Are you gearing up to buy a new home or perhaps refinance your existing mortgage? Navigating the world of mortgage documentation can feel overwhelming, but it doesn't have to be. A well-crafted letter requesting necessary documents can simplify the process and set you on the right path. Ready to learn how to create an effective mortgage documentation request? Keep reading for our easy-to-follow template!

Borrower's Personal Information

To secure a mortgage successfully, thorough documentation regarding the borrower's personal information is crucial. Key details include the borrower's full name (first, middle, last), social security number (specific 9-digit identifier), date of birth (to establish credit history), current address (including city, state, and ZIP code), and employment information (name of employer, job title, and duration of employment). Additionally, income verification documents, such as W-2 forms and recent pay stubs, should be collected for assessment. A list of any outstanding debts (credit card balances, loans) enhances the lender's understanding of the borrower's financial obligations, while bank statements validate account balances and savings. This comprehensive profile assists lenders in determining creditworthiness and loan suitability for mortgage approval processes.

Description of Requested Documents

Mortgage documentation requests often include essential paperwork needed for loan approval and processing. Key documents commonly requested include the completed loan application form, which outlines the borrower's financial background and housing details. Income verification statements such as recent pay stubs, W-2 forms, and tax returns are necessary to ensure the borrower's financial stability, typically covering the last two years. Additionally, bank statements from all accounts provide insight into the borrower's assets and cash flow. Property documents like the purchase agreement (for home buyers) and title report ensure the property's legitimacy. Identification documents such as government-issued photo ID confirm the borrower's identity, while credit reports reveal creditworthiness. Finally, any documentation regarding existing debts, including loan statements or credit card balances, is requested to assess the borrower's overall financial health.

Purpose of Request

In the context of requesting mortgage documentation, the purpose often revolves around verifying loan details or assessing financial viability. Mortgage documentation may include important elements such as loan application forms, credit reports, and income verification, which play crucial roles in determining eligibility for home financing. Essential details such as the loan amount, interest rate (often expressed as a percentage), and loan term (typically 15 to 30 years) must be clearly outlined. Furthermore, records from financial institutions, such as bank statements and pay stubs, are essential for a comprehensive evaluation of an applicant's financial health. This documentation request aims to gather all necessary information efficiently, ensuring a smooth processing of the mortgage application and facilitating timely approvals for potential homeowners.

Contact Information for Follow-up

Requesting mortgage documentation necessitates precise contact information for seamless follow-up. Essential details include the sender's full name and current address for verification purposes. Additionally, email address serves as a primary electronic communication channel, while phone number enables prompt inquiries. If applicable, including fax number adds an alternative method for document transmission. Clearly outlining this information ensures swift resolution of any queries related to mortgage account, enhancing the efficiency of the documentation process.

Deadline for Submission

Mortgage documentation requests require careful attention to detail, especially regarding deadlines for submission. For instance, lenders often impose a strict deadline, typically 30 days from the initial application date, to receive necessary documents. This can include items like proof of income, bank statements, credit reports, and tax returns, pertinent to the applicant's financial history. Missing the submission deadline can jeopardize the mortgage approval process, potentially resulting in higher interest rates or even denial of the application. Applicants should check with their lender--such as Bank of America or Wells Fargo--regarding specific requirements and dates to ensure compliance and streamline the approval process.

Letter Template For Mortgage Documentation Request Samples

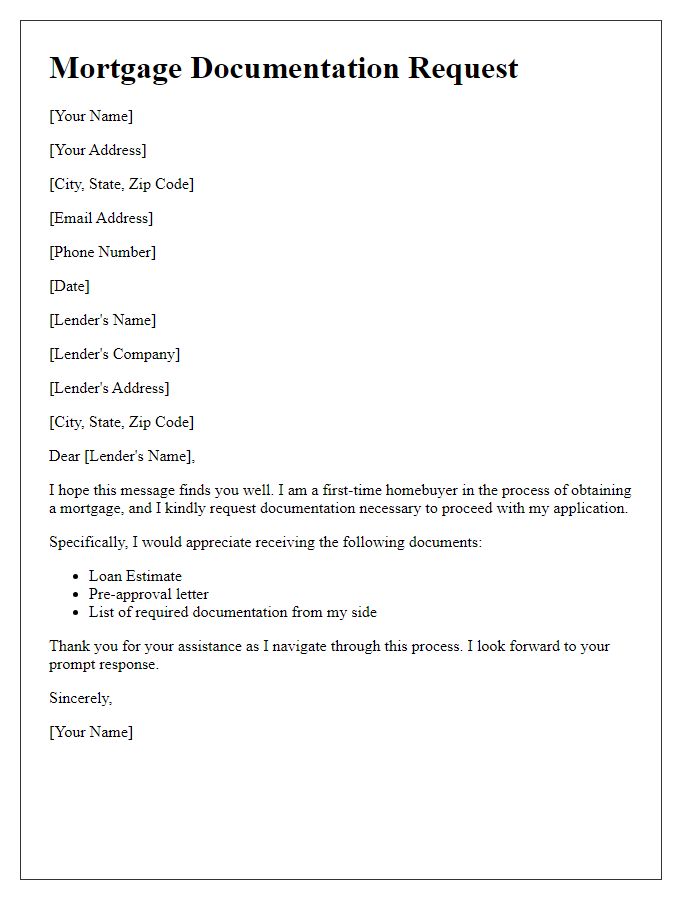

Letter template of mortgage documentation request for first-time homebuyer

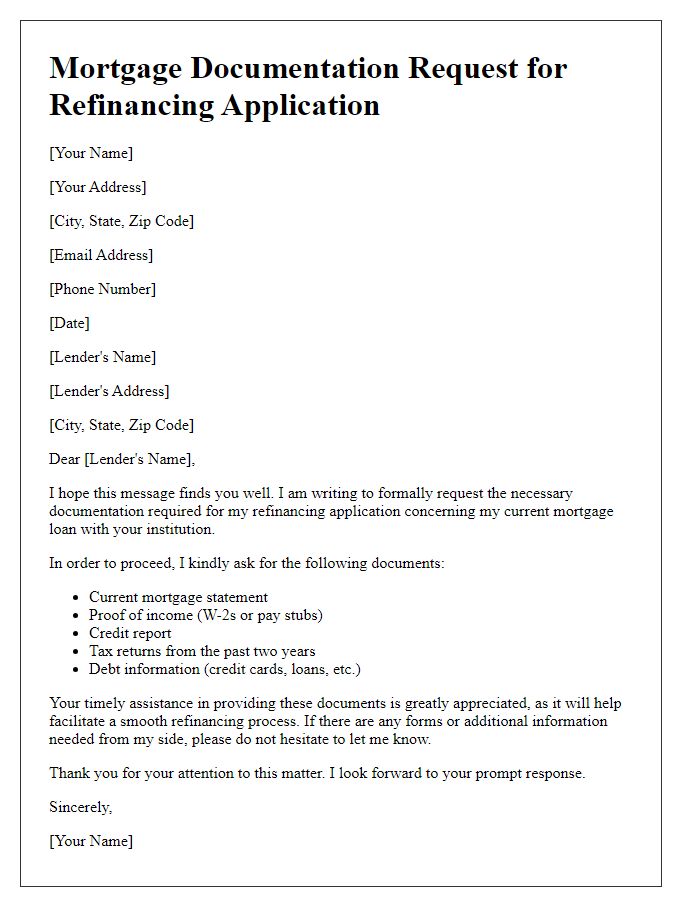

Letter template of mortgage documentation request for refinancing application

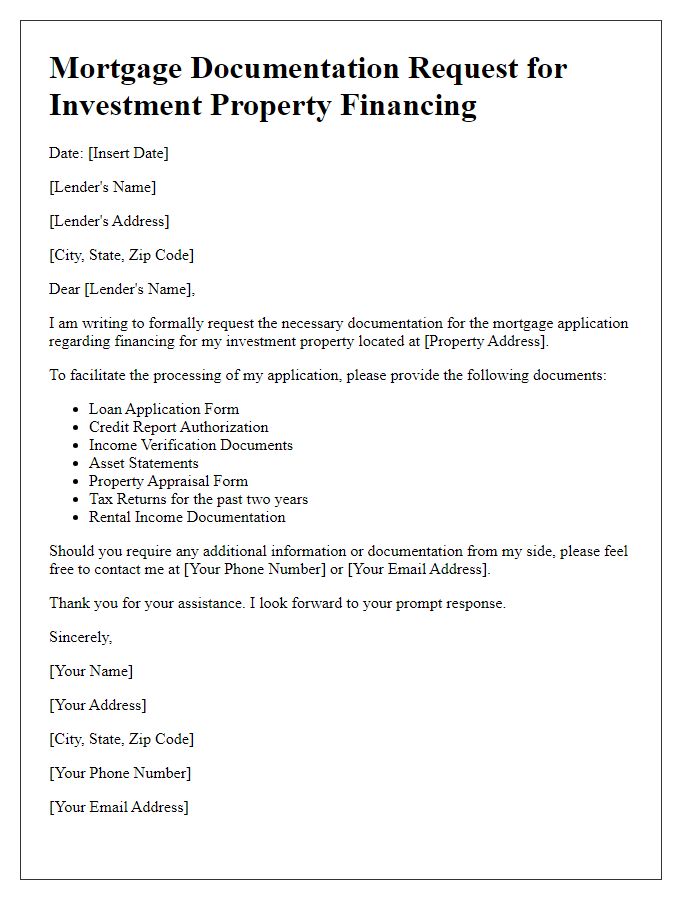

Letter template of mortgage documentation request for investment property financing

Letter template of mortgage documentation request for self-employed applicants

Letter template of mortgage documentation request for co-borrower inclusion

Letter template of mortgage documentation request for clarification of income sources

Letter template of mortgage documentation request for updated financial statements

Comments