Are you feeling overwhelmed by your current mortgage terms? It's common for homeowners to seek better options as financial situations change or interest rates fluctuate. Renegotiating your mortgage can lead to significant savings and a more manageable payment plan. If you're curious about how to navigate this process effectively, read on to discover essential tips and strategies!

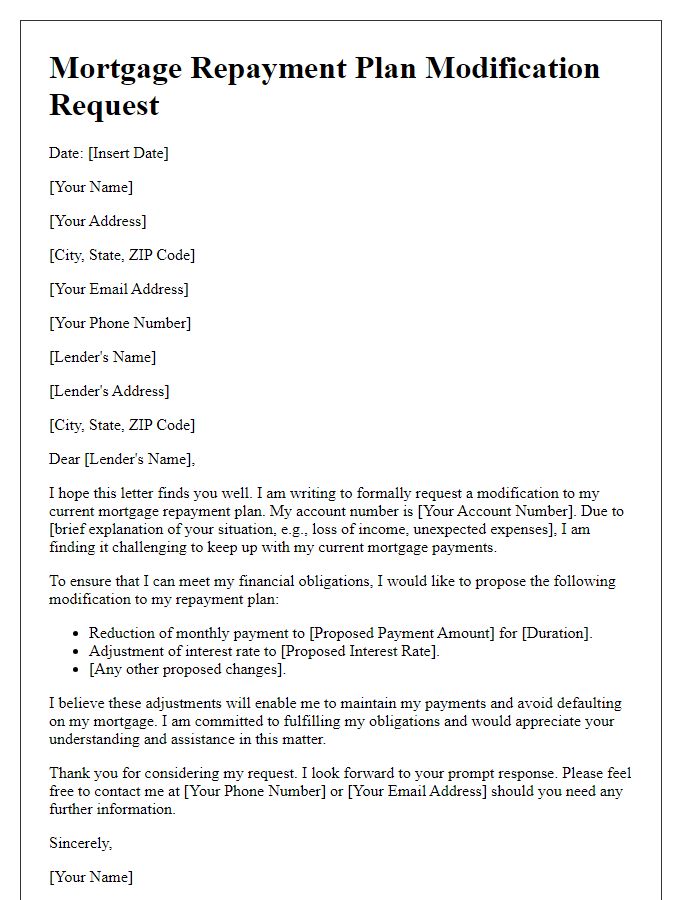

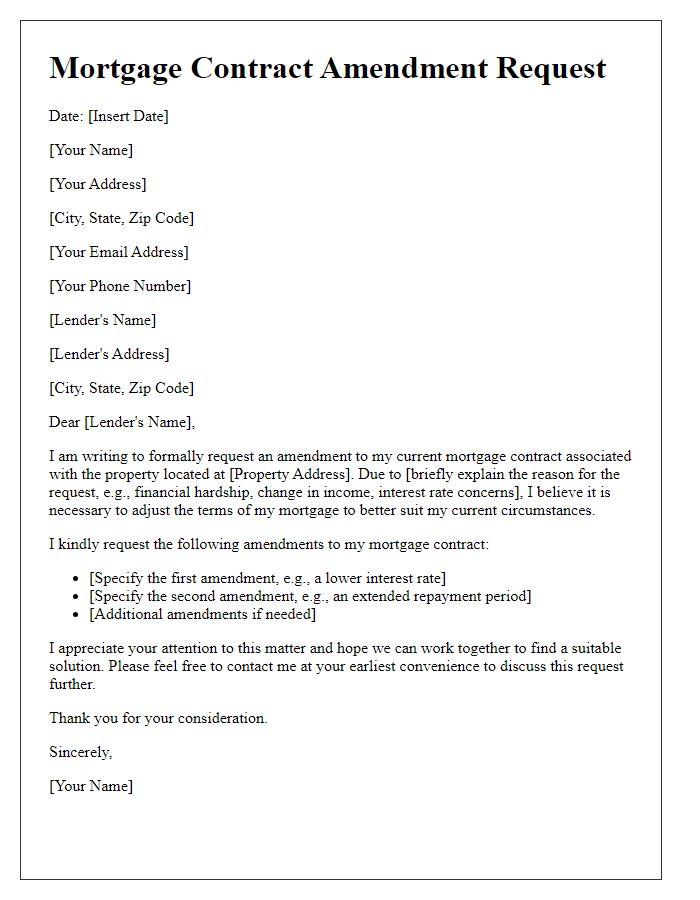

Current financial situation and changes.

Mortgage term renegotiation may arise due to significant changes in current financial situation, such as increased living expenses or unforeseen circumstances like job loss, impacting repayment capabilities. Homeowners often seek adjusted terms to reduce monthly payments or extend the loan duration, easing financial strain. Financial institutions, such as banks and credit unions, may consider these requests based on current interest rates, borrower loyalty, and market conditions. Moreover, even slight modifications in mortgage agreements could lead to more manageable payments, allowing homeowners to remain compliant without extensive financial hardship. Recent economic indicators in 2023, such as rising inflation rates impacting living costs, also underscore the necessity for renegotiation discussions.

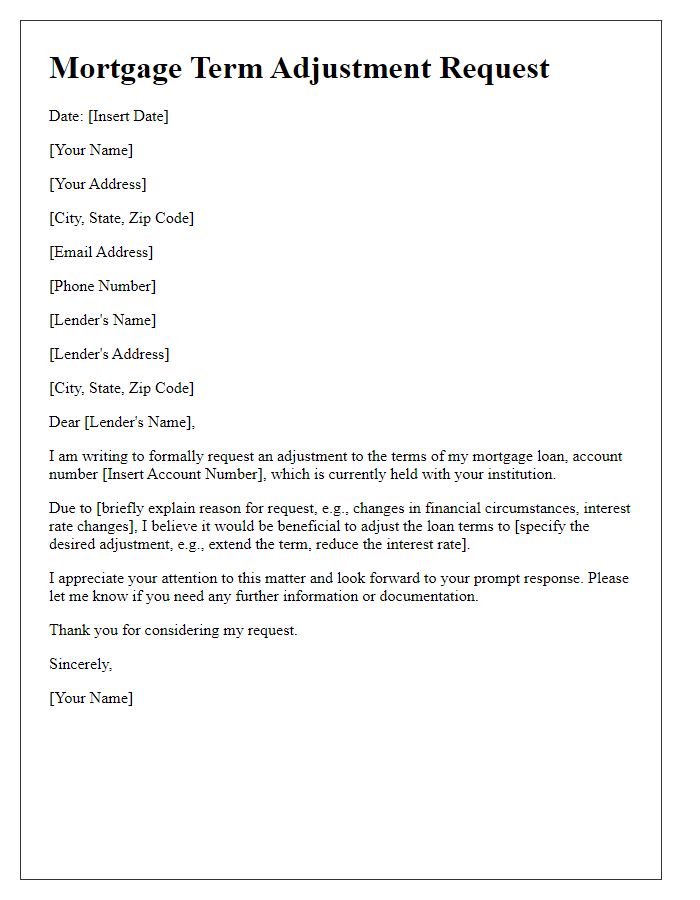

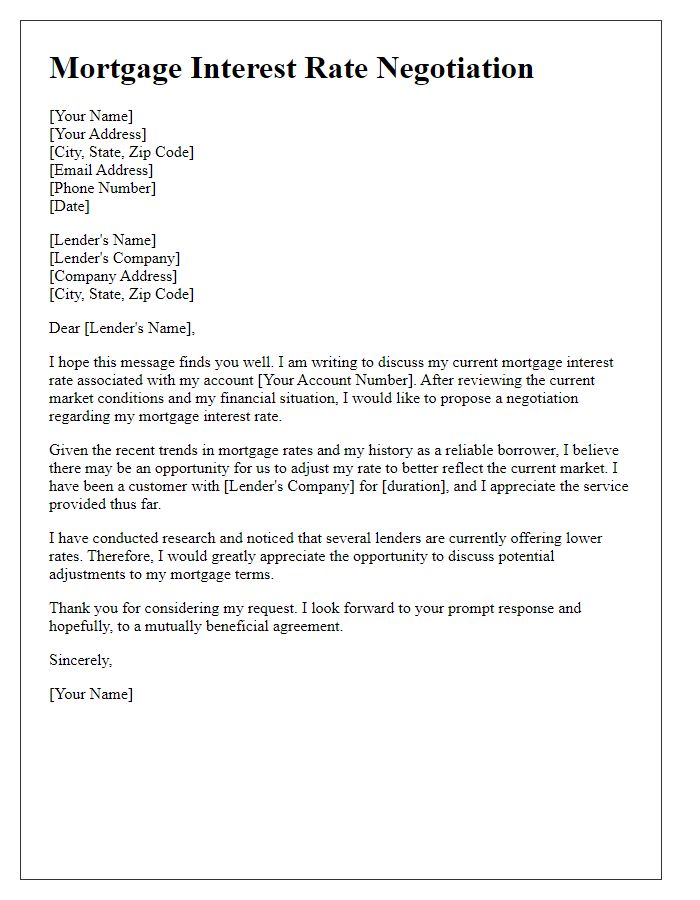

Desired mortgage terms and interest rate.

Mortgage term renegotiation can significantly impact long-term financial commitments. Many homeowners, currently holding fixed-rate mortgages, seek adjustments to interest rates that have shifted since the initial agreement. For instance, average mortgage rates as of October 2023 hover around 6.5%, but some borrowers locked in rates above 8% in previous years, making renegotiation appealing. Homeowners may desire extended terms, perhaps shifting from a 30-year to a 15-year plan, resulting in lower monthly payments and less interest paid overall. Engaging with mortgage lenders or brokers at this point can facilitate discussions about current market conditions, potential refinancing options, and negotiation strategies tailored to personal financial goals.

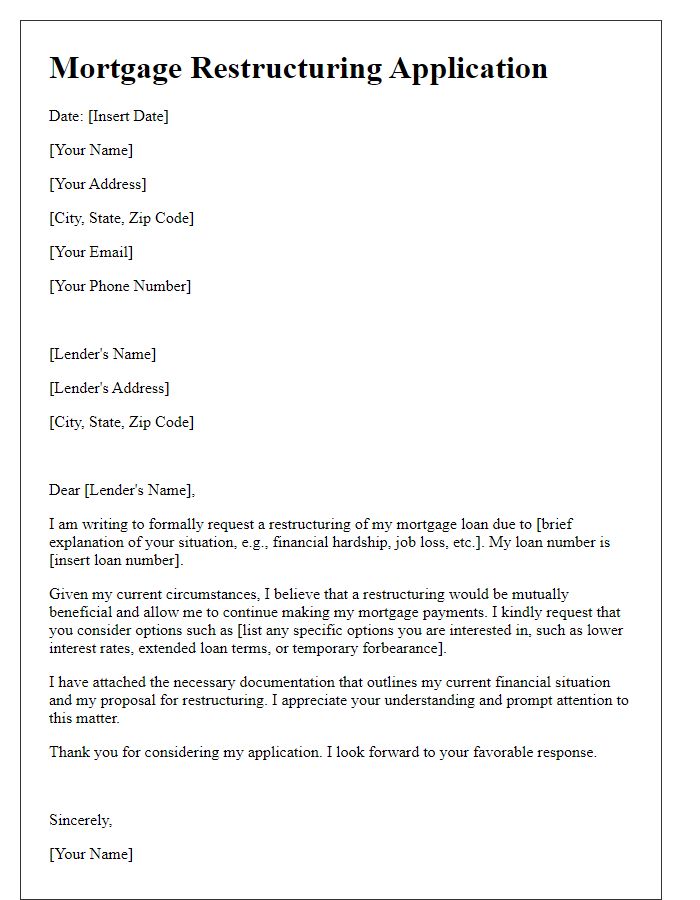

Explanation of benefits to both parties.

Renegotiating mortgage terms can bring substantial advantages for both lenders and borrowers. Borrowers can secure more favorable interest rates, potentially reducing monthly payments significantly--by 10-20% in some cases--leading to increased financial stability. This process can also lower overall borrowing costs, saving thousands of dollars over the life of the loan. For lenders, maintaining a positive relationship with borrowers can reduce the risk of default, ensuring consistent income from mortgage payments. Additionally, adapting to changing market conditions enables lenders to attract and retain clients, enhancing their portfolio's attractiveness. In regions experiencing economic shifts or fluctuations in property values, renegotiating terms can help both parties adapt to the changing landscape and foster mutual benefit.

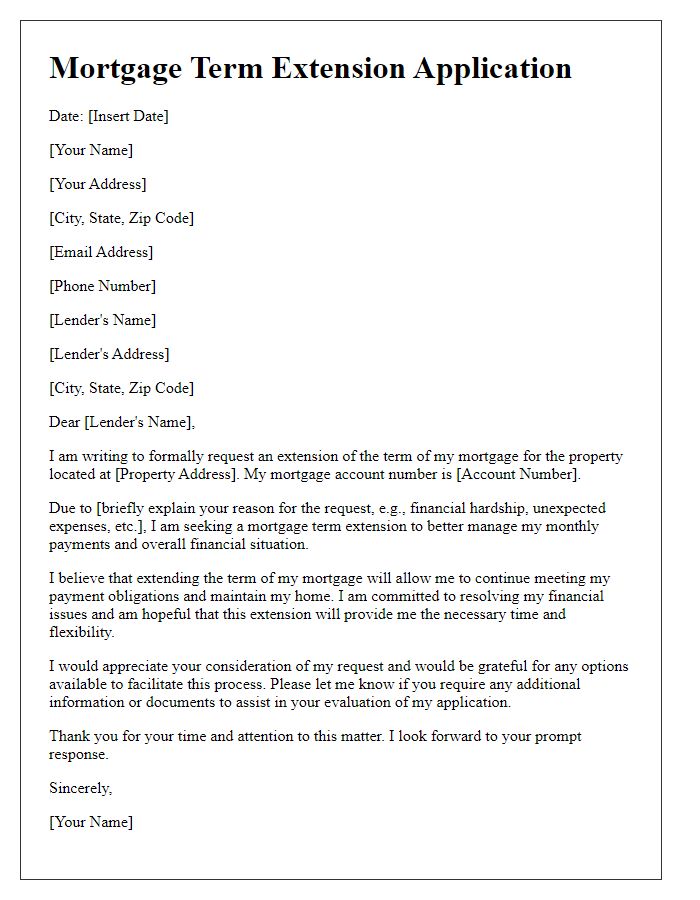

Supporting financial documents and credit report.

A mortgage term renegotiation can significantly impact financial stability for homeowners, especially when considering interest rates that currently hover around 7% in the United States. Essential supporting financial documents include tax returns from the last two years, which provide insight into income levels and deductions. Bank statements from the past three months also reveal savings and spending habits that lenders analyze for risk assessment. A credit report, detailing credit scores and outstanding debts, is crucial as well; scores above 700 are generally viewed favorably during renegotiations. These documents directly influence loan terms, potentially leading to lower monthly payments, reduced interest rates, or favorable repayment periods for homeowners seeking financial relief.

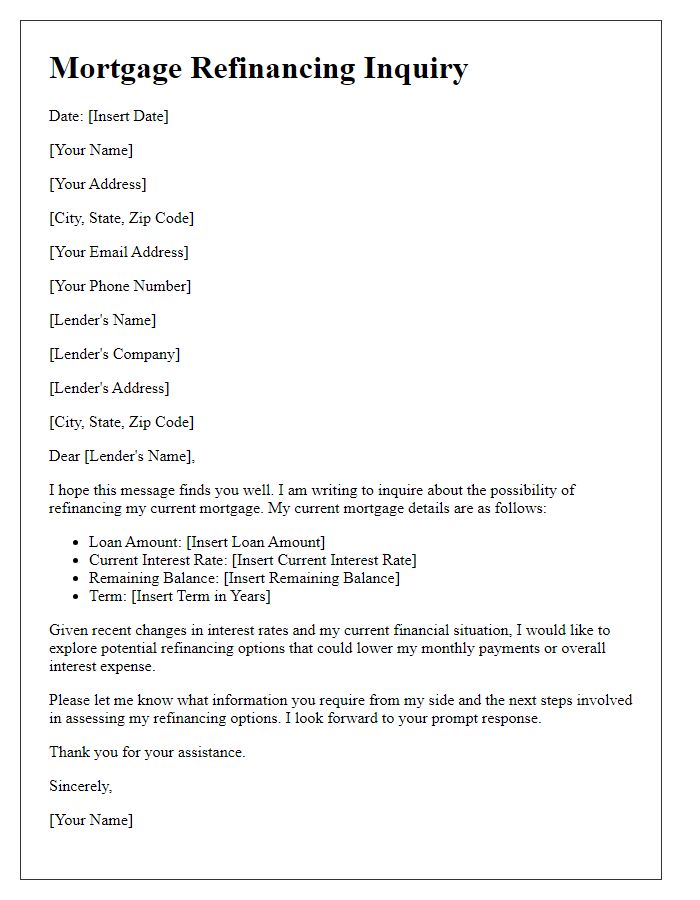

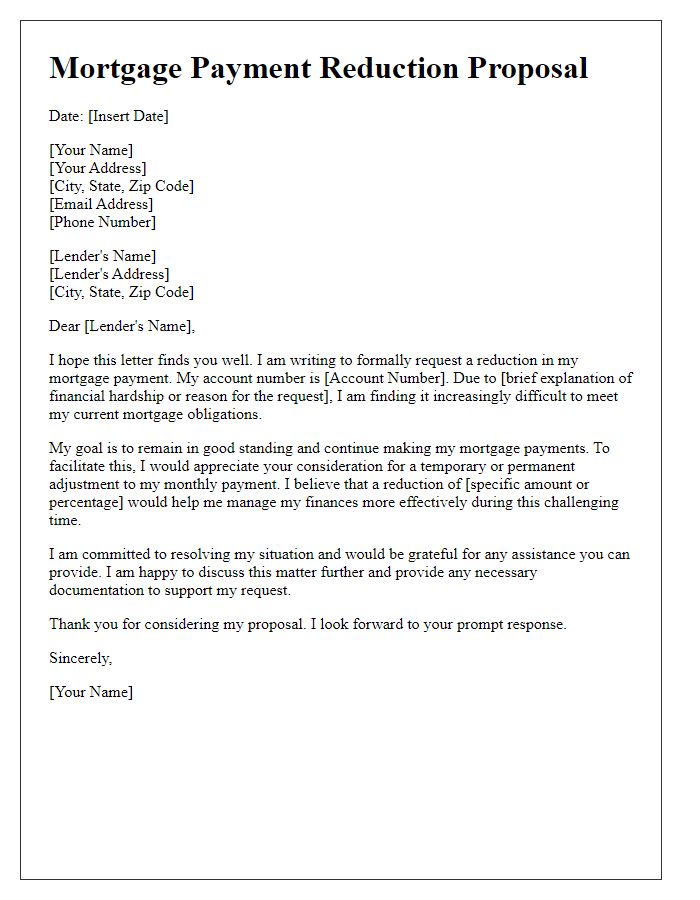

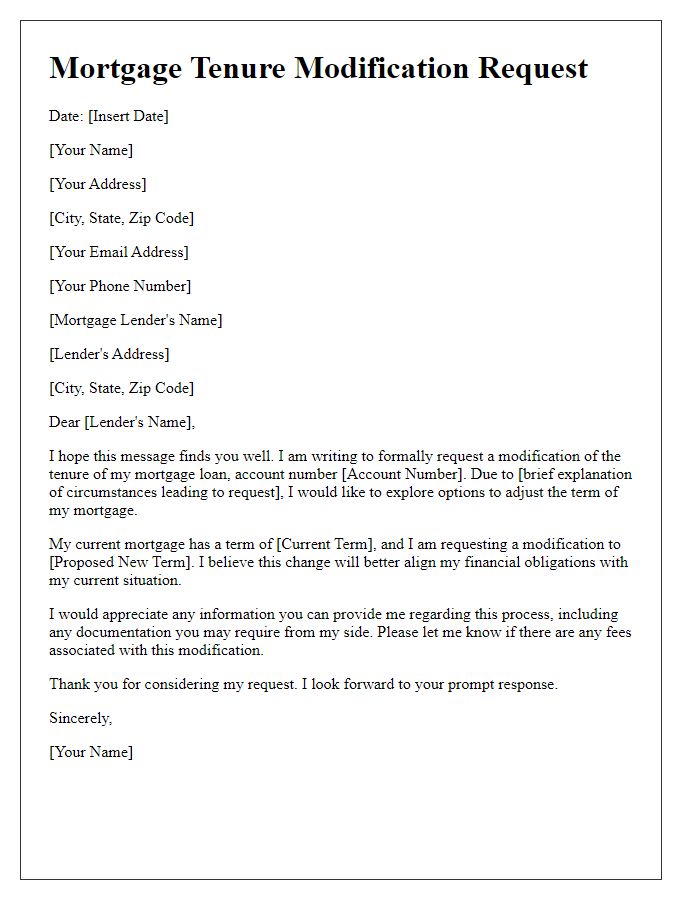

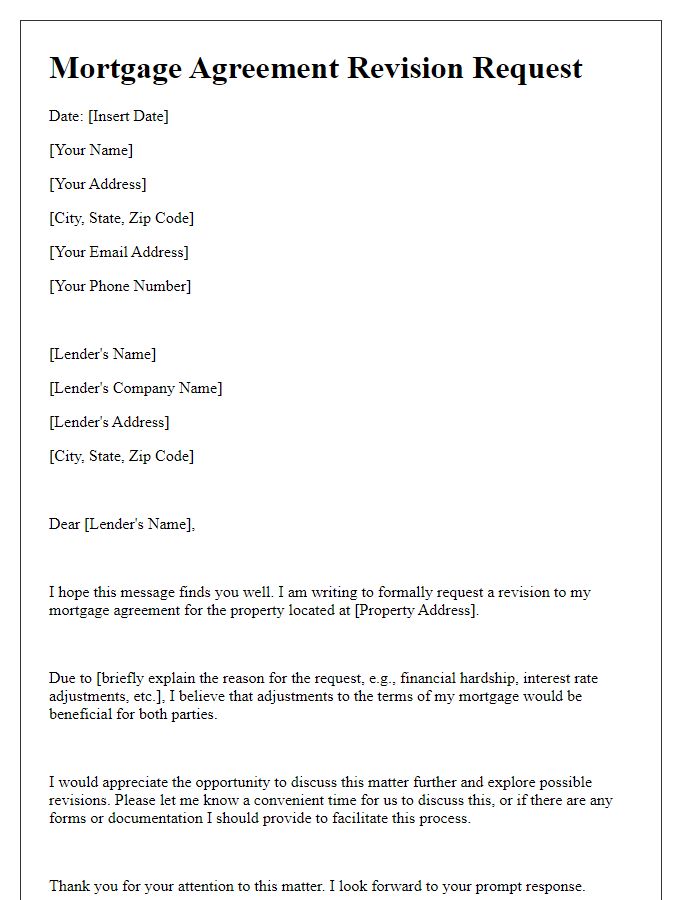

Contact information and request for meeting or discussion.

Homeowners seeking mortgage term renegotiation often reach out to their lenders for a discussion. Key elements of this interaction include providing full contact details (name, address, phone number, email) for optimal communication. Requesting a meeting or discussion allows flexibility in addressing specific concerns regarding interest rates or repayment terms, especially during financial hardships. Highlighting the importance of personalized service can enhance engagement, ensuring both parties understand options that may lead to more favorable loan conditions.

Comments