Are you considering a temporary pause on your mortgage payments? It's a decision that can provide some much-needed relief during uncertain times. In this article, we'll guide you through the essentials of drafting a letter to your lender, ensuring you communicate your request clearly and effectively. Stick around to learn how to navigate this process and find the right solution for your financial situation!

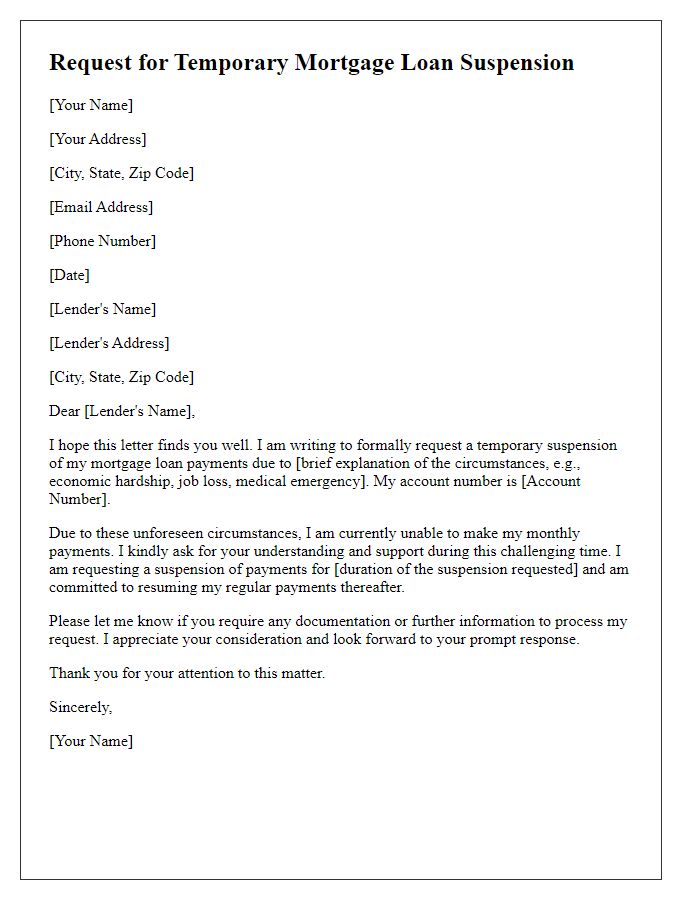

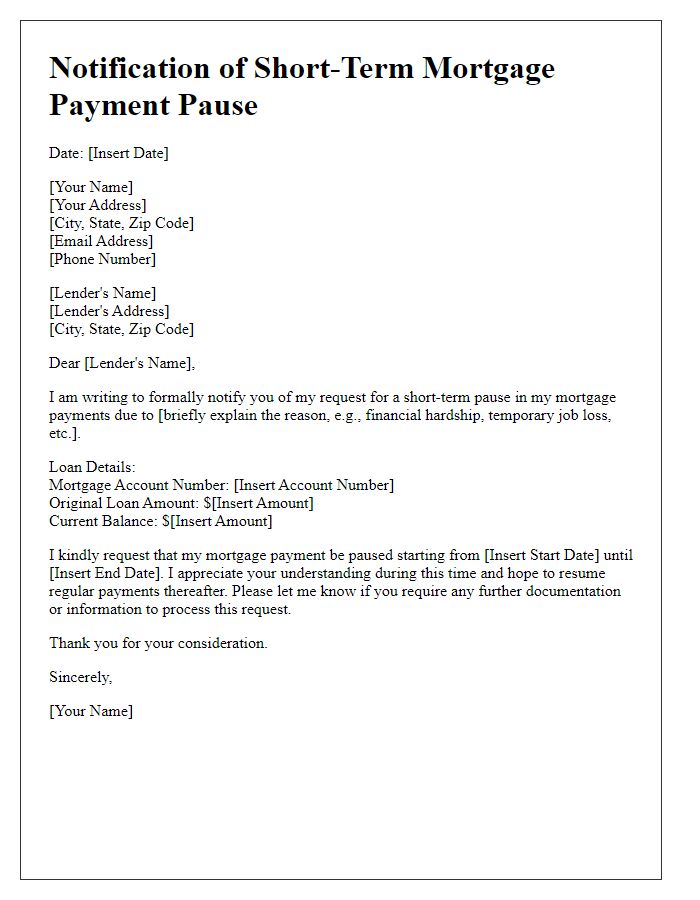

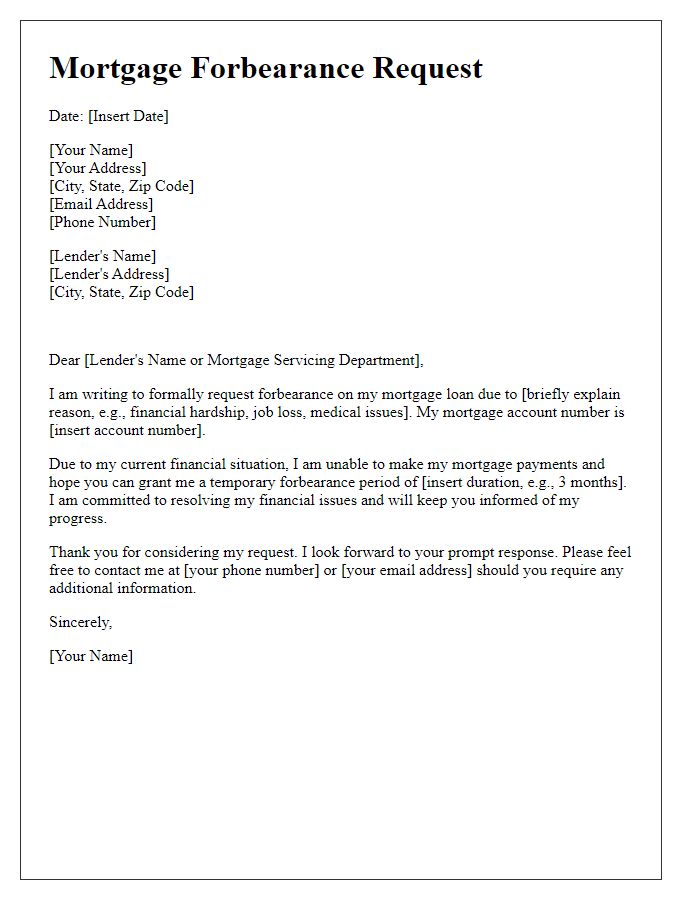

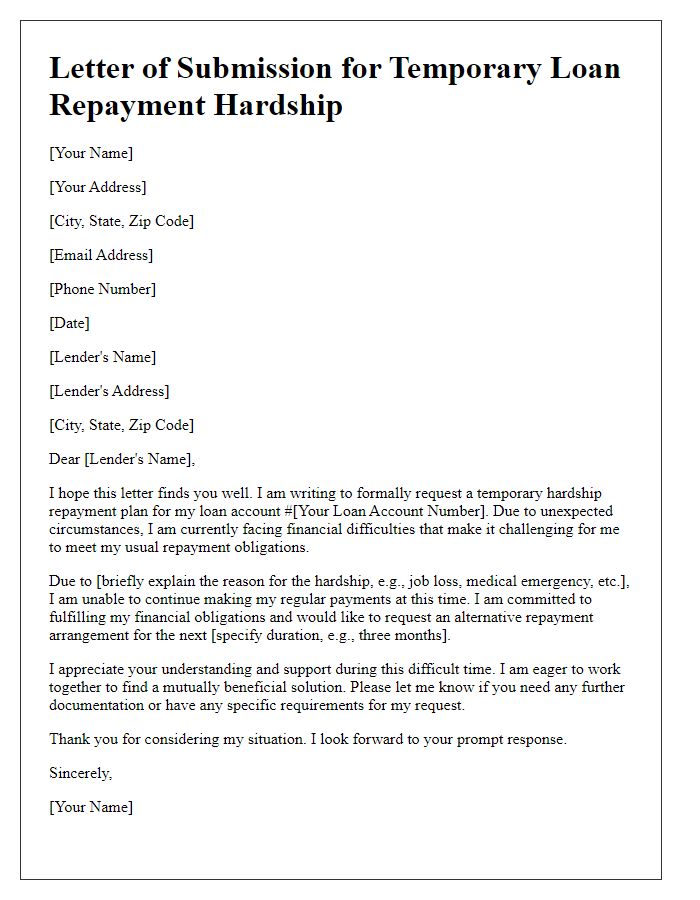

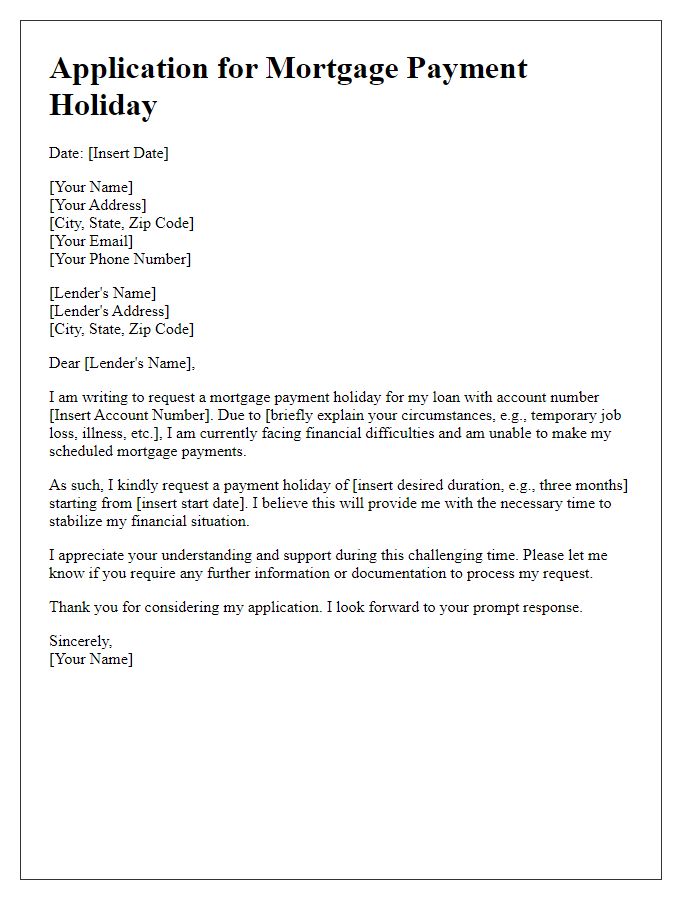

Borrower and lender identification.

In response to the temporary cessation of mortgage loan payments, borrowers (individuals or entities who have taken out a mortgage) must provide detailed identification information, including their full names, address of the mortgaged property, and loan account number, which serves as a unique identifier for the specific mortgage loan in question. Lenders (financial institutions or mortgage companies) should be identified with their official name, contact information, and any relevant loan officer details to facilitate direct communication. Clarity in presenting this information ensures that both parties have a mutual understanding of the mortgage loan status and related obligations.

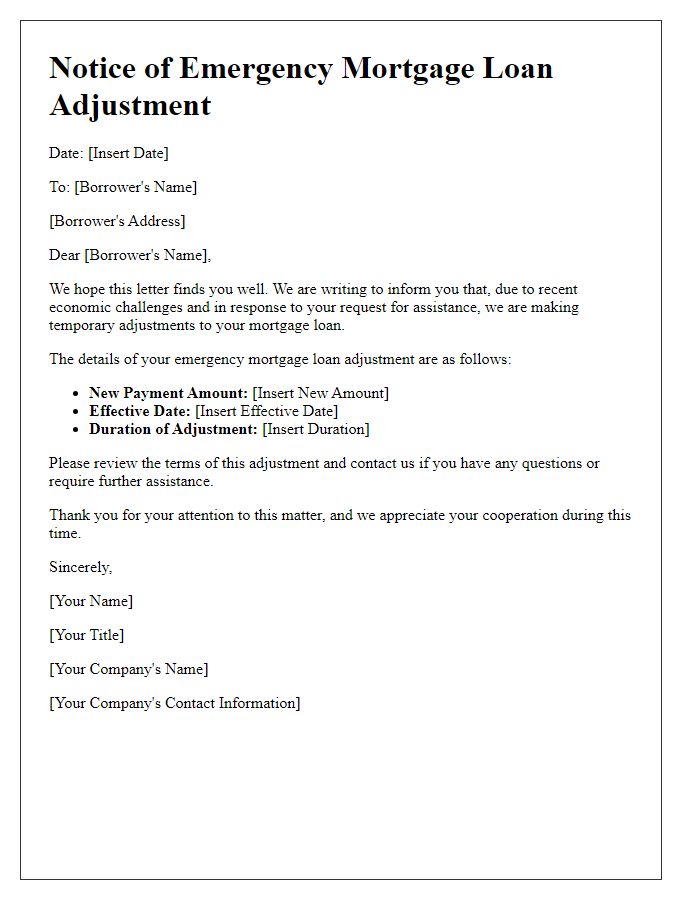

Subject and purpose of request.

A temporary mortgage loan cessation request aims to temporarily suspend mortgage payments due to financial hardship or unforeseen circumstances. Homeowners facing difficulties, such as job loss, medical emergencies, or natural disasters, may seek assistance from lenders to alleviate immediate financial burdens. This formal request typically includes specific details about the mortgage account number, property address, and pertinent personal information. Supporting documentation, such as evidence of income loss or medical records, may be required to substantiate the claim. The outcome of such requests can provide much-needed relief, allowing homeowners to regain financial stability before resuming regular mortgage payments.

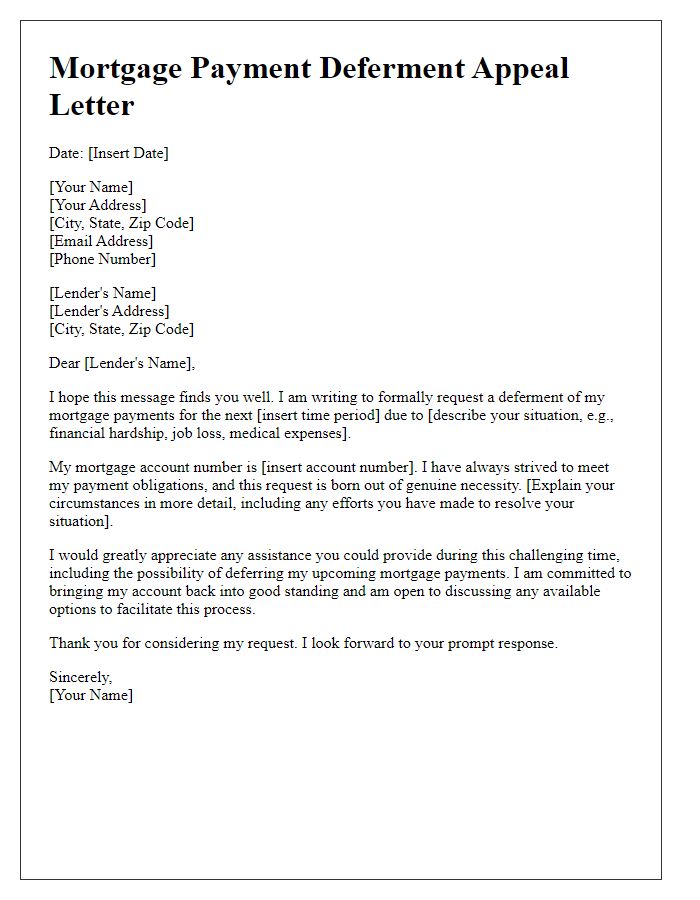

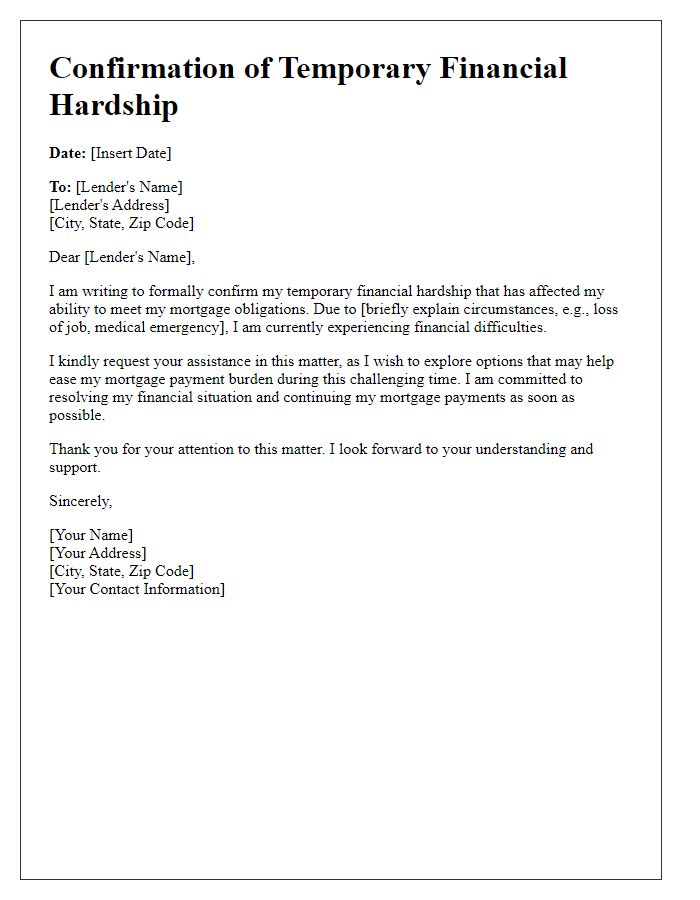

Duration of cessation period.

A temporary cessation of mortgage loan payments can significantly impact financial planning and management. Borrowers may request a pause in their obligations for a specific duration, often ranging between three to twelve months, allowing time for personal circumstances such as job loss or medical emergencies. During this cessation period, the mortgage lender, typically a bank or credit union, may implement deferred payment options, meaning missed payments are added to the loan balance rather than being completely forgiven. It is crucial for borrowers to understand the implications of such arrangements, including potential increases in the overall loan amount and the interest accrued during the hiatus. Additionally, communication with the lender is essential to ensure that all terms are clearly outlined and agreed upon.

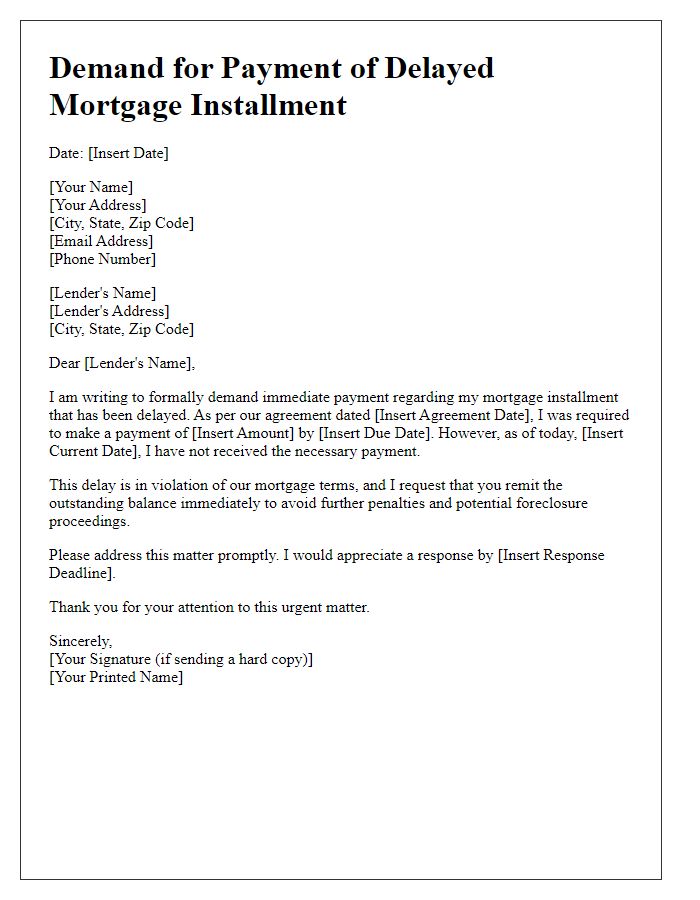

Reason for cessation request.

Individuals facing financial difficulties may request temporary cessation of mortgage loan payments due to unexpected circumstances. Situations such as job loss, medical emergencies, or natural disasters can impact income stability, leading to the need for financial relief. For example, according to the U.S. Bureau of Labor Statistics, unemployment rates rose by over 10% during the COVID-19 pandemic in 2020, prompting many homeowners to seek assistance. Furthermore, states like California and Texas experienced significant wildfires in 2020, which prompted numerous residents to request relief from mortgage obligations. Engaging with lenders to communicate these challenges can lead to potential forbearance agreements, allowing homeowners to pause payments temporarily while working on financial recovery.

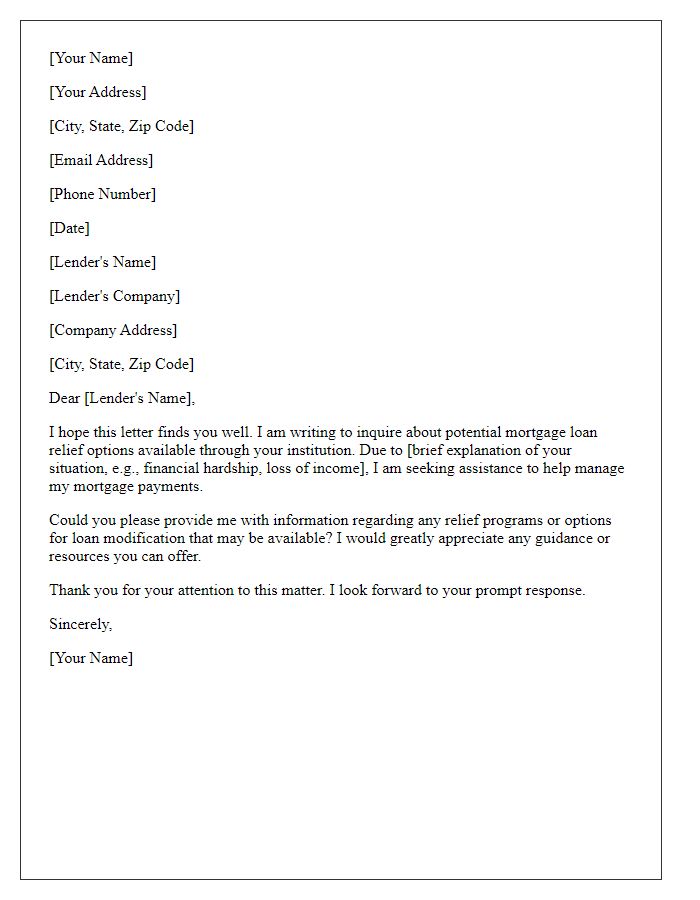

Contact information for future correspondence.

Due to the ongoing economic challenges, many homeowners are seeking temporary mortgage loan cessation. A mortgage pause allows homeowners to suspend payments for a specified duration, offering relief during financial hardship. The Department of Housing and Urban Development (HUD) provides guidelines outlining how to formally request this cessation. Homeowners typically need to submit a detailed request form along with supporting documentation, such as proof of income or a hardship statement. Lenders, like Wells Fargo or Bank of America, assess these requests on a case-by-case basis and may provide options for loan modification or forbearance agreements. Future correspondence regarding the loan status can be directed to the designated loan servicer through secure online portals or customer service hotlines for timely responses.

Comments