Are you in the process of buying a home and need to verify your down payment? It's essential to provide accurate documentation to ensure a smooth transaction, and that's where our down payment verification letter template comes in handy. This simple yet effective resource will guide you through creating a professional letter that meets all lender requirements. Ready to dive into the details? Keep reading to discover everything you need to know!

Letterhead and Contact Information

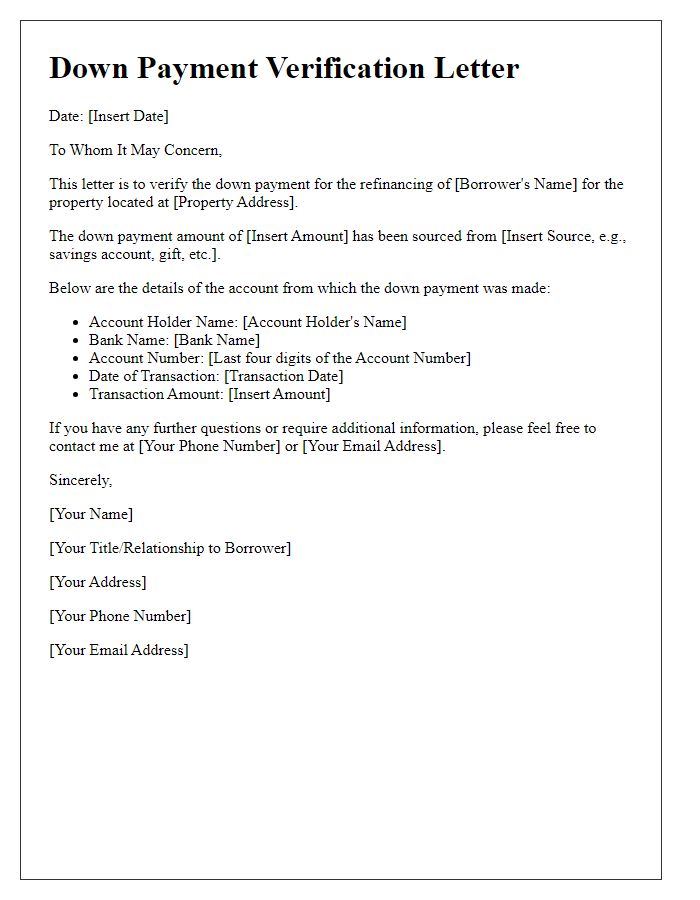

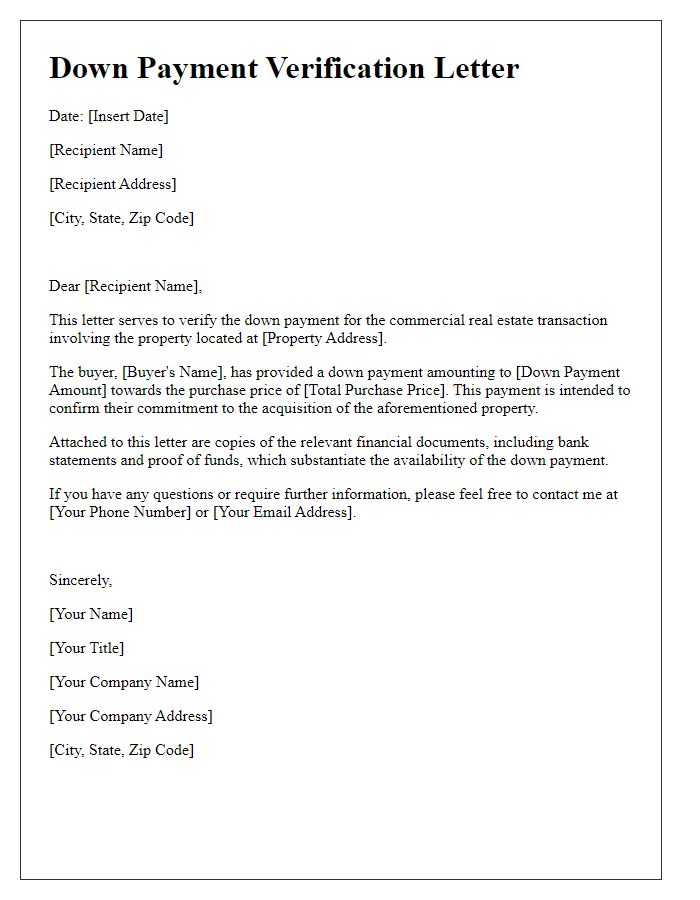

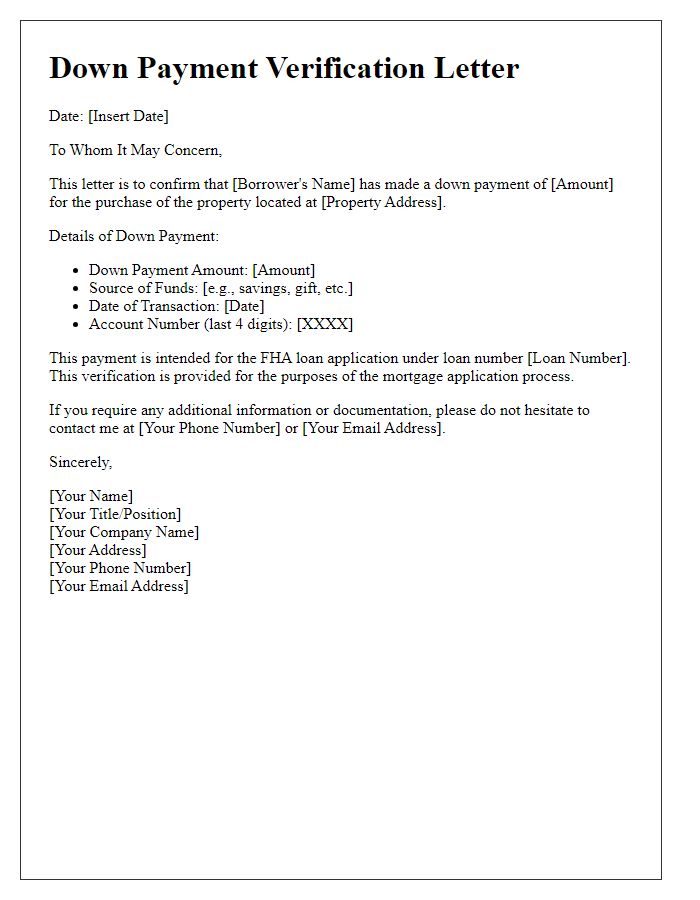

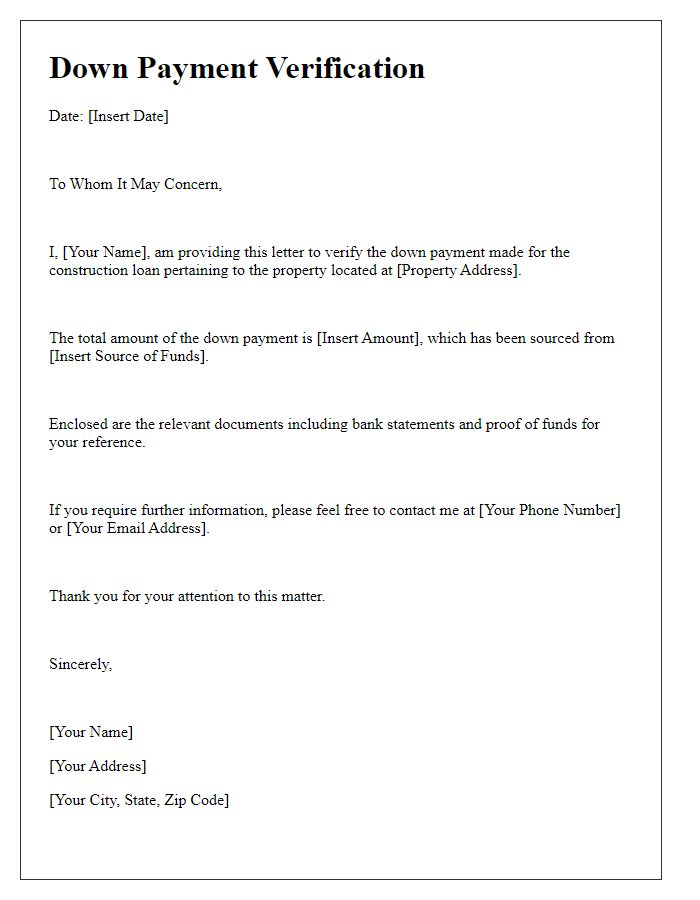

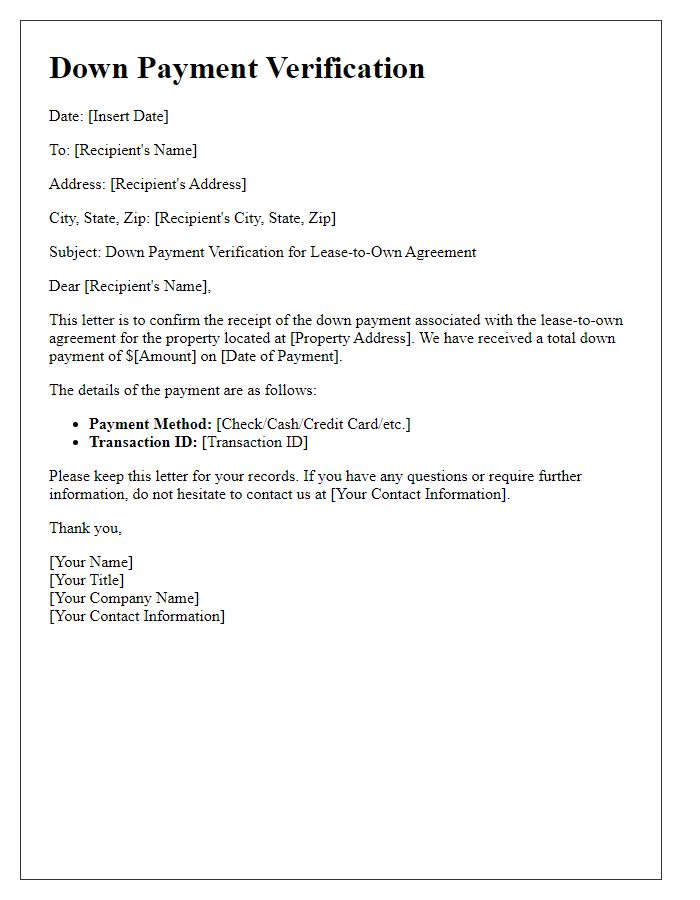

A formal down payment verification involves a structured format, typically with a letterhead containing the organization's name, address, phone number, and email. Specifics like the date of the letter should follow, along with the recipient's details, including their name and address. The body of the letter must clearly state the purpose, confirming the amount of down payment (often a percentage of the total purchase price) made by the buyer on the specified property or vehicle, referencing the transaction date and any pertinent agreement information. A professional closing and signature from an authorized representative, alongside corporate seal if applicable, finalize the document, ensuring authenticity and clarity in the financial transaction.

Date and Recipient Details

A down payment verification letter serves to confirm the transaction details in real estate purchases. The document typically includes the date of issuance, important for record-keeping and timelines (such as financing approvals). Recipient details, including the name and address of the buyer or financial institution involved in the transaction, ensure that the information is directed accurately. Additionally, including specific amounts related to the down payment (often a percentage of the total purchase price) reassures both parties of the commitment involved, highlighting the necessity of such verification in the buying process.

Subject Line

Subject Line: Down Payment Verification Request - [Your Name/Company Name]

Verification Statement

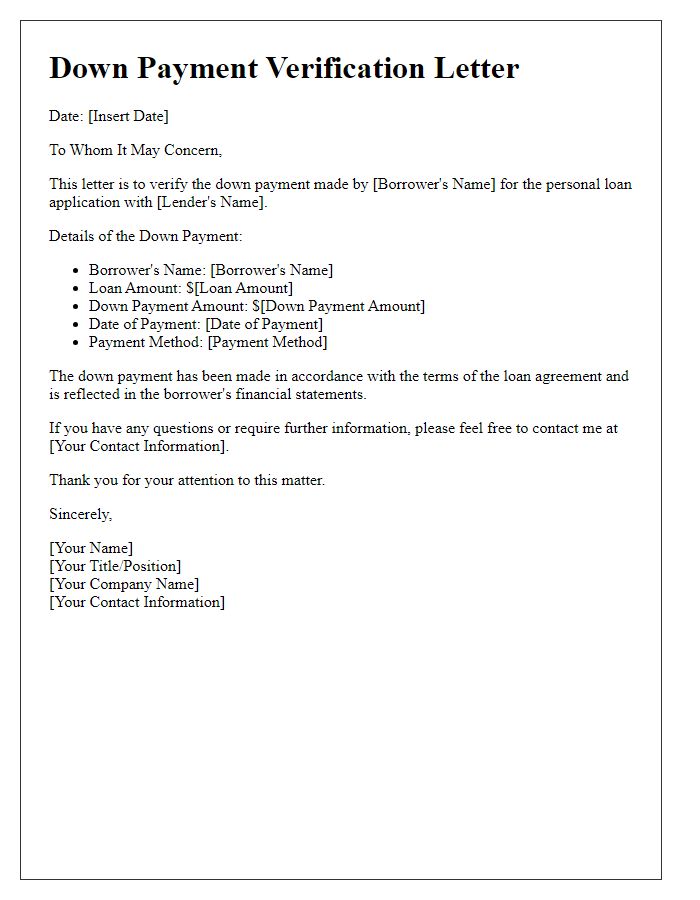

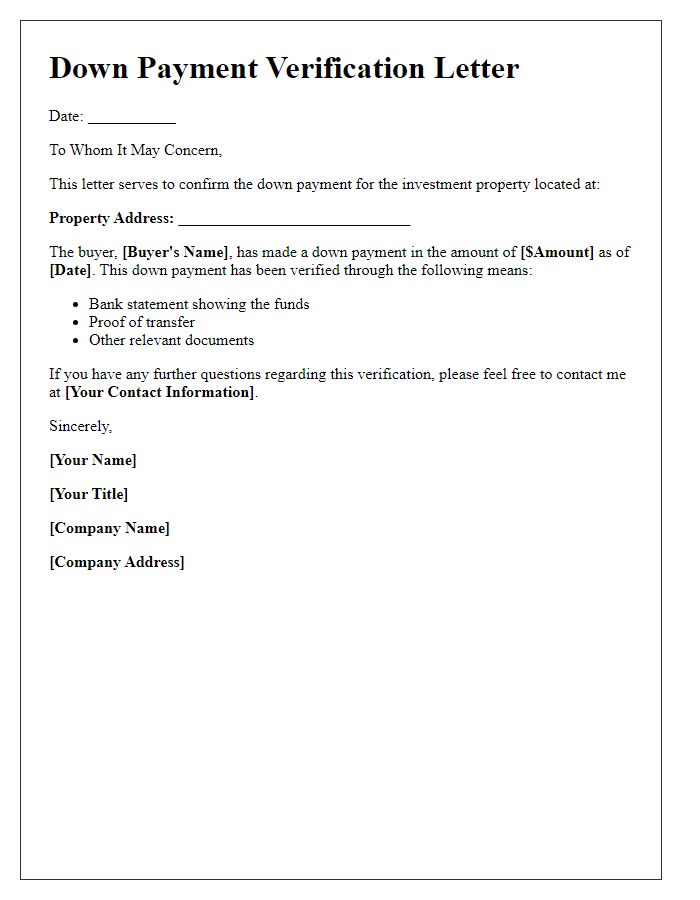

A down payment verification statement is a crucial document used in real estate transactions, particularly for verifying funds provided by buyers for properties, such as residences or commercial buildings. Financial institutions, like banks or credit unions, often require this statement to confirm the buyer's ability to secure necessary financing. A verification statement typically includes essential details, such as the buyer's name, the amount of the down payment (often expressed as a percentage of the property's total price), and the source of funds, which may include savings accounts or monetary gifts. Accurate documentation is vital during the closing process, ensuring compliance with regulations and providing reassurance to all parties involved.

Authorized Signature and Contact Information

Down payment verification requires accurate details from both parties involved in a transaction. The authorized signature must include full name, position within the organization, and date of signing to ensure authenticity. Contact information should provide a direct line, typically a phone number and email address, facilitating immediate communication regarding the verification process. This documentation enhances trust in financial dealings, especially in real estate or automotive purchases, where down payments often represent significant amounts, potentially reaching tens of thousands of dollars. Proper verification can prevent fraudulent transactions and expedite the approval process for financing options.

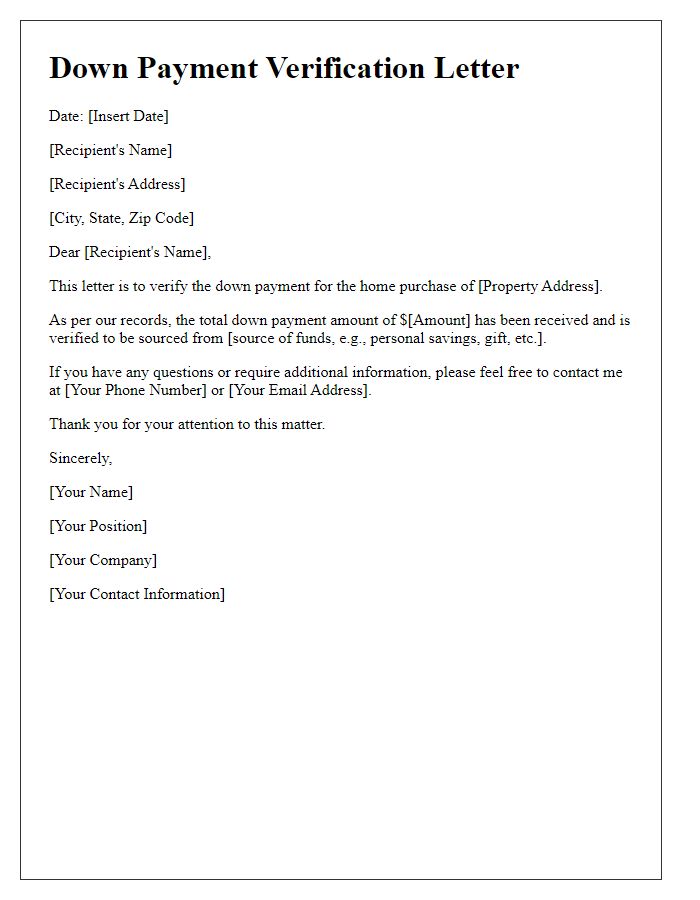

Letter Template For Down Payment Verification Samples

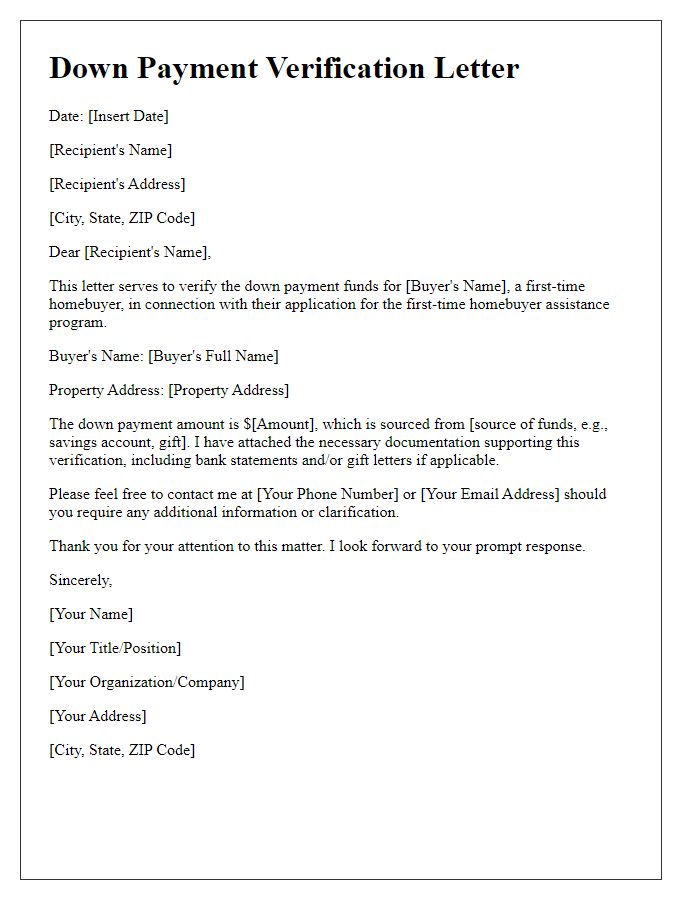

Letter template of down payment verification for first-time homebuyer assistance

Comments