Are you feeling overwhelmed by the mortgage process and unsure if you need counseling help? Many homeowners find themselves in this situation, especially when trying to navigate the complexities of mortgage requirements. In this article, we'll explore how you can waive the mortgage counseling requirement by understanding the criteria and submitting the right documentation. Stick around to discover the steps you need to take to simplify your mortgage journey!

Borrower's Information

Mortgage counseling waivers can significantly streamline the loan process for borrowers seeking funds. These waivers may apply in specific circumstances, such as when borrowers demonstrate sufficient financial literacy or when the loan amount remains below certain thresholds, like $100,000, as determined by the Department of Housing and Urban Development (HUD). Documentation of prior successful mortgage experiences or participation in homebuyer education programs can further support the waiver request. Various lenders, including banks and credit unions, may have distinct eligibility criteria. Providing clear borrower information, such as credit scores, income levels, and employment history, is essential to justify the waiver and expedite the approval process.

Lender's Information

Mortgage counseling requirements can be waived under certain circumstances, particularly for specific loan types or borrower situations. Lenders need to provide substantial information regarding their procedures for waiving this requirement. During the application process, lenders, such as Wells Fargo, Bank of America, or Quicken Loans, should outline the necessary documentation and eligibility criteria for waiving counseling. Specific factors like borrower income levels, credit scores, and the type of loan, such as FHA or conventional loans, can influence this decision. Additionally, lenders may refer applicants to designated housing counseling agencies that comply with the U.S. Department of Housing and Urban Development (HUD) guidelines to ensure borrowers are informed about their responsibilities and options.

Property Details

Waiving the mortgage counseling requirement can facilitate a smoother transaction for prospective homeowners. The property, located at 123 Maple Street, Springfield, boasts a three-bedroom layout with 1,800 square feet of living space. Built in 2010, it includes modern amenities such as stainless steel appliances and energy-efficient windows. The surrounding neighborhood, known for its excellent school district and community parks, attracts families seeking a stable environment. Additionally, the property's assessed value is $250,000, with current mortgage rates hovering around 3.5%. By waiving the counseling requirement, buyers can expedite the mortgage process, enabling quicker access to homeownership in this desirable market.

Statement of Waiver Request

A statement of waiver request concerning mortgage counseling requirements involves a formal appeal made by a borrower to their lender, requesting exemption from mandatory pre-purchase or refinancing counseling, typically mandated by regulations such as those from the United States Department of Housing and Urban Development (HUD). This request may include details about the borrower's financial situation, such as income level, credit history, and previous experience with mortgage processes, which may illuminate their capability to make informed decisions without additional counseling. Additional supporting documents, like proof of income or documentation of prior homeownership, can accompany the request to underscore the borrower's knowledge and preparedness, thus potentially facilitating a smoother communication process with the lender.

Justification for Waiver

A mortgage counseling requirement waiver can significantly streamline the home buying process. This waiver is often justified by demonstrating pre-existing financial literacy, such as completion of accredited financial education programs, or substantial prior experience in real estate transactions, ensuring borrowers possess the necessary knowledge for informed decision-making. In addition, a consistent credit history (with a credit score above 700, as indicated by FICO) may suggest financial responsibility, further supporting the request for this waiver. Economic conditions in areas like urban centers, where heightened competition necessitates quick actions in acquiring properties, also underline the importance of reduced barriers during the mortgage process. By presenting these factors, borrowers can make a compelling case for the necessity of waiving the mortgage counseling requirement, allowing for a more efficient path toward homeownership.

Letter Template For Waiving Mortgage Counseling Requirement Samples

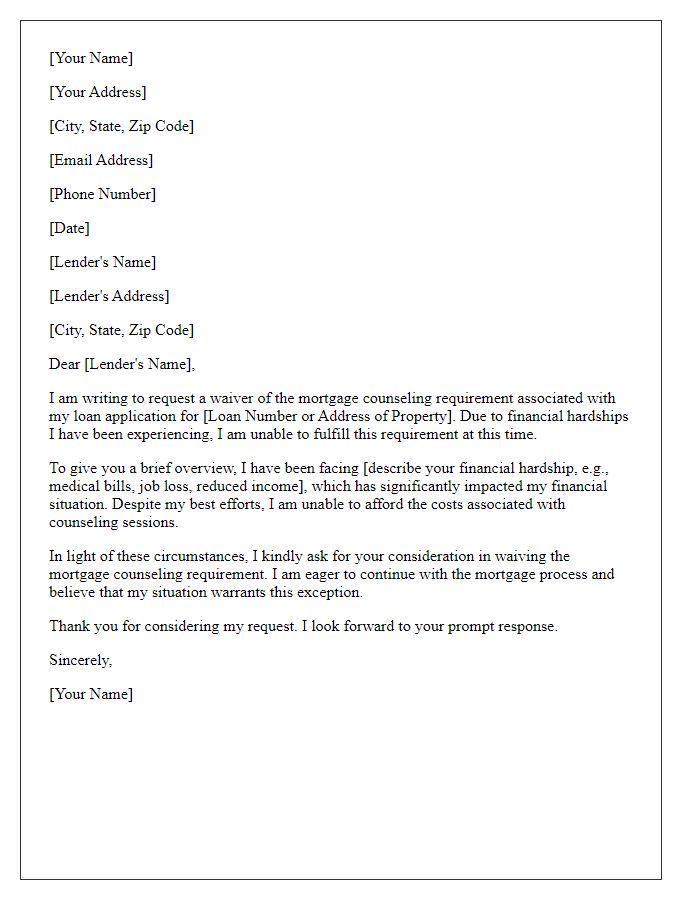

Letter template of request for waiver of mortgage counseling requirement due to financial hardship.

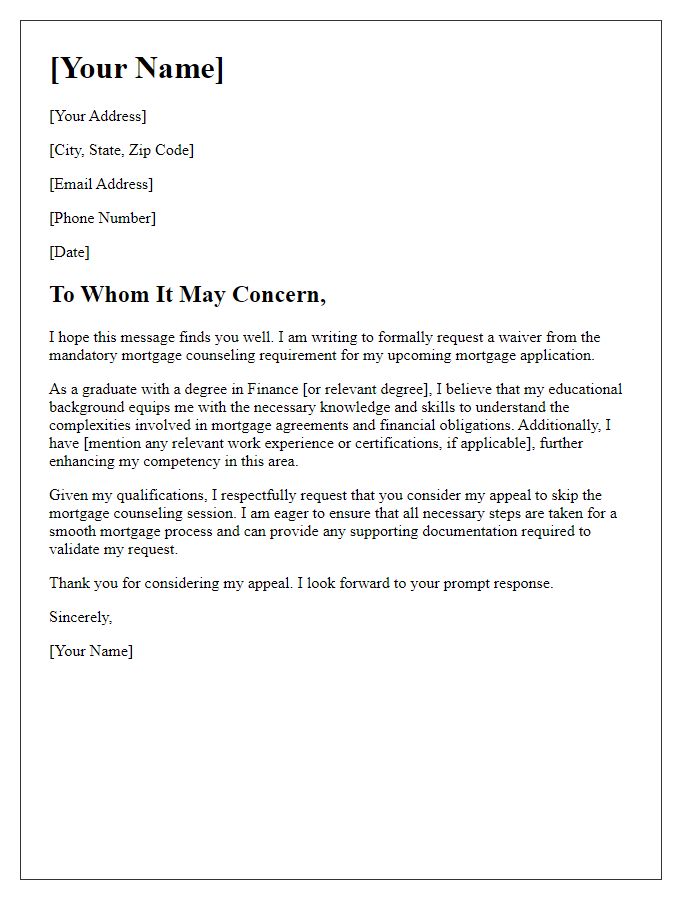

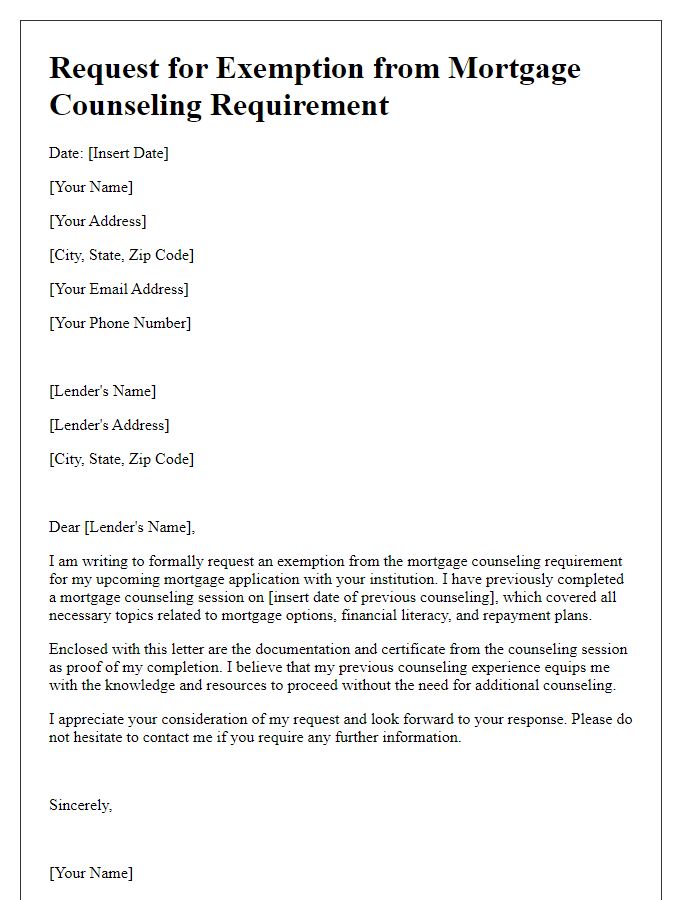

Letter template of application to waive mortgage counseling based on prior knowledge and experience.

Letter template of appeal to skip mortgage counseling due to educational background in finance.

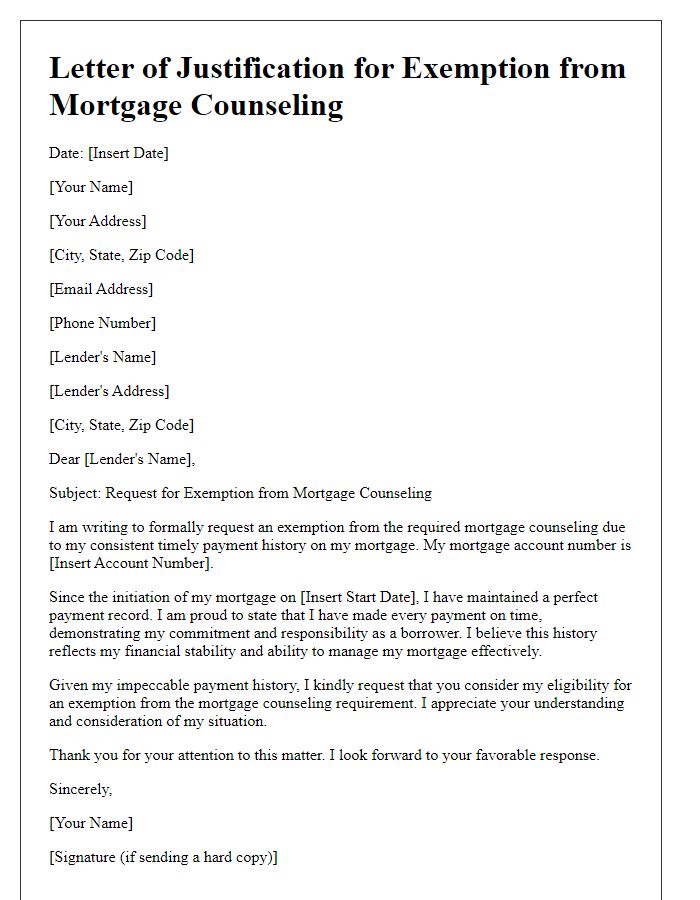

Letter template of justification for exemption from mortgage counseling due to timely payments history.

Letter template of formal request to forego mortgage counseling on account of self-education in home buying.

Letter template of inquiry regarding waiver of mortgage counseling requirement for multiple property ownership.

Letter template of appeal for mortgage counseling requirement waiver during emergency circumstances.

Letter template of request for exemption from mortgage counseling based on existing financial literacy resources.

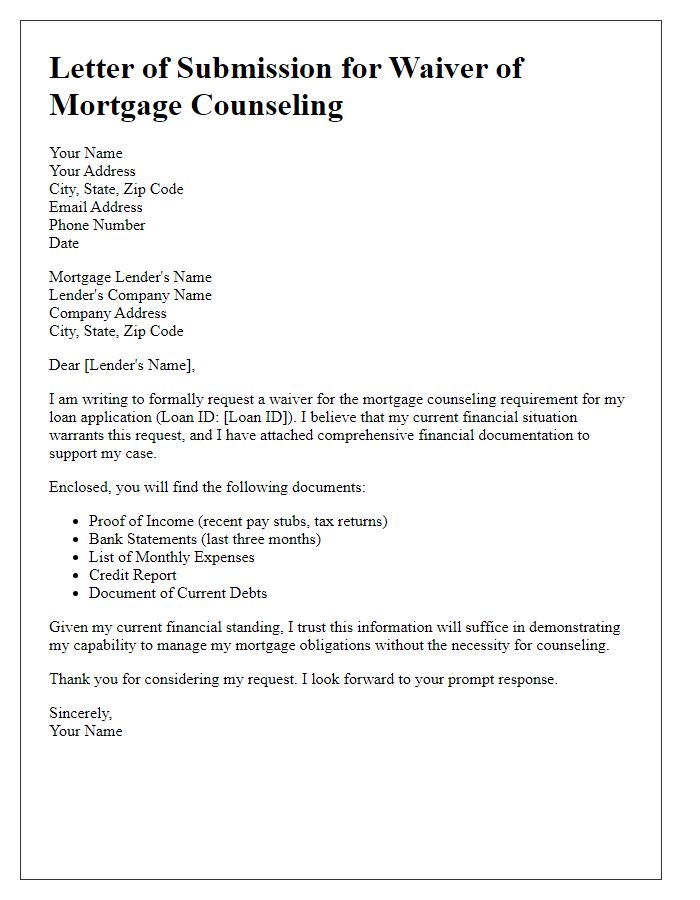

Letter template of submission for waiver of mortgage counseling, supported by comprehensive financial documentation.

Comments