Are you preparing for a change in your mortgage deeds? Understanding the process of transferring mortgage deeds can seem daunting, but it doesn't have to be. In this article, we break down the essential steps, key considerations, and what you need to know to ensure everything goes smoothly. So, grab a cup of coffee, sit back, and let's dive into the details that will help you navigate this important process with confidence!

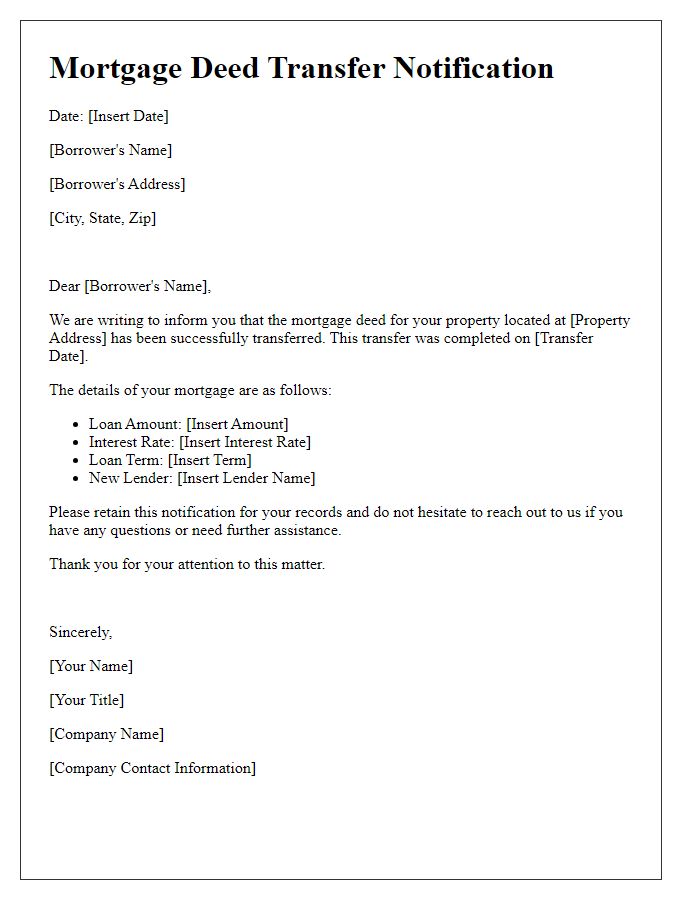

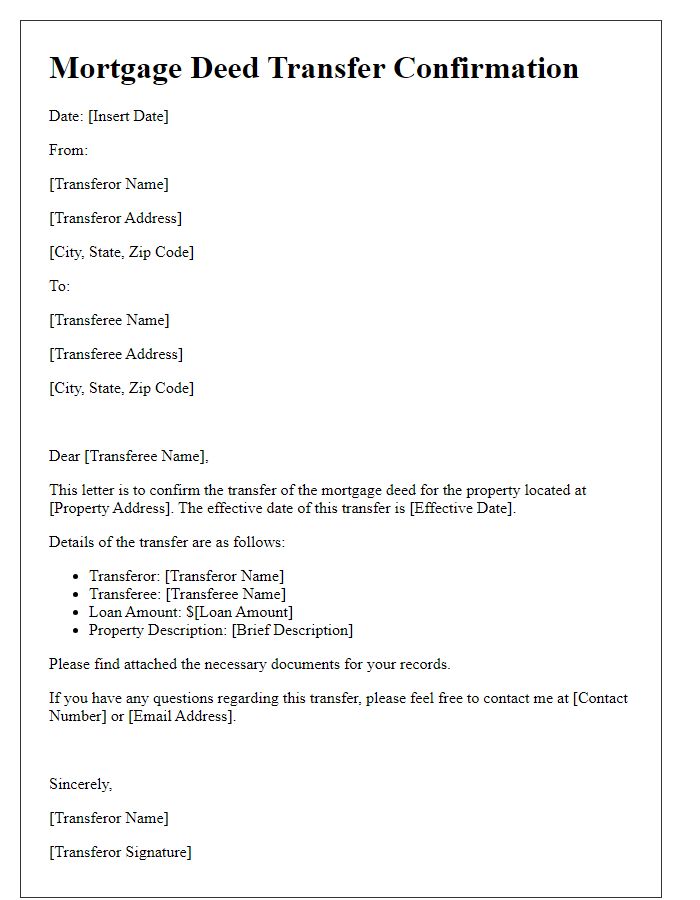

Heading and Sender Information

Notifying parties of a mortgage deed transfer requires clarity and attention to detail. A well-structured header presents essential sender information such as the name of the lending institution (e.g., First National Bank), address (e.g., 123 Main St, Springfield, IL), contact number (e.g., (555) 123-4567), and email address (e.g., info@firstnationalbank.com). The header should also include the date of notification (e.g., October 15, 2023), serving as a timeline for the transaction. Additionally, the recipient's name and address (e.g., John Doe, 456 Elm St, Springfield, IL) should be clearly displayed to ensure proper delivery. This organized layout not only enhances professionalism but also ensures that both parties have all necessary information regarding the mortgage transfer process.

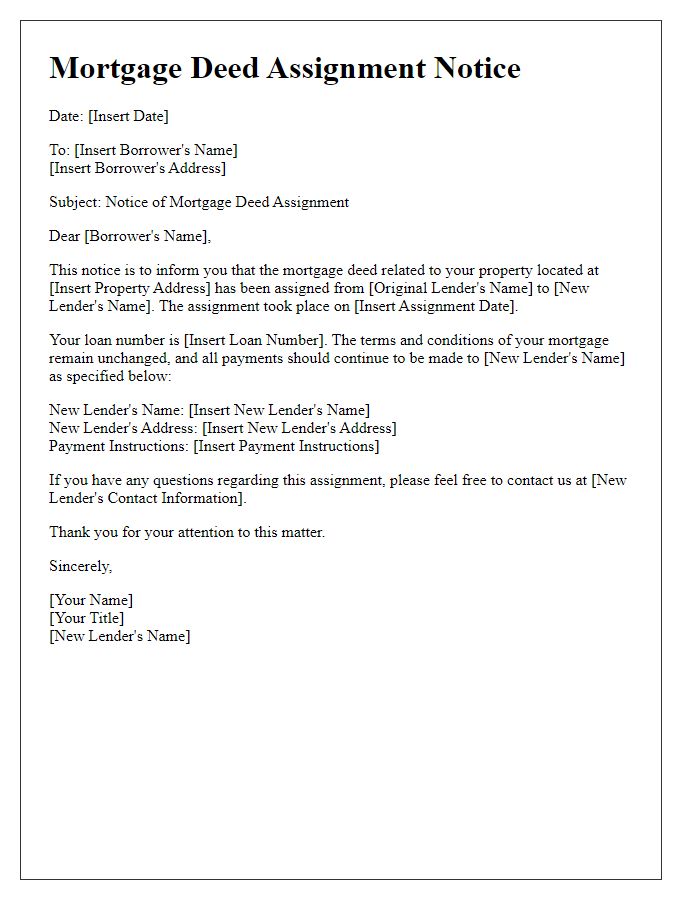

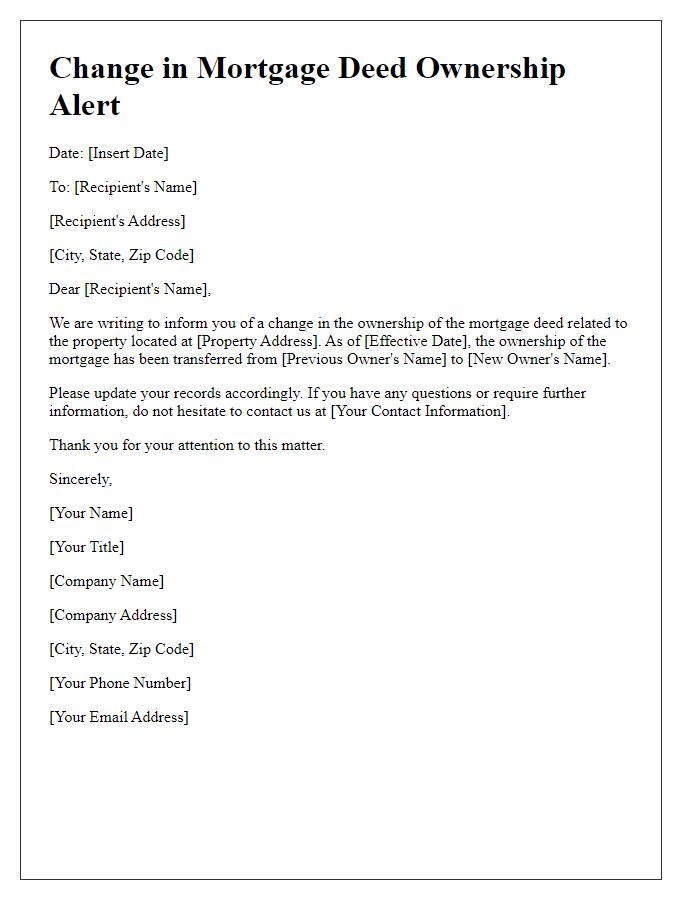

Recipient's Details

Recipient's details often include essential information such as the name of the recipient, their mailing address, city, state, and postal code. Additional relevant data may cover the recipient's email address and phone number for effective communication. Including the date of the notification can establish a timeframe for the transfer situation, ensuring the recipient is aware of important timelines. Furthermore, it is beneficial to specify the details of the mortgage deed involved, including the original lender, property address, and any reference numbers pertinent to the mortgage account. Clear and accurate recipient details facilitate a smooth process during the transfer of mortgage deeds, reducing potential confusion or delays.

Opening Greeting

Mortgage deeds transfer notifications require careful attention to detail. Ensure accuracy in dates, names, and financial details throughout the correspondence. Include specific information about the parties involved, the property address, and any loan or mortgage identification numbers, as well as contact details for inquiries. Clear communication about the transfer process and any implications for loan repayment or ownership rights is essential for both parties to understand their responsibilities. This notice serves as a formal acknowledgment of changes in deed ownership, important for legal clarity.

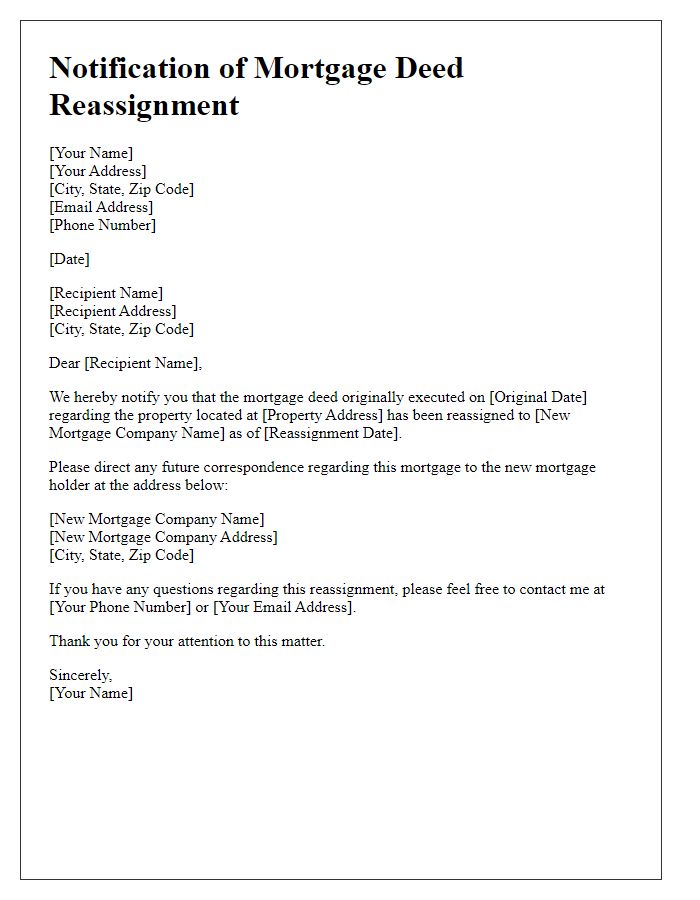

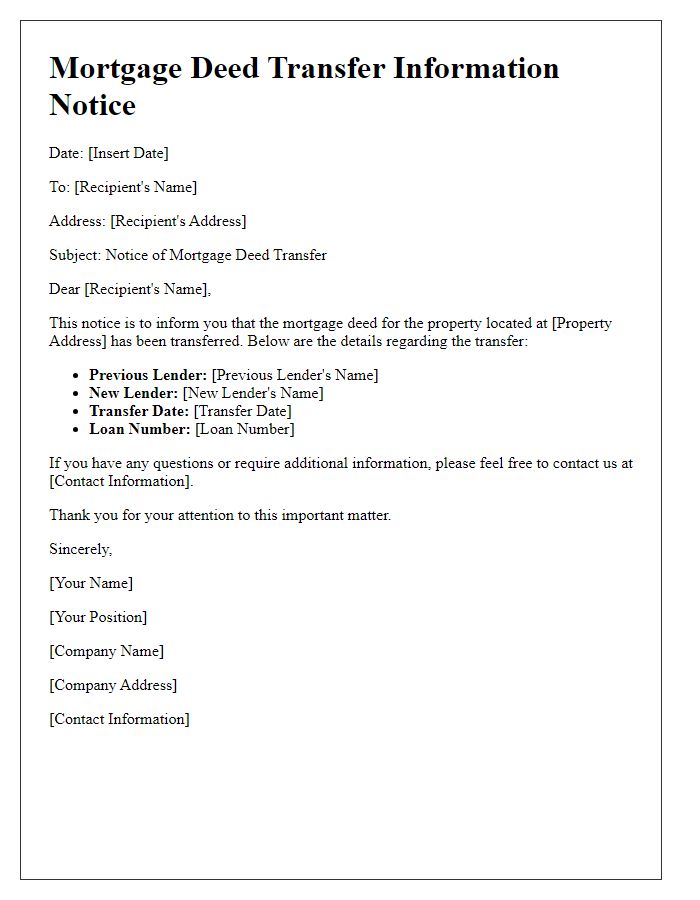

Explanation of Transfer

A mortgage deed transfer involves significant changes to property ownership, typically during a sale or refinancing process. In such situations, the borrower relinquishes responsibility for the existing loan to a new borrower, which necessitates the proper documentation of this transfer to ensure legal compliance. This document includes essential information such as the names of the original mortgage holder and the new mortgage holder, precise property address (including the county and state), loan number, and any outstanding loan balance. Additionally, the mortgage deed transfer highlights any associated legal obligations and rights concerning the property. Ensuring that the transfer complies with local regulations, such as those enforced by the Department of Housing and Urban Development (HUD) or the Federal Housing Administration (FHA), is critical for enforcing the terms of the mortgage effectively. Proper execution and filing of this deed transfer with the county recorder's office safeguard the interests of both parties involved.

Contact Information and Closing

Mortgage deeds transfer involves a crucial legal process when ownership of property changes. This process typically includes vital contact information for all parties involved, such as the lender, borrower, and attorney, ensuring efficient communication. The closing date marks a pivotal point in the transaction where the final paperwork is signed, and ownership officially transfers. It is essential to verify details like loan numbers and property addresses to avoid discrepancies. Additionally, providing updated contact information facilitates any last-minute queries before the closing, ensuring a smooth finalization of the mortgage deed transfer.

Comments