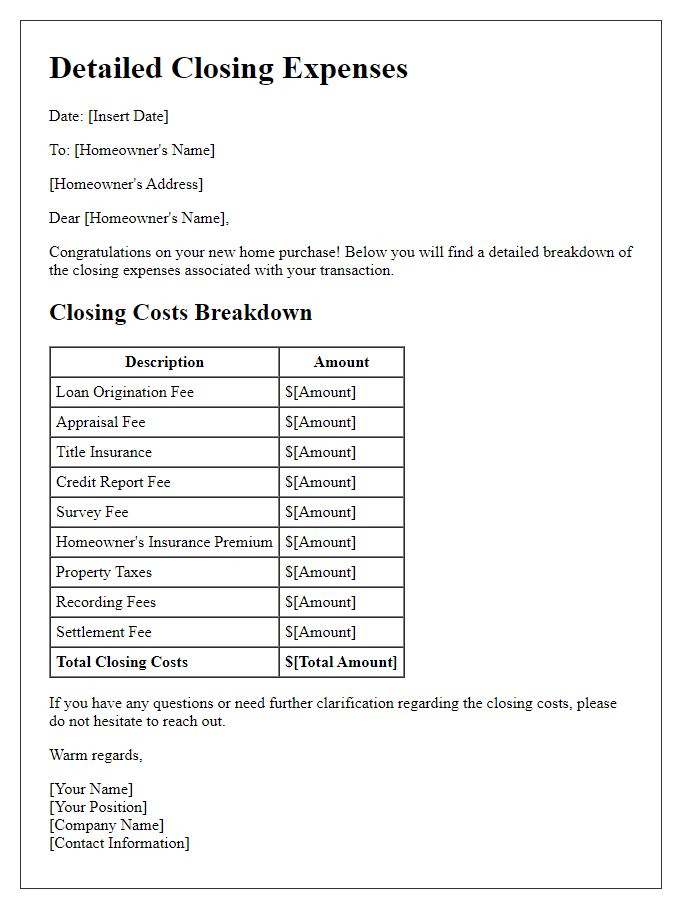

Letter template of closing cost clarification for residential transactions

Comments