Are you eager to take the next step toward homeownership? Securing a mortgage pre-qualification is an exciting milestone on your journey, as it not only gives you a clear understanding of your budget but also strengthens your position in the market. By confirming your pre-qualification, you're signaling to sellers that you're a serious buyer, ready to make your move. Join me as we dive deeper into the essentials of this process and what you need to know to navigate it successfully!

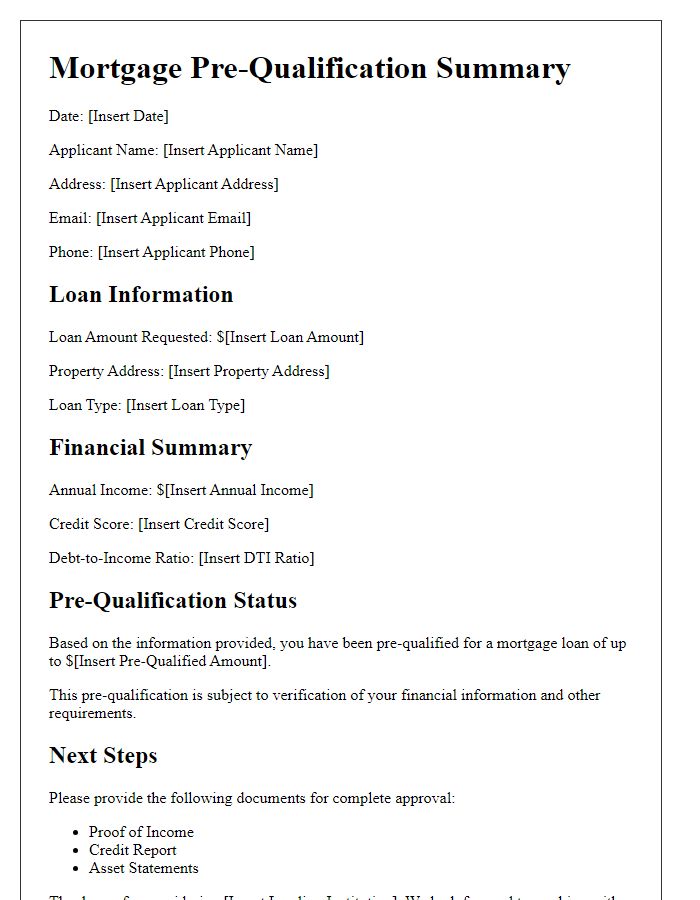

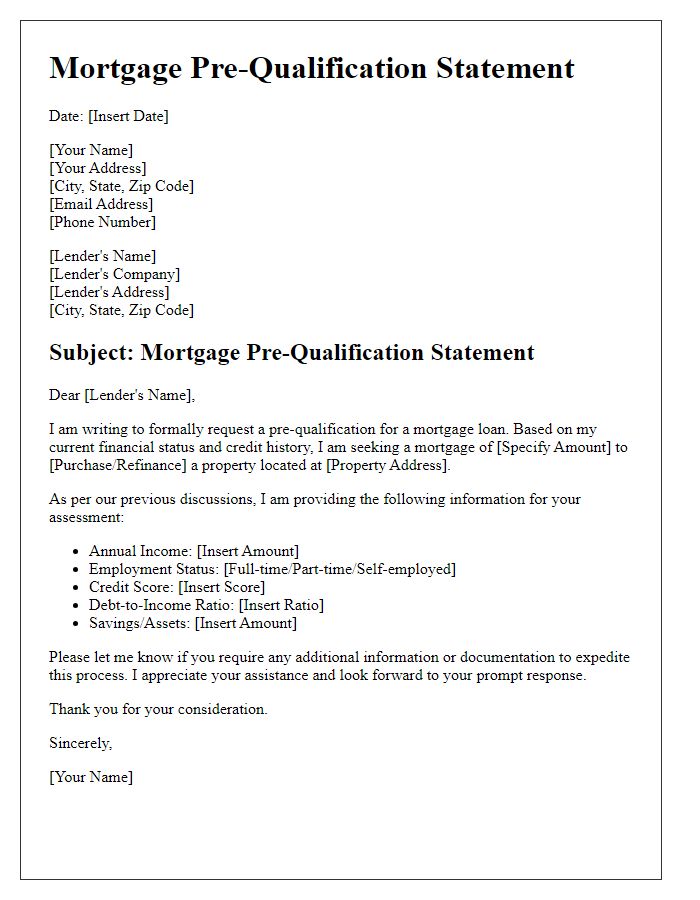

Borrower's full name and contact information.

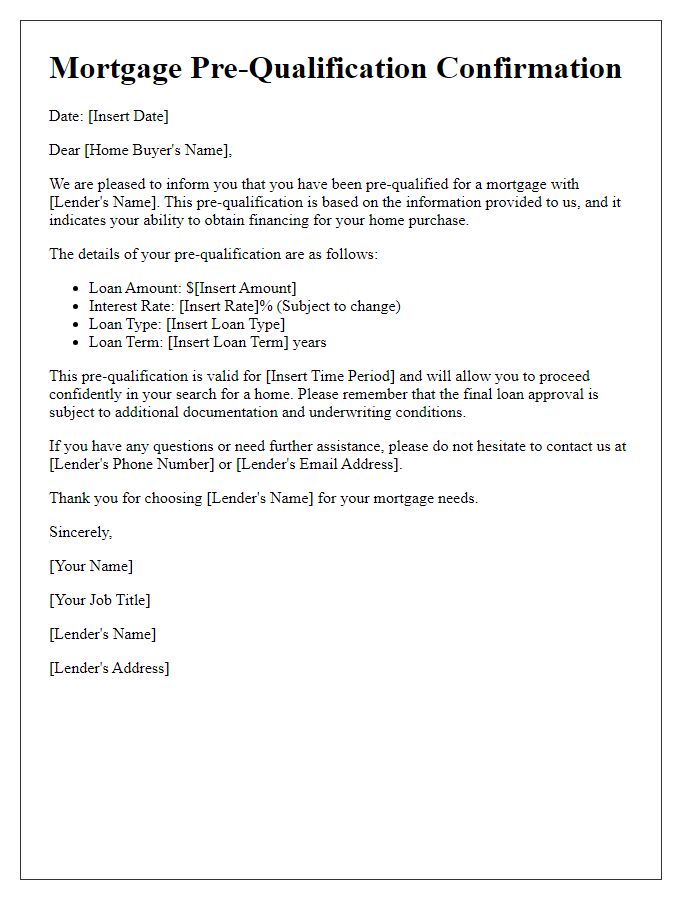

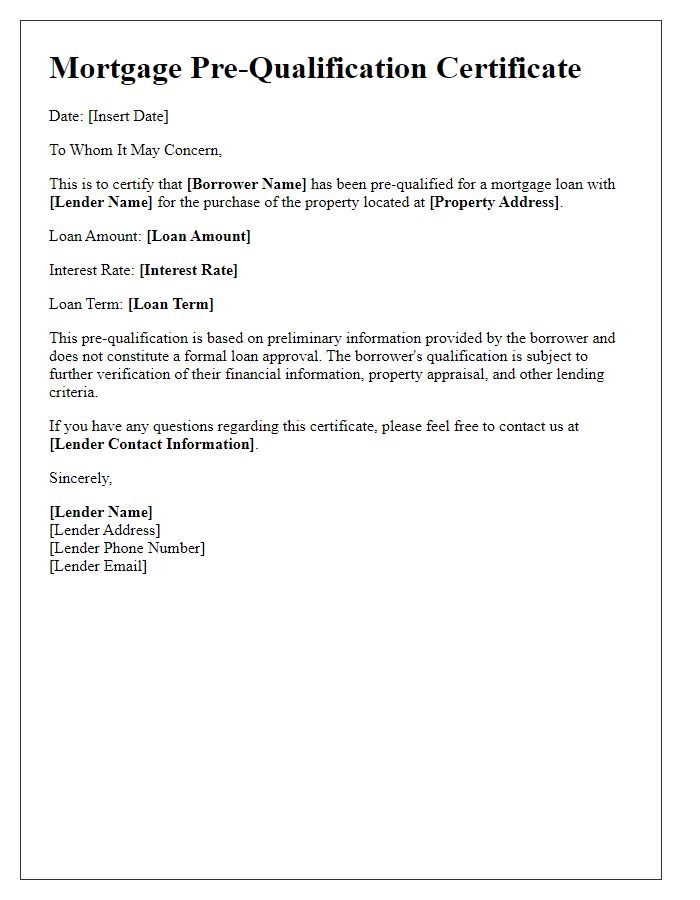

Mortgage pre-qualification confirmation provides essential details crucial for potential homebuyers. Borrower's full name, including first, middle, and last names, is required for accurately processing the application. Contact information, consisting of phone numbers (both home and mobile) and email addresses (personal or work), ensures efficient communication between the borrower and the lending institution. The confirmation typically includes the lender's name, the date of the pre-qualification, and an indication of the estimated loan amount based on the borrower's financial profile, including income verification and credit score assessment.

Property address and details.

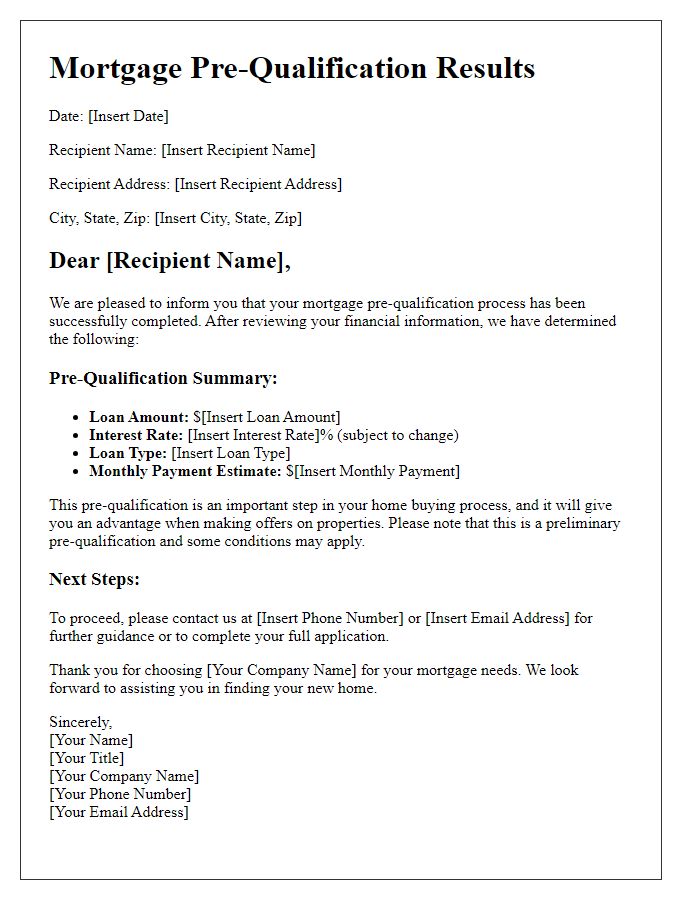

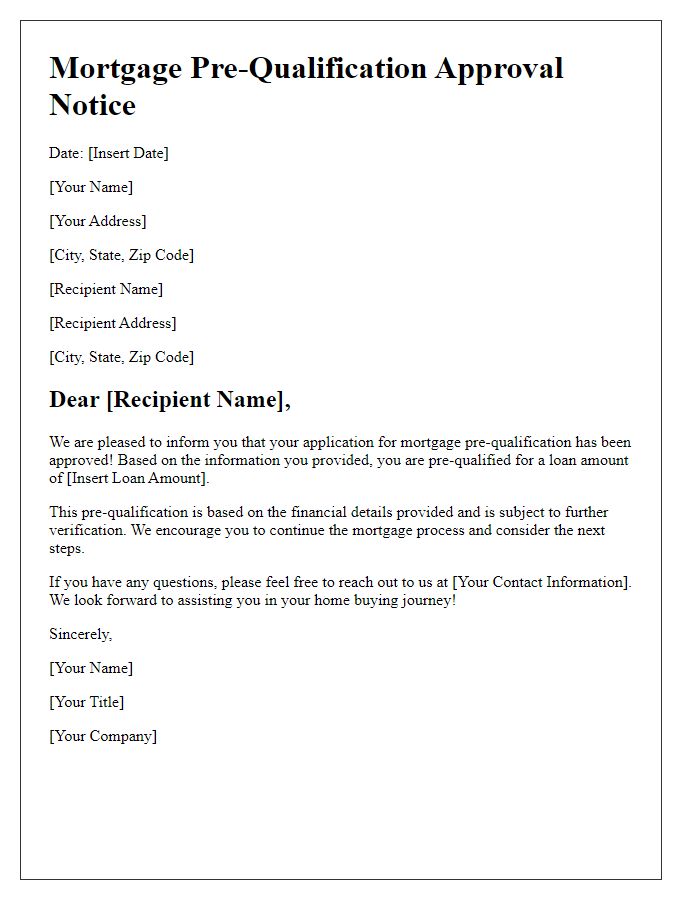

Receiving a mortgage pre-qualification confirmation is a pivotal step in the home buying process. This confirmation typically includes essential details such as the property address, which can significantly influence the status of the application. The pre-qualification letter outlines key financial information, including the applicant's estimated loan amount, interest rate, and proposed monthly payments based on current market conditions, often influenced by relevant entities like the Federal Reserve. Additionally, the property details, such as its assessed value (often determined by local real estate markets), square footage (measured in square feet), and neighborhood characteristics (including proximity to schools and amenities), provide context for the lender's decision-making process. Being equipped with this information allows potential homeowners to approach sellers with greater confidence during negotiations.

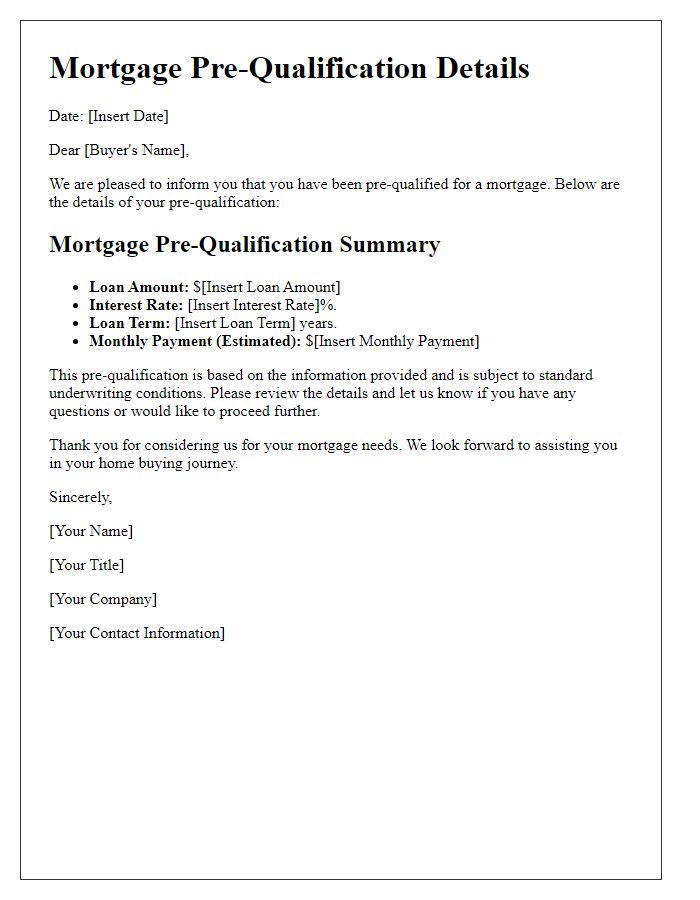

Loan amount and terms.

Mortgage pre-qualification confirmation provides borrowers with an estimated loan amount and terms based on their financial profile. Key factors influencing this process include credit score, income, debt-to-income ratio, and loan type. For example, a conventional fixed-rate mortgage typically offers loan amounts ranging from $50,000 to $1 million, with fixed interest rates averaging between 3% and 5% over a 15 to 30-year period. Additionally, a borrower's employment history and asset verification play crucial roles in determining loan terms such as down payment requirements and monthly payment calculations. Understanding these variables helps prospective homeowners navigate the mortgage process more effectively.

Lender's contact information and logo.

The mortgage pre-qualification confirmation document serves as an essential communication tool for prospective homebuyers navigating the often complex real estate financing process. This document typically includes the lender's contact information, such as the official name of the lending institution, phone number, email address, and physical mailing address, which allows clients to easily reach out for further inquiries or assistance. Additionally, the inclusion of the lender's logo enhances brand recognition and establishes credibility. This confirmation should explicitly outline the key details of the pre-qualification, including the estimated loan amount, the interest rate, and the terms of the pre-qualification period, providing recipients with essential information as they embark on their home buying journey.

Expiration date and next steps.

The mortgage pre-qualification confirmation, typically issued by lending institutions, outlines the granted pre-qualification status for potential homebuyers. This document usually includes an expiration date, which may range from 30 to 90 days, signaling the timeframe within which the buyer must finalize their mortgage application process to maintain their pre-qualified status. Next steps generally involve submitting additional financial documentation, such as tax returns or pay stubs, to the lender for a comprehensive review. It is essential for the applicant to stay informed about market interest rates, as fluctuations can impact the overall mortgage agreement. Consequently, potential borrowers should remain proactive in communicating with their lenders to ensure a smooth transition into the borrowing phase.

Letter Template For Mortgage Pre-Qualification Confirmation Samples

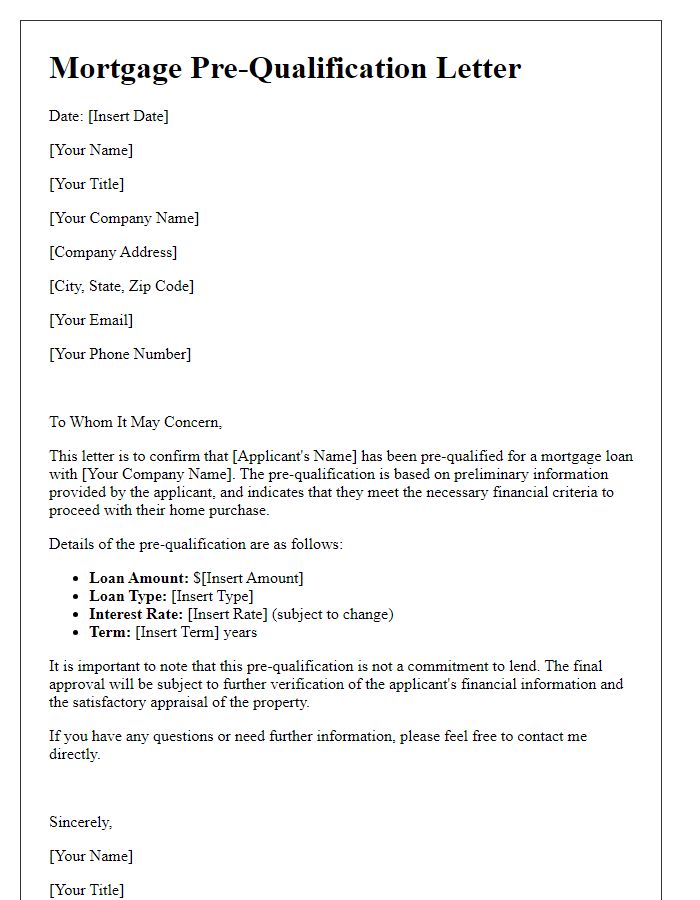

Letter template of mortgage pre-qualification confirmation for home buyers

Letter template of mortgage pre-qualification summary for loan applicants

Letter template of mortgage pre-qualification results for real estate transactions

Letter template of mortgage pre-qualification endorsement for potential homeowners

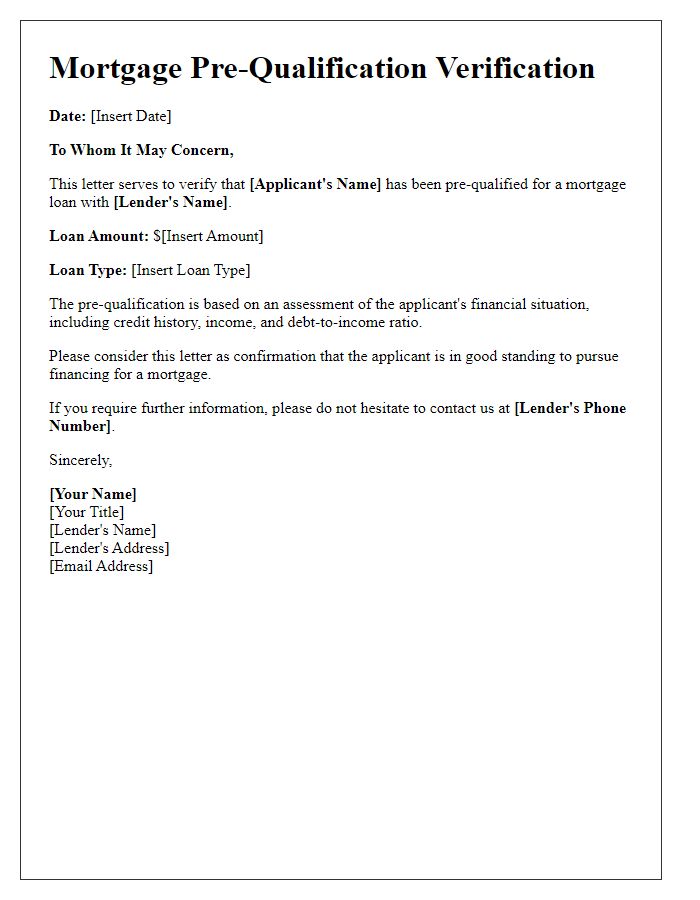

Letter template of mortgage pre-qualification verification for financing purposes

Letter template of mortgage pre-qualification details for interested buyers

Letter template of mortgage pre-qualification acknowledgment for lenders

Letter template of mortgage pre-qualification certificate for property purchases

Comments