Are you trying to keep track of your mortgage payments and want a clear record? A well-structured letter can help you request a detailed history of your mortgage payments, ensuring that you have all the necessary information at your fingertips. With the right template, you can easily communicate your needs to your lender, making the process as smooth as possible. Read on to discover how to craft the perfect letter to obtain your mortgage payment history!

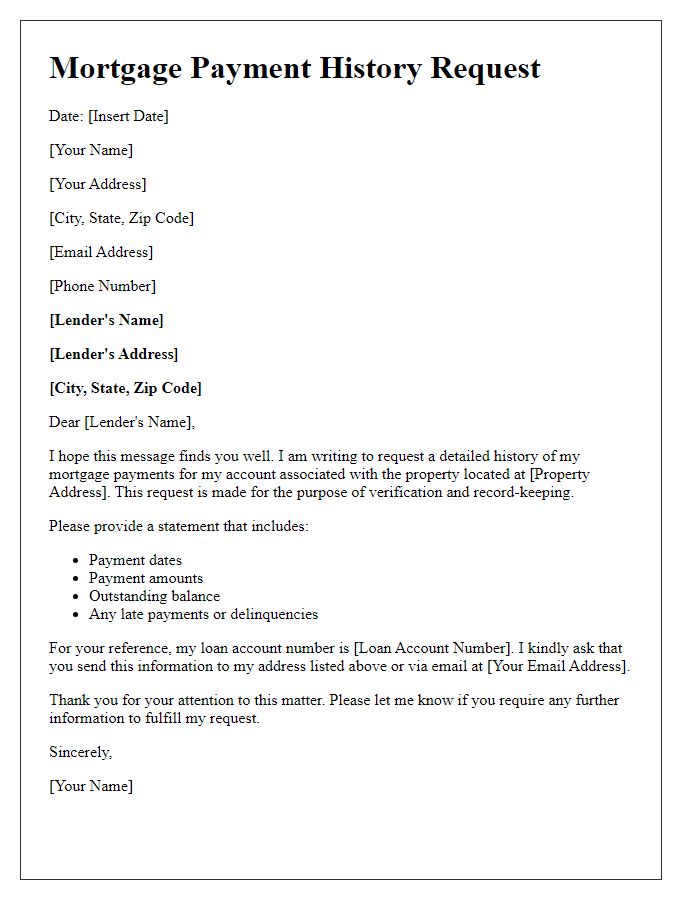

Borrower's personal and contact information

The mortgage payment history record encapsulates essential details pertinent to the borrower, such as full name, address including city, state, and zip code, and phone number for contact purposes. Additionally, the email address serves as a vital channel for communication, allowing for prompt notifications regarding payment confirmations or outstanding balances. Accurate recording of this information is crucial for maintaining updated records with financial institutions, ensuring seamless communication and transparency in the mortgage repayment process.

Lender's details and contact information

Mortgage payment history serves as a vital financial record for homeowners, detailing every payment made toward the mortgage loan. Lender details, including the institution's name (for example, Bank of America), address (like 100 North Tryon Street, Charlotte, NC), and contact information can facilitate communication regarding account inquiries. This report typically covers key dates of payments, amounts, and outstanding balances, providing an essential overview of the payment timeline. Homeowners may use this documentation for refinancing options or seeking further loans while ensuring accurate tracking of their mortgage responsibilities over the loan term. Additionally, maintaining a comprehensive record can support credit assessment processes.

Loan account number and mortgage details

A detailed record of mortgage payment history is essential for tracking financial progress and maintaining accurate documentation. The mortgage account number, usually a unique identifier assigned by lenders, plays a crucial role in accessing specific loan information. Monthly payment amounts can vary based on interest rates, terms (typically 15 or 30 years in fixed-rate mortgages), and additional costs like property taxes and insurance. Payment history often includes noteworthy events such as missed payments, late fees, or any mortgage modifications that may affect terms, thus impacting the overall loan repayment strategy. Regular updates of this payment record can provide transparency and foster accountability for both the borrower and lender in places such as financial institutions within the United States.

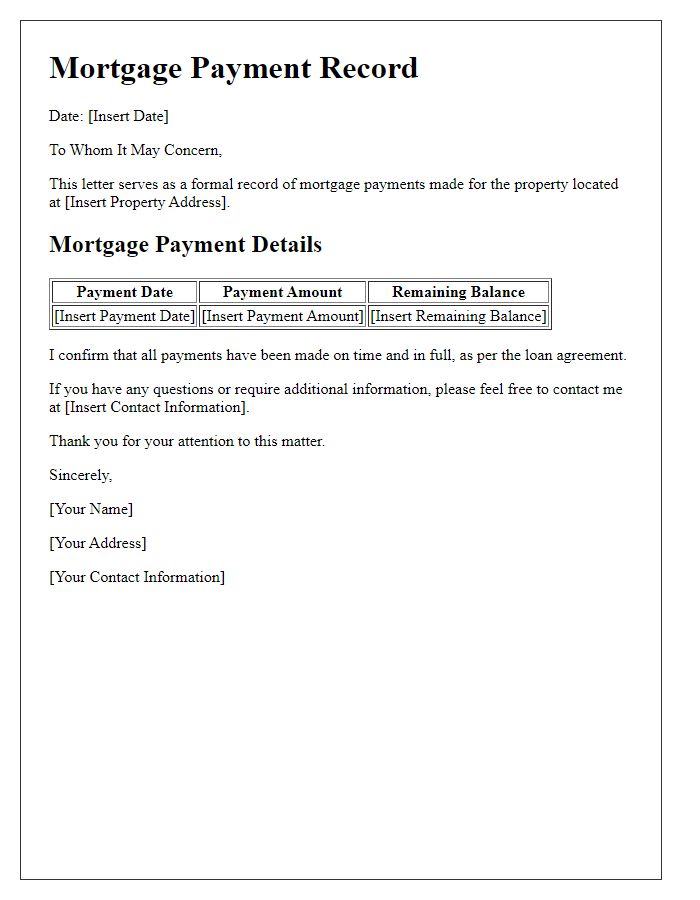

Detailed payment history with dates and amounts

A detailed mortgage payment history provides essential information for both borrowers and lenders regarding the repayment of a loan secured against a property. This history includes specific dates on which payments were made, reflecting the scheduled monthly payments alongside any additional contributions. For example, in a typical amortization schedule, monthly payments may amount to $1,500 due on the 1st of each month, starting January 1, 2020. Any missed payments may be noted, along with any associated late fees, which can accrue interest rates of up to 5%. Notably, prepayment amounts, such as a supplementary payment of $3,000 made on July 15, 2021, can significantly reduce the principal balance. Each entry in the payment history should state the total paid thus far, offering a comprehensive overview of the mortgage lifecycle and highlighting trends that may affect refinancing eligibility.

Statement of account status and any additional remarks

The record of mortgage payment history, detailing the monthly payments made towards the loan secured against the property located at 123 Elm Street, Springfield, includes information on the principal balance originally set at $250,000. Payments were scheduled on the first of each month, commencing January 2020, with a fixed interest rate of 3.5% over a 30-year term. Timely payments were consistently made until June 2023, resulting in a current outstanding balance of approximately $240,000. Additional remarks indicate the successful completion of a loan modification in March 2021, which temporarily reduced the monthly payment amount to $1,200 due to financial hardship. The account status remains active with no late payments reported since the modification. Documentation verifies adherence to agreed-upon terms throughout the mortgage period, promoting a positive credit rating.

Letter Template For Record Of Mortgage Payment History Samples

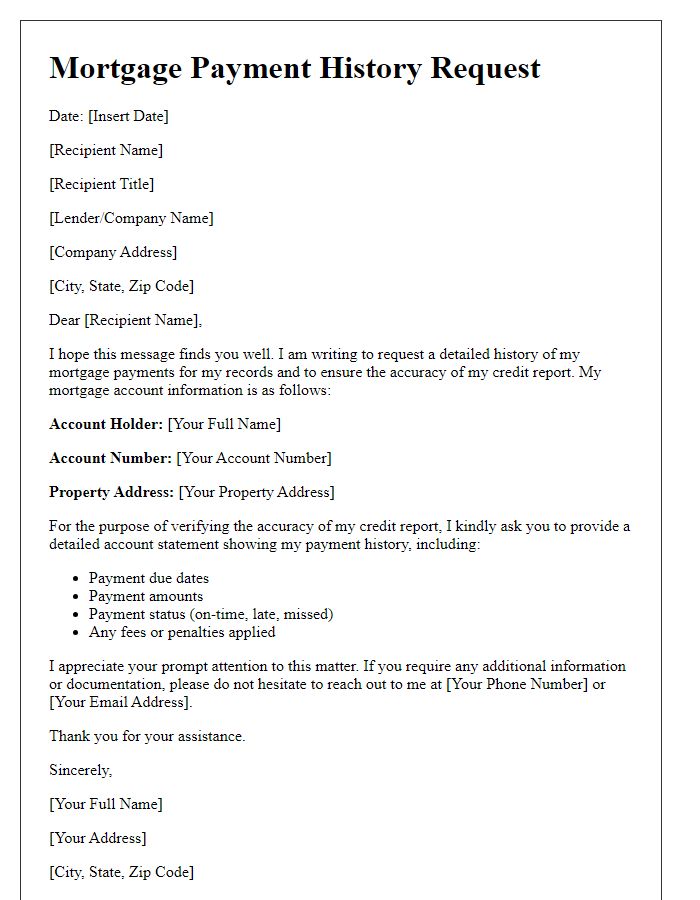

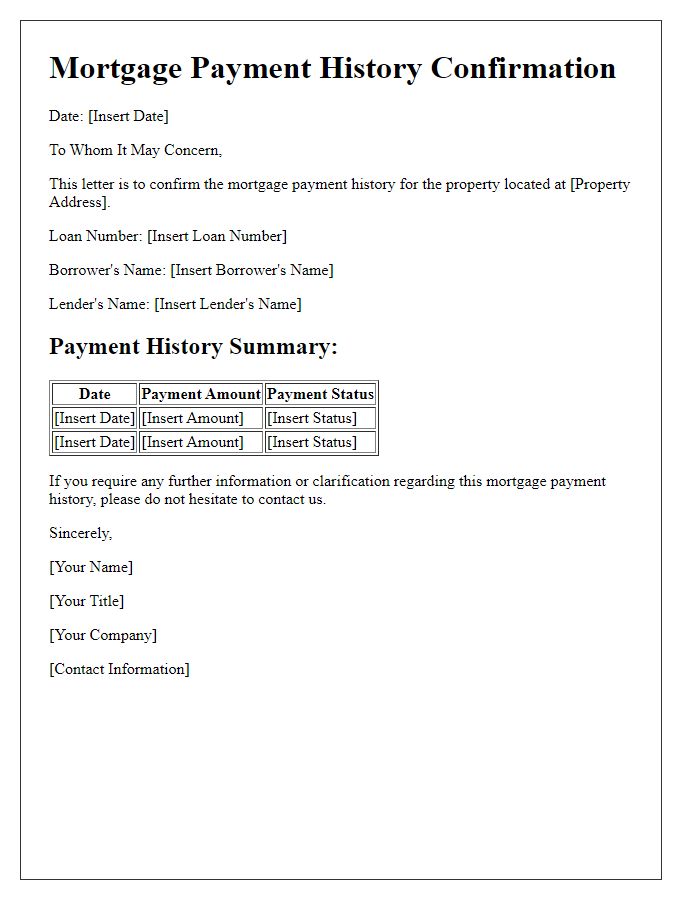

Letter template of mortgage payment history request for lender verification

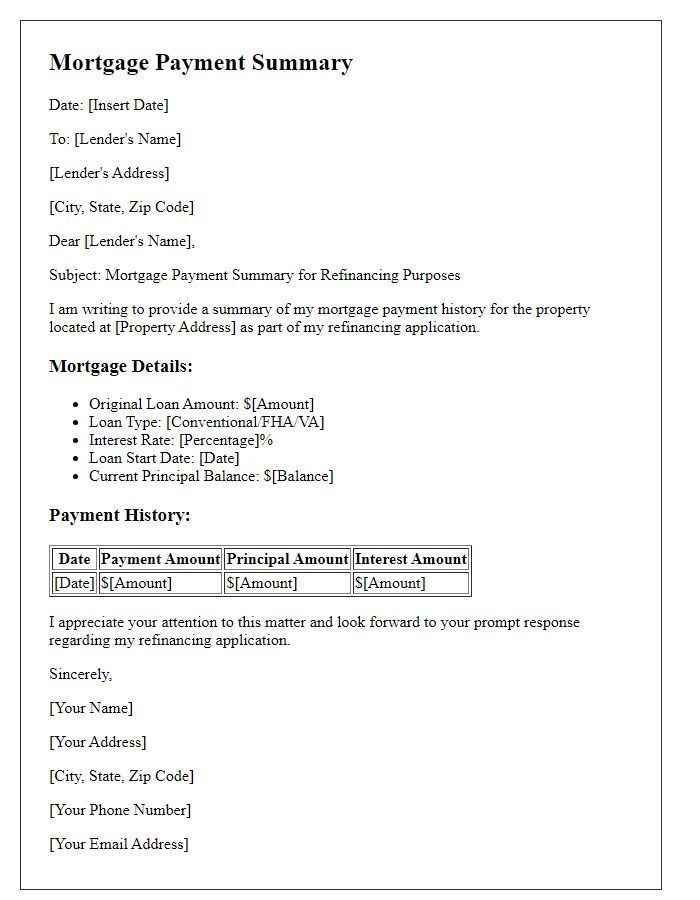

Letter template of mortgage payment record for home equity loan application

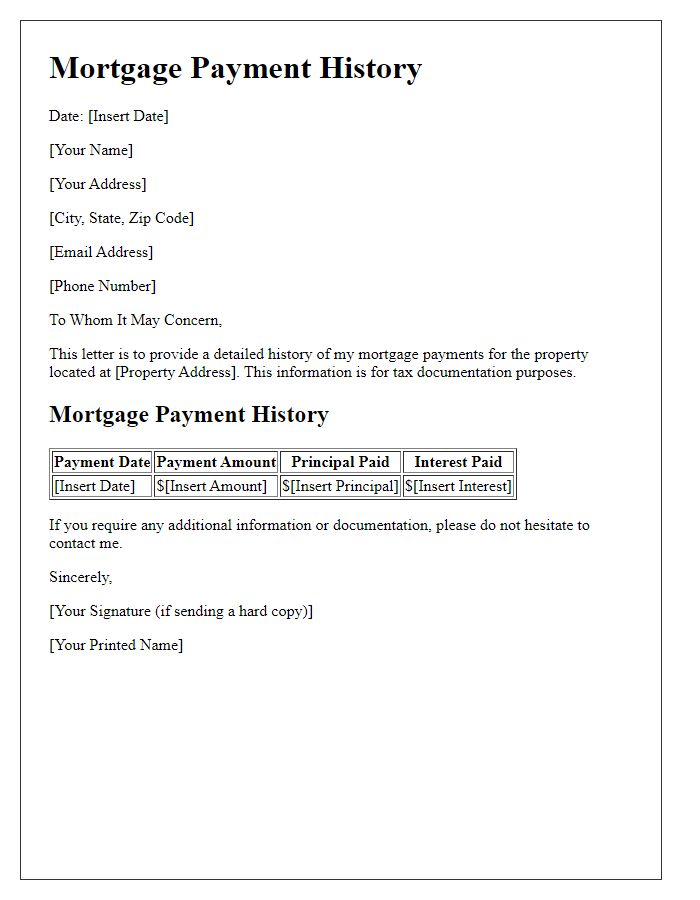

Letter template of detailed mortgage payment history for credit report accuracy

Letter template of mortgage payment history confirmation for real estate sale

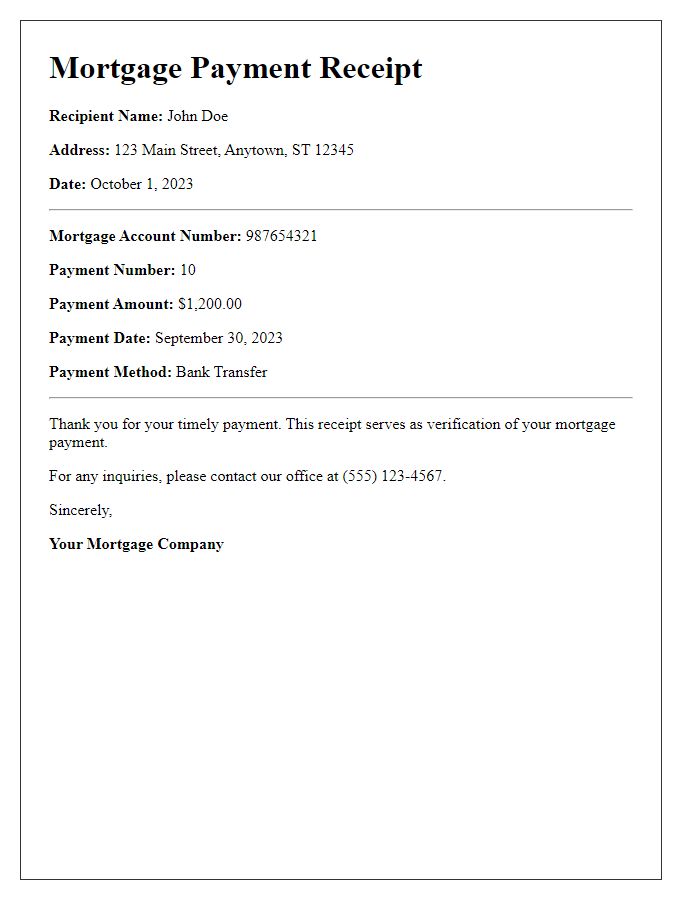

Letter template of mortgage payment receipts for personal financial records

Comments