Are you facing the daunting reality of foreclosure? It's a situation that many homeowners dread, and understanding the process can feel overwhelming. In this article, we'll break down everything you need to know about foreclosure notices, including how to respond and what options you have available. So, grab a cup of coffee and let's dive in to help you navigate this challenging time!

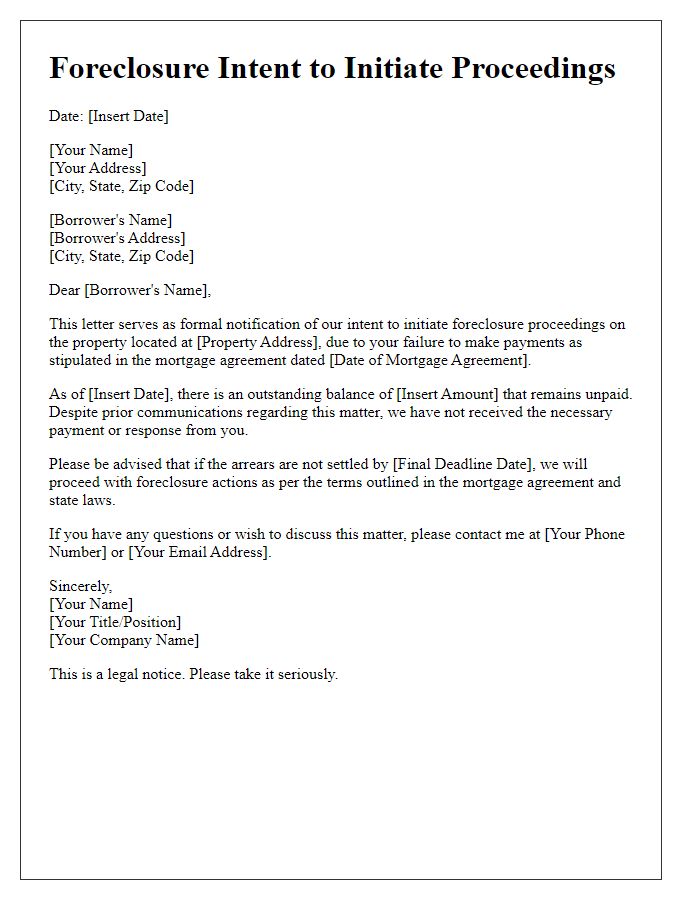

Legal Compliance and Regulations

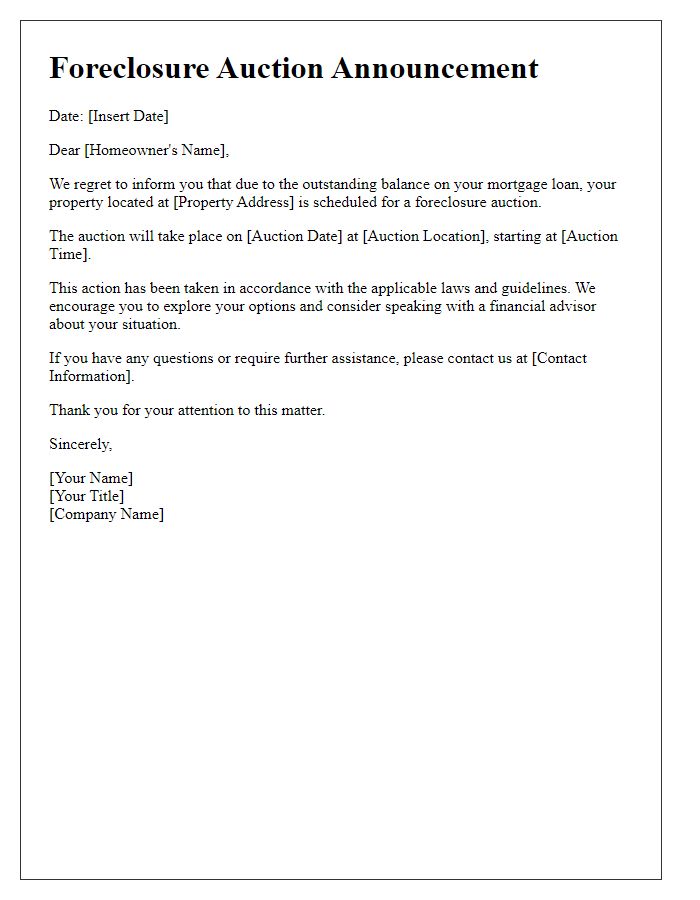

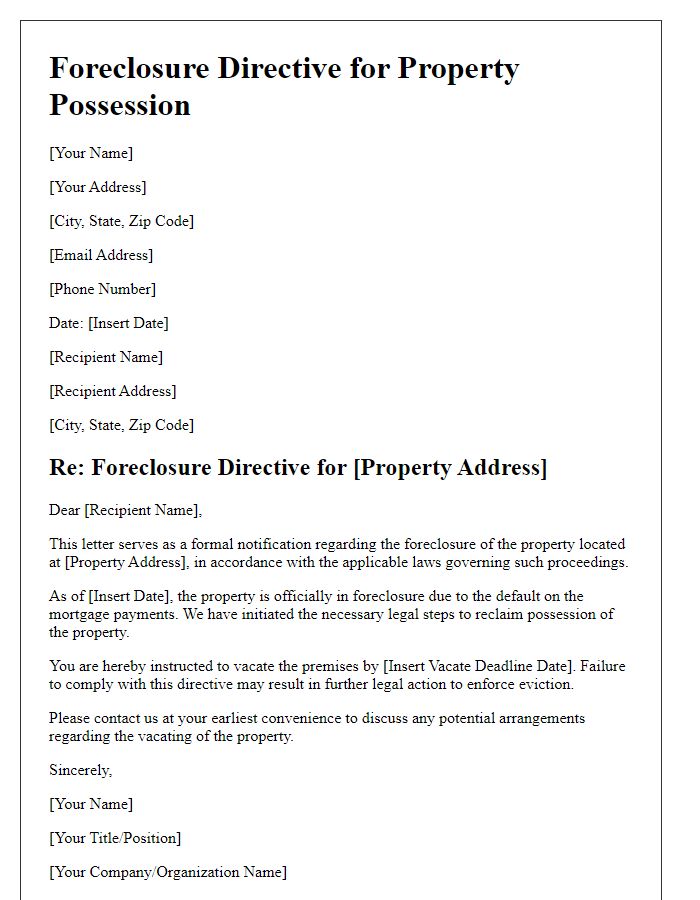

Foreclosure notices are legal documents that inform homeowners of the impending foreclosure process on their property, typically due to non-payment of mortgage obligations. Such notices must comply with state-specific foreclosure laws, which can vary significantly across jurisdictions. For example, in California, the notice must be issued at least 90 days before the actual foreclosure auction, while in Florida, the lender must file a lawsuit to initiate foreclosure. Each state also has regulations regarding the content of these notices, often requiring clear information about the defaulted amount, mortgage identity, and the homeowner's rights to remedy the situation. Additional requirements may include mailing the notice via certified postal service to ensure the homeowner receives it. Homeowners facing foreclosure should understand their rights and explore potential alternatives like loan modification or short sale options before the foreclosure process is finalized.

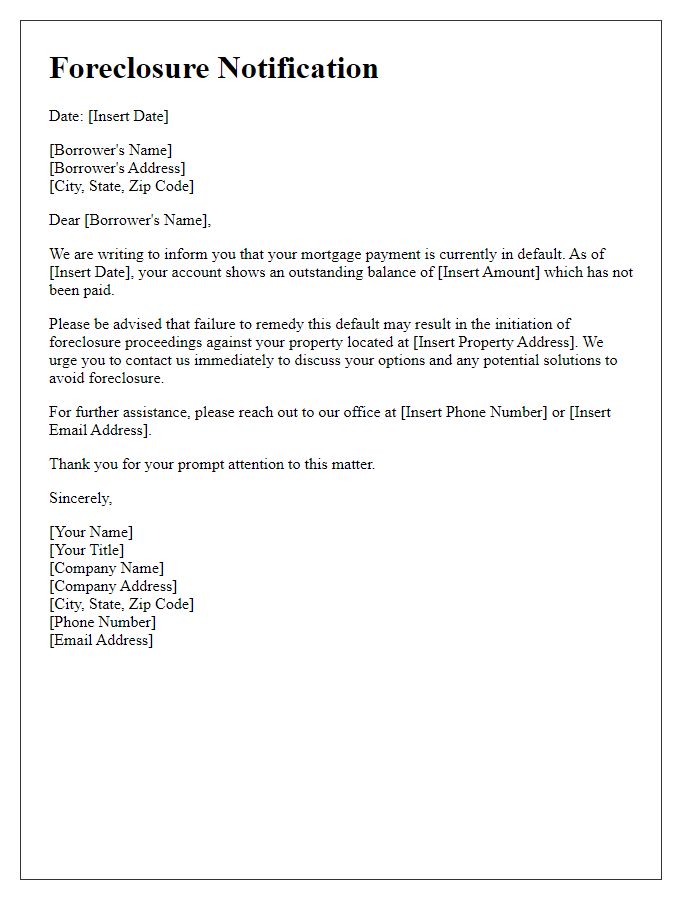

Clear Identification of Property and Parties Involved

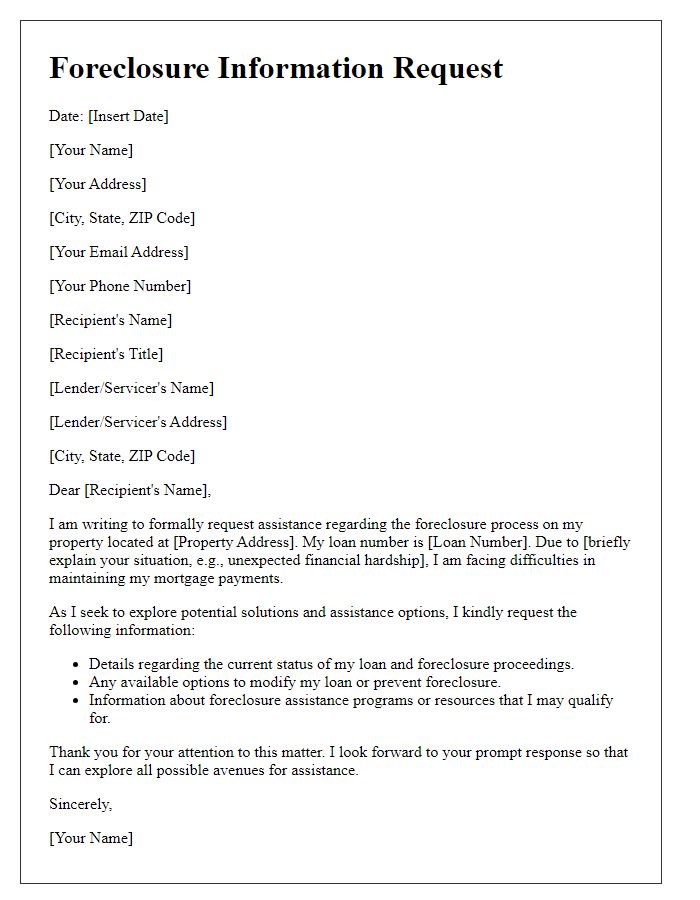

A foreclosure notice serves as a formal document indicating the initiation of the foreclosure process concerning a specific residential property. This notice must clearly identify the property in question, including crucial details such as the street address, city, state, and postal code. The parties involved should also be explicitly named, including the homeowner (borrower) and the lending institution (lender), typically indicating the lender's legal status and contact information. Additional information such as the loan number, the date of the mortgage agreement (often referred to as the date of the deed of trust), and any relevant attachment or legal instrument number should be included to ensure accurate identification and transparency in the foreclosure proceedings. This level of detail fosters clear communication and helps protect the rights of all parties involved in the real estate transaction.

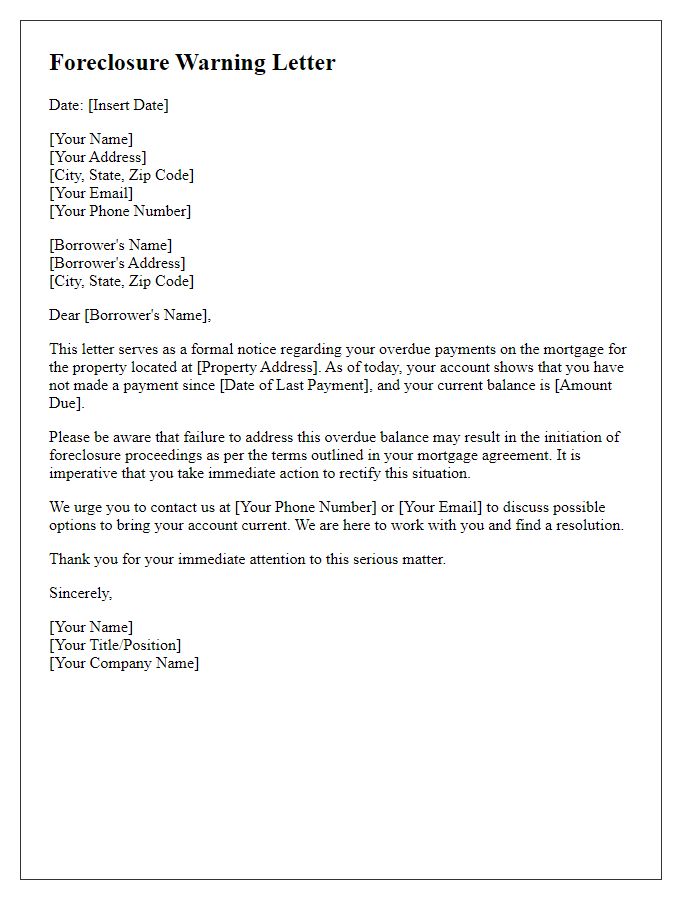

Detailed Explanation of Default and Amount Due

A foreclosure notice outlines the specific details of a homeowner's default on mortgage payments, clearly indicating the outstanding amount owed. For instance, a homeowner may have missed three consecutive payments, with each monthly payment being $1,200. Therefore, the total amount in default could reach $3,600, not including additional fees or penalties that could accumulate, such as late fees averaging $50 per month. The notice typically specifies the original mortgage agreement date, the lender's name, and the property address, ensuring clarity for the homeowner. Additionally, the document may include a deadline for rectifying the situation, providing a final chance to avoid foreclosure proceedings, which could lead to the sale of the property located in a specific jurisdiction, like Cook County, Illinois. Understanding these details is crucial for the homeowner to take appropriate action before facing the potential loss of their residence.

Consequences and Timelines

Homeowners facing foreclosure often experience significant emotional and financial distress. A foreclosure process initiates when mortgage payments, typically due monthly, remain unpaid for several months, often around three to six months, depending on state regulations. Upon initiation, lenders must issue a notice, which may include a timeline detailing critical dates. The initial notice may arrive via certified mail, informing homeowners of impending legal action and potential consequences, such as loss of property--typically valued at hundreds of thousands of dollars, depending on market conditions. Additionally, delayed actions by homeowners may lead to a redemption period, lasting from a few weeks to several months, during which they can reclaim ownership by settling outstanding debts. It's vital for homeowners to communicate with lenders urgently, explore options such as loan modification or forbearance, and understand local laws governed by state regulations, as consequences vary significantly, impacting both credit scores and future homeownership opportunities.

Contact Information for Assistance and Next Steps

Homeowners facing foreclosure often receive important notifications indicating their financial situation regarding the property. This notice typically includes an identification number specific to the case, the name of the mortgage servicer, and a contact phone number, usually accessible during standard business hours. The document may provide details on available resources such as housing counseling agencies certified by the U.S. Department of Housing and Urban Development (HUD), which can assist in understanding rights and potential solutions. Additionally, there may be a timeline detailing critical dates for response or action, including any upcoming court hearings, deadlines for payment arrangements, or options for loan modification. Information on local legal assistance services may also be included, allowing homeowners to receive appropriate counsel to navigate the foreclosure process effectively.

Comments