Are you considering the idea of refinancing your mortgage but feeling a bit overwhelmed by the process? You're not alone, and that's why we're here to simplify things for you! In this article, we'll walk you through everything you need to know about mortgage refinancing offers and how they can potentially save you money in the long run. So, grab a cup of coffee and dive in to discover how refinancing might be the perfect solution for your financial goals!

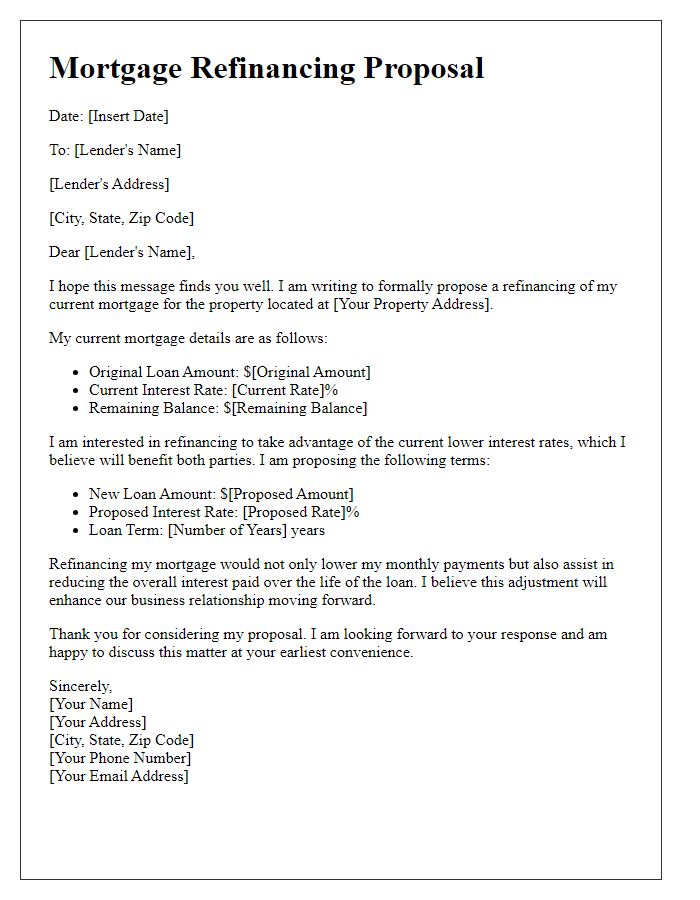

Borrower's personal information.

A mortgage refinancing offer typically includes essential details such as the borrower's full name, current address including city, state, and zip code, contact number for direct communication, email address for electronic correspondence, and the property address tied to the original mortgage. The document should also mention vital identifiers like the mortgage account number, and often the current mortgage lender's name for clarity. These personal and property-related specifics help ensure that the refinancing proposal is accurate and tailored to the borrower's financial situation.

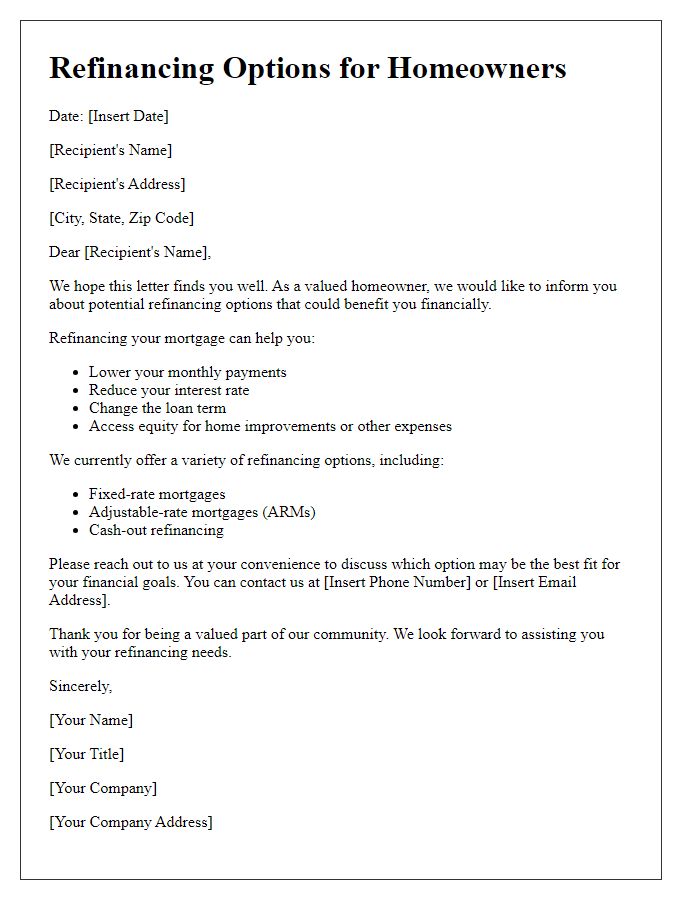

Loan terms and interest rate details.

When considering mortgage refinancing, borrowers can benefit from understanding specific loan terms and interest rates which significantly impact overall financial implications. A loan term typically ranges from 15 to 30 years, with shorter terms often offering lower interest rates but higher monthly payments. Current interest rates may fluctuate, reaching as low as 2.5% for 30-year fixed-rate mortgages in 2023, depending on the borrower's credit score and the lender's criteria. Additionally, evaluating closing costs, which can average between 2% to 5% of the loan amount, is crucial for making informed decisions. Refinancing can also affect cash flow and long-term financial goals, necessitating careful consideration of monthly payment changes against equity build-up in real estate markets across areas like California or Texas.

Estimated closing costs and fees.

When refinancing a mortgage, borrowers need to consider estimated closing costs and fees that often include appraisal costs (averaging $400 to $600), title insurance fees (ranging from $1,000 to $3,000 depending on the property value and location), and a credit report fee (typically about $30 to $50). Lender origination fees, which can be around 0.5% to 1% of the loan amount, must also be factored in, impacting the overall refinancing expense. Additional costs to consider are recording fees, generally between $50 to $150, and prepaid costs such as homeowners insurance and property taxes. Each of these elements plays a critical role in determining the total cost of refinancing, influencing the decision on whether to proceed with the mortgage refinancing offer.

Required documentation checklist.

Mortgage refinancing often requires various documents to ensure eligibility and streamline the approval process. Borrowers typically need to provide proof of income, including recent pay stubs (usually from the last 30 days) and W-2 forms from the past two years. Financial institutions may also require bank statements (typically from the last two months) to assess asset levels. Additionally, a credit report will be reviewed to evaluate creditworthiness, which includes the borrower's credit score and history. Property documentation such as the current mortgage statement and property tax records may also be necessary. Lastly, personal identification, including a government-issued photo ID like a driver's license or passport, helps verify the identity of the borrower during the application process.

Loan officer contact information.

Contact information for a loan officer typically includes their full name, professional title (such as Mortgage Loan Officer), and the name of the lending institution (for instance, ABC Mortgage Company). Additional details include the office address, which might be located in a city like Denver, Colorado, the phone number (specific area code like 303), and a professional email address (for example, loanofficer@abcmortgage.com). Other relevant contact methods could be listed, such as a direct line (perhaps a mobile number), and social media connections (like LinkedIn). Providing this information ensures clients have multiple ways to reach the loan officer for assistance with mortgage refinancing offers.

Comments