Are you feeling overwhelmed by your mortgage payments and looking for a way to ease the burden? You're not aloneâmany homeowners face unexpected financial challenges that can make timely payments tough. In this article, we'll walk you through a simple letter template that can help you formally request a mortgage payment extension from your lender. So, if you're ready to explore your options and regain some peace of mind, keep reading!

Subject line

Subject: Request for Extension on Mortgage Payment Due Date

Account information

Requesting a mortgage payment extension involves specific account information and clear communication. The mortgage account number (usually a unique identifier consisting of digits) should be prominently stated for identification. Include the lender's name (such as Bank of America) along with the loan type (for instance, fixed-rate mortgage) and the original loan amount (often ranging from $100,000 to over $500,000). Mention the current due date of the mortgage payment (common payment dates are the 1st of each month) to provide a timeline context. In your request, highlight any extenuating circumstances (such as job loss, medical emergency, or natural disaster) that necessitate the extension. Clearly specify the duration of the requested extension (commonly 30 to 90 days) to help lenders assess the situation. Providing detailed and accurate account information will enhance the legitimacy of the request and facilitate communication with the lending institution.

Reason for extension

Mortgage payment extensions can provide financial relief during challenging times, such as unexpected medical expenses or job loss. Individuals facing these situations may need to defer payments for a specific period (typically 30 to 90 days) to regain financial stability. Lenders often require documentation to support the request, including income verification, bank statements, or a letter of termination from an employer. Communicating effectively with the mortgage servicer is crucial, as they can provide detailed information on eligibility and procedures for applying for an extension, ensuring borrowers remain informed throughout the process.

Proposed payment plan

Homeowners often seek mortgage payment extensions due to financial difficulties. A mortgage payment extension can provide temporary relief, allowing individuals to manage monthly obligations without defaulting. In crafting a proposed payment plan, it is critical to include specific details such as the new payment timeline, total outstanding balance, and any revised interest rates. Individuals typically request an extension for a period ranging from three to six months, depending on financial circumstances. Clear communication with mortgage lenders, such as Wells Fargo or Bank of America, is essential to ensure proper documentation and confirmation of the agreed terms. A well-defined payment plan demonstrates the homeowner's commitment to fulfilling their loan obligations in a more manageable timeframe.

Contact information

A mortgage payment extension request typically involves the borrower contacting their lender to seek temporary relief from financial obligations. The borrower's contact information, including full name, address, email, and phone number, is essential for verification purposes. The lender's contact details, such as the name of the representative, department, mailing address, and phone number, facilitate direct communication regarding the request. It is important to include a concise subject line, such as "Request for Mortgage Payment Extension," to indicate the letter's purpose clearly. Ensuring the format is formal and respectful, the body of the request outlines the reasons for the extension, such as unexpected medical expenses, job loss, or other financial hardships, while also proposing potential solutions or timelines for repayment.

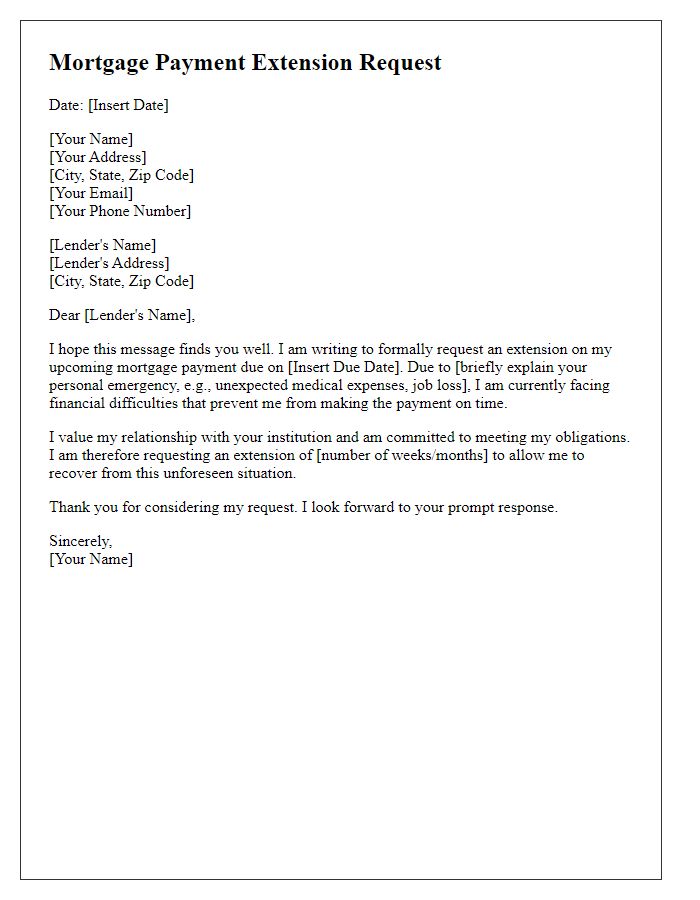

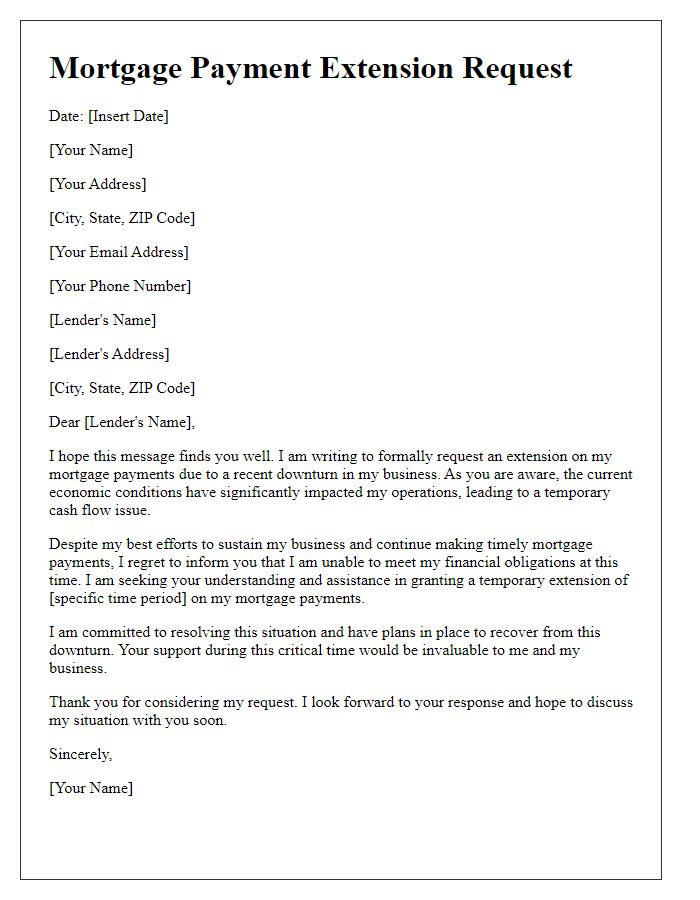

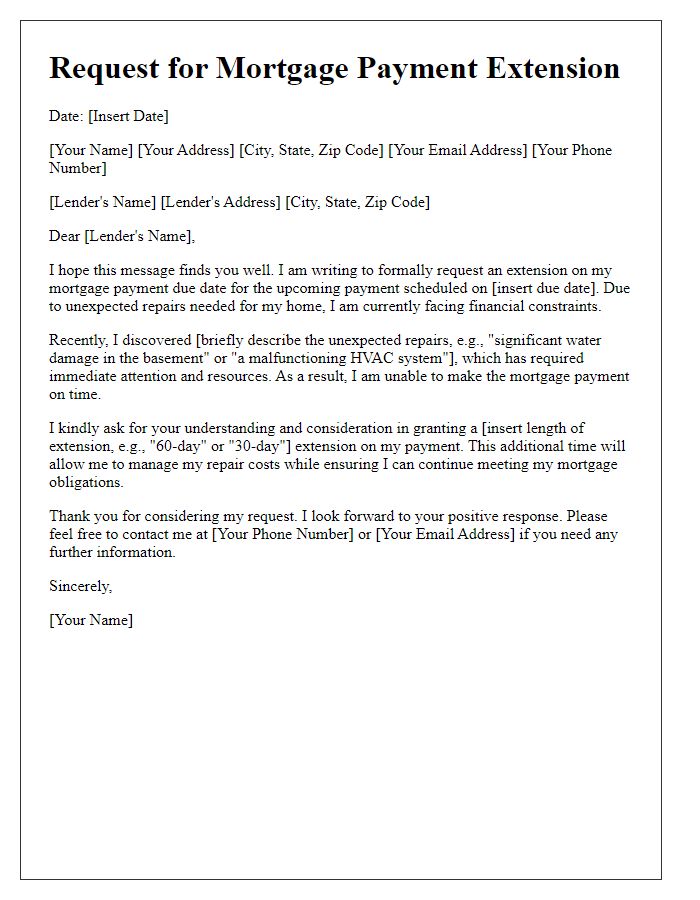

Letter Template For Mortgage Payment Extension Request Samples

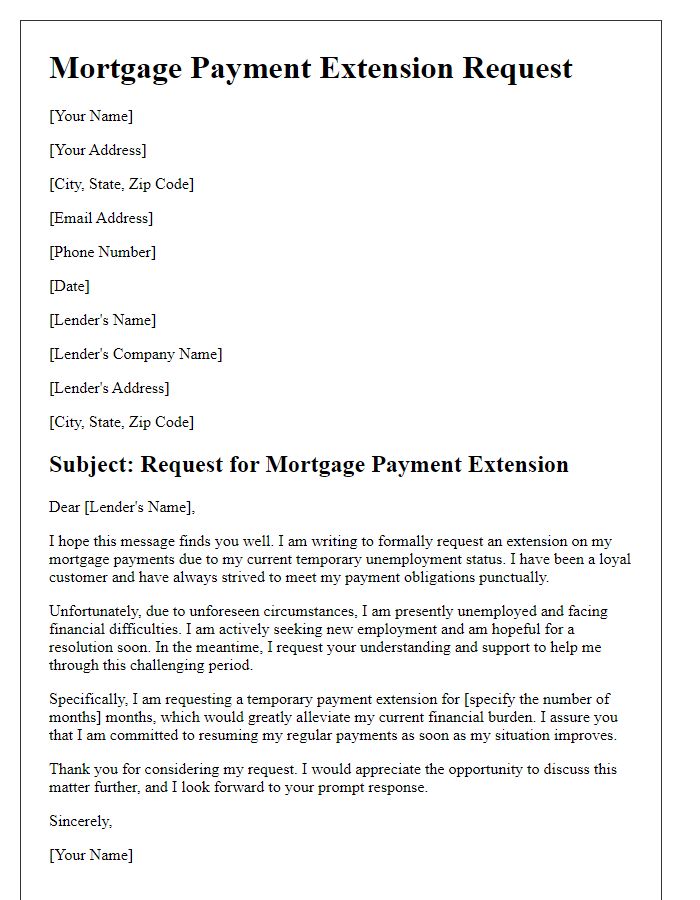

Letter template of mortgage payment extension request for temporary unemployment.

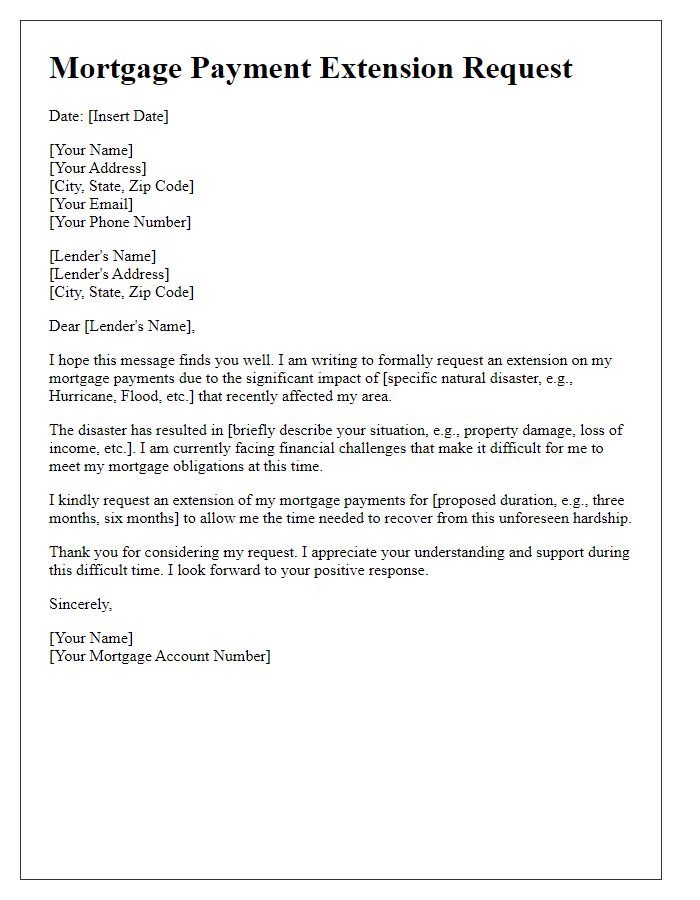

Letter template of mortgage payment extension request for natural disaster impact.

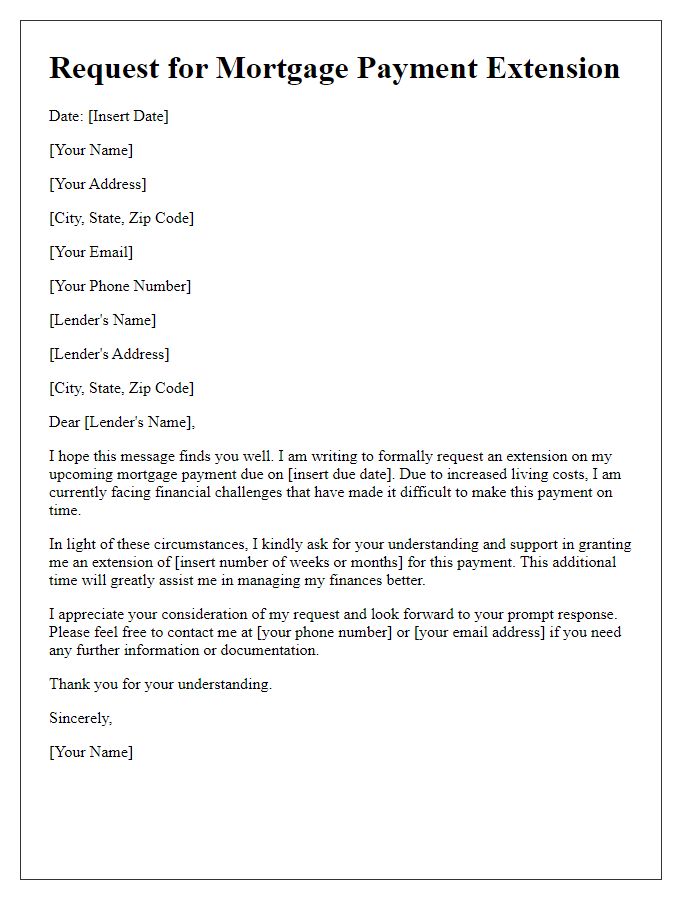

Letter template of mortgage payment extension for increased living costs.

Letter template of mortgage payment extension for caregiving responsibilities.

Comments