Are you considering a mortgage or refinancing your current home loan? If so, you might be wondering about the various fees associated with these processes. One potential cost that is often negotiable is the mortgage fee, and there's a chance you could have it waived altogether. Join us as we explore effective strategies for requesting a mortgage fee waiver and make your home financing journey smoother!

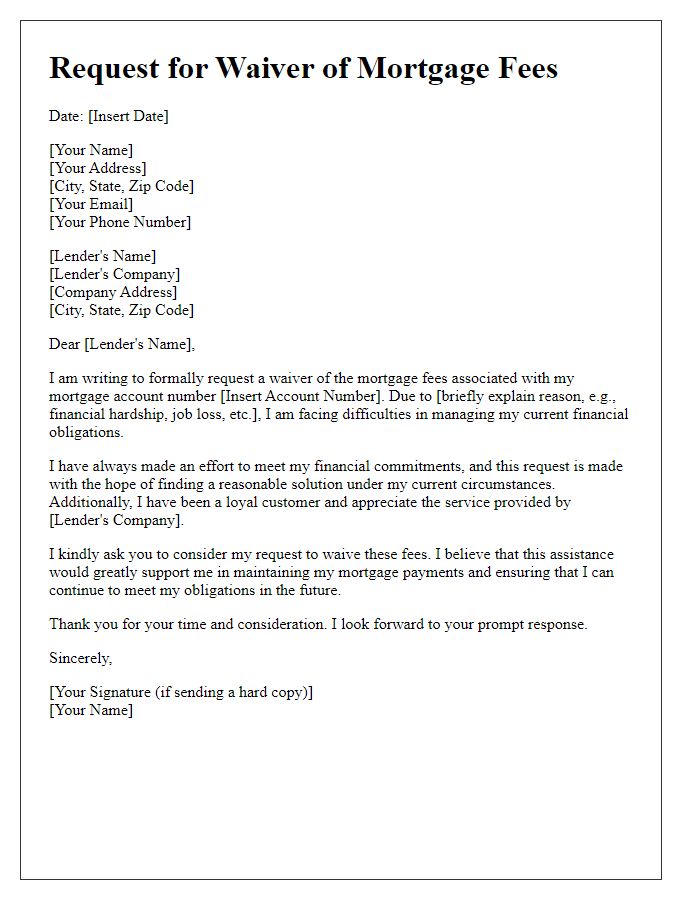

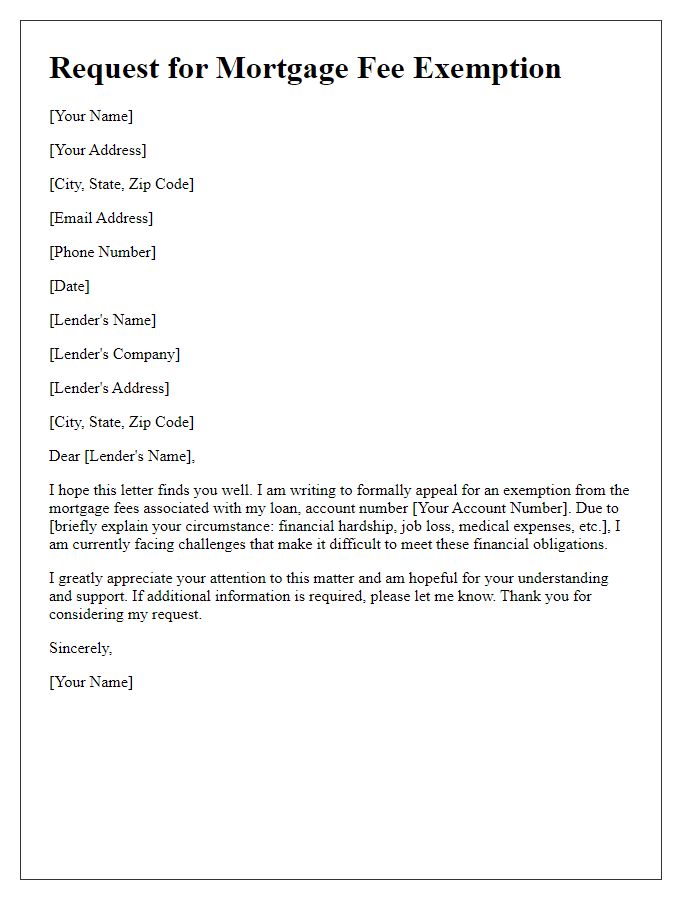

Purpose of Waiver Request

Requesting a mortgage fee waiver can significantly ease financial burdens for homeowners. The primary purpose of this waiver request is to alleviate mortgage-related fees, which may include application fees, origination fees, or processing fees. Homeowners facing financial challenges, such as job loss or medical expenses, greatly benefit from fee waivers. A fee waiver could help maintain homeownership, avoid foreclosure, and provide financial stability during difficult times. Additionally, institutions may offer waivers as part of customer retention strategies or community support programs, encouraging trust and loyalty among borrowers.

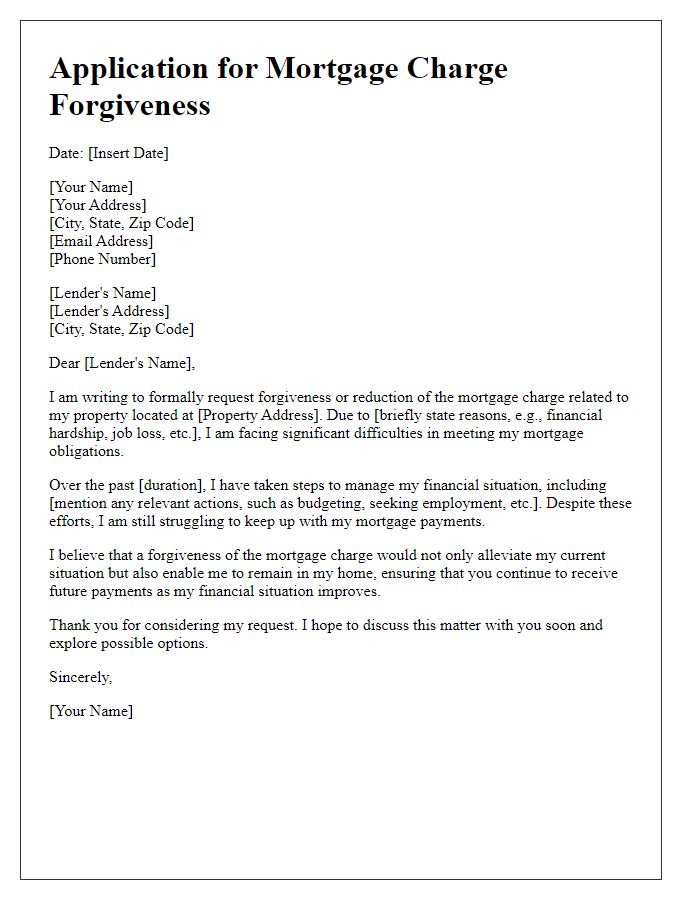

Personal and Financial Circumstances

Navigating personal financial challenges can be overwhelming, especially when managing mortgage-related fees. Recent circumstances, including a significant loss of income due to unexpected unemployment or medical expenses, often strain monthly budgets. Essential expenses such as utilities, groceries, and healthcare may compete with mortgage obligations, making it crucial to seek assistance. Individuals facing such challenges may benefit from a mortgage fee waiver, which could provide relief by eliminating or reducing costs associated with processing fees, late payment penalties, or refinancing charges. Engaging with lenders to discuss these circumstances can create opportunities for more manageable financial solutions.

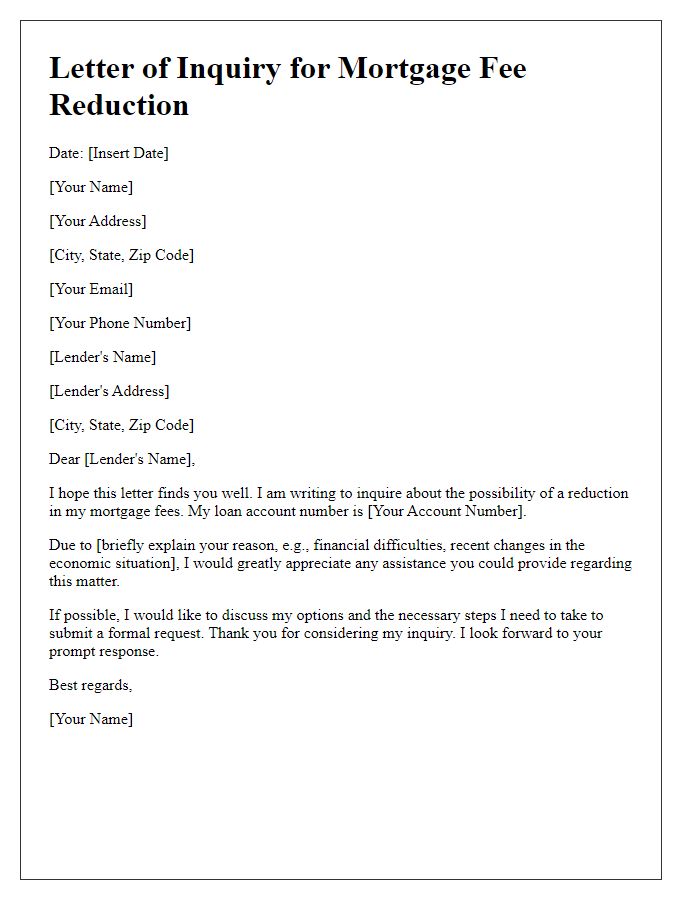

Relationship with Lender

Building a strong relationship with a lender is crucial when requesting a mortgage fee waiver. Maintaining open communication fosters trust, allowing homeowners to present their financial situations clearly. Consistent engagement demonstrates reliability, as borrowers who have made timely payments and adhered to loan agreements are more likely to receive favorable consideration. Furthermore, presenting a strong case backed by documentation and expressing willingness to maintain a positive partnership can significantly enhance the likelihood of approval for fee waivers. Personal touches, such as addressing the lender by name and acknowledging past interactions, can also add warmth and sincerity to the request.

Supporting Documentation

Supporting documentation for requesting a mortgage fee waiver typically includes several key items. First, personal identification such as a government-issued photo ID (e.g., driver's license or passport) providing proof of identity. Second, financial documents detailing income sources, like pay stubs or tax returns, validating the individual's financial situation. Third, a copy of the original mortgage agreement outlines the fees in question. Fourth, any correspondence with the mortgage lender regarding the fee dispute demonstrates prior attempts to resolve the issue. Lastly, a detailed written explanation of the reasons for the fee waiver request may help clarify circumstances such as financial hardship due to job loss or unexpected medical expenses, bolstering the case for consideration.

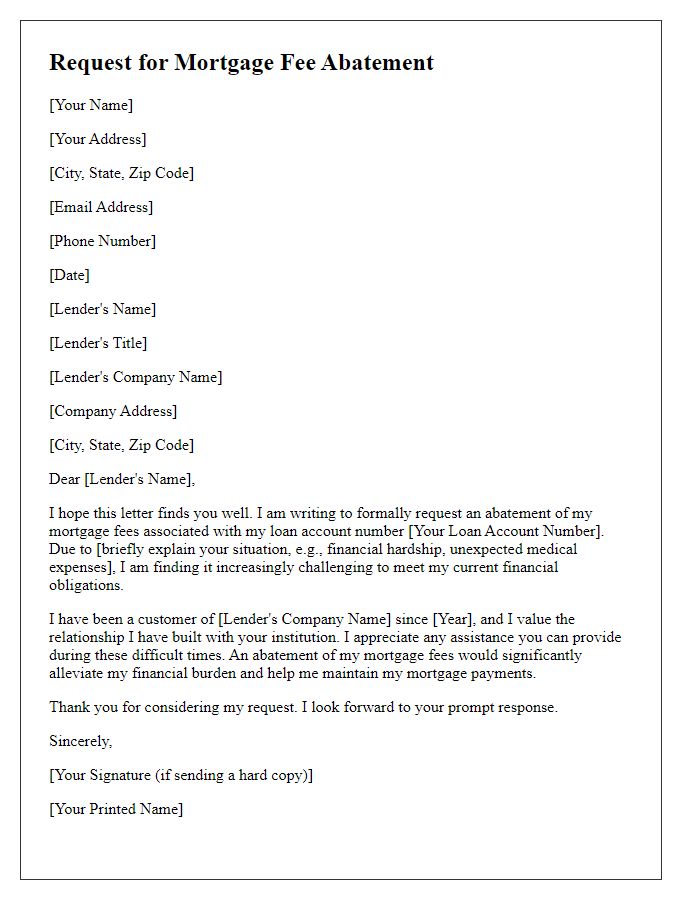

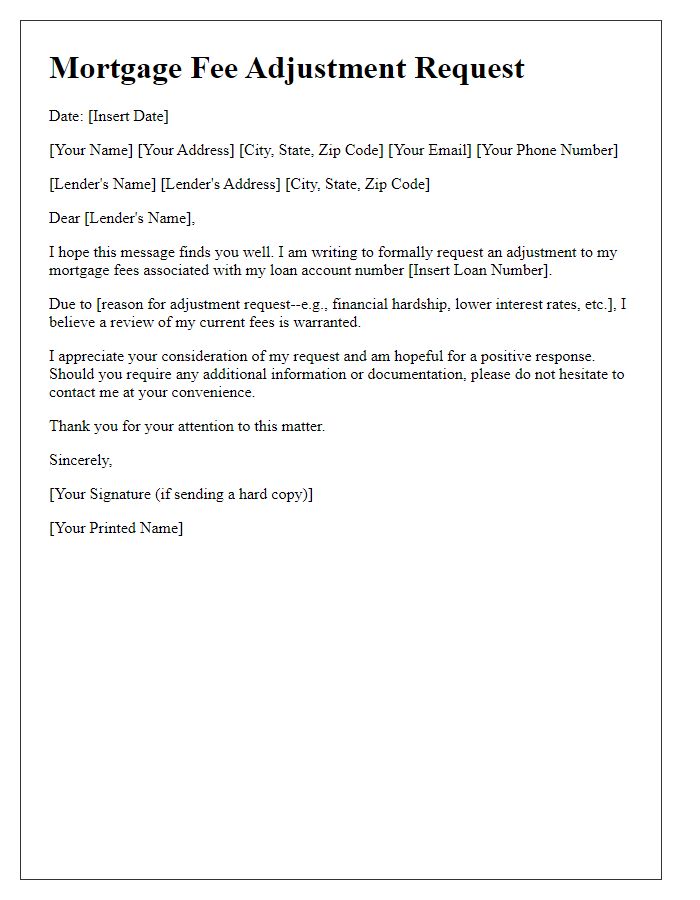

Contact Information and Follow-up

When a borrower approaches a financial institution, such as a bank or mortgage lender, for a mortgage fee waiver, it is vital to include personal details such as name, address, email, and phone number for proper identification. The request may refer to specific fees, such as origination fees, processing fees, or closing costs, which can cumulatively amount to thousands of dollars. Including the relevant mortgage application number and property details, like the address and square footage, adds clarity. Follow-up communication may involve specific timeframes, ensuring timely processing preferences, while reminding them of the importance of excellent customer service in maintaining borrower relationships.

Comments