Have you ever found yourself puzzled by the intricacies of a mortgage contract? You're not alone! Many homeowners and prospective buyers often encounter clauses that raise more questions than answers. In this article, we'll break down common mortgage contract clauses, clarify their meanings, and empower you to make informed financial decisionsâso stick around!

Clause reference number

Mortgage contracts can contain various clauses that outline specific terms and conditions, including the clause reference number. The clause reference number identifies a particular provision among the many included in the contract, such as repayment terms, interest rates, or penalties for late payments. Understanding the implications of a specific clause is crucial for both lenders and borrowers, as it determines the rights and responsibilities of each party involved. Clarity on this reference number ensures that both parties can effectively communicate any questions or concerns regarding the terms laid out in the mortgage agreement. Detailed scrutiny of this clause can also reveal potential risks, such as fluctuating rates or unexpected fees that may arise over the life of the loan.

Specific wording of the clause

Confusion often arises regarding the specific wording of mortgage contract clauses, particularly concerning payment terms and conditions. For example, the phrase "late fee accrual" may vary between contracts, leading to assumptions about grace periods and interest calculations. This ambiguity can result in significant financial consequences for borrowers, particularly if the fee structure stipulates a percentage of the outstanding balance after a certain number of days. Furthermore, clauses related to default definitions and consequences may differ widely among lenders, with some specifying a 30-day period without payment while others impose penalties after just 15 days. Understanding these variations is critical in navigating one's financial obligations and rights within the mortgage agreement.

Concern or clarification needed

A mortgage contract clause regarding prepayment penalties can be crucial for borrowers considering early repayment options. Prepayment penalties may apply if homeowners, such as those who took out a mortgage with XYZ Bank, decide to pay off their loan balance before a specified timeframe, typically 3 to 5 years. These penalties, sometimes calculated as a percentage of the remaining loan balance or a fixed fee, can significantly affect financial planning. Therefore, understanding the exact terms, conditions, and implications is paramount for any mortgage applicant navigating their financial responsibilities.

Proposed amendment or suggestion

Questioning a mortgage contract clause can lead to critical revisions. For instance, the clause regarding interest rates may specify fixed rates versus variable rates, influencing payment stability. If the document states a rate of 3.5%, stakeholders should clarify whether this is an introductory offer or a long-term rate. Furthermore, provisions about penalties for early repayment could significantly impact borrowers' financial flexibility, particularly if the penalty is set at 5% of the principal amount. It is crucial to examine additional components such as late fees, which can escalate according to state regulations, often ranging from $25 to $50. These inquiries into specific clauses ensure protection for both lenders and borrowers in the mortgage agreement process.

Contact information for follow-up

Contact details for follow-up inquiries regarding mortgage contract clauses are essential for ensuring clear communication between parties involved in the agreement. Include specific names and titles, such as John Smith, Senior Mortgage Advisor, or Jane Doe, Legal Counsel. Provide direct phone numbers, such as (555) 123-4567, and email addresses like john.smith@mortgagecompany.com, ensuring prompt responses. Specify business hours, typically 9 AM to 5 PM, Monday through Friday, for availability to address concerns. Clarity in this information fosters transparency and facilitates resolutions as needed in the mortgage process.

Letter Template For Mortgage Contract Clause Questioning Samples

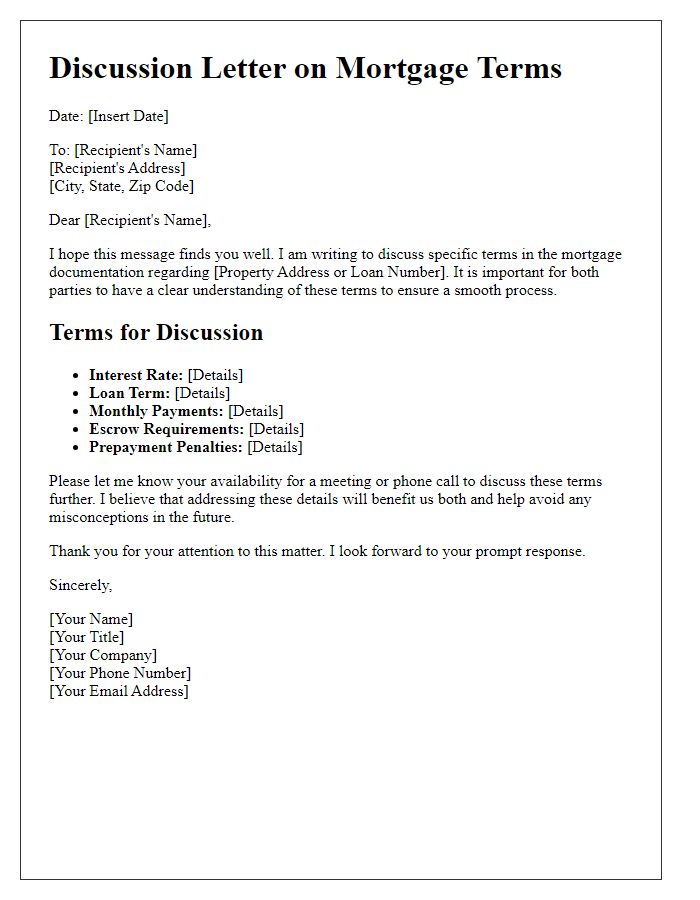

Letter template of discussion on specific terms in mortgage documentation.

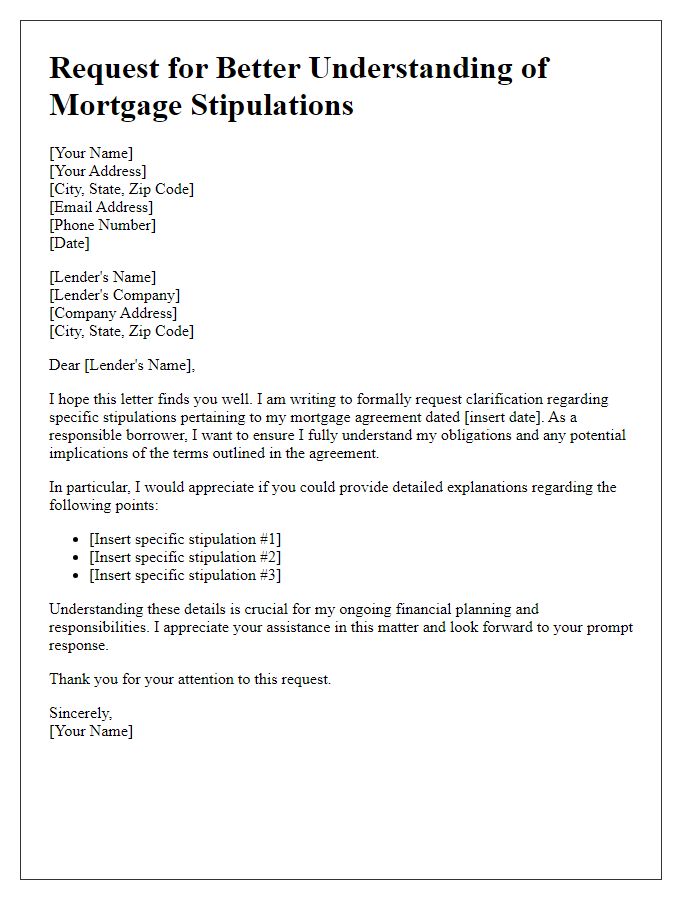

Letter template of appeal for better understanding of mortgage stipulations.

Comments