Are you feeling overwhelmed by the process of requesting a mortgage refund? You're not alone! Many homeowners find themselves confused when it comes to navigating the necessary steps for a successful refund request. In this article, we'll break down the essential components of a mortgage refund letter, making it easier for you to reclaim what's rightfully yoursâso stick around and let's dive in!

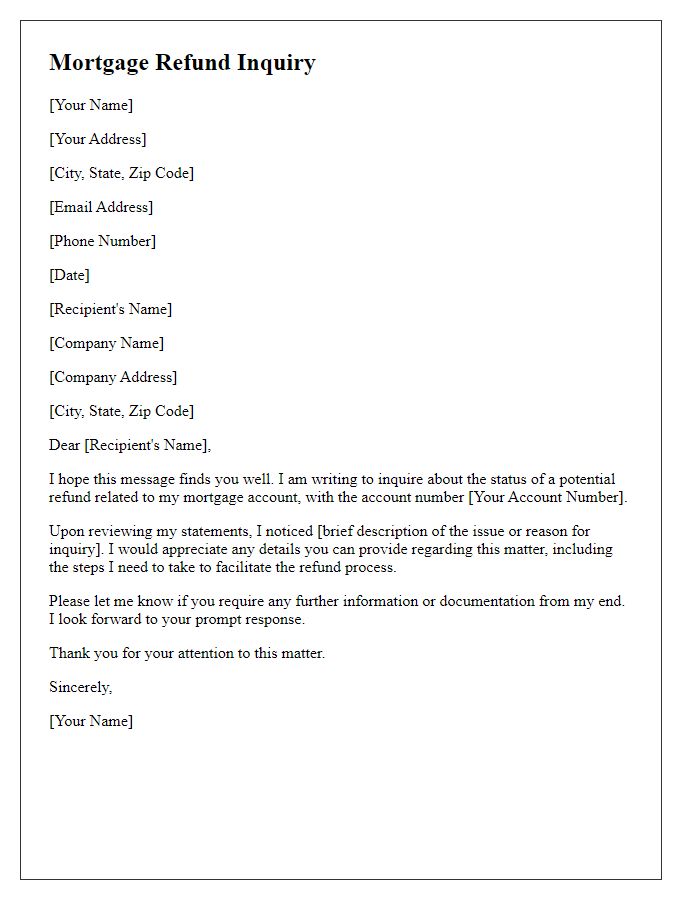

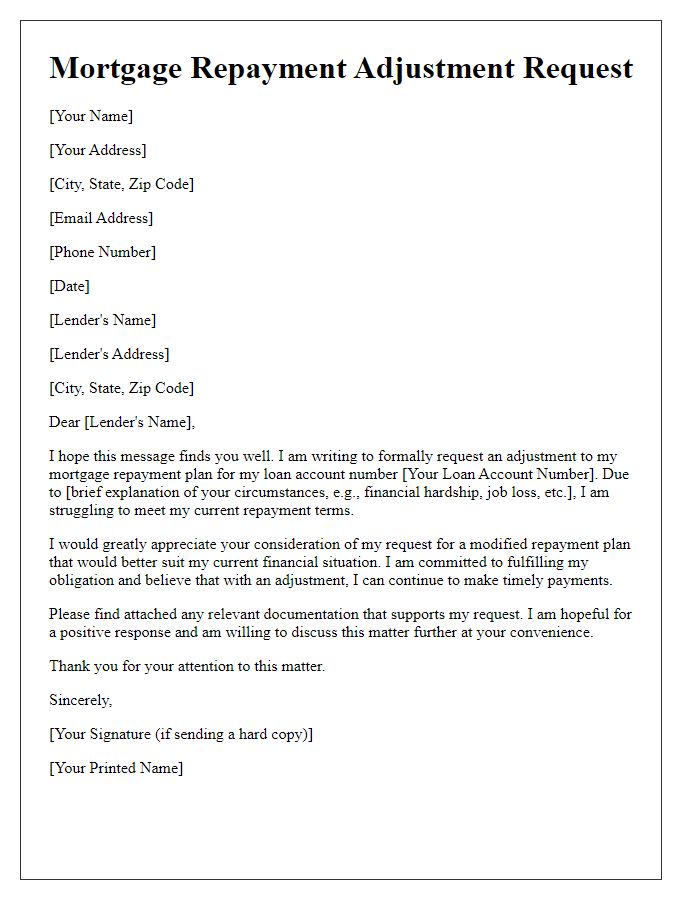

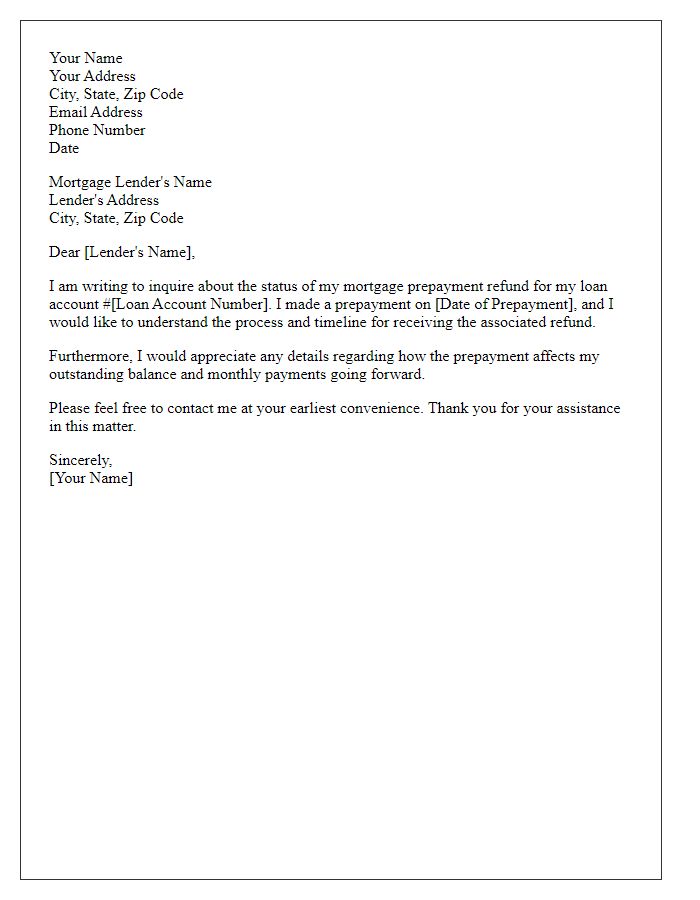

Borrower's Information

The mortgage refund request requires clear identification of the borrower, including essential details such as the full name of the borrower, which connects to the mortgage account application, the unique mortgage account number (often comprising 12 to 20 digits), and contact information like the address of the residence associated with the mortgage, which serves to verify ownership. Additionally, providing an accurate email address and phone number enables seamless communication during the refund processing. Dates associated with the mortgage agreement and any relevant documents must also be noted, ensuring efficient processing through the loan servicing company, often required under state regulations.

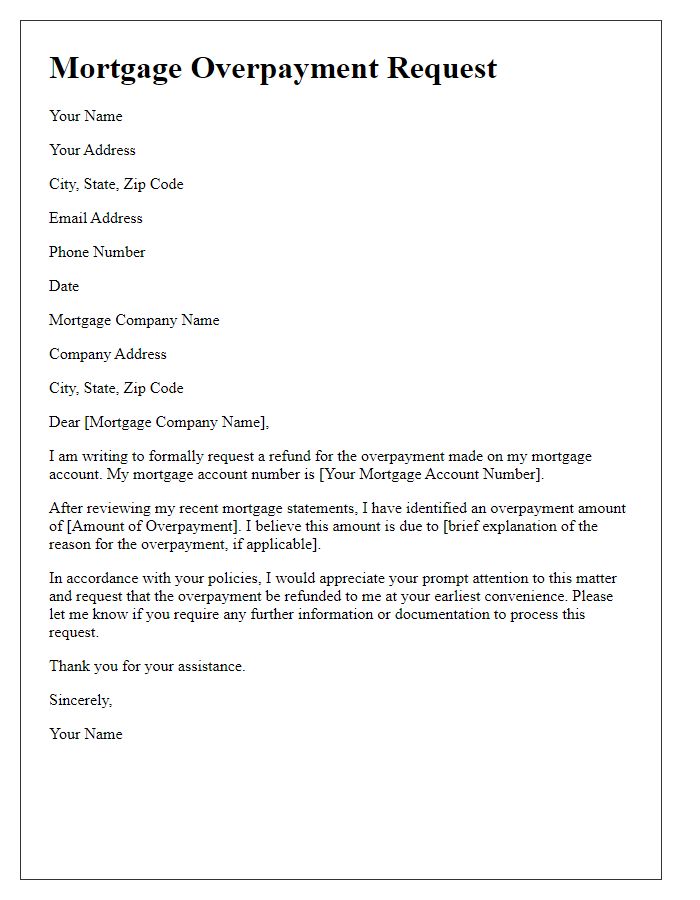

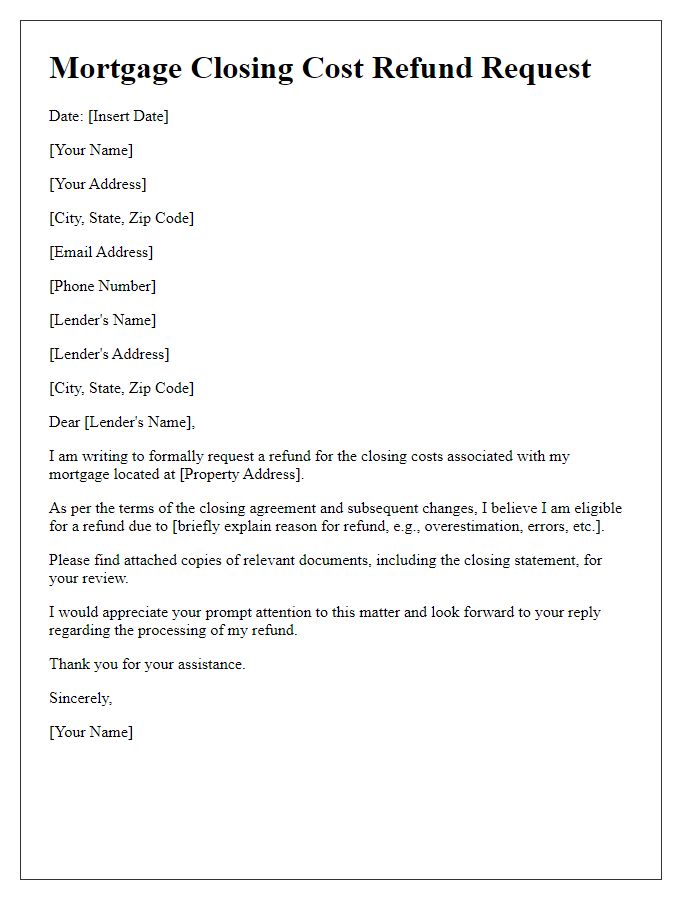

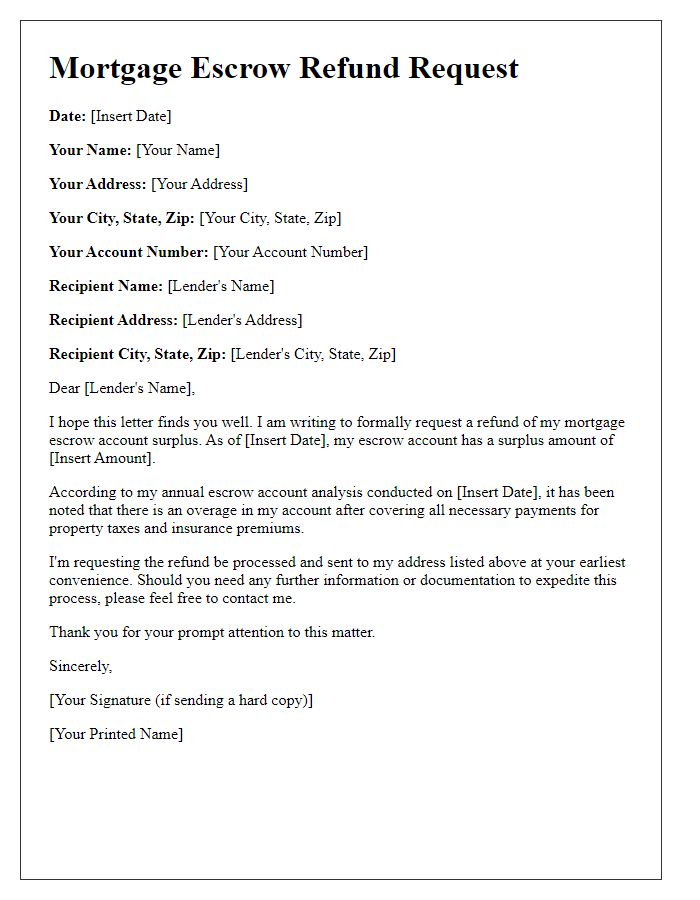

Loan Details

A mortgage refund request often involves specific loan details such as the loan number, the original loan amount, and the property's address. Homeowners should reference the loan number (typically a unique identifier assigned to the mortgage), outline the original loan amount (the total sum borrowed, often tens of thousands or more), and include the property address (the physical location of the real estate). Documentation supporting the refund claim, such as overcharges or miscalculations, should be detailed alongside the timeline of payments, including the date of the last payment and any communication with the lender.

Reason for Refund Request

A mortgage refund request may arise from various scenarios, including overpayment, incorrect charges, or account adjustments. Homeowners often discover discrepancies in their mortgage statements, where interest calculations do not align with agreed terms, potentially leading to excess payments. For instance, a homeowner paying a 4% interest on a $200,000 mortgage should expect specific monthly obligations outlined in original loan documents, like the Good Faith Estimate. Additionally, property taxes or insurance premiums added to escrow accounts might have been inaccurately assessed, resulting in inflated costs. Identifying such issues necessitates careful review of amortization schedules and bank statements, often requiring documentation like payment histories or correspondence with mortgage servicers for validation of claims. Therefore, a clear articulation of the reasons for the refund request, backed by precisely gathered evidence, is crucial in the process of seeking reimbursement.

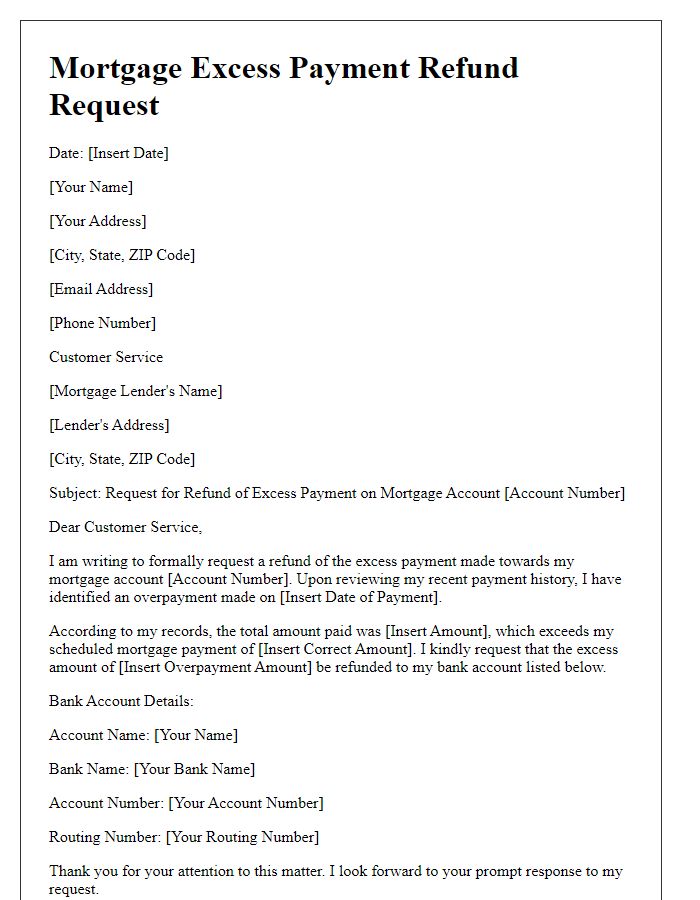

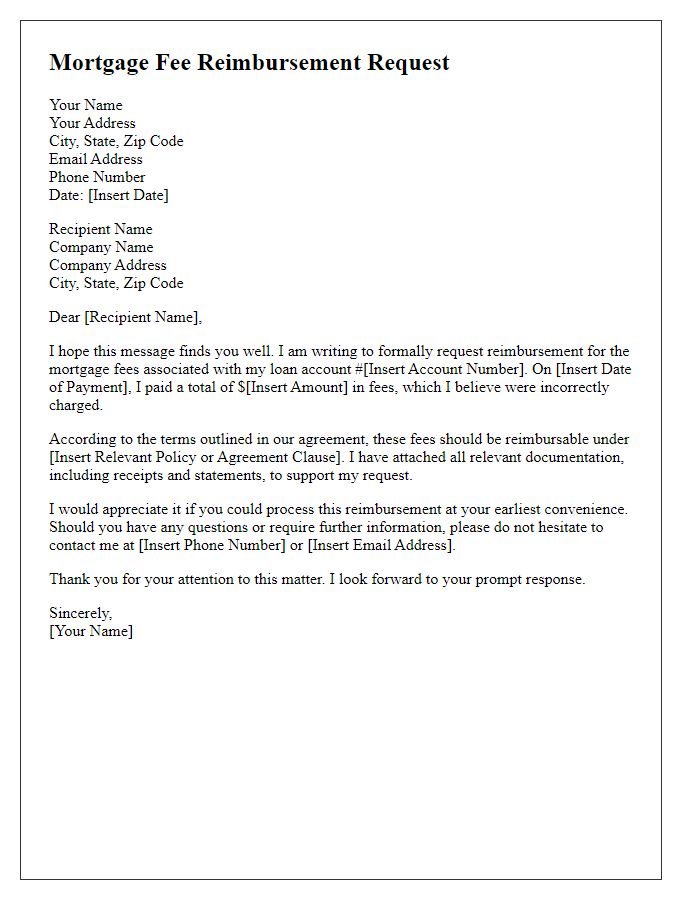

Supporting Documentation

A mortgage refund request requires comprehensive supporting documentation to validate the appeal and expedite processing. Documents should include the original mortgage agreement detailing the loan amount, interest rate, and terms, as well as payment history statements spanning the last 12 months, highlighting any discrepancies or overpayments. In addition, a copy of the property tax statement indicates eligibility for potential refunds related to overpayment or changes in valuation. Proof of income documentation, typically recent pay stubs or tax returns, reinforces the necessity for a refund due to financial constraints. Lastly, any correspondence with the mortgage lender regarding the refund situation should be included to demonstrate the ongoing dialogue regarding the case.

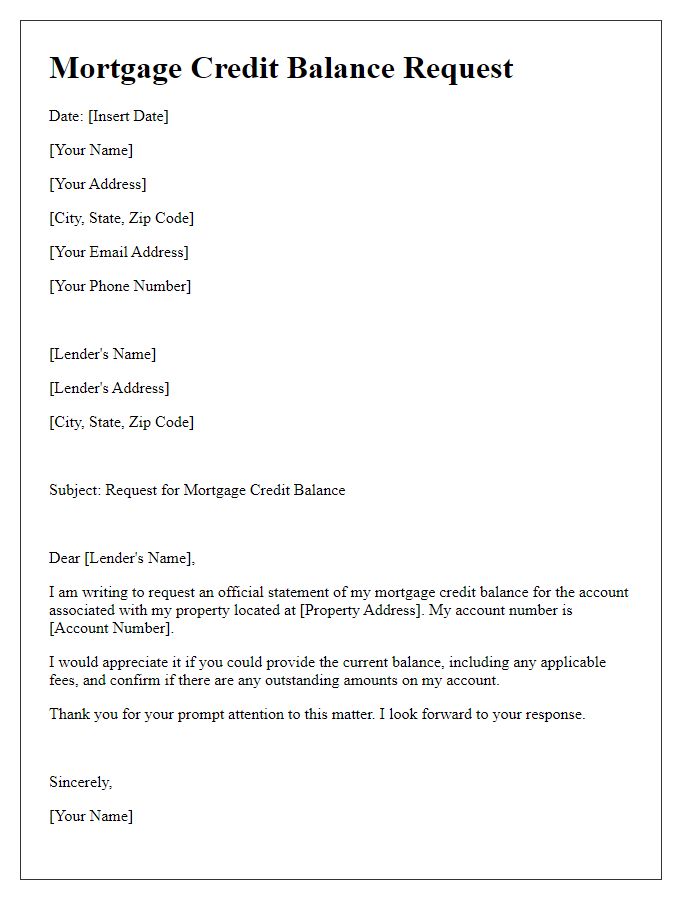

Contact Information

To obtain a mortgage refund, individuals should ensure they have accurate contact information readily available. This includes personal details such as full name (including middle initials), current address (including state and ZIP code), phone number (preferably a direct line), and email address for correspondence. Additionally, relevant loan information is crucial; this should encompass the mortgage account number (unique identifier for the loan), lender's name (bank or financial institution holding the mortgage), and any associated dates (like origination or payment records). Including these specific details facilitates a smoother communication process and may expedite the refund request.

Comments