Hey there! Understanding your mortgage payment terms can sometimes feel a bit overwhelming, right? In this article, we'll break down everything you need to know about your payment schedule, interest rates, and what happens if you miss a payment. Stick around to discover tips and insights that will make managing your mortgage a breeze!

Clear and concise language

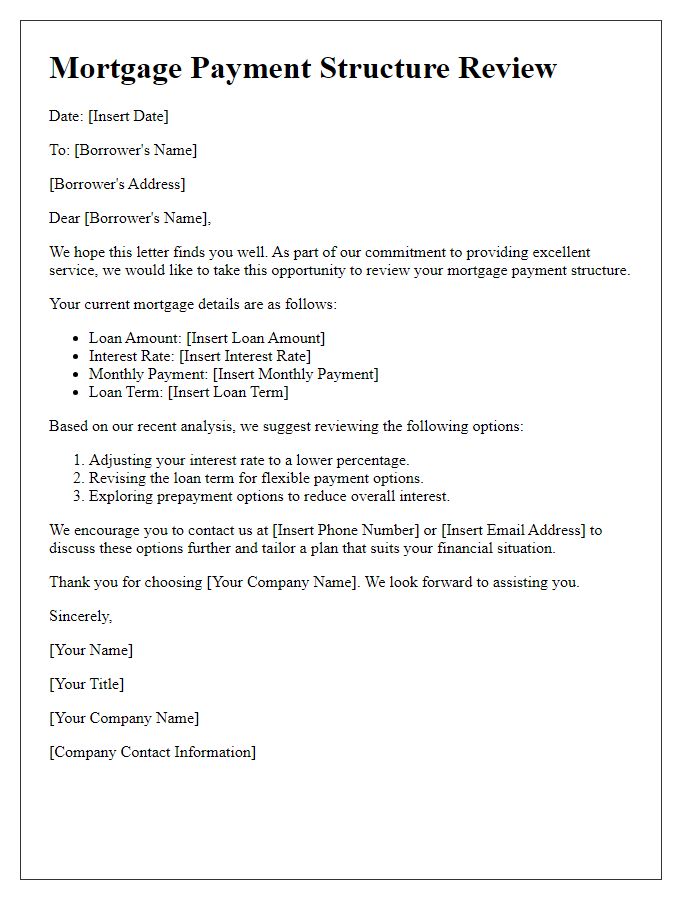

Late mortgage payments can incur significant penalties, impacting loan accounts negatively. Payment schedules typically stipulate due dates, often the first of each month. Repeated missed payments may result in late fees averaging $25 to $50 per occurrence and can adversely affect credit scores, lowering them by 100 points or more. Communication with lenders regarding any potential financial hardships is critical to avoid default, which could lead to foreclosure processes initiated after just a few missed payments. Understanding the full terms outlined in documents such as the Note and Deed of Trust is essential for maintaining favorable standing.

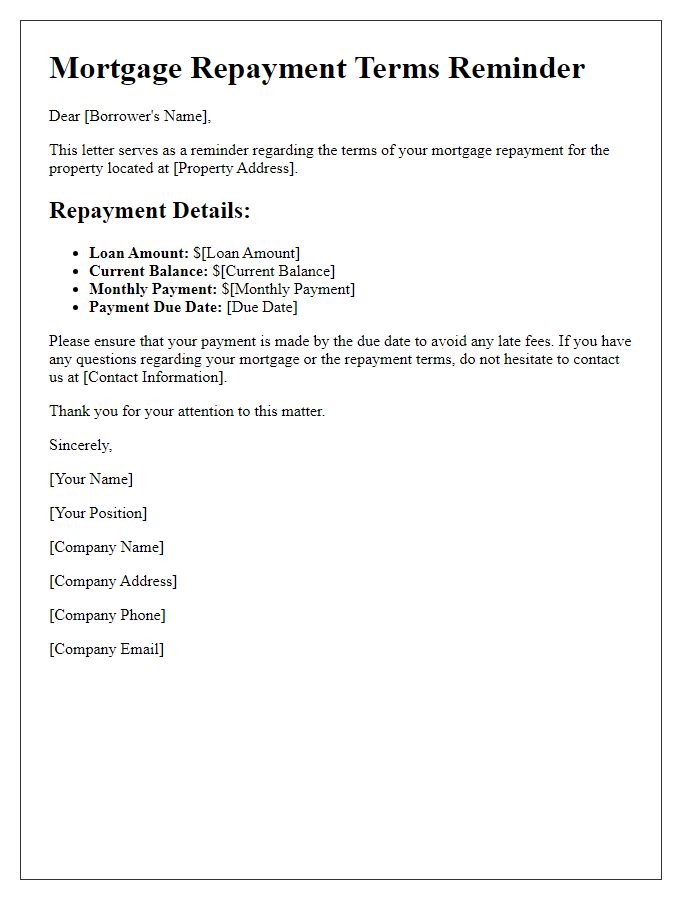

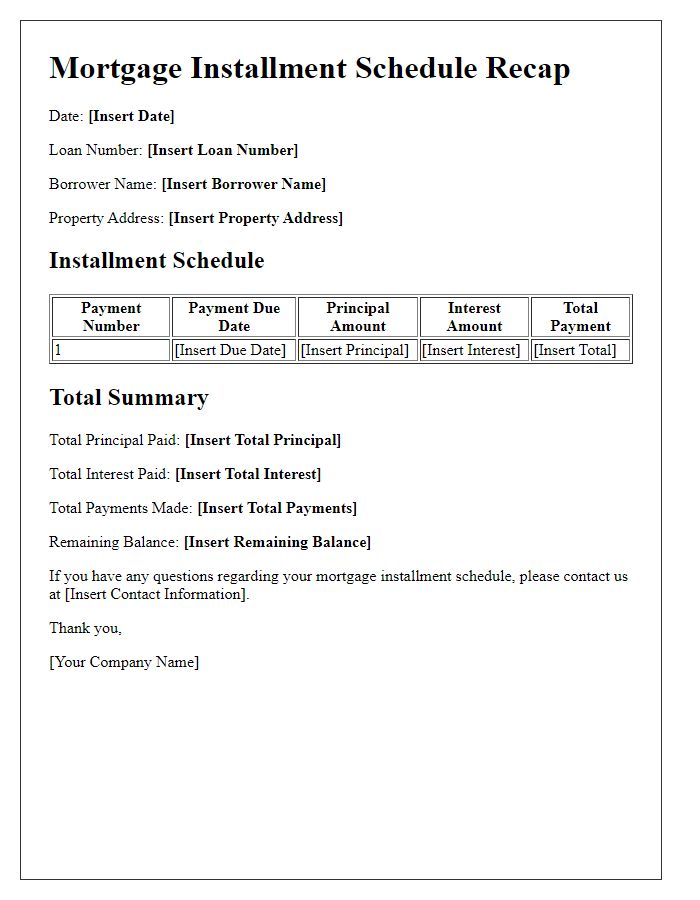

Payment schedule details

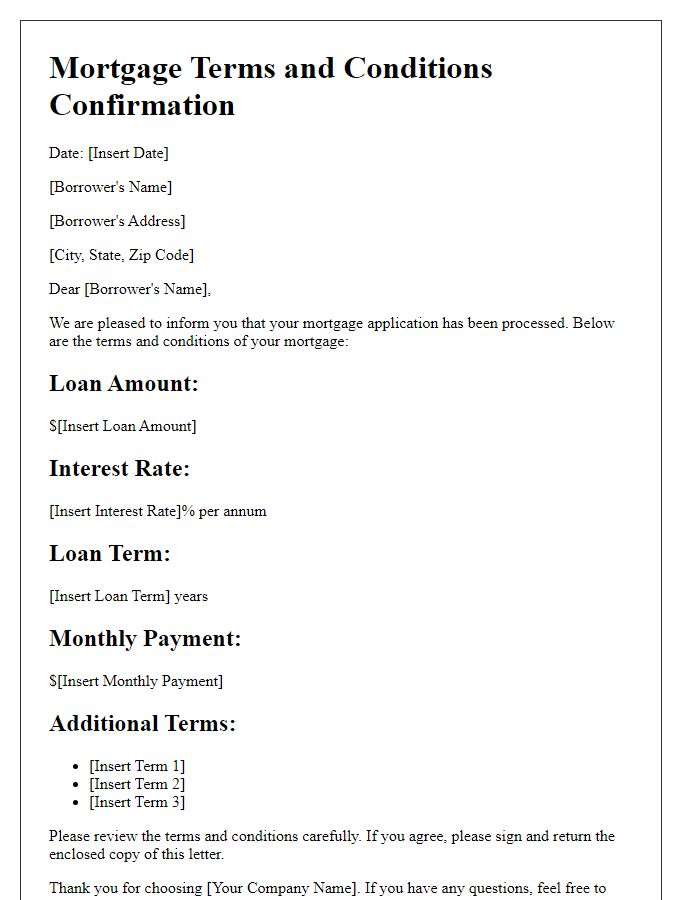

Reiterating mortgage payment terms ensures clarity for borrowers. Monthly payment schedules typically specify due dates, such as the first of each month, alongside fixed amounts based on loan agreements. Borrowers may encounter late fees if payments are not received by a set grace period, usually 15 days after the due date. Principal and interest components of each payment contribute to mortgage balance reduction over time. Annual percentage rates (APRs), detailing interest costs, impact overall payment amounts significantly. Understanding amortization schedules, illustrating payment breakdowns over the loan duration, aids borrowers in managing finances effectively. Awareness of adjustable-rate mortgages (ARMs) versus fixed-rate options influences long-term payment strategies.

Contact information for queries

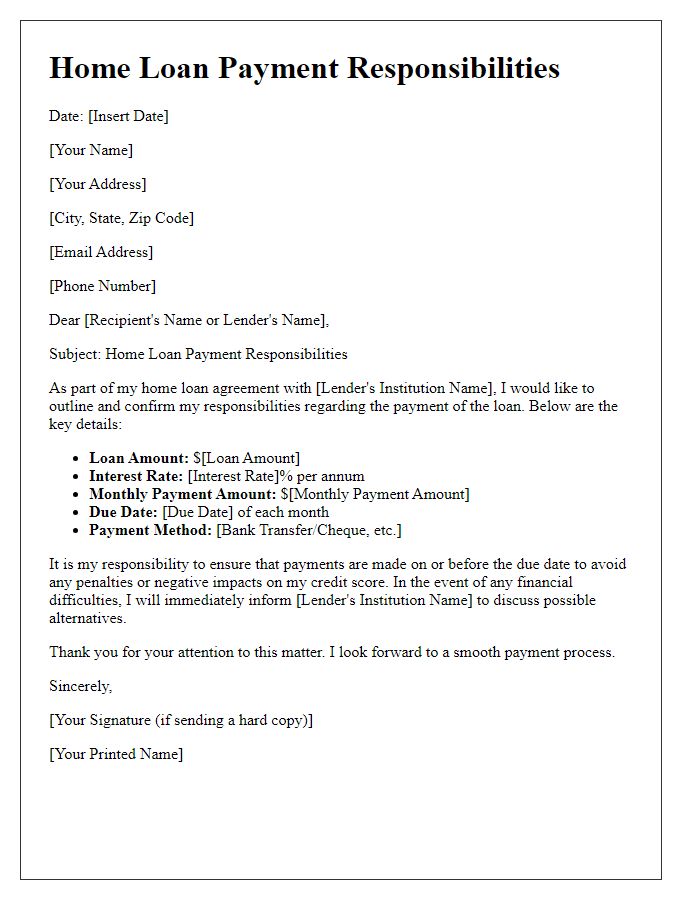

Mortgage payment terms are crucial for homeowners managing their finances. Standard obligations often include monthly installments, typically due on the first of each month. Many loans, such as conventional mortgages from prominent institutions like Wells Fargo or Bank of America, require homeowners to pay principal and interest amounts, along with property taxes and homeowners insurance. Failure to make timely payments may result in penalties or potential foreclosure, a legal process affecting residential properties. Homeowners should carefully review their mortgage agreement and seek clarification from lenders for any queries regarding payment structure or adjustments. Contact information, including phone numbers and email addresses for customer service, is essential for navigating potential issues.

Consequences of non-compliance

Failure to adhere to mortgage payment terms can result in serious repercussions, including but not limited to foreclosure, which is the legal process that allows lenders to reclaim property after a borrower defaults. The monthly mortgage payment, typically consisting of principal, interest, property taxes, and homeowners insurance (often referred to as PITI), must be submitted by the due date stipulated in the mortgage agreement. Late payments, often defined as payments made after a 15-day grace period, may incur penalties such as additional fees, increased interest rates, and damage to the borrower's credit score. Persistent non-payment can lead to a loan default, potentially triggering collection actions and legal proceedings, which can ultimately jeopardize homeownership. Furthermore, in various states, the foreclosure process may take several months to years, significantly impacting the homeowner's financial stability and future housing options.

Ways to make a payment

Timely mortgage payments are crucial for maintaining good standing with financial institutions like banks or credit unions. Various payment methods provide convenience and flexibility for homeowners. Options include online payments through banking websites or mobile apps, allowing real-time transactions from anywhere with internet access. Automatic bank drafts enable effortless monthly deductions right from savings or checking accounts, ensuring punctuality without manual intervention. Homeowners may also utilize automated phone systems to process payments securely over the telephone. Additionally, mailing checks or money orders directly to the lender's processing center remains a traditional method. Some institutions offer in-person payment options at local branches, providing direct interactions with service representatives. Understanding these avenues ensures borrowers comply with their mortgage obligations, protecting credit scores and preventing penalties.

Comments