Hey there! If you've ever felt lost in the maze of mortgage processing, you're not alone. Understanding the timelines involved can make a huge difference in your home-buying journey and help you navigate the process smoothly. We'll break down the key stages and what you can expect at each step, so you feel informed and empowered along the way. So, let's dive in and clarify those timelines together!

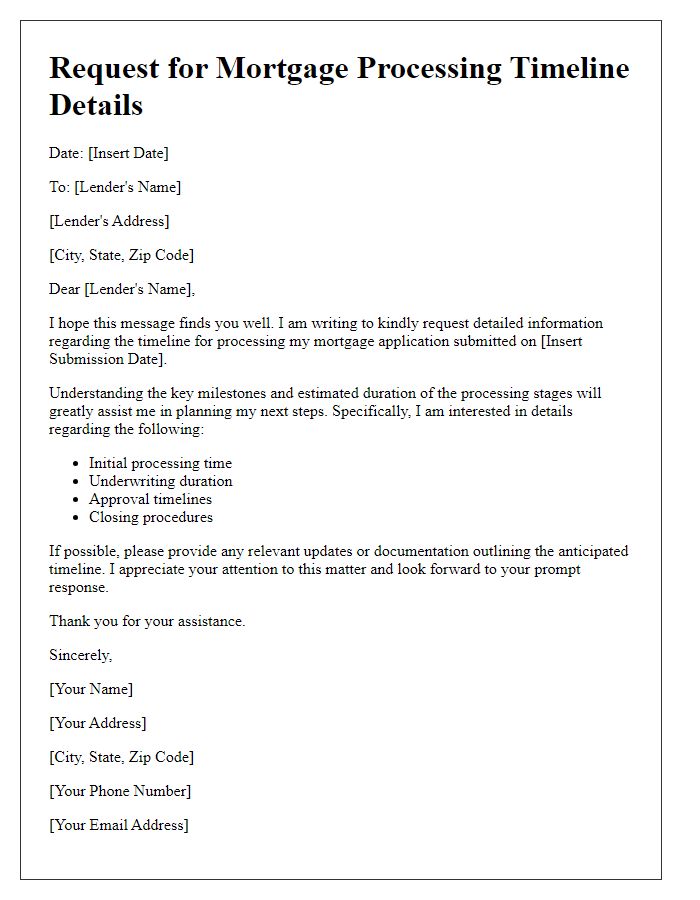

Contact information

Understanding mortgage processing timelines is essential for prospective homeowners navigating the real estate landscape. The mortgage process typically involves several stages, including pre-approval, underwriting, and closing. Pre-approval can take anywhere from a few days to several weeks, depending on documentation readiness and lender workloads. Underwriting, often the most time-consuming stage, may require an additional 2 to 3 weeks, as it involves thorough examination of the borrower's finances and property appraisal. The closing stage generally takes a week, culminating in the signing of documents and transfer of ownership. Being aware of these timeframes allows buyers to plan accordingly and manage expectations effectively during their home buying journey.

Loan details

Mortgage processing timelines can significantly impact the home-buying experience, especially for loans like conventional mortgages or FHA loans. Standard processing times can range from 30 to 60 days, depending on factors such as lender efficiency, borrower documentation, and property appraisals. Loan details like the loan amount, interest rate, and term length directly influence the timeline, where larger loans and unique properties may require additional scrutiny. Additionally, changes in market conditions or regulatory requirements can further extend processing times, necessitating clear communication with lenders to ensure all parties are aligned throughout the process. Understanding these timelines helps borrowers set realistic expectations and plan accordingly.

Timeline breakdown

Mortgage processing timelines can significantly vary based on numerous factors. Initial application review typically takes around 1-2 weeks, allowing lenders to verify submitted financial documents such as bank statements, tax returns, and employment verification. Once the application is approved, a property appraisal conducted by a certified appraiser usually occurs within 1 week, ensuring the home's value aligns with the loan amount. After appraisal, underwriting takes an additional 1-3 weeks, where the lender assesses risk and borrower eligibility. Closing may then be scheduled, generally occurring within 30-60 days after the initial application submission, depending on local regulations or the buyer's preparedness with required documentation. Communication during each step is crucial for smooth processing.

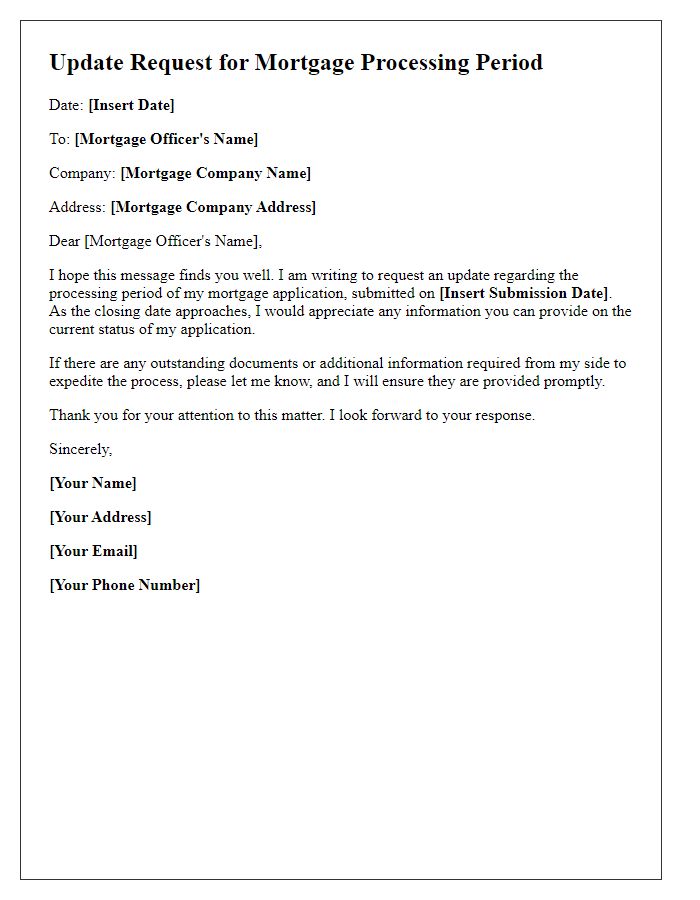

Processing stage explanation

Mortgage processing timelines can significantly impact homeowners during the loan approval journey. The initial stage, often termed application submission, typically lasts around three to five business days, where essential documents like income verification and credit reports are collected. Following this, the underwriting phase, lasting about one to three weeks, involves a detailed review of the borrower's financial profile and property appraisals, critical for determining creditworthiness and ensuring the property's value aligns with the loan amount. Once underwriting is complete, the final review stage takes approximately one week, where all conditions are verified before closing. Each timeline phase plays a pivotal role in ensuring a smooth mortgage process while providing clarity for homeowners navigating this complex landscape.

Communication protocol

Mortgage processing timelines involve several critical steps that can significantly affect the overall efficiency of securing a home loan. The typical process begins with the loan application submission, where borrowers provide comprehensive financial information alongside supporting documents such as income verification, employment records, and credit history statements. Following this, lenders conduct an initial review, which can take anywhere from three to five business days, assessing eligibility and determining the required documentation. The underwriting phase, often lasting 7 to 14 days, involves a thorough evaluation of the borrower's financial stability, ensuring compliance with lending guidelines. An appraisal, which ranges from $300 to $700 depending on property location, follows to confirm the home's market value. Due diligence requires an additional two to four weeks before final approval, during which conditions set by the underwriter must be met. Ultimately, closing dates can vary significantly based on local regulations and lender-specific practices, often occurring between 30 to 60 days after the loan application submission. Efficient communication protocols throughout these phases are essential to keep borrowers informed and ensure a smooth transaction.

Letter Template For Clarifying Mortgage Processing Timelines Samples

Letter template of request for clarification on mortgage processing timeframes

Letter template of follow-up on mortgage application processing schedule

Comments