Are you navigating the intricate world of mortgage underwriting and seeking some clarity? Understanding the nuances can often feel overwhelming, especially when it comes to providing the necessary documentation and addressing potential concerns. In this article, we'll break down some common questions and provide insightful tips to help streamline your mortgage application process. Let's dive in and uncover the answers together!

Loan applicant's personal and financial information.

Mortgage underwriters require in-depth personal and financial information from loan applicants for accurate assessment and risk evaluation. This information includes the applicant's credit score (ranging from 300 to 850), employment history (typically covering the last two years), and income details (monthly or annual figures, including salary and bonuses). Additionally, underwriters analyze debt-to-income ratio (commonly below 43%) to ensure the applicant can manage monthly mortgage payments. Furthermore, assets like savings accounts, retirement funds, and real estate holdings are scrutinized for financial stability. Tax returns from the last two years (Form 1040) are necessary to verify income consistency. Verification of identity (through documents such as a Social Security number and government-issued ID) is also essential to prevent fraud and confirm the applicant's eligibility for the mortgage.

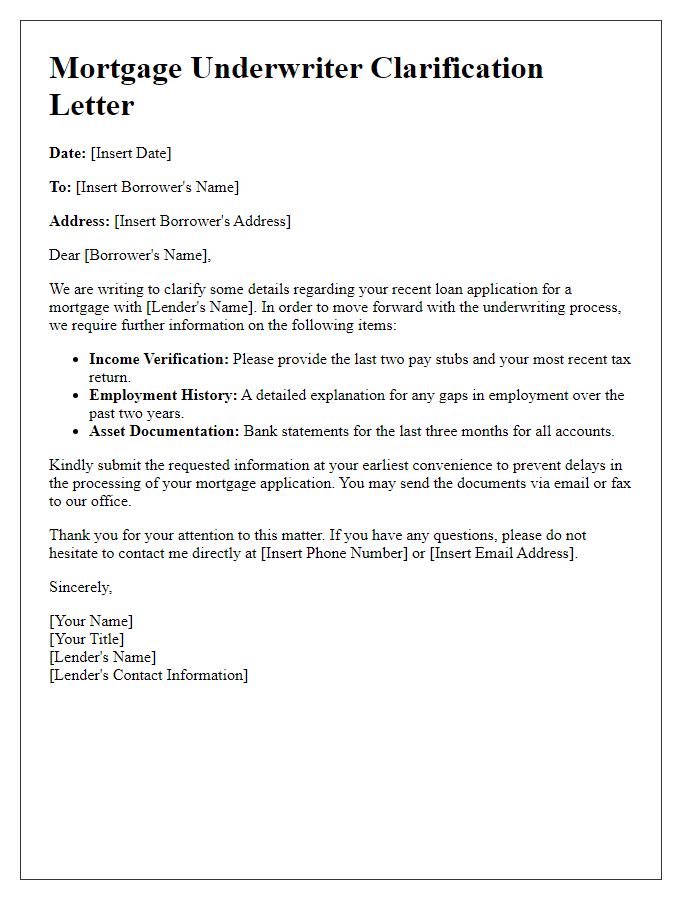

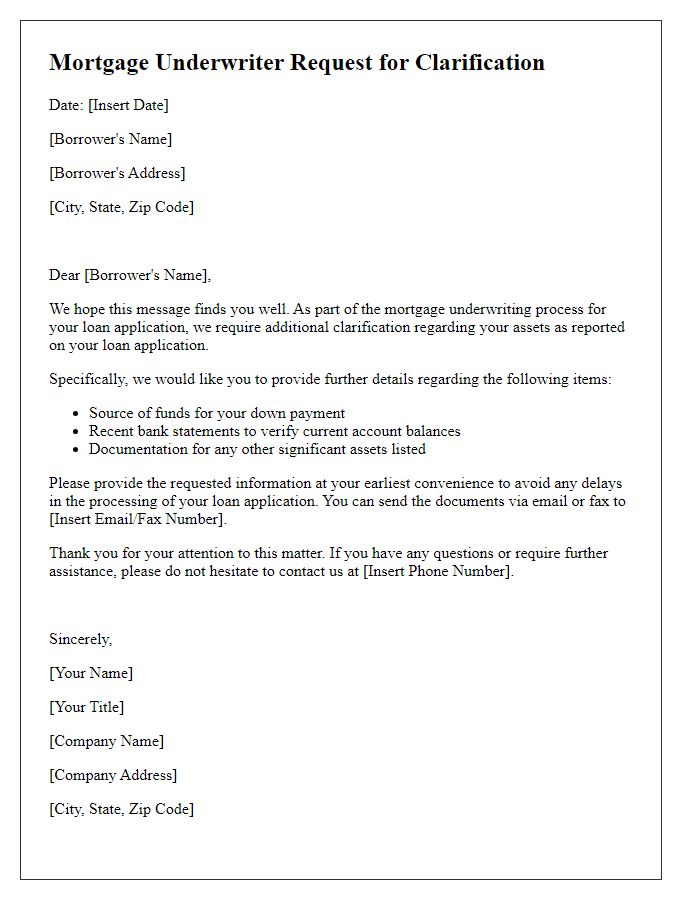

Specific clarification points or questions.

Mortgage underwriters often seek specific clarifications during the loan approval process to assess borrower eligibility accurately. Key areas of focus include income verification, such as detailed documentation of all income sources, including salary, bonuses, and any freelance earnings, which collectively must total an amount adequate to support the loan payment. Additionally, underwriters require clarity on credit history, particularly recent delinquencies or significant debts exceeding $30,000, as these can impact credit scores. Property appraisal details are crucial, with emphasis on the fair market value assigned to the home located at [property address], ensuring it meets or exceeds the purchase price. The source of the down payment also demands attention, particularly if gifts or unconventional funds are involved; underwriters may need bank statements or gift letters for verification. Lastly, employment stability over the last two years becomes a critical focus, where specific job titles, lengths of employment, and any employment gaps must be clearly documented for a comprehensive risk assessment.

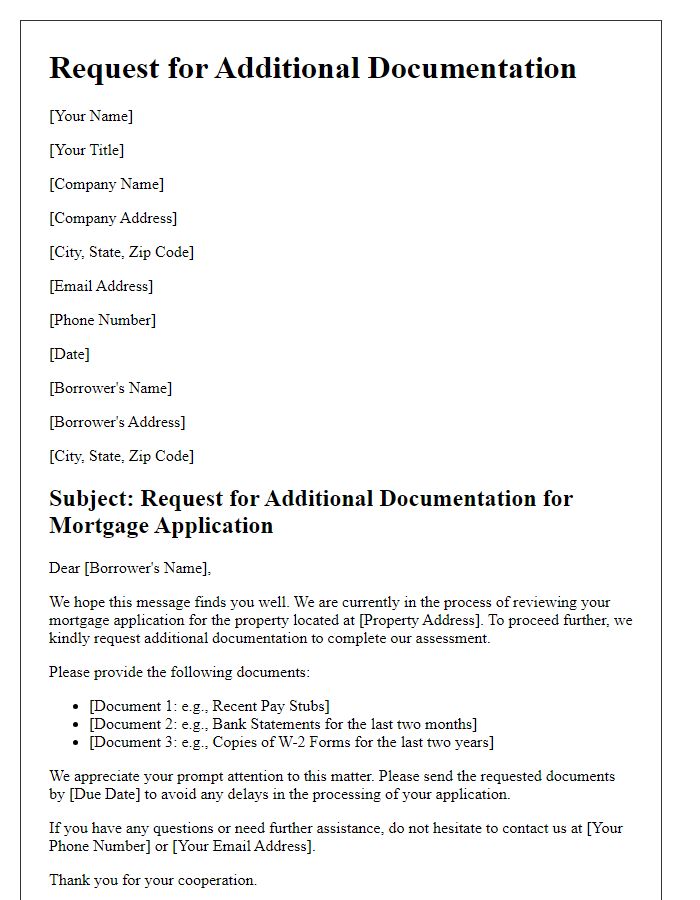

Supporting documentation references.

Mortgage underwriting processes require thorough verification of supporting documentation to ensure compliance with lending standards. A typical underwriter might request IRS Form 4506-T (Request for Transcript of Tax Return) to confirm income reported on tax returns and validate borrower financial details from years such as 2020 and 2021. Additionally, pay stubs from the last 30 days, alongside W-2 forms, help ascertain income stability. Bank statements from the past two months are crucial for assessing asset availability and overall financial health, especially for down payment verification. Furthermore, property appraisals conducted by certified professionals provide an estimation of market value, supporting the mortgage amount requested. Each piece of documentation plays a vital role in the underwriting process, influencing loan approval decisions.

Deadlines for response or submission.

Mortgage underwriting involves a meticulous review of financial documentation, credit histories, and asset verification processes. Underwriters often establish strict deadlines for responses or document submissions, typically within 3 to 5 business days following a request from the lender. Adherence to these timelines is crucial, as delayed submissions may jeopardize mortgage approval or the closing date, which is usually set within 30 to 45 days of the purchase agreement in real estate transactions. Additionally, if further clarification is required regarding the borrower's financial situation, underwriters may issue a conditions letter outlining specific documents needed for review. Timely provision of these documents helps ensure a smooth underwriting process and minimizes the risk of complications that could arise in the residential mortgage funding phase.

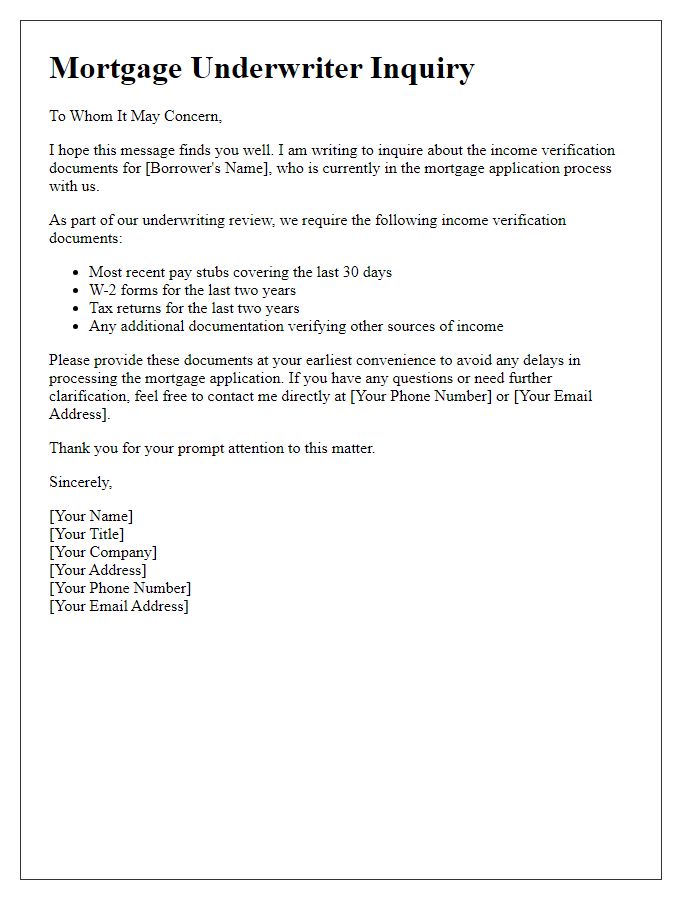

Contact information for follow-up.

Mortgage underwriting processes require meticulous attention to detail, especially when evaluating documentation. Inquiries related to income verification (e.g., pay stubs, tax returns) or asset statements (bank accounts, retirement funds) often necessitate a follow-up with the mortgage underwriter. Providing precise contact information is essential, typically including a direct phone line and a professional email address, facilitating any necessary clarifications. This direct communication streamlines the underwriting process, ensuring timely responses that can expedite loan approval. Secure lines of communication between borrowers and underwriters foster transparency, allowing for a smoother overall lending experience.

Letter Template For Mortgage Underwriter Clarification Samples

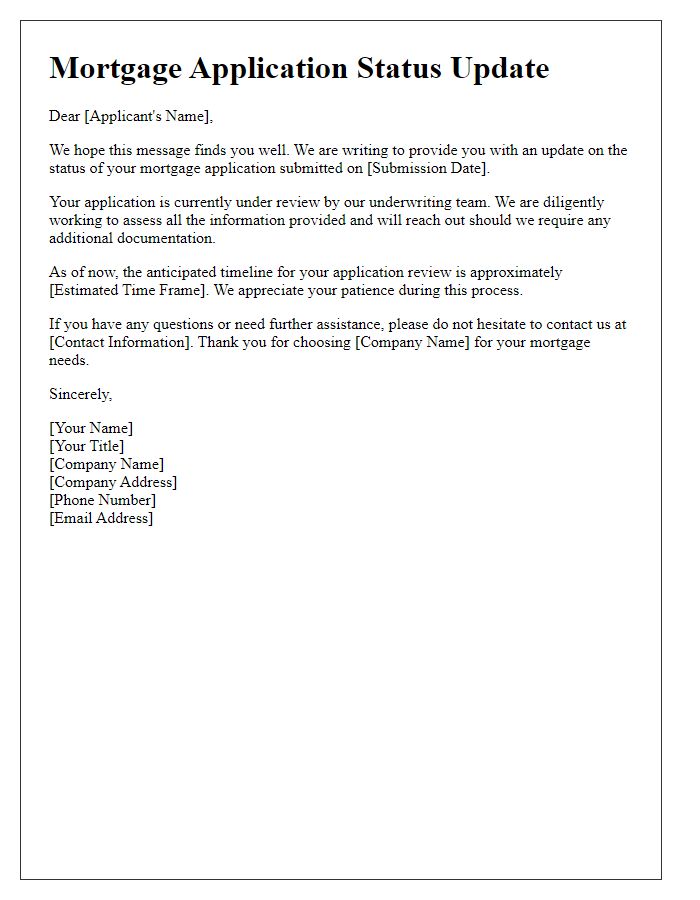

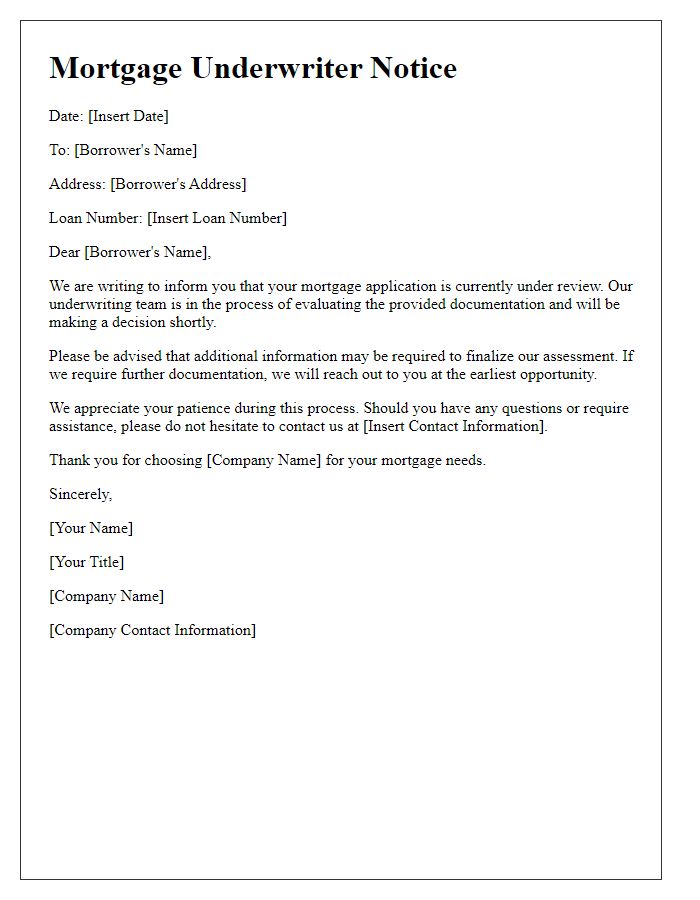

Letter template of mortgage underwriter request for additional documentation.

Letter template of mortgage underwriter clarification on loan application details.

Letter template of mortgage underwriter inquiry regarding income verification.

Letter template of mortgage underwriter requirements for property appraisal.

Letter template of mortgage underwriter follow-up on credit report discrepancies.

Letter template of mortgage underwriter explanation of underwriting process.

Letter template of mortgage underwriter clarification for debt-to-income ratio.

Comments