Hey there! We're excited to share some important news regarding your mortgage loan closing process. Your closing date is just around the corner, and we want to ensure that you have all the details you need to make it seamless and stress-free. From final paperwork to funding confirmations, there's a lot to cover, so let's dive in and get you ready for this big step towards homeownership! Keep reading to find out everything you need to know about your upcoming closing.

Borrower's Information

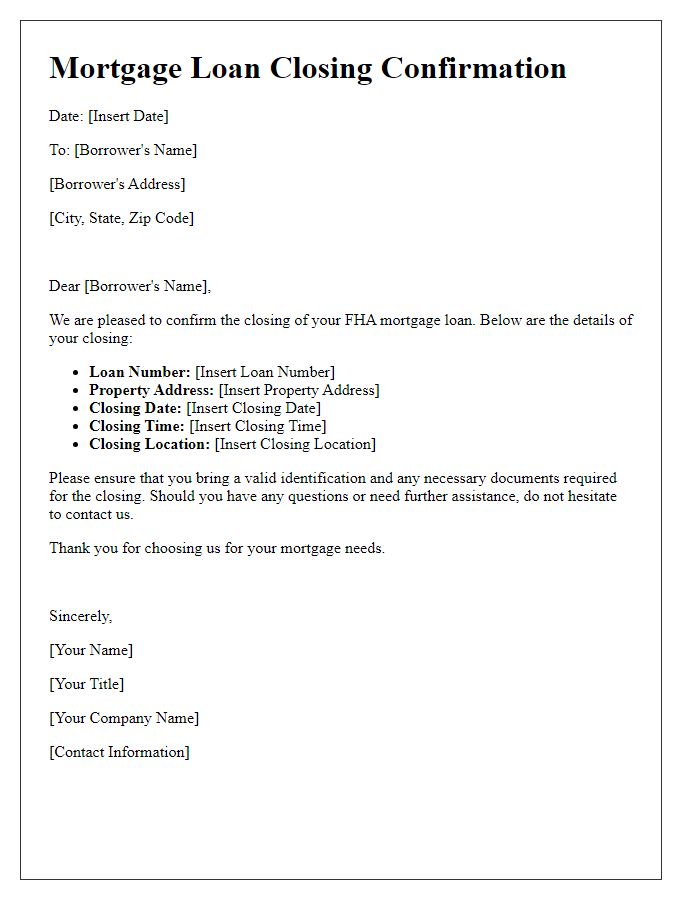

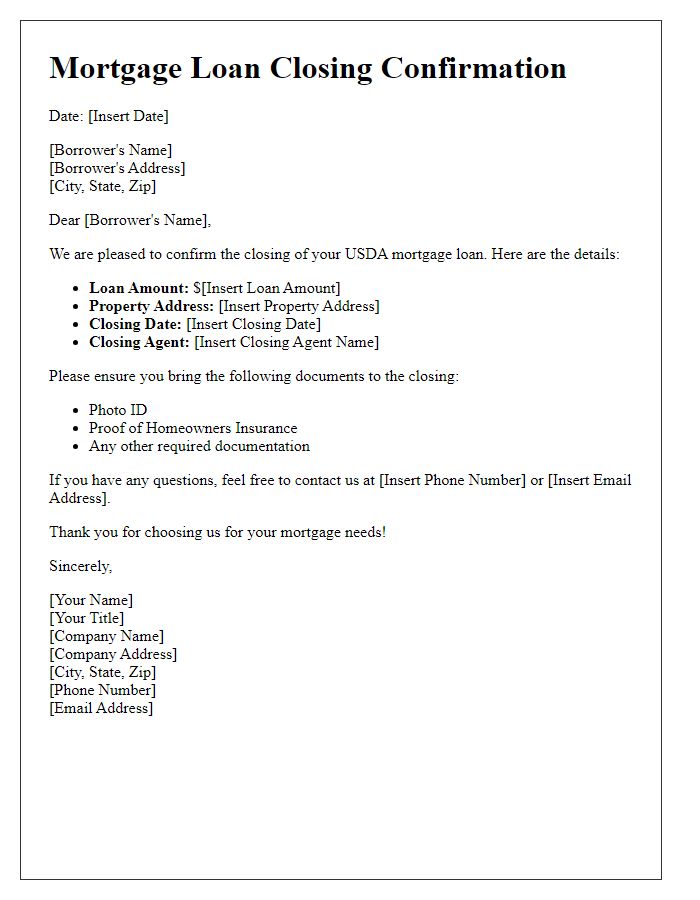

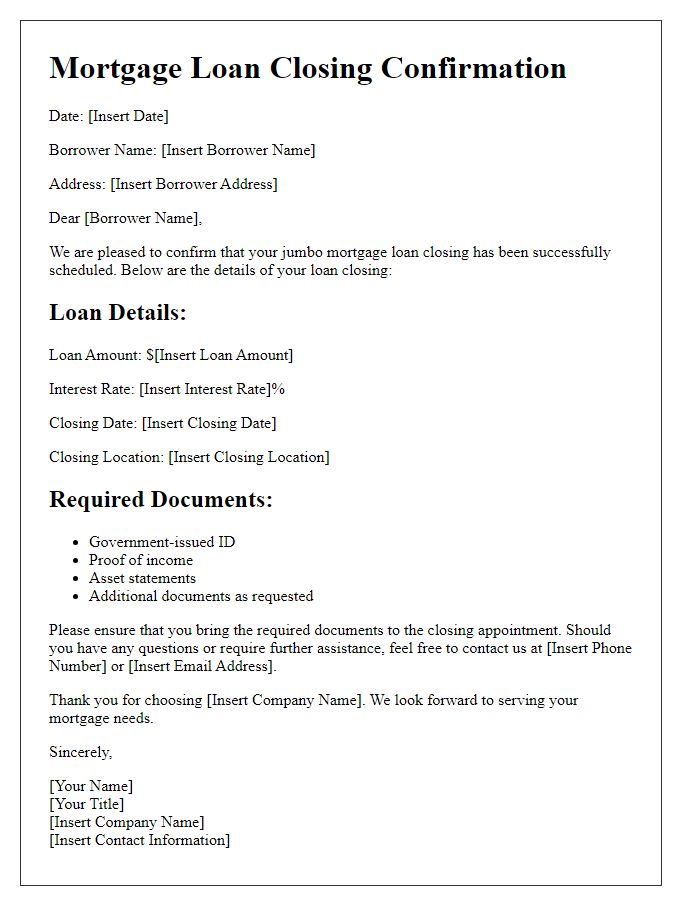

The mortgage loan closing confirmation provides essential details regarding the transaction for borrowers, including full names, property addresses, and loan numbers. This communication typically confirms critical dates, such as the closing date, which may occur on weekdays around the end of the month. The confirmation may also outline necessary documentation needed, including personal identification and proof of income, to complete the process smoothly. Lastly, a breakdown of the final loan terms, including interest rates, monthly payments, and closing costs, is often included to ensure borrowers are fully informed before finalizing their mortgage agreement.

Loan Closing Date and Time

The mortgage loan closing confirmation typically involves specific details about the transaction, including date and time. For instance, the closing event for a mortgage loan, scheduled for 10:00 AM on March 15, 2024, at the Skyline Title Company in Denver, Colorado, signifies the final step in the home-buying process. Important parties such as the buyer, seller, and their respective agents, along with a representative from the title company, gather to review and sign essential documents, including the promissory note and deed of trust. Upon successful completion, the mortgage loan funds will be disbursed, transferring ownership of the property situated at 123 Maple Street, Denver, CO, officially to the buyer.

Property Details

Mortgage loan closing confirmations are essential in real estate transactions, particularly for properties like single-family homes and condominiums, ensuring all parties acknowledge the finalization. Critical elements include the property's legal description (such as the tax parcel number), the closing date (typically within 30 to 60 days post-approval), and the loan amount (sometimes ranging from $100,000 to over $1 million). Essential participants involve the buyer, seller, mortgage lender (like a national bank or credit union), and title company overseeing the transaction. The confirmation serves to detail any remaining contingencies, earnest deposits, and the final interest rate (often between 3% to 6% depending on market conditions). Proper documentation, including proof of homeowner's insurance and closing disclosures, must be reviewed to ensure compliance with local real estate regulations.

Payment Terms and Conditions

Mortgage loan closing confirmations require careful consideration of payment terms and conditions attached to the loan agreement. The borrower must adhere to the specified monthly payment schedule, typically set for 15 to 30 years, alongside the interest rate, which can vary from 2.5% to 5% depending on market conditions. Closing costs, including appraisal fees and title insurance, usually range between 2% to 5% of the loan amount, necessitating clear communication regarding the total amount due at closing. The lender must also provide details regarding any penalties for late payments, often implemented after a 15-day grace period, which may incur charges of up to $50 or more. Additionally, it is crucial for the borrower to understand the implications of a fixed versus adjustable-rate mortgage, as these can significantly impact long-term financial commitments. Understanding these components ensures a smooth and transparent closing process.

Contact Information for Loan Officer

The mortgage loan closing confirmation process requires effective communication between all parties involved, including the loan officer's contact information. A loan officer, such as John Smith from ABC Mortgage Company, can be contacted at (555) 123-4567 or john.smith@abcmortgage.com. This ensures any queries regarding the loan, paperwork, or the closing process can be promptly addressed. Closing dates typically take place at a title company, like XYZ Title Services in Austin, Texas, where essential documents, such as the Closing Disclosure and Deed of Trust, are finalized. Contacting the loan officer well in advance of the closing date allows for a smoother transaction and ensures that all necessary steps have been completed effectively.

Letter Template For Mortgage Loan Closing Confirmation Samples

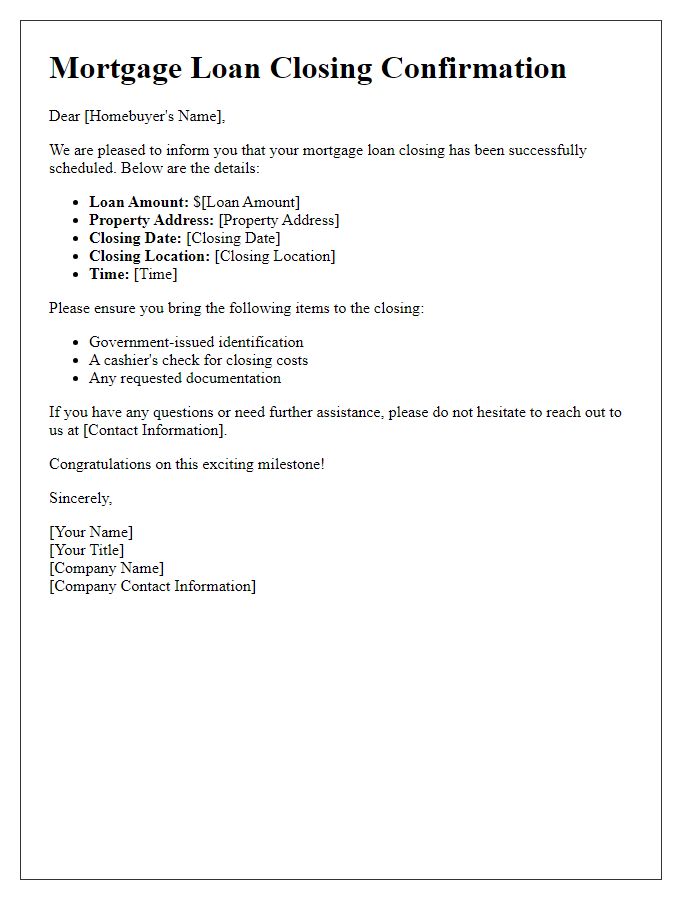

Letter template of mortgage loan closing confirmation for first-time homebuyers

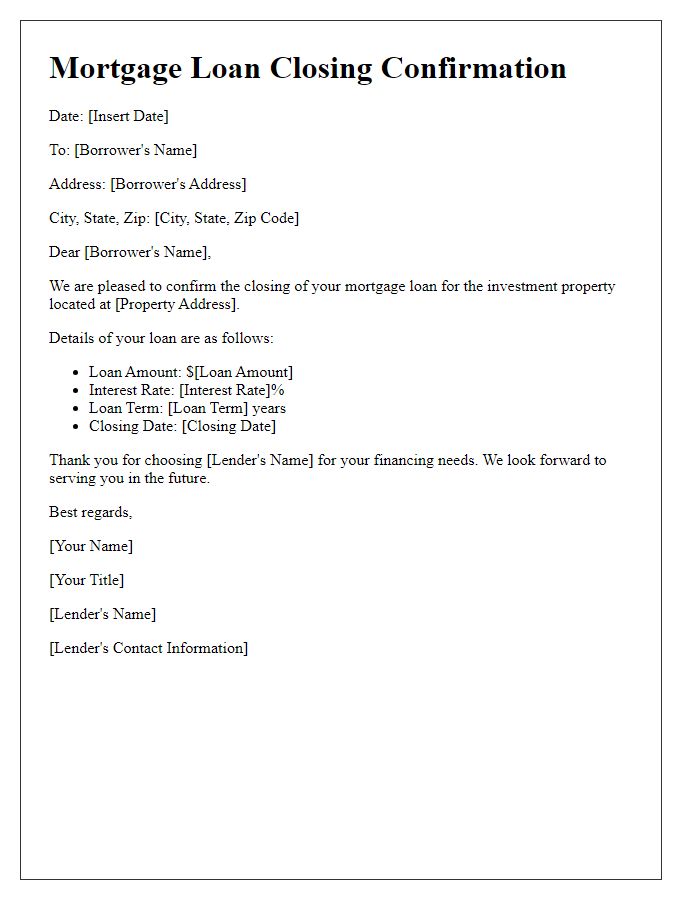

Letter template of mortgage loan closing confirmation for investment properties

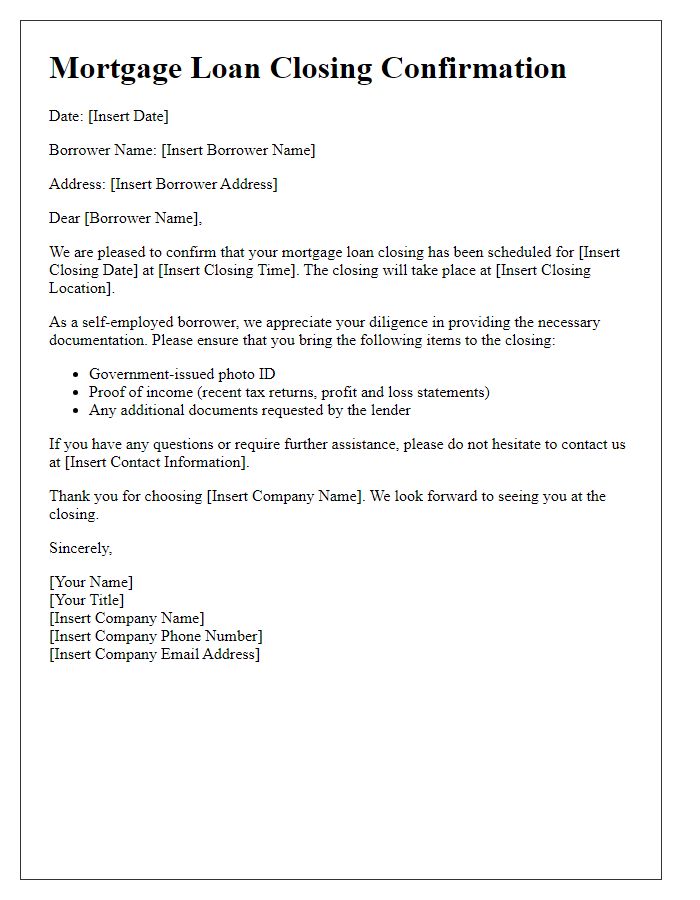

Letter template of mortgage loan closing confirmation for self-employed borrowers

Letter template of mortgage loan closing confirmation for low-income applicants

Letter template of mortgage loan closing confirmation for adjustable-rate mortgages

Comments