Are you feeling overwhelmed by mortgage debt and exploring options to regain control of your finances? Crafting a well-structured mortgage debt settlement agreement can be a pivotal step in your journey toward financial freedom. This letter template will guide you through the essential elements needed to negotiate with your lender effectively. So, if you're ready to tackle your mortgage challenges head-on, keep reading to discover more!

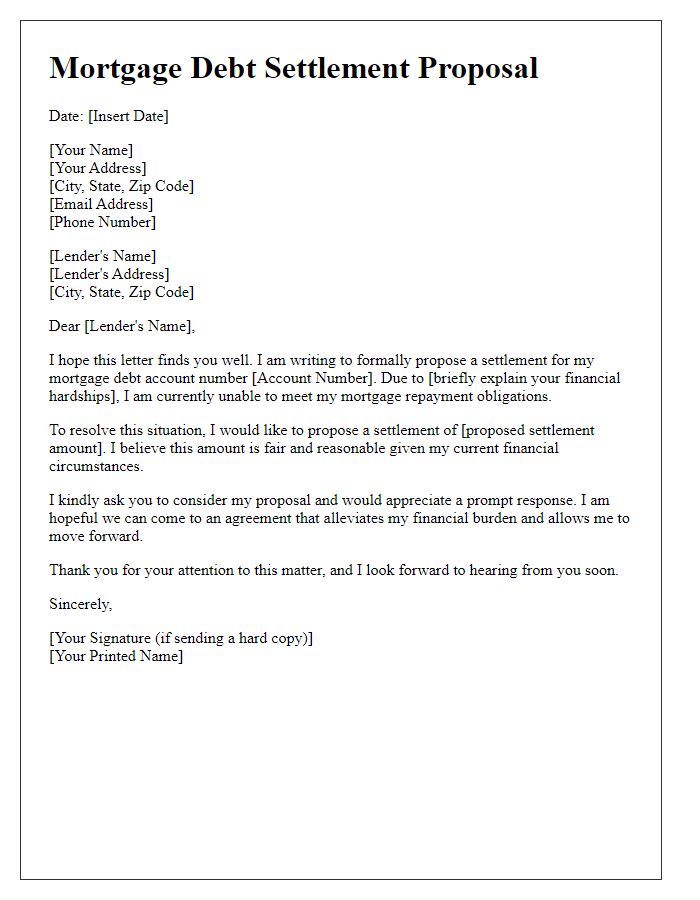

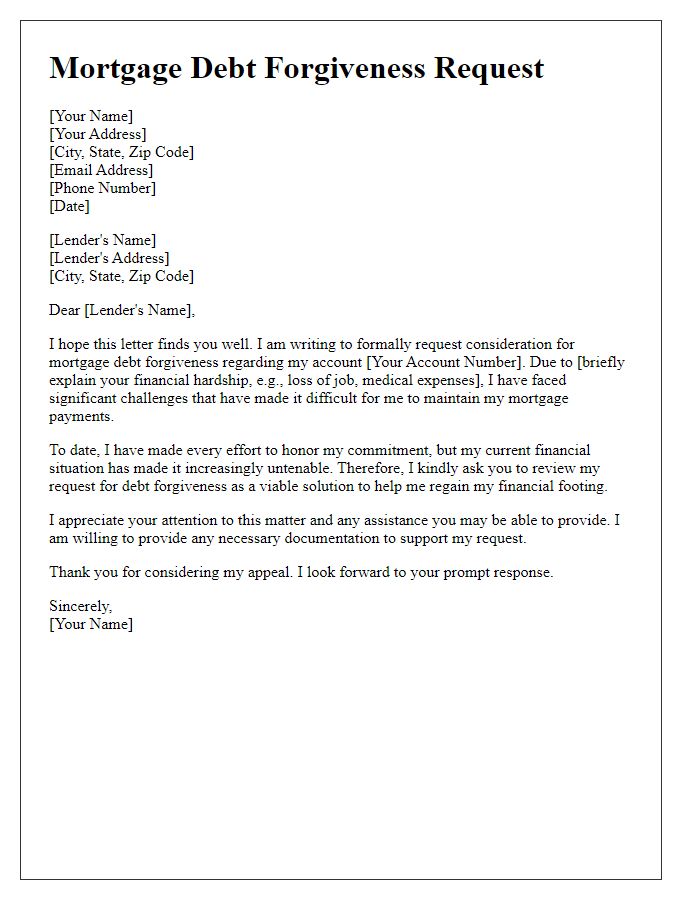

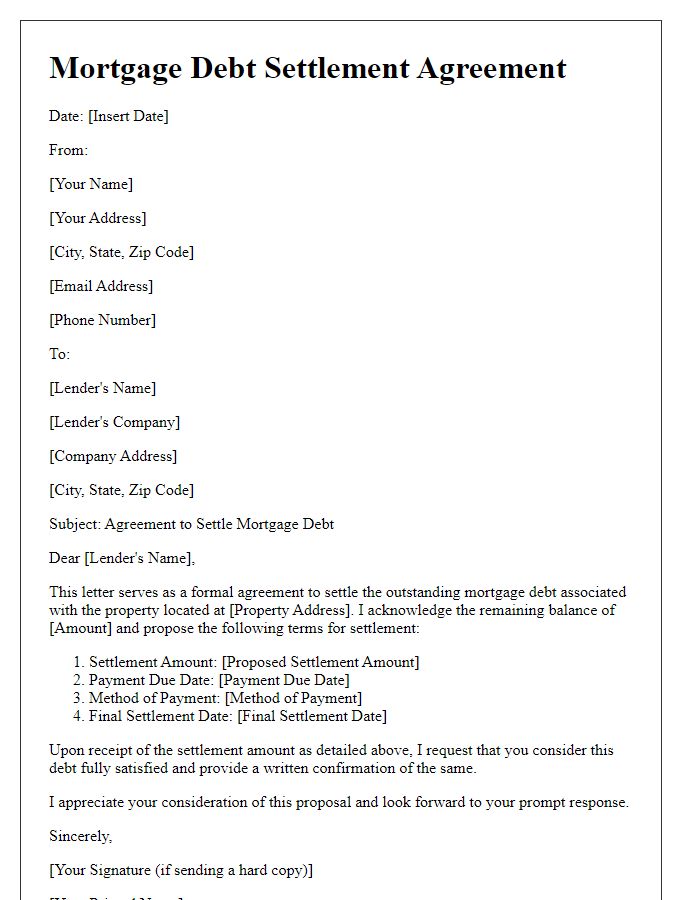

Borrower and lender contact information.

A mortgage debt settlement agreement includes essential contact information such as the borrower (individual or entity responsible for the mortgage), typically featuring their full name, address, email address, and phone number. The lender (financial institution or bank providing the mortgage) also needs comprehensive details including the institution's name, mailing address, email contact, and a designated point of contact (such as a mortgage officer), to facilitate clear communication. Ensuring the accuracy of all contact information is crucial for progressing with any negotiations or legal documentation related to the mortgage debt.

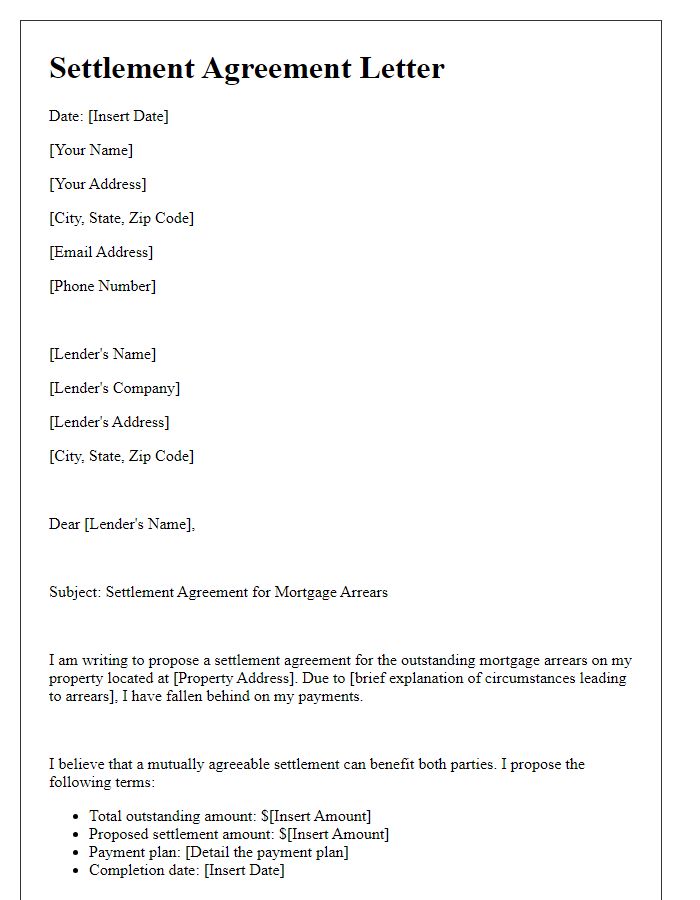

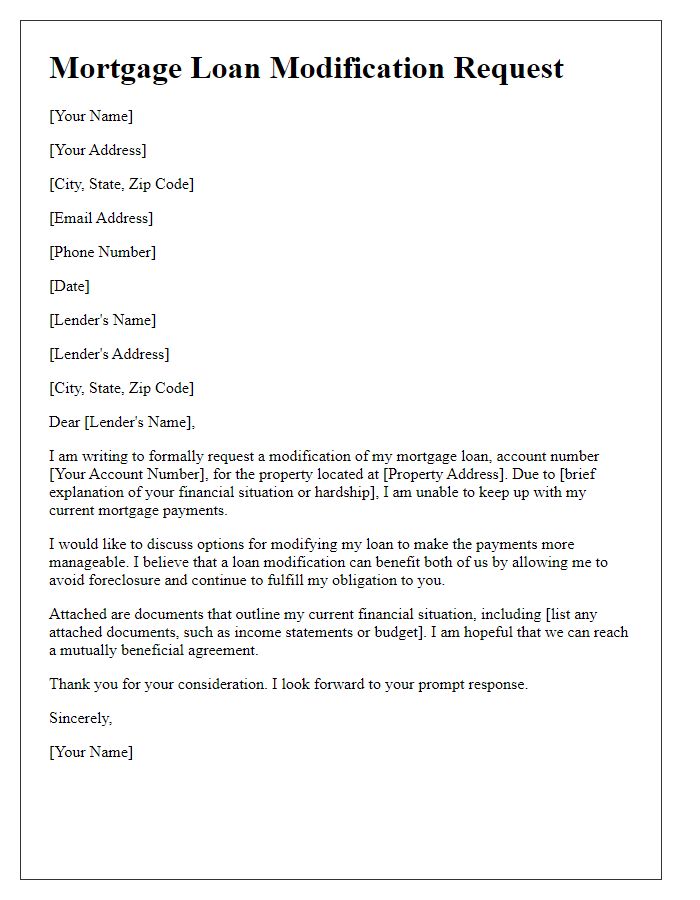

Detailed loan account information.

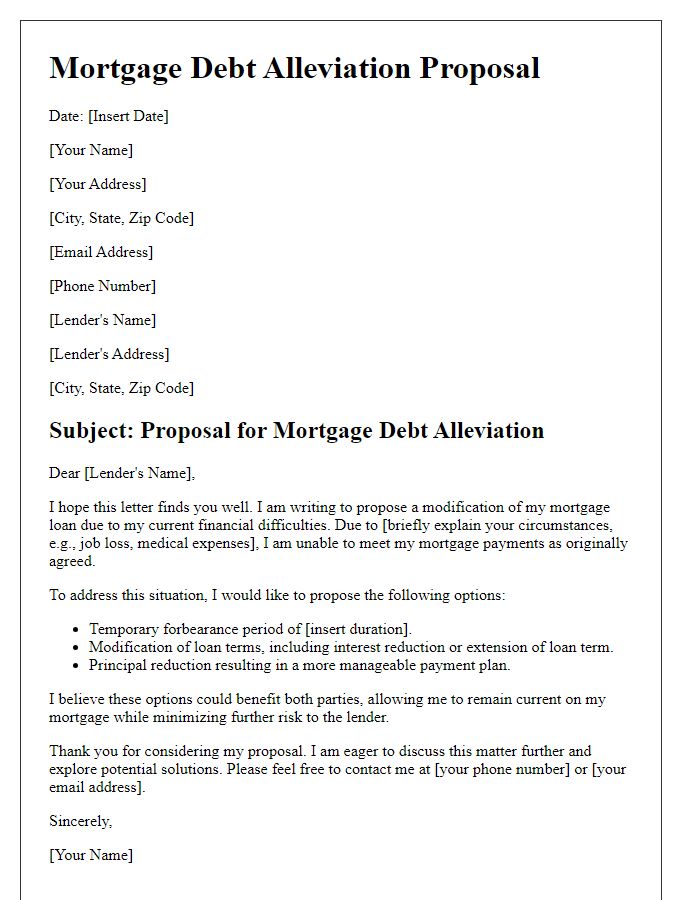

A mortgage debt settlement agreement outlines the arrangements made to settle outstanding loan balances typically due to financial hardship. Key details include the original loan account number, reflecting the specific mortgage issued by the lender. The amount due at the time of settlement is critical, often representing the total remaining principal balance, interest accrued, and any late fees or penalties incurred. Additionally, the lender's name, such as Bank of America or Wells Fargo, alongside the property address, serves to clearly identify the mortgage tied to the agreement. Settlement terms usually stipulate the reduced amount agreed upon for full payment and the timeline for making these payments. The agreement may also include provisions addressing the impact on the borrower's credit score and the procedure for obtaining a written release upon successful completion of the settlement.

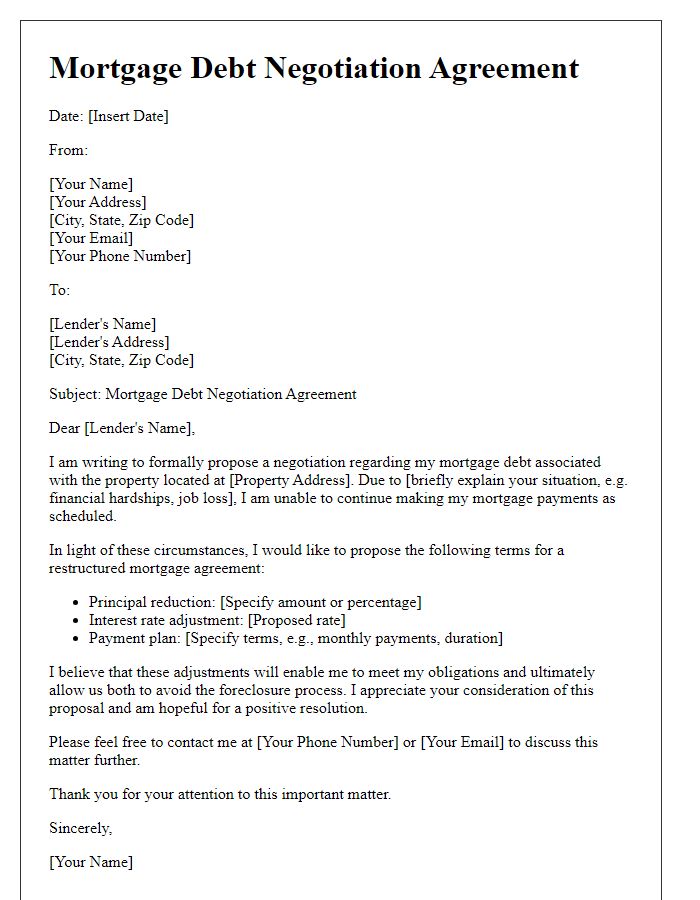

Proposed settlement terms and conditions.

A mortgage debt settlement agreement can provide a comprehensive resolution for borrowers facing financial difficulties regarding their mortgage obligations. The proposed settlement terms might include a reduction of the total outstanding principal balance, which could decrease significantly based on negotiations. For example, a borrower with a $300,000 mortgage may settle for $200,000, reducing their debt by $100,000. Payment plans could also be outlined, specifying a timeframe of 12 to 36 months for the borrower to fulfill the remaining balance, allowing manageable monthly payments. Additionally, the agreement should address any potential tax implications linked to debt forgiveness, especially considering the Internal Revenue Code's impact. Legal fees and administrative costs will need to be noted, as they can influence the overall financial burden on the borrower. Clear stipulations about deadlines for each payment and the consequences of default should be included to protect both parties. Finally, terms regarding the release of lien on the property, contingent upon successfully meeting the settlement conditions, are crucial for providing the borrower with future financial freedom and peace of mind.

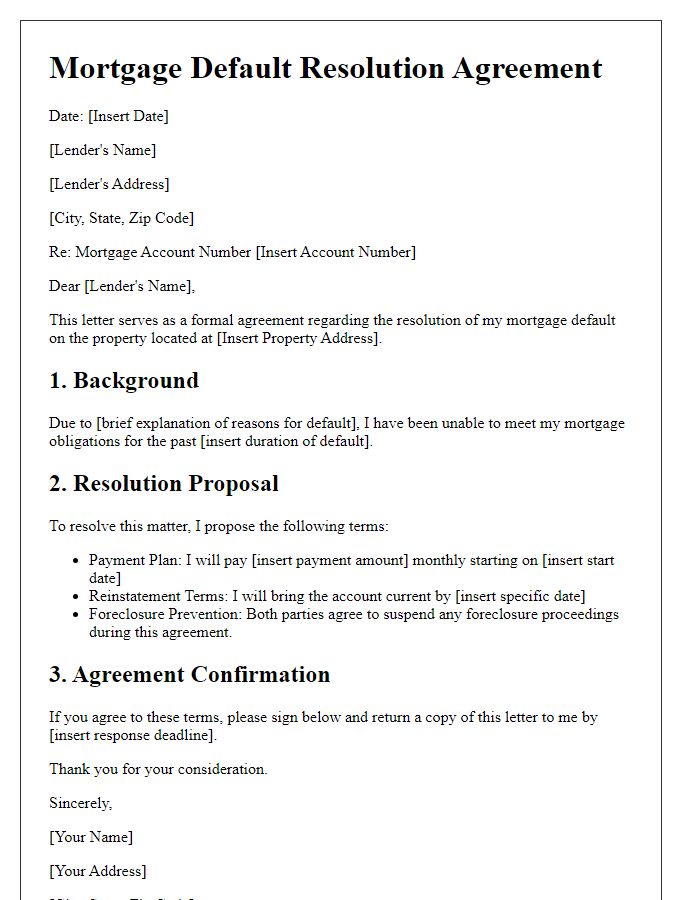

Legal compliance and regulatory adherence.

A mortgage debt settlement agreement is a legal document aimed at establishing the terms of resolving outstanding mortgage debt between a borrower and lender. This agreement typically outlines specific conditions for reduced payments, total debt forgiveness, or renegotiated payment plans. Important elements include compliance with relevant laws such as the Fair Debt Collection Practices Act and the Truth in Lending Act, ensuring that interest rates and fees are transparent and fair. The agreement should be signed by both parties in a designated location (often a lawyer's office), providing legal recourse if terms are violated. Adherence to federal regulations, along with state-specific guidelines, is crucial to avoid potential legal disputes and to ensure consumer protection is maintained throughout the settlement process.

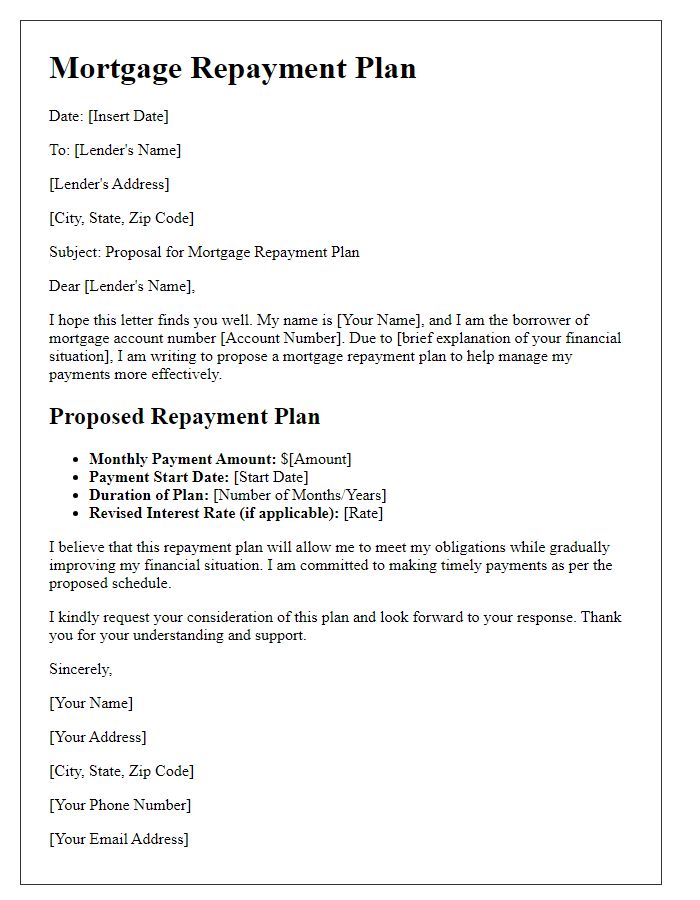

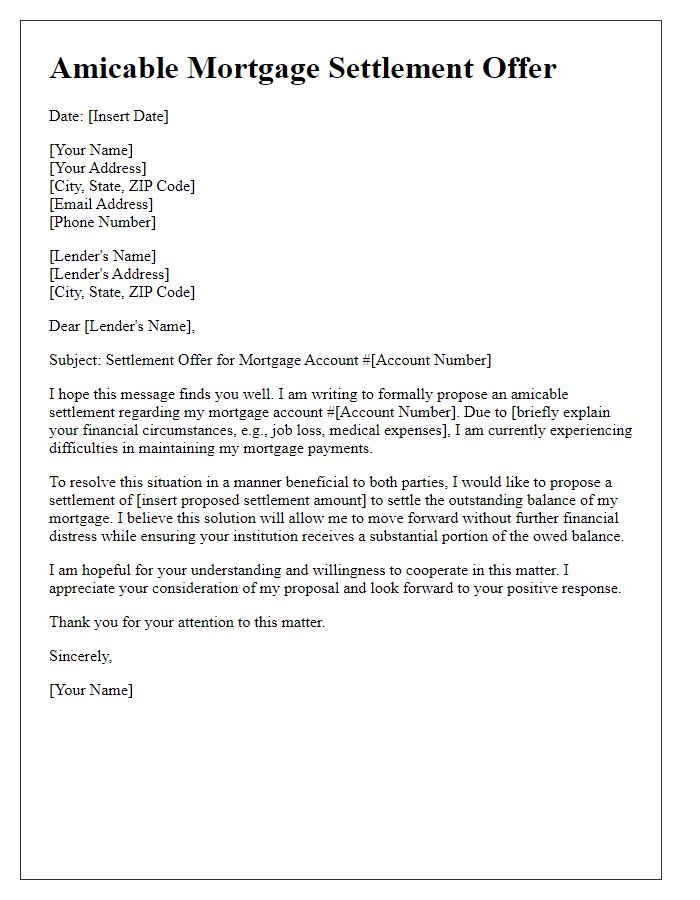

Signatures and notarization requirements.

A mortgage debt settlement agreement requires careful attention to signatures and notarization to ensure its legal validity. All parties involved, typically the borrower and lender, must provide their signatures on the agreement document. This document, which outlines the terms of the settlement including any agreed-upon payment amounts and timelines, should clearly identify each party by full legal names and address. Notarization involves the presence of an official notary public, a trained professional authorized to witness the signing of documents and verify the identities of the signatories. The notary's seal and signature confirm the authenticity of the signatures, providing an extra layer of protection against disputes. Proper documentation of this process can enhance the enforceability of the agreement, particularly in jurisdictions such as California or Texas, where formal requirements can differ significantly.

Comments