Are you feeling the pressure of an impending mortgage loan deadline? You're not alone, and requesting a mortgage loan extension can provide some much-needed relief. In this article, we'll walk you through a simple, effective letter template that you can customize to secure that extension and ease your financial worries. So, let's dive in and discover how to give yourself the breathing room you need!

Borrower's Personal Information

When applying for a mortgage loan extension, the borrower's personal information serves as a critical component in the process. This information typically includes full legal name (John Doe), current residential address (1234 Elm Street, Springfield, IL, 62704), phone number (555-123-4567), and email address (johndoe@email.com). Additionally, the borrower's social security number (123-45-6789), date of birth (January 1, 1980), and employment details, including job title (Senior Analyst) and employer name (ABC Corporation), are vital for verifying identity and financial stability. Providing accurate personal information enables lenders to assess the borrower's eligibility for the loan extension and ensure compliance with legal requirements.

Loan Details and Current Terms

A mortgage loan extension provides additional time for borrowers to meet their financial obligations. Typical loan details include the principal amount, such as $250,000, and current interest rates that may vary, usually between 3% to 5%. Loan terms often specify the duration, commonly 15 to 30 years. Borrowers with fixed-rate mortgages experience stable monthly payments, while variable-rate loans may undergo fluctuations based on market indices. Lenders often assess credit scores, typically above 620, and debt-to-income ratios, ideally below 43%, to approve extensions. An extension could involve amendments to existing contracts, potential fees, or a change in payment schedule, impacting the borrower's total financial landscape.

Reason for Extension Request

Requesting a mortgage loan extension often arises from significant life events or financial adjustments. Common reasons include job loss, which can lead to reduced income, affecting repayment ability. Medical emergencies may incur unexpected costs, straining monthly budgets, while divorces can split household finances, making it challenging to meet existing mortgage obligations. Additionally, economic downturns in specific regions, such as the housing market collapse of 2008, can lead to decreased property values, impacting the borrower's ability to refinance or sell. Documenting these reasons clearly enhances the likelihood of approval, presenting a compelling case to lenders for consideration.

Proposed Extension Terms

Proposed extension terms for a mortgage loan typically include a revised interest rate, adjusted loan term, and specific repayment schedule. For instance, an interest rate of 4.5% might replace the original 5%, resulting in reduced monthly payments. The loan term could be prolonged from 15 years to 20 years to accommodate financial constraints. The revised repayment schedule could consist of monthly payments that are structured to align with the borrower's income, ensuring affordability. Additional terms may involve an appraisal requirement to reassess property value or a potential modification fee contingent upon the lender's policy.

Contact Information and Signature

A mortgage loan extension request requires a formal approach that includes essential contact information and a clear signature. The contact information should consist of the borrower's full name, mailing address, phone numbers, and email address to ensure that the mortgage lender can easily reach out for any inquiries or confirmations. The signature serves as a personal affirmation, indicating the borrower's intention to extend the loan terms officially. This should be a handwritten signature, preferably accompanied by the date, which adds authenticity and serves as a record for both parties. Each element contributes to an effective presentation of intent for the mortgage loan extension process.

Letter Template For Mortgage Loan Extension Samples

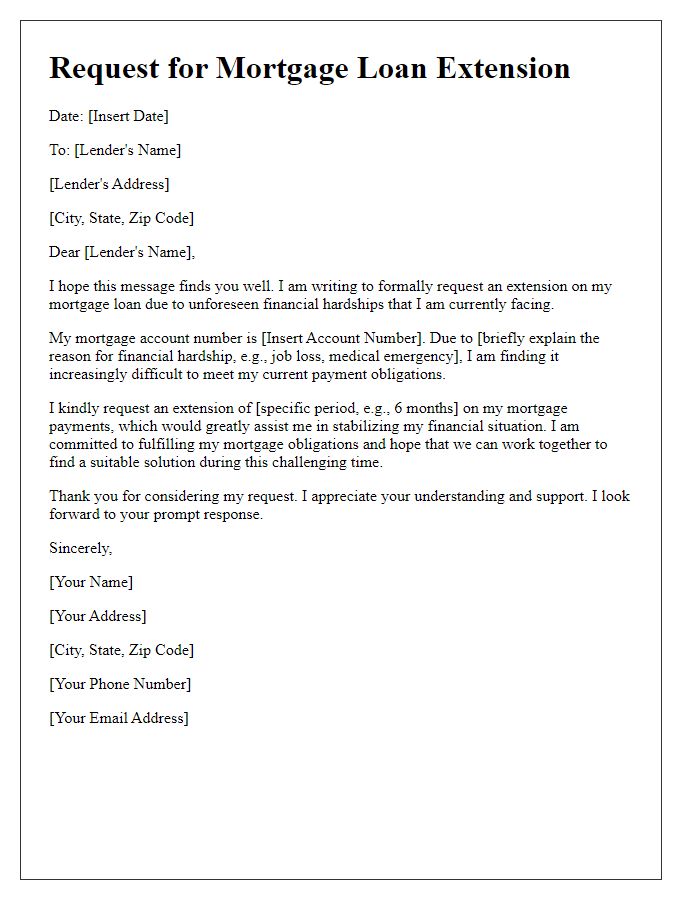

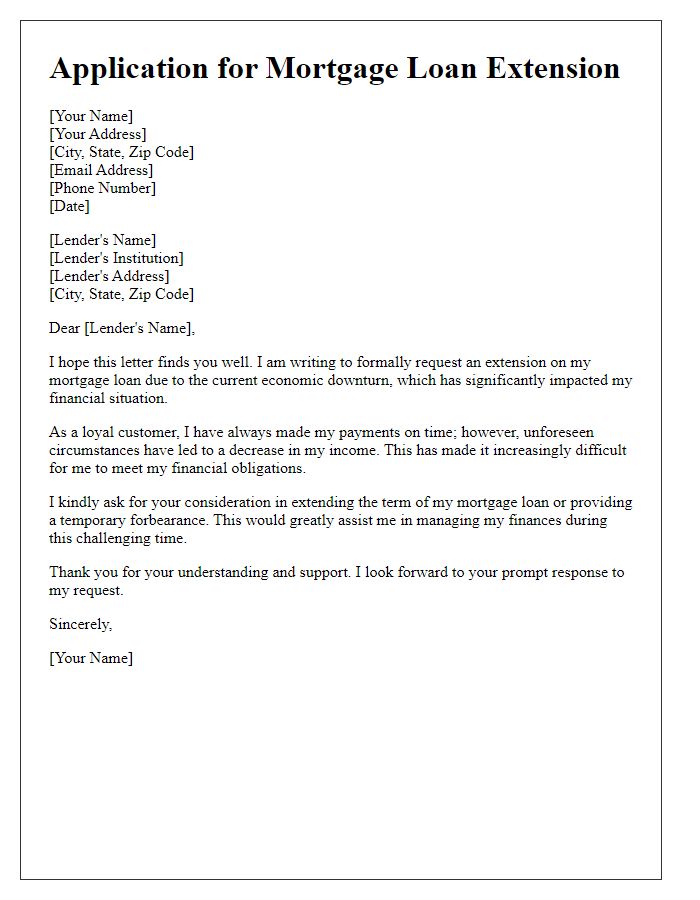

Letter template of request for mortgage loan extension for financial hardship

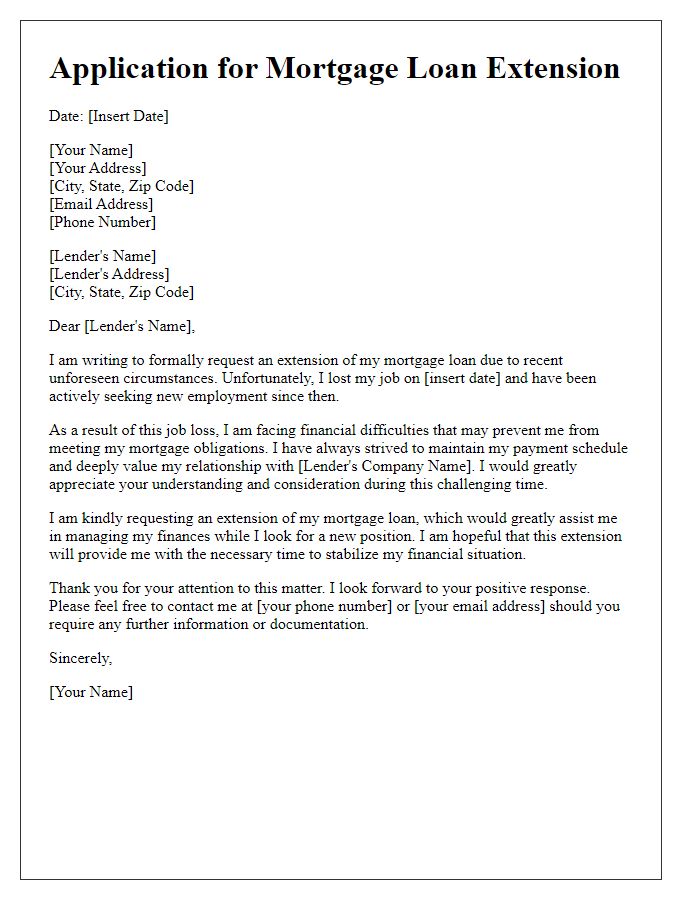

Letter template of formal application for mortgage loan extension due to job loss

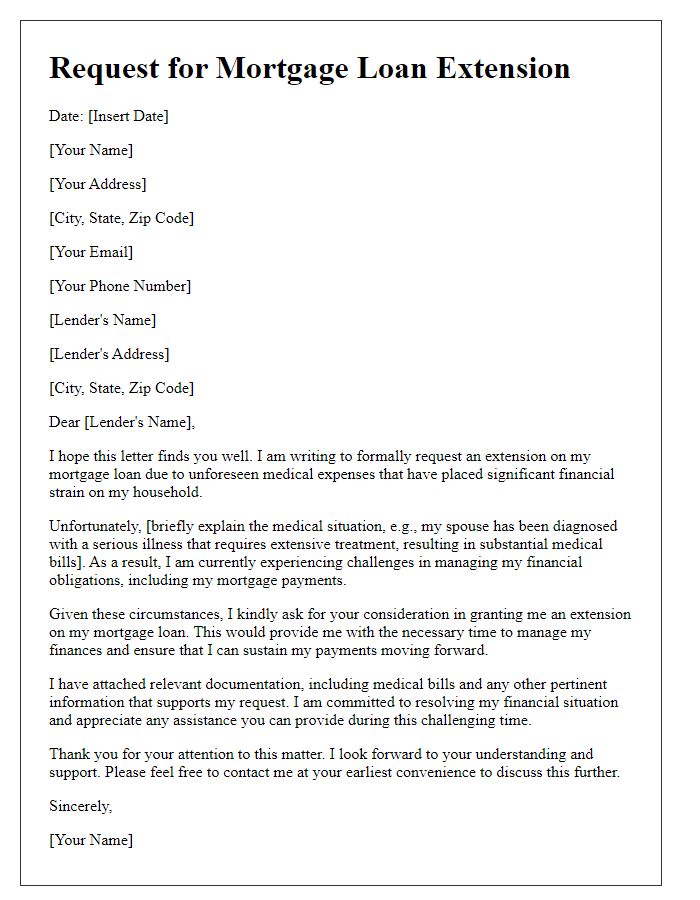

Letter template of appeal for mortgage loan extension related to medical expenses

Letter template of inquiry about mortgage loan extension options for self-employed individuals

Letter template of notification for mortgage loan extension while awaiting divorce settlement

Letter template of proposal for mortgage loan extension during home renovation

Letter template of justification for mortgage loan extension due to unexpected repairs

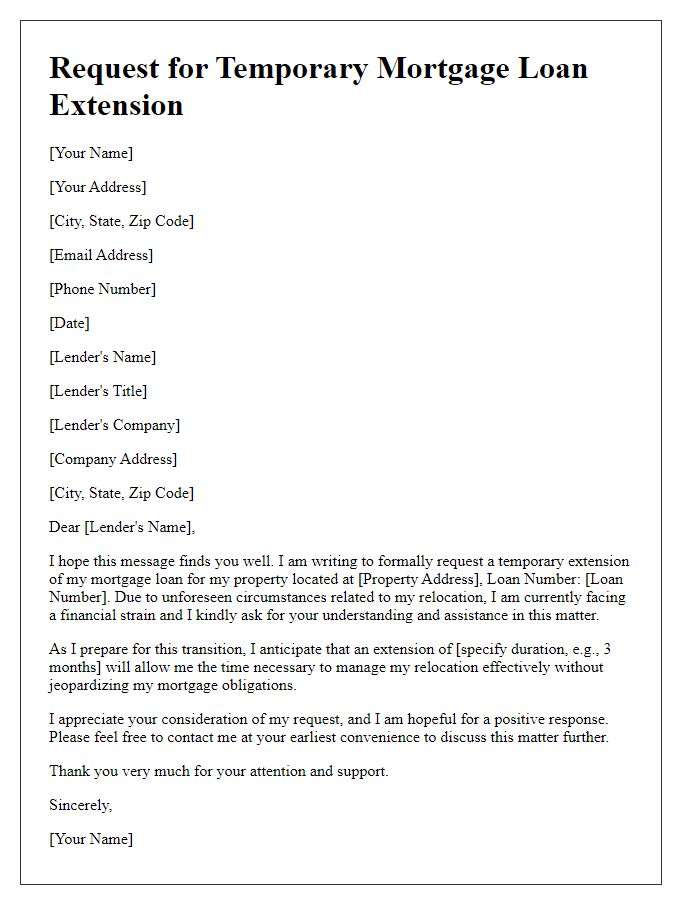

Letter template of request for temporary mortgage loan extension for relocation

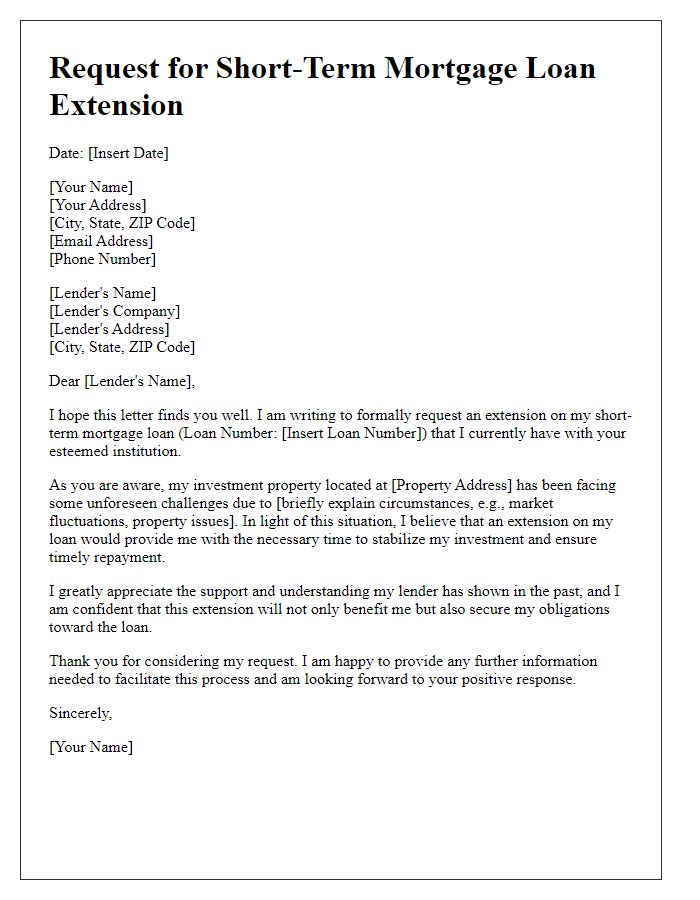

Letter template of appeal for short-term mortgage loan extension for investment purposes

Comments