Are you considering a mortgage subordination but not sure how to get the ball rolling? Understanding the intricacies of this process can feel overwhelming, but with the right letter template, you can navigate it smoothly. In this article, we'll break down the essential components of a mortgage subordination request, ensuring you clearly communicate your needs to lenders. So, let's dive in and explore how you can effectively draft your request!

**Clear Subject Line** - Direct statement of the request.

Mortgage subordination allows a new loan to take priority over an existing mortgage. This process often involves a property owner seeking approval from the current lender to enable refinancing opportunities or second mortgages. Specific forms, such as a subordination agreement, are required for formal documentation. The request typically involves detailing the existing loan amount, property address (including local jurisdiction), and the reasons for refinancing, such as lower interest rates or cash-out options. Additionally, borrowers must mention the new lender's information to ensure clarity in the transaction. Understanding local regulations regarding mortgage subordination is essential for a smooth process.

**Recipient's Details** - Accurate lender's contact information.

When requesting mortgage subordination, providing precise details is crucial. Include the recipient's name, title, and organization for clarity. Next, specify the lender's contact information, including an accurate mailing address, email address, and phone number. This ensures that all communication reaches the appropriate party involved in the mortgage process. For example, the lender may be a bank, credit union, or financial institution specializing in real estate loans. Additionally, mention any specific reference numbers, property addresses involved (include city and state), and relevant dates, enhancing the request's effectiveness and response speed.

**Your Details** - Borrower's name, address, and loan account number.

Submitting a mortgage subordination request involves outlining essential borrower details for processing. Borrower's name serves as the primary identifier, appearing prominently on official documents. Address includes street, city, state, and ZIP code, ensuring precise identification of property involved in the mortgage transaction. Loan account number is crucial for tracking the specific mortgage in question, allowing the lender to quickly access all relevant information and history associated with the loan. Accurate and comprehensive information aids in expediting the request while maintaining clarity for the lending institution.

**Purpose Statement** - Explicit request for mortgage subordination.

Mortgage subordination allows a borrower to refinance a primary mortgage while keeping a second mortgage in its current position. This process typically involves the second lender agreeing to subordinate their lien, allowing the first mortgage to take precedence. In real estate transactions, mortgage subordination is crucial for securing better loan terms, as it enables homeowners to access lower interest rates or different loan structures. Homeowners looking to negotiate favorable refinancing terms must formally communicate this request to their lenders, ensuring that all necessary documentation and justifications are provided to facilitate the subordination process.

**Supporting Documentation** - List of attached necessary documents and details.

To successfully request mortgage subordination, relevant supporting documentation must be meticulously prepared and included. Essential documents include the original mortgage agreement detailing terms, a subordination agreement that reflects the new lien hierarchy, proof of homeownership such as a deed, recent mortgage statements showcasing current loan balances, an official appraisal report valuing the property conducted by a certified appraiser, a credit report indicating the borrower's creditworthiness, and a copy of the purchase agreement if applicable for any related refinancing or secondary mortgage requests. Additionally, include identification documents such as a government-issued ID and any other financial statements that may assist in the evaluation process. Ensuring the completeness and accuracy of these documents enhances the likelihood of a favorable outcome in the subordination request.

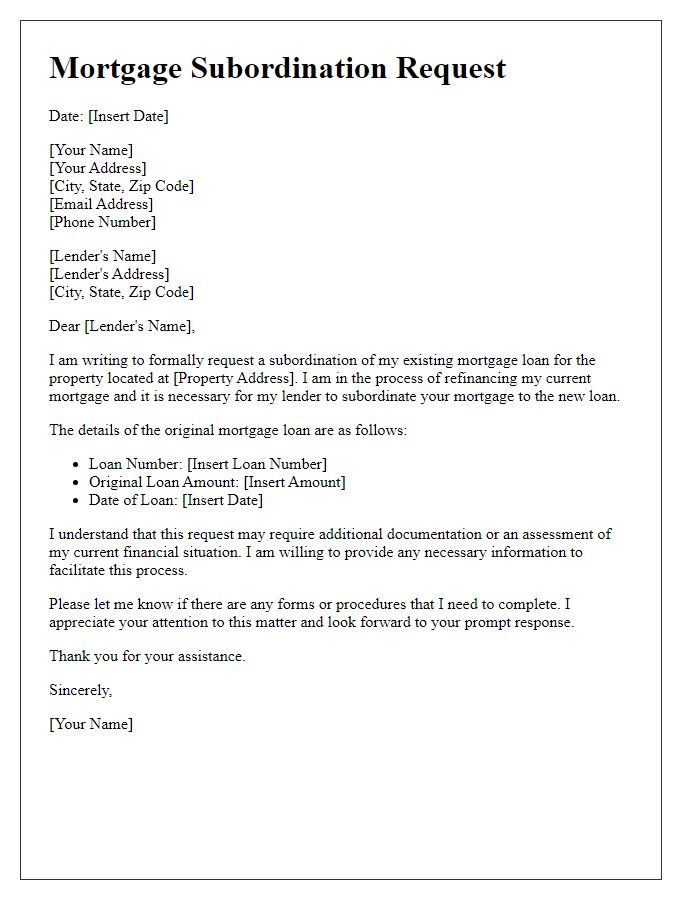

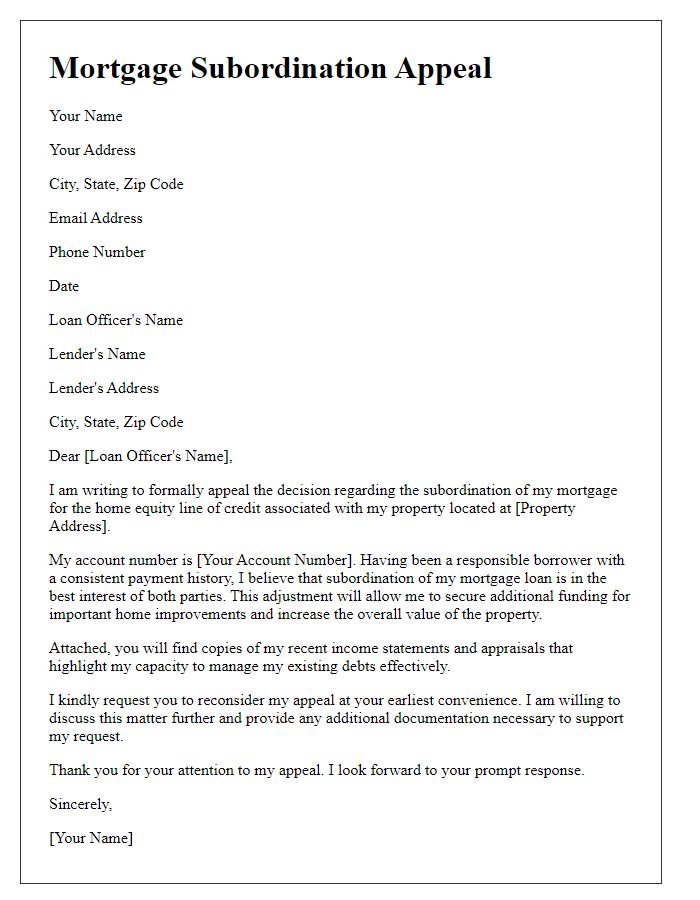

Letter Template For Requesting Mortgage Subordination Samples

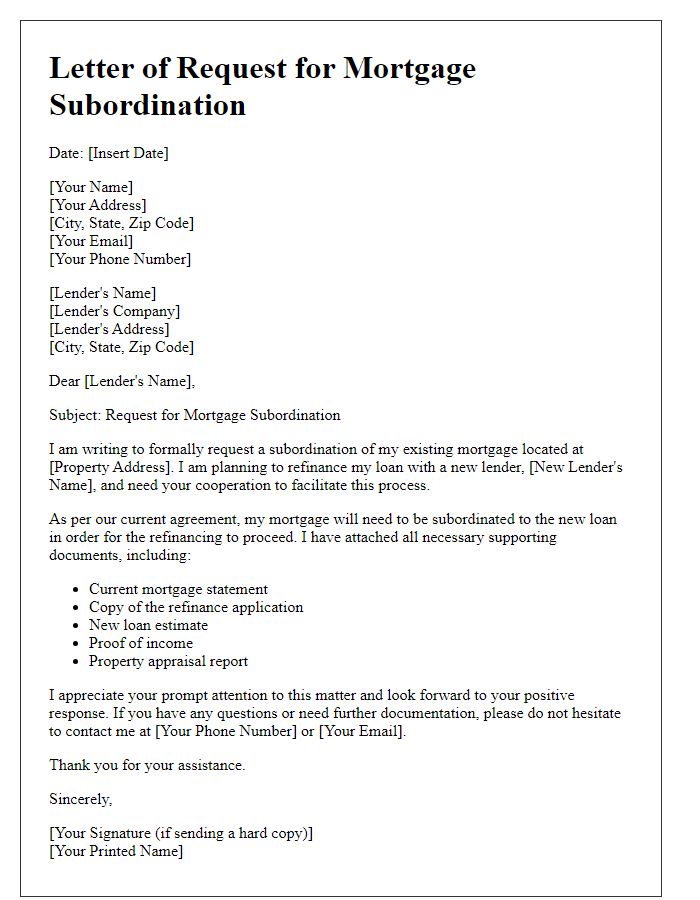

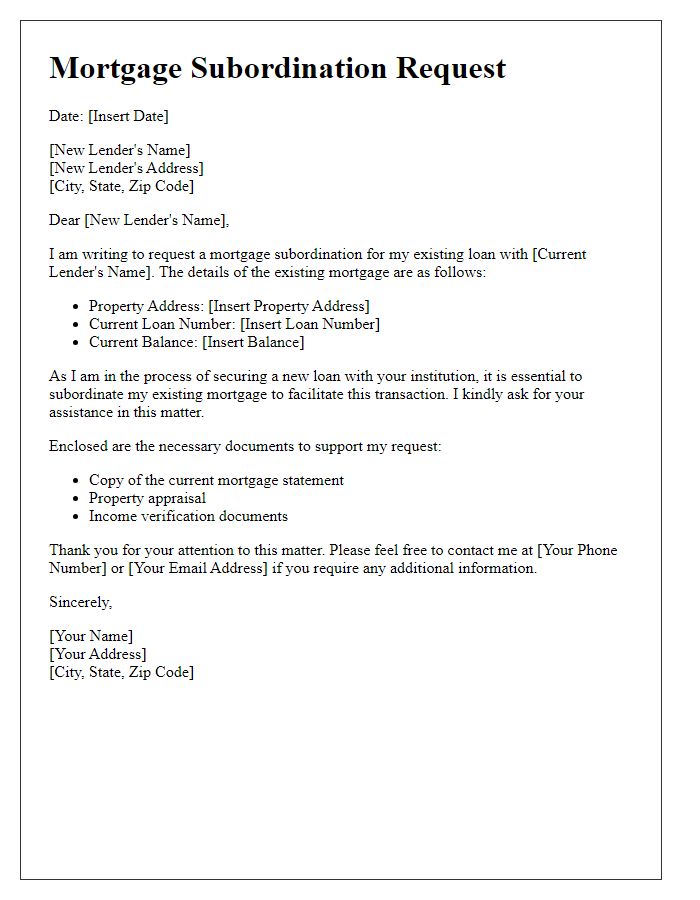

Letter template of request for mortgage subordination with supporting documents.

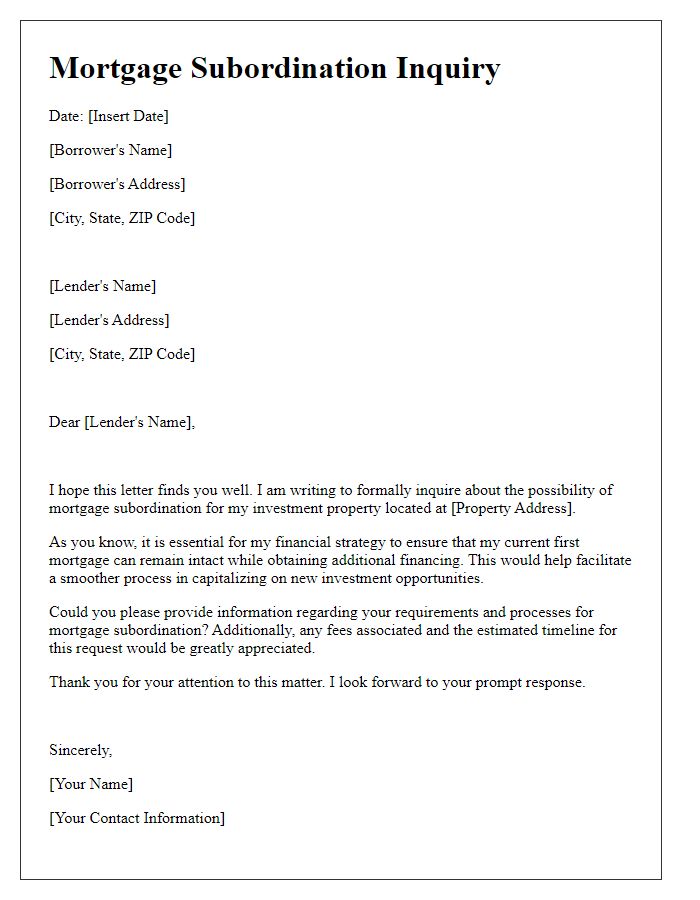

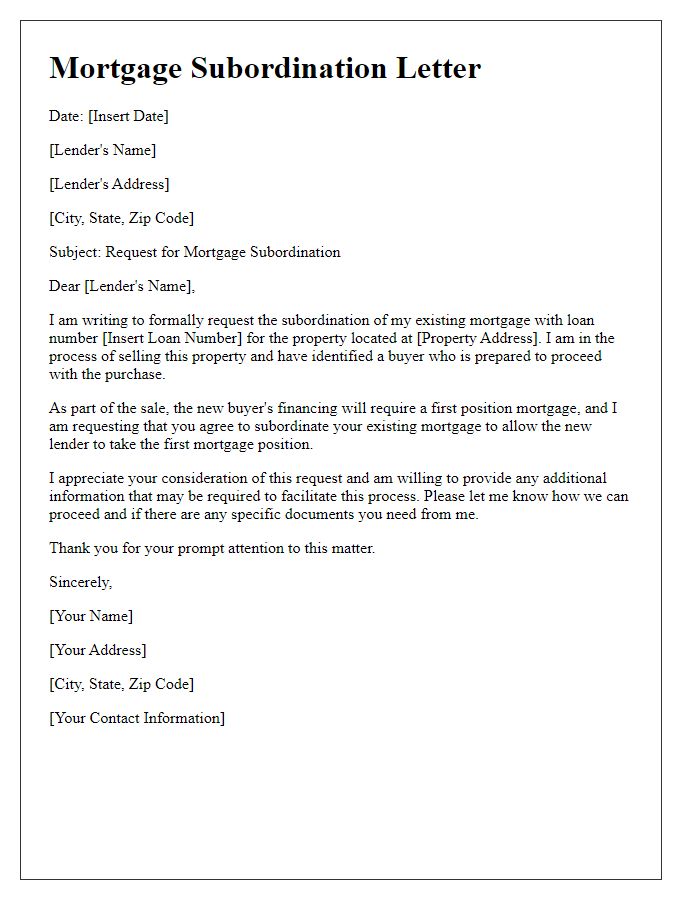

Letter template of mortgage subordination inquiry for investment property.

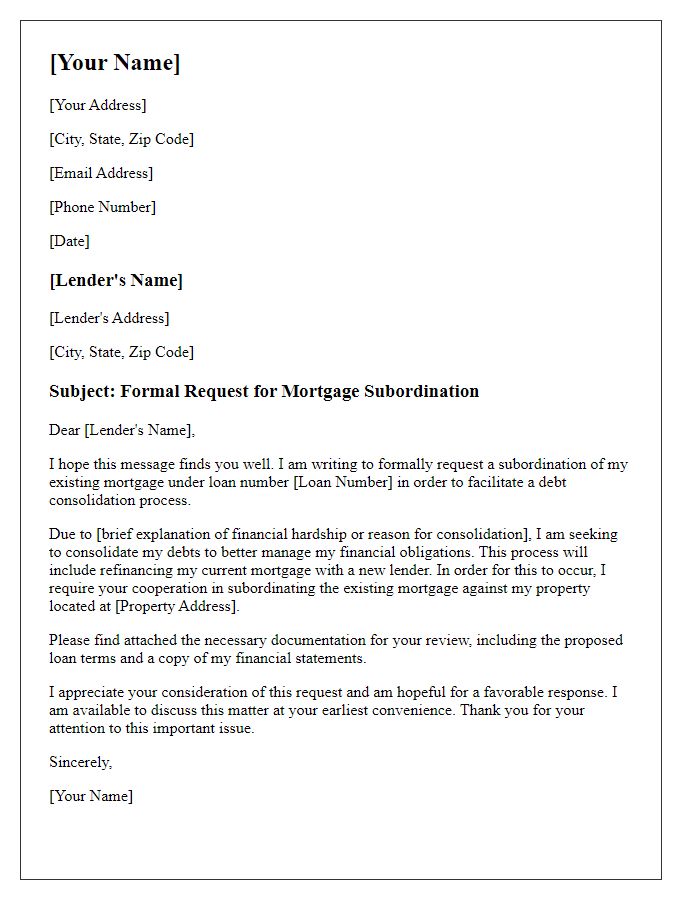

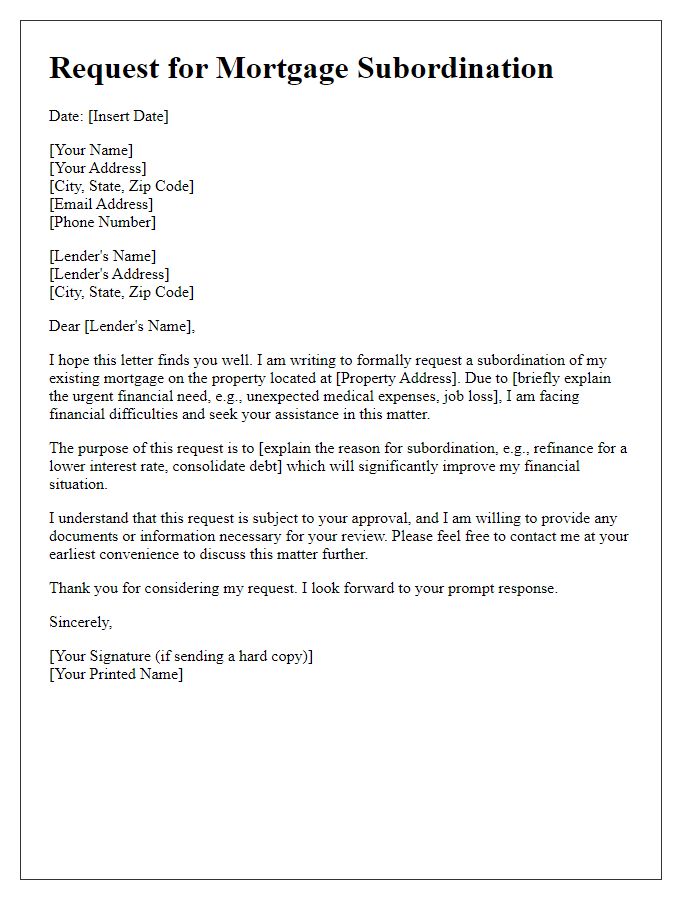

Letter template of formal request for mortgage subordination for debt consolidation.

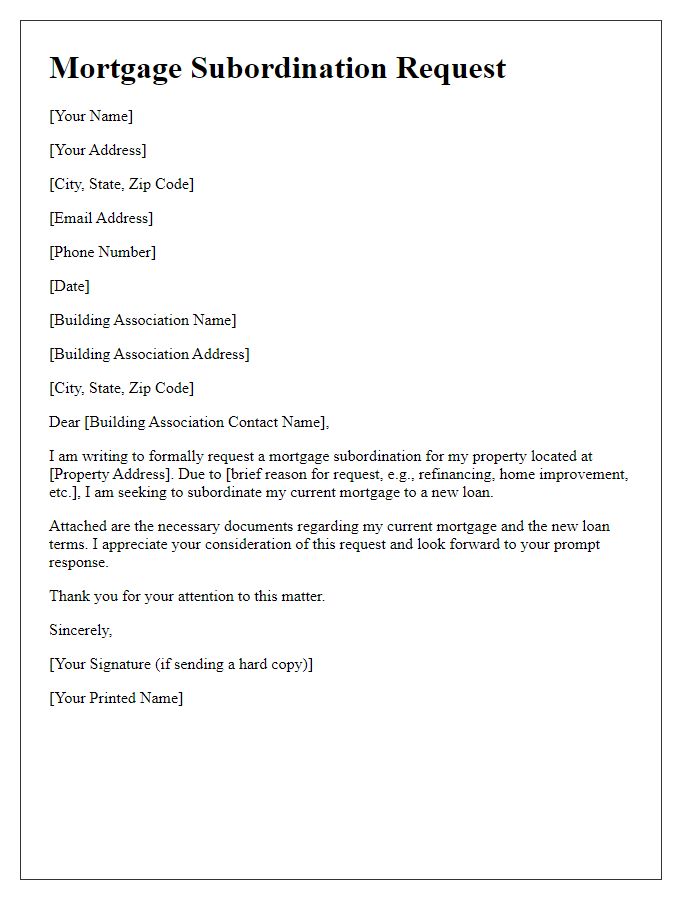

Letter template of mortgage subordination request to a building association.

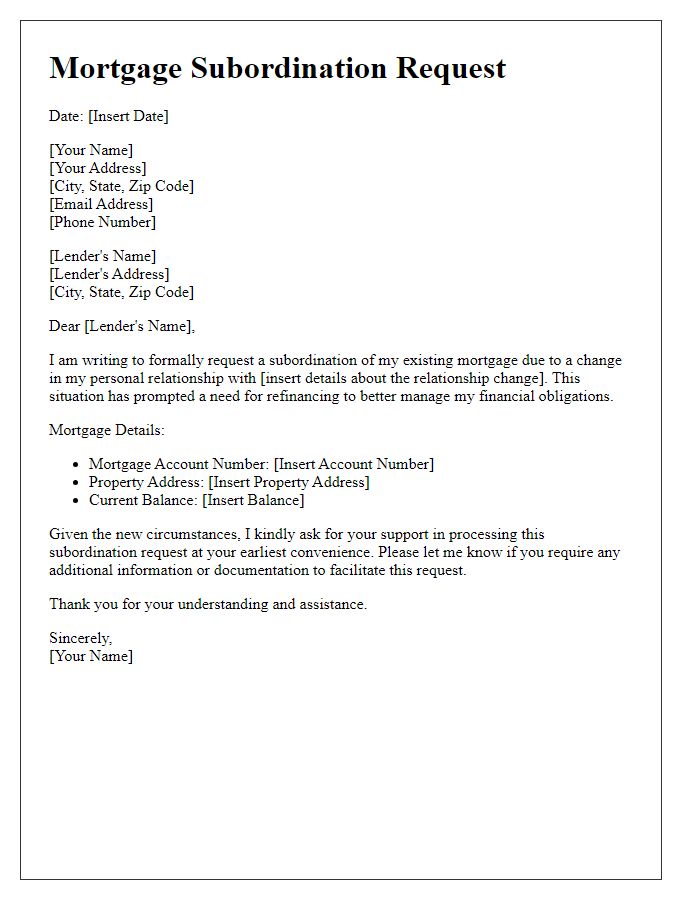

Letter template of mortgage subordination request due to relationship change.

Comments