Are you tired of paying for private mortgage insurance (PMI) when you believe you no longer need it? Understanding how to request a waiver can save you money and give you the peace of mind you deserve. In this article, we'll walk you through the steps to write an effective letter for your PMI waiver request, highlighting key factors that can strengthen your case. So, let's dive in and empower you to take control of your mortgage costs!

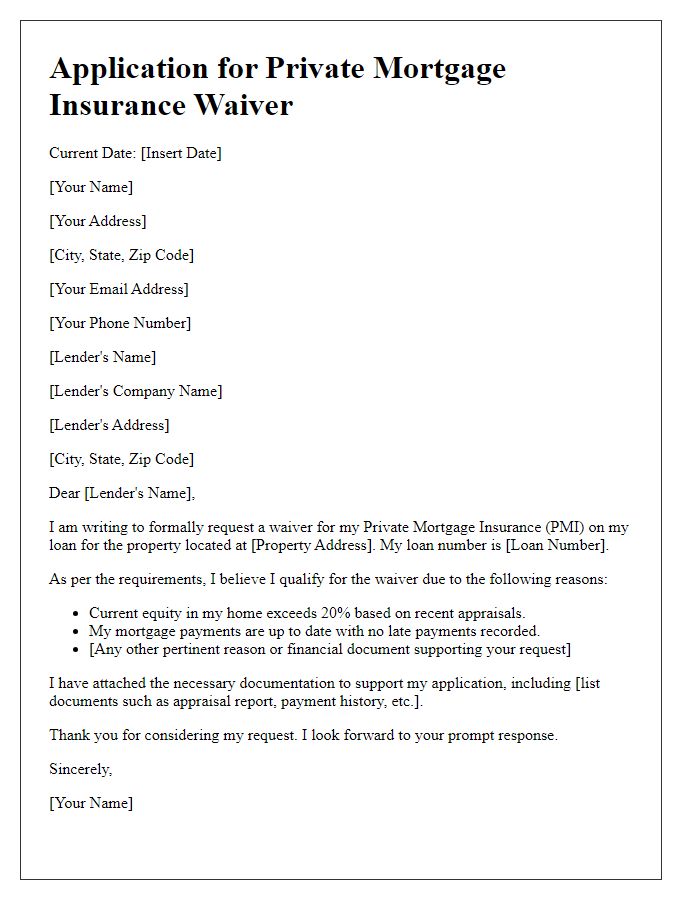

Borrower's personal and loan details

Private mortgage insurance (PMI) can significantly increase monthly mortgage payments, making homeownership less affordable for many borrowers. In most cases, PMI is required when the borrower's down payment is less than 20% of the home's appraised value. For example, on a $300,000 home, a borrower putting down only $15,000 must pay PMI, which typically ranges from 0.3% to 1.5% of the original loan amount annually. To qualify for a PMI waiver, borrowers usually need to demonstrate a loan-to-value ratio (LTV) of 80% or less, where the current loan balance is below 80% of the new appraised value of the home. An updated appraisal might be necessary, and some lenders prefer that borrowers have made timely payments for a specific period, often 24 months. Each lender may have unique requirements for waiving PMI that borrowers must follow to reduce their monthly financial burden effectively.

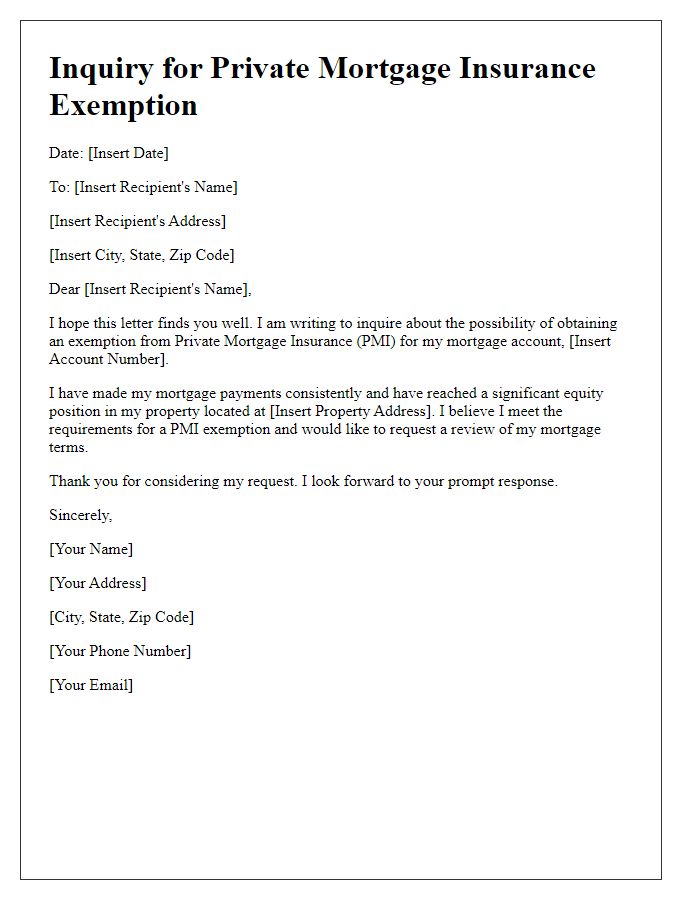

Property value and loan-to-value ratio

Private mortgage insurance (PMI) can be a significant cost for homeowners, often required when the loan-to-value (LTV) ratio exceeds 80%. For instance, if the property's current market value is $300,000, a mortgage of $240,000 creates a LTV ratio of 80%. Homeowners should regularly assess property values, which can increase due to market trends or improvements made. In 2023, average home appreciation rates in the United States reached 14%, suggesting substantial potential for equity buildup. By providing updated property appraisals that demonstrate lower LTV ratios, homeowners may qualify for PMI cancellation, ultimately leading to significant savings in monthly mortgage payments.

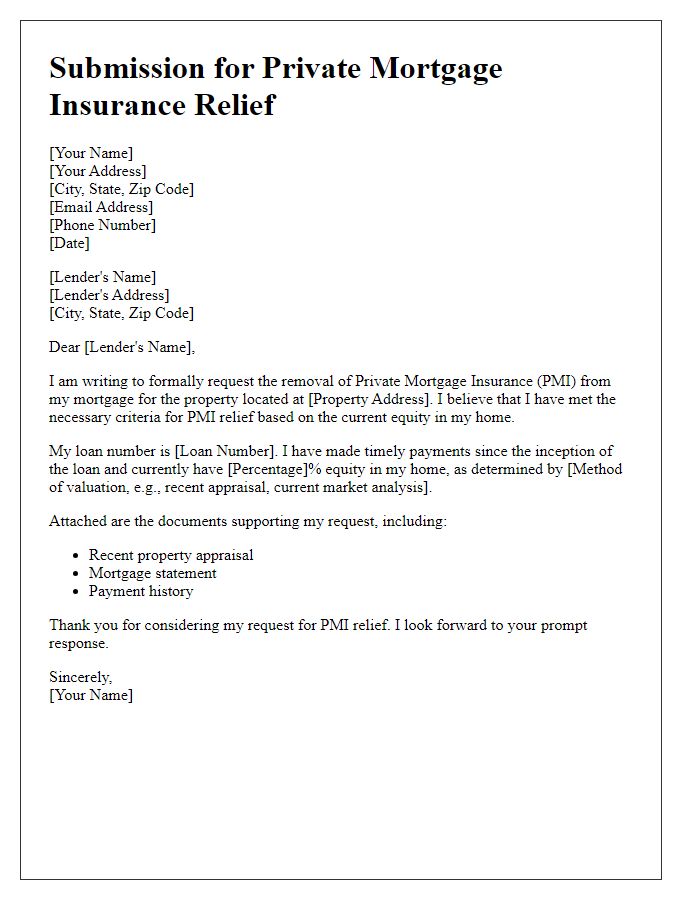

Proof of increased equity or property appreciation

Homeowners seeking a waiver for private mortgage insurance (PMI) often rely on proof of increased equity or property appreciation. Documenting recent property evaluations, such as an appraisal from a certified appraiser or a comparative market analysis featuring similar properties that have sold in the area, can substantiate claims of increased value. Homeowners should also consider providing evidence of significant renovations or improvements, like kitchen upgrades or landscape enhancements, that enhance the property's overall worth. Additionally, including data on local real estate market trends, such as recent sales prices, can further support the argument for PMI removal. Having an organized presentation of this information, including dates, property addresses, and estimated appraised values, increases the likelihood of a successful waiver request.

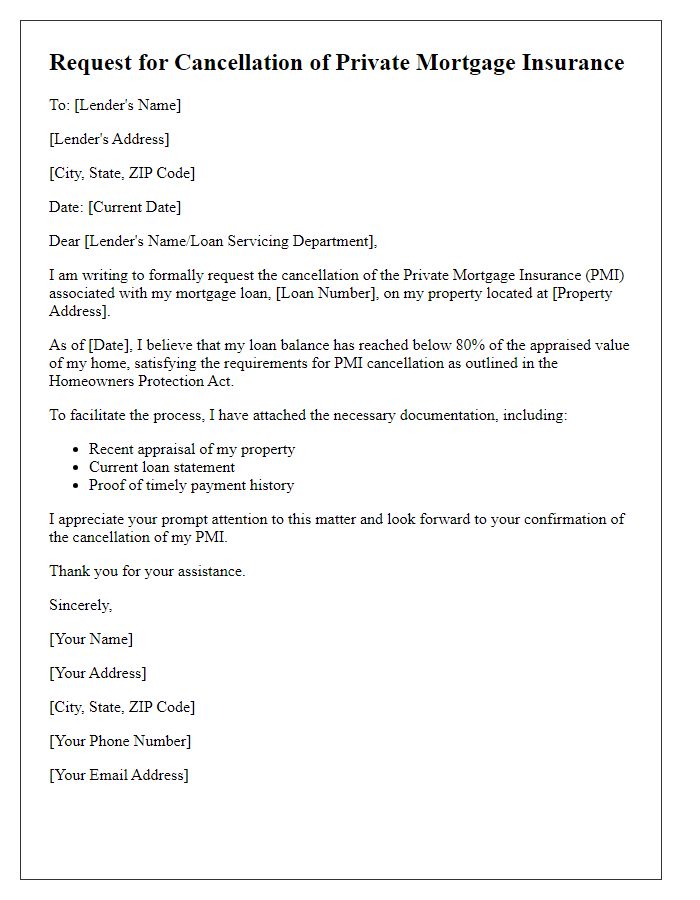

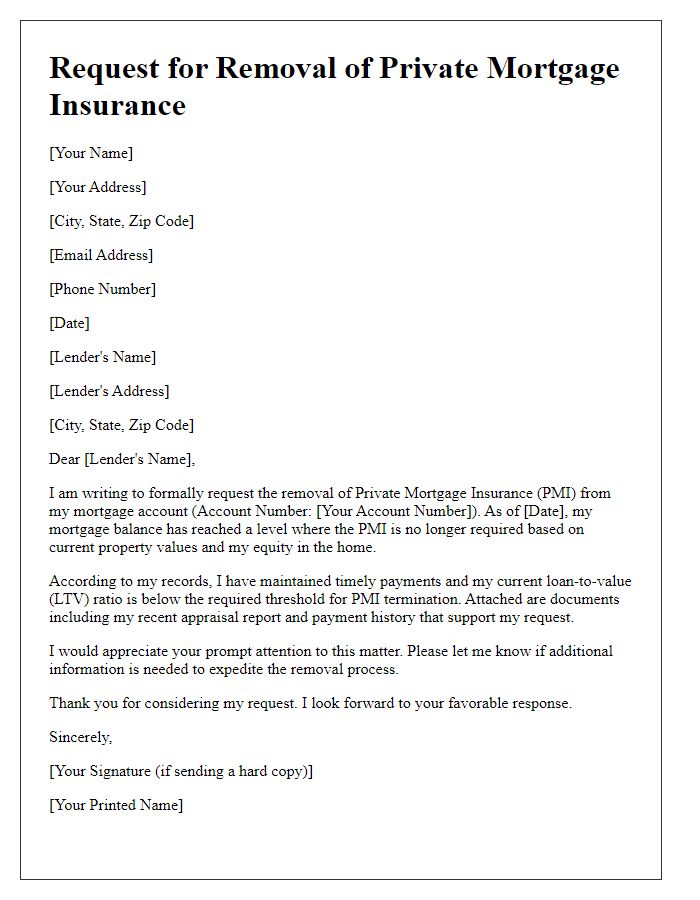

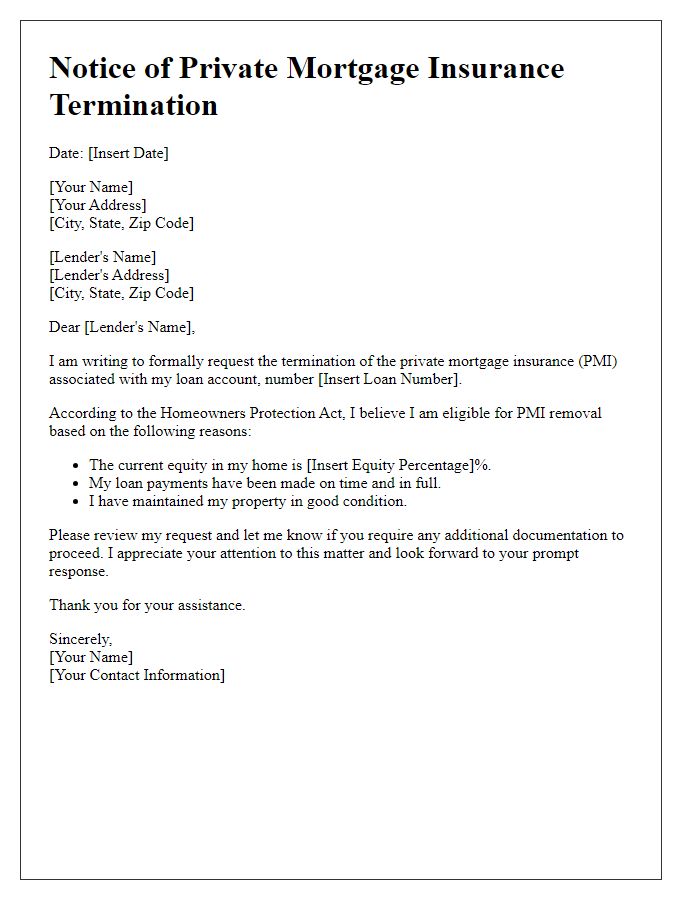

Request and justification for PMI removal

Private mortgage insurance (PMI) serves as a safeguard for lenders in the event of borrower default, typically required when the home equity is less than 20%. Homeowners, such as those residing in suburban areas like Maplewood, New Jersey, may request PMI removal once they demonstrate a reduction in mortgage balance and an increase in property value. For example, if a homeowner's mortgage balance decreased to $150,000 due to consistent monthly payments and the current appraisal reflects a market value of $250,000, they would have achieved a 40% equity stake. This substantial equity position, often verified through updated appraisals conducted by licensed appraisers, can justify the removal of PMI, resulting in significant monthly savings and a more manageable financial burden. Homeowners should compile documentation, such as recent appraisals and payment history, to support their request for PMI cancellation effectively.

Contact information for lender communication

Private mortgage insurance (PMI) waivers can significantly benefit homeowners by eliminating added monthly costs associated with mortgage loans. Lenders, such as banks or credit unions, typically require PMI when the down payment is less than 20% of the home's purchase price. Homeowners in states like California or Texas, where property values are often high, may seek PMI waivers to reduce monthly expenses. Documentation showcasing a loan-to-value ratio below 80%, usually requiring an appraisal, is essential for this process. Timely communication with the lender's mortgage servicing department ensures that homeowners can navigate requirements effectively and advocate for their financial interests.

Letter Template For Private Mortgage Insurance Waiver Samples

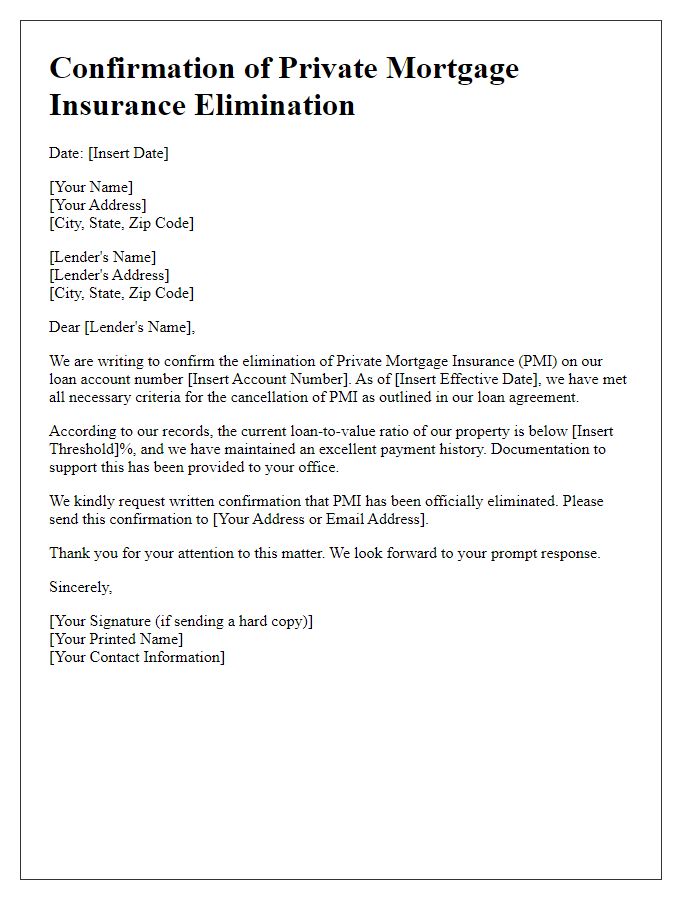

Letter template of confirmation for private mortgage insurance elimination

Comments