Are you navigating the often confusing world of mortgage fees? Understanding the mortgage origination fee is a crucial step in the home-buying process, and it can significantly impact your overall costs. In this article, we'll break down what this fee entails, why it matters, and how it fits into your mortgage application. Join us as we dive deeper into this essential topic and equip yourself with the knowledge you need to make informed financial decisions!

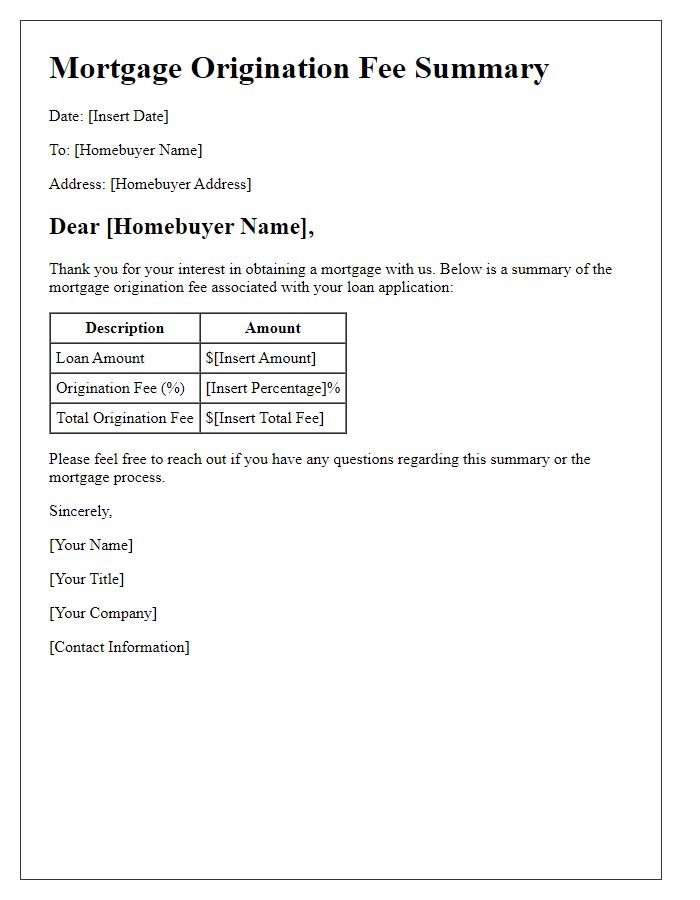

Borrower Information

The mortgage origination fee disclosure is crucial for borrowers, outlining the costs associated with obtaining a mortgage loan. Typically, this fee, often expressed as a percentage of the loan amount, covers the lender's administrative expenses (such as processing and underwriting) and can range from 0.5% to 1% of the total loan amount. For instance, on a $300,000 mortgage, the origination fee could be between $1,500 and $3,000. This document should include borrower information such as the borrower's full name, contact details, and the property address (the real estate involved in the transaction), ensuring clarity in the loan agreement process. A detailed breakdown of all fees and charges, including points, processing fees, and any other associated costs, should accompany the disclosure to help borrowers understand their financial obligations clearly.

Loan Details

The mortgage origination fee plays a crucial role in the home loan process, typically charged by lenders for processing a new mortgage application. Commonly set as a percentage of the total loan amount, this fee can range from 0.5% to 1% of the loan value, significantly impacting overall borrowing costs. For instance, on a $300,000 mortgage, an origination fee of 1% translates to $3,000. This fee covers essential services, including underwriting and administrative efforts involved in securing the mortgage. Furthermore, understanding local regulations and lender requirements related to the origination fee is vital for borrowers, as it can vary state-to-state and among different financial institutions. Accurate disclosure of this fee aids in transparent communication between lenders and borrowers, fostering informed decision-making throughout the loan process.

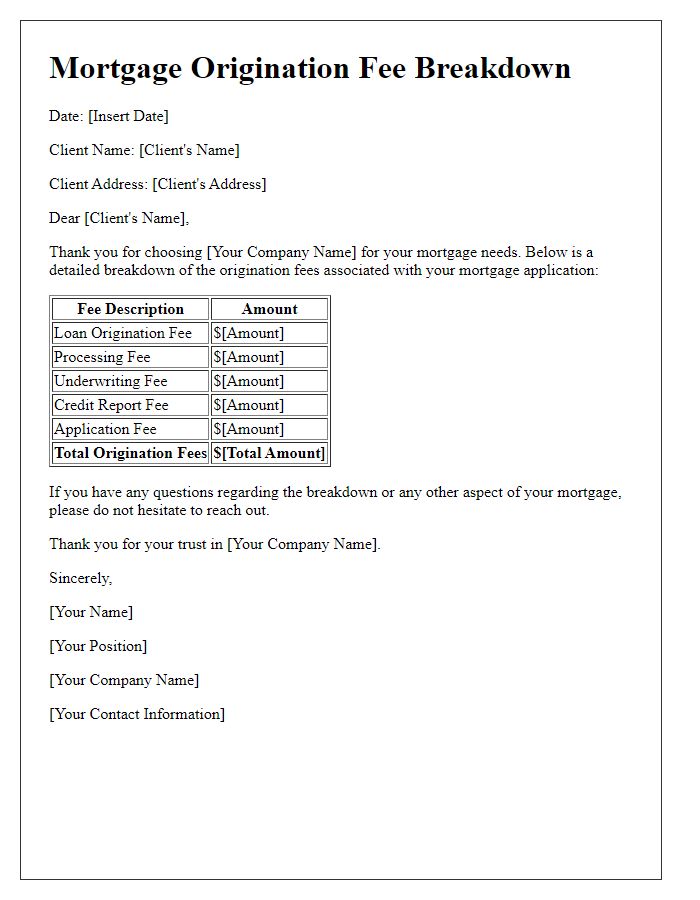

Origination Fee Breakdown

The mortgage origination fee typically comprises several key components aimed at covering the costs associated with processing a home loan application. The most common charges include underwriting fees, which can range from $400 to $1,000, and application fees, usually between $300 and $500. Additionally, broker fees may be involved if a mortgage broker is employed, typically around 1% of the loan amount. Other components, such as credit report fees (approximately $30 to $50) and appraisal costs (ranging from $300 to $700 depending on region), may also be included in the overall origination fee. Understanding these individual fees can provide clarity and transparency in the mortgage process for prospective homeowners.

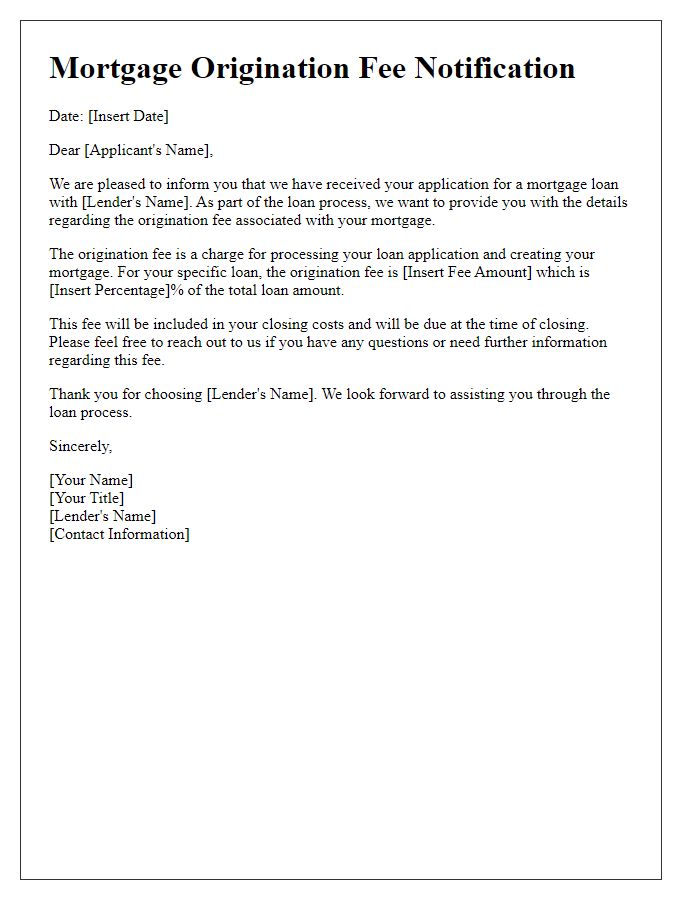

Payment Terms

Mortgage origination fees can influence the overall cost of a home loan significantly. Typically expressed as a percentage of the total loan amount, these fees range from 0.5% to 1% for many lenders. Local regulations, such as those enforced by the Consumer Financial Protection Bureau (CFPB), require clear disclosure of these fees during the lending process. This fee structure is designed to encompass various services including underwriting, processing, and administrative tasks associated with the mortgage application. Borrowers should carefully review the Loan Estimate form, which outlines these origination fees, typically within three business days of the application submission. Understanding these payment terms can help borrowers make informed financial decisions and compare offers across different lenders.

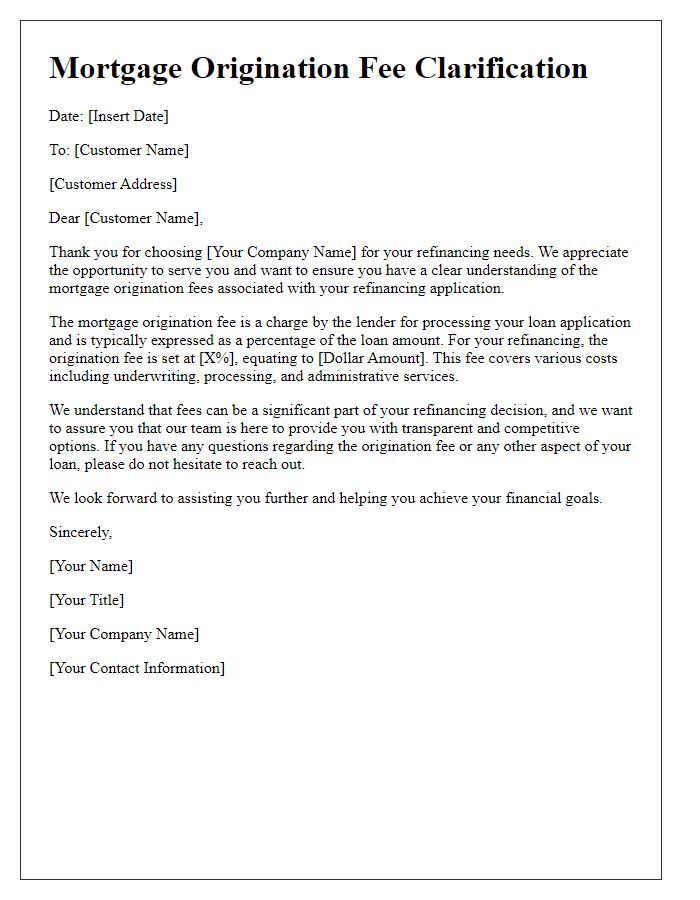

Disclosure Acknowledgment

Mortgage origination fees represent upfront charges associated with processing a loan application, typically varying between 0.5% to 1% of the loan amount. This fee is essential as it covers various administrative costs incurred by lenders, including underwriting and processing the mortgage. Borrowers should carefully review the disclosure acknowledgment document, which outlines these fees and ensures transparency in the mortgage transaction process. The acknowledgment serves as a confirmation that the borrower is aware of and understands all associated costs, allowing for informed financial decisions when proceeding with the mortgage. It is advisable for borrowers to compare these fees across multiple lenders to seek favorable terms in their mortgage agreements.

Letter Template For Mortgage Origination Fee Disclosure Samples

Letter template of mortgage origination fee summary for potential homebuyers

Letter template of mortgage origination fee notification for loan applicants

Letter template of mortgage origination fee clarification for refinancing customers

Letter template of mortgage origination fee details for real estate agents

Letter template of mortgage origination fee structure for financial advisors

Letter template of mortgage origination fee confirmation for closing documents

Comments