Are you feeling the pressure of mortgage payments and need a bit of breathing room? You're not aloneâmany homeowners are seeking mortgage forbearance to help cope with financial hardships. Crafting a well-structured forbearance request letter can be your first step towards finding relief. Ready to learn how to navigate this process effectively? Let's dive into the details!

Borrower's personal information

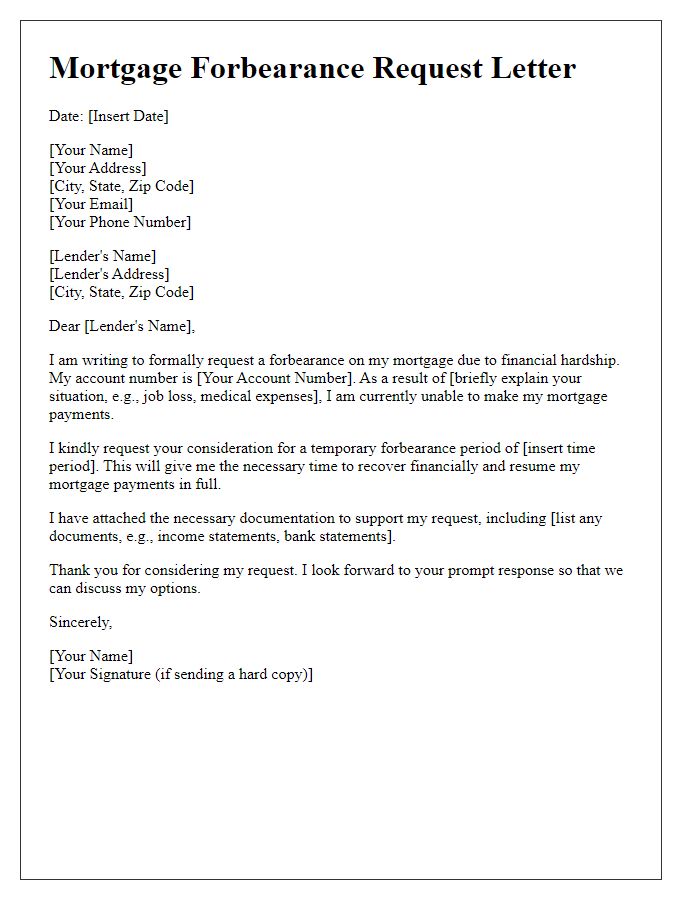

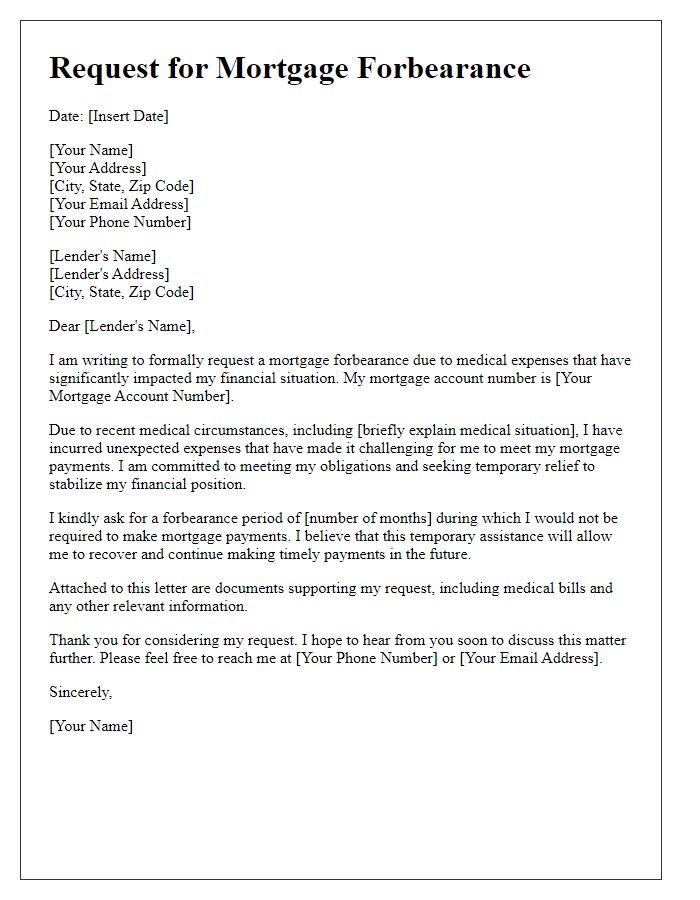

Mortgage forbearance allows homeowners facing financial hardships to temporarily pause or reduce their mortgage payments. For effective communication with lenders, it is vital to provide accurate and complete personal information. Essential details include the borrower's full name (John Smith), property address (123 Main Street, Springfield, Illinois), loan number (123456789), contact number (555-123-4567), and email address (johnsmith@email.com). Additional context may enhance the request's credibility, such as the reason for seeking forbearance, which could stem from events like job loss (unemployment since May 2023) or medical expenses (hospitalization due to COVID-19). Supporting documents (pay stubs, bank statements) can fortify the request, demonstrating the borrower's current financial status and commitment to maintaining the mortgage.

Loan details and account number

A mortgage forbearance request entails a formal appeal to a lender, allowing a temporary reduction or cessation of mortgage payments. Essential details include the loan account number, typically a unique identifier comprising 16 digits, and the borrower's loan details, such as the original loan amount, the current outstanding balance, and the interest rate, reflecting the terms established during the mortgage agreement. The reason for the forbearance request is crucial, often linked to financial hardships like job loss or medical expenses, which can be documented through financial statements or employment termination letters. Specifics about the duration of the requested forbearance, often ranging from three to six months, are also necessary to provide the lender with a clear understanding of the timeline for assistance.

Explanation of financial hardship

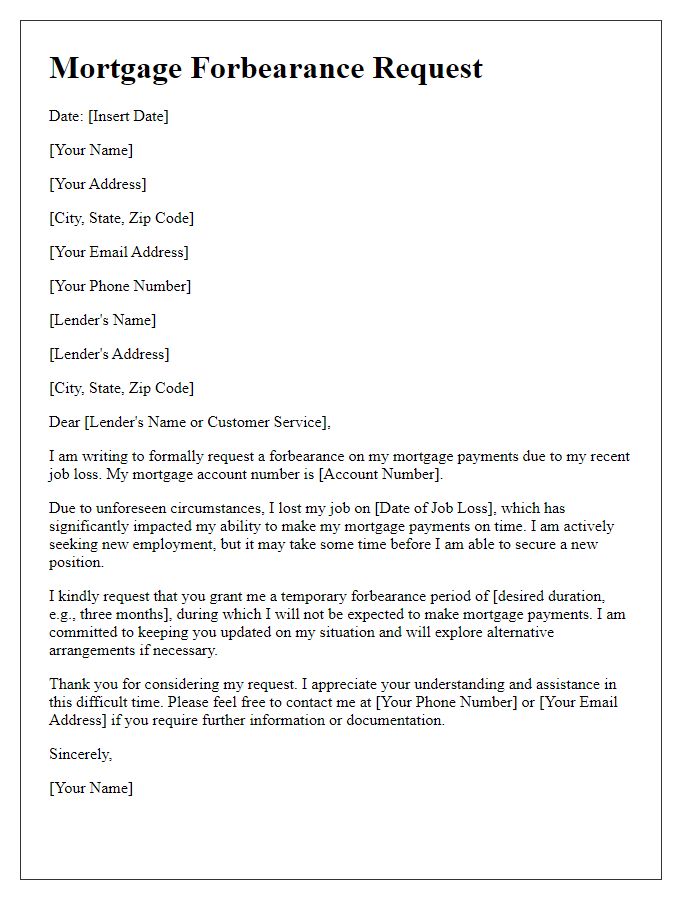

Facing financial hardship can significantly impact the ability to meet mortgage obligations, especially during unforeseen circumstances like job loss, medical emergencies, or economic downturns. Many homeowners, particularly in regions affected by high unemployment rates or natural disasters, struggle to maintain consistent payments, leading to stress and uncertainty. Essential expenses such as food, healthcare, and utilities often take precedence over mortgage payments, further aggravating the situation. Seeking mortgage forbearance becomes crucial, as it allows temporary relief during challenging times, enabling homeowners to stabilize their finances without the immediate threat of foreclosure. Understanding the specific requirements and processes involved in requesting forbearance is essential for homeowners navigating these difficult circumstances.

Request for specific forbearance terms

Mortgage forbearance allows homeowners facing financial hardship to temporarily pause or reduce mortgage payments. In 2023, a significant number of homeowners in the United States, particularly in states like California and New York, are navigating economic challenges due to rising inflation and job loss. A specific forbearance request typically outlines unique circumstances, such as loss of employment in specified industries like hospitality or retail, impacting over 15 million workers nationwide. Homeowners may request terms like a three-month pause on payments or reduced payments for six months, during which they can demonstrate good faith efforts to regain financial stability. Providing documentation, such as proof of income loss or medical expenses, can support the request, increasing the likelihood of favorable terms from loan servicers.

Contact information for follow-up communication

Mortgage forbearance is a financial relief option for homeowners facing temporary financial hardship, allowing them to pause or reduce mortgage payments for a specified period. Borrowers often initiate this process by contacting their loan servicer, which manages the mortgage account. Contact information, such as a designated phone number, email address, or online portal, is crucial for enabling effective follow-up communication between the borrower and the loan servicer. Documentation may include account numbers, social security numbers, and evidence of financial hardship, such as pay stubs or a letter from an employer detailing job loss or reduced hours. Timely communication is vital, as it can lead to favorable outcomes during this critical financial situation.

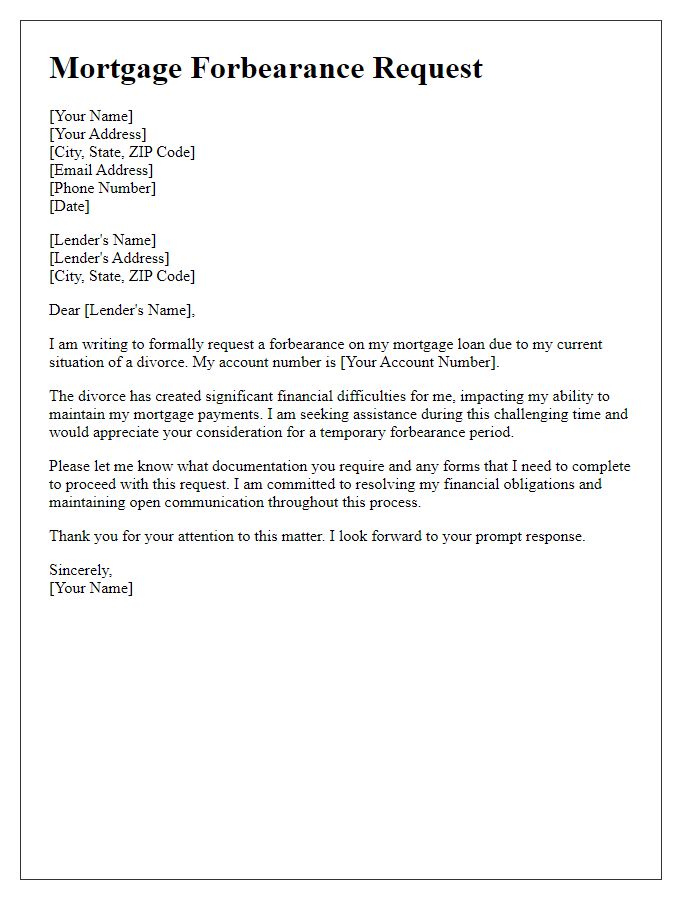

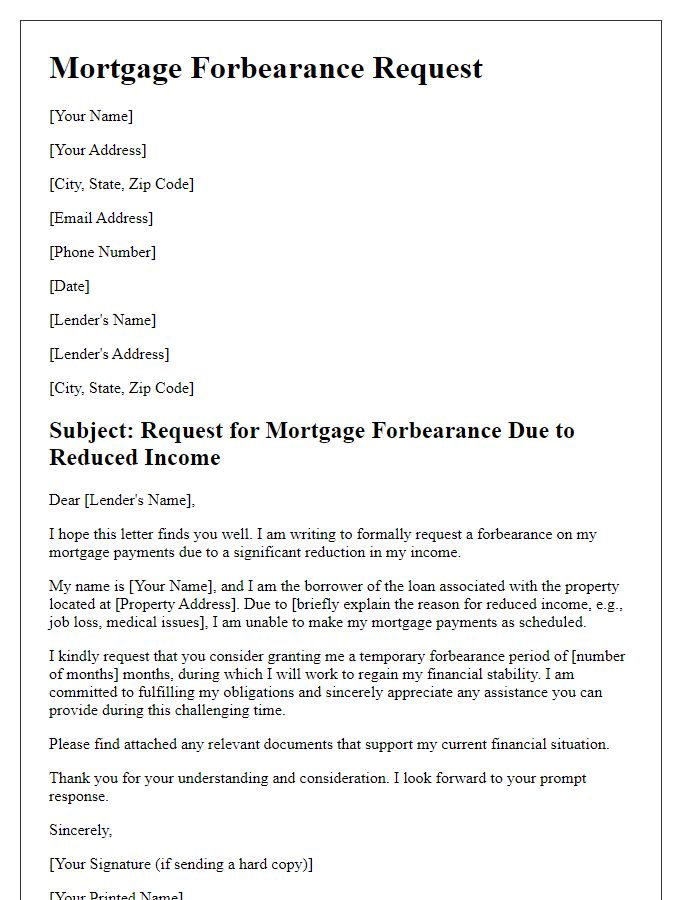

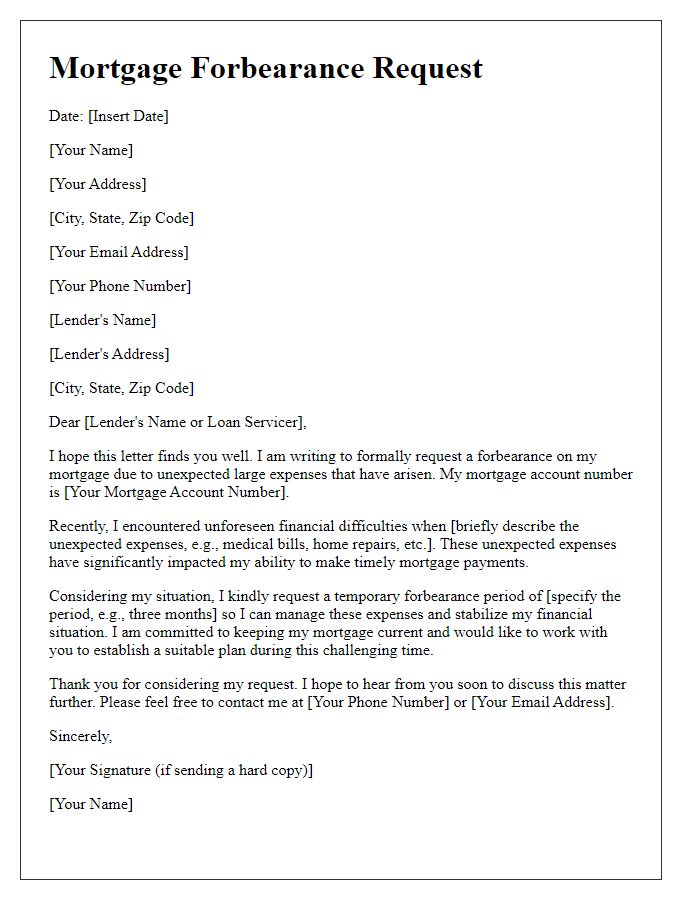

Letter Template For Mortgage Forbearance Request Samples

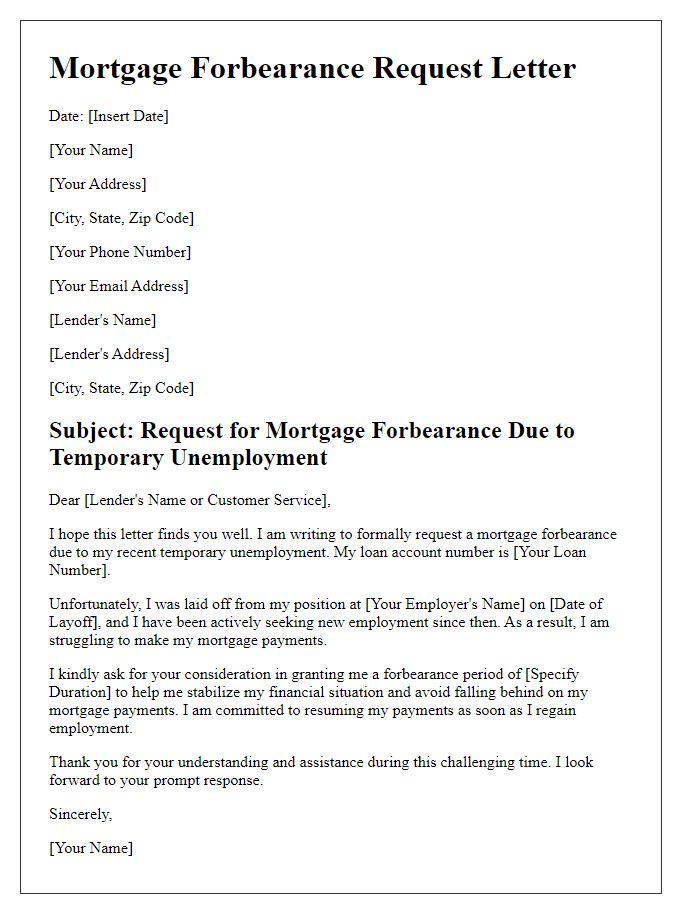

Letter template of mortgage forbearance request for temporary unemployment

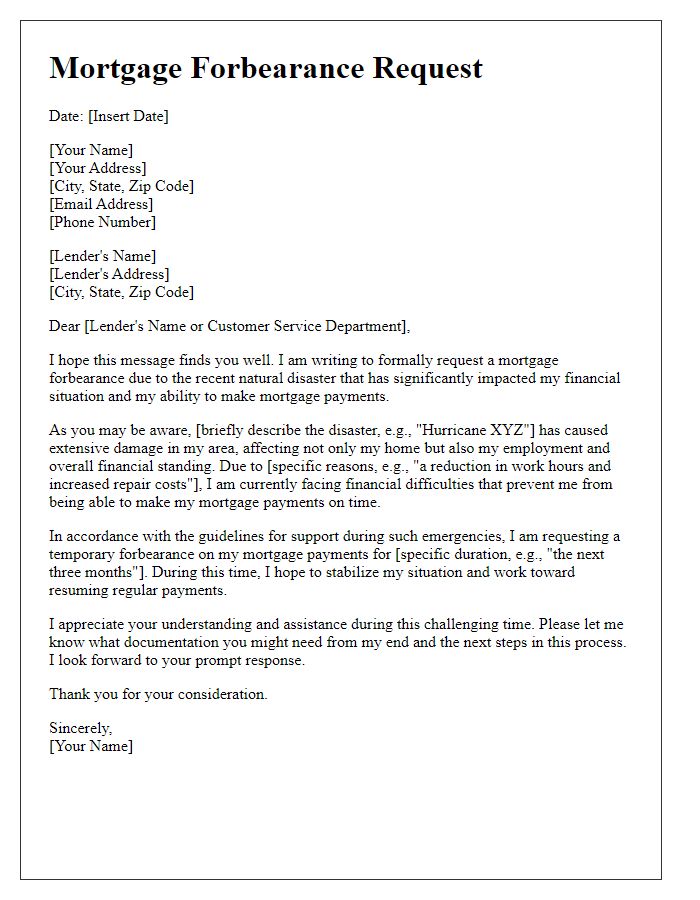

Letter template of mortgage forbearance request for natural disaster impact

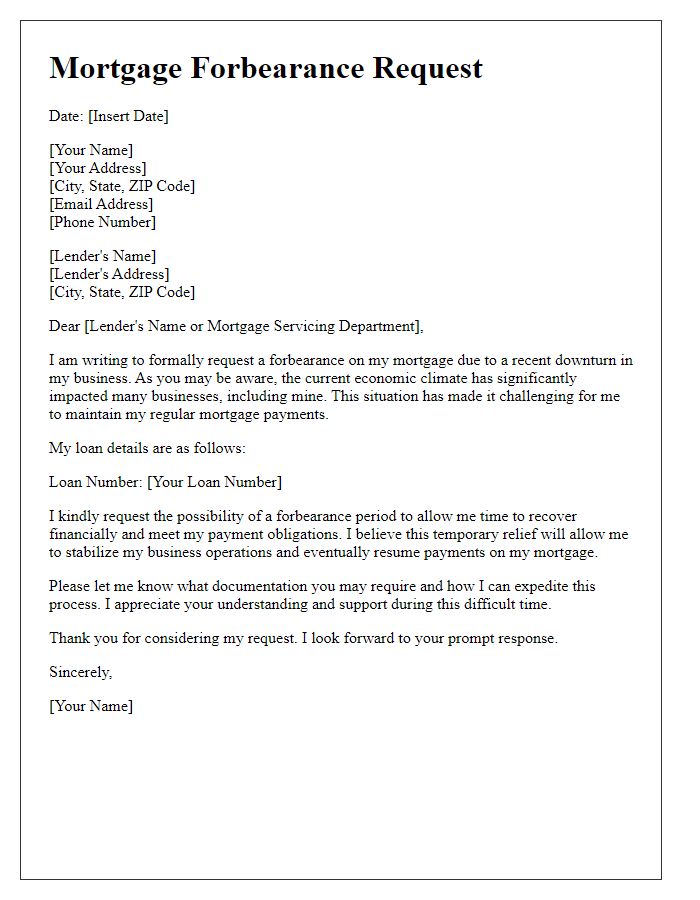

Letter template of mortgage forbearance request during business downturn

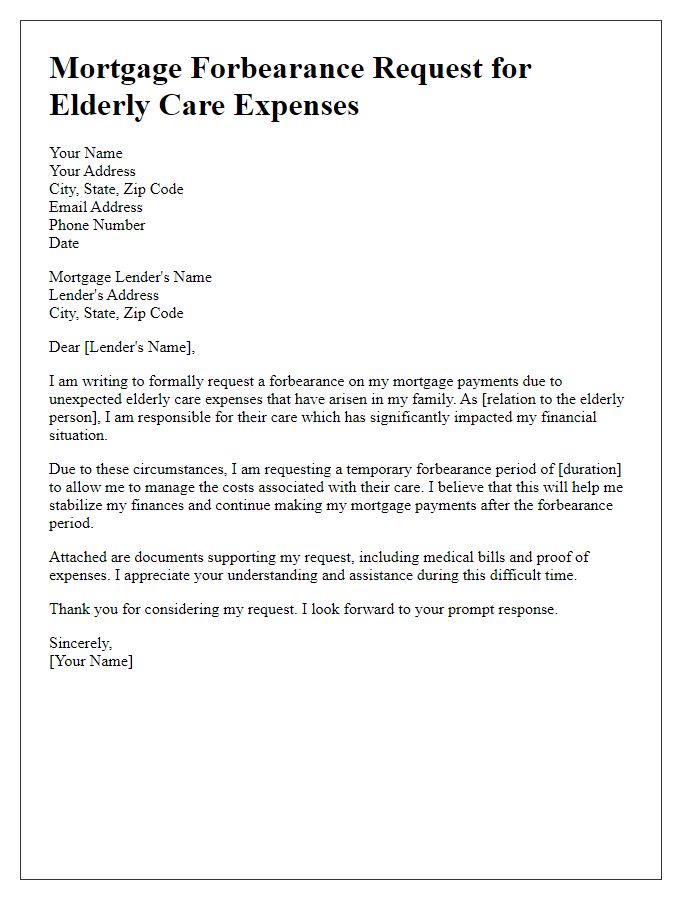

Letter template of mortgage forbearance request for elderly care expenses

Comments