Are you currently on the journey to understanding your mortgage better? Keeping track of your mortgage statements is crucial for managing your finances effectively. If you've been wondering how to request an update on your mortgage statement, you're in the right place! Join us as we explore a simple letter template that can help you get the information you need seamlessly.

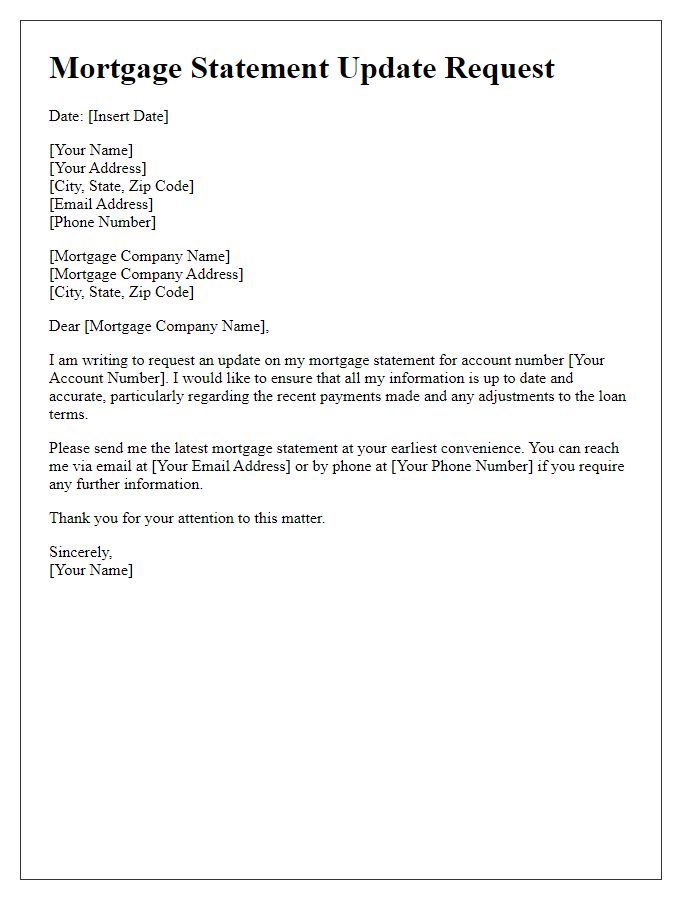

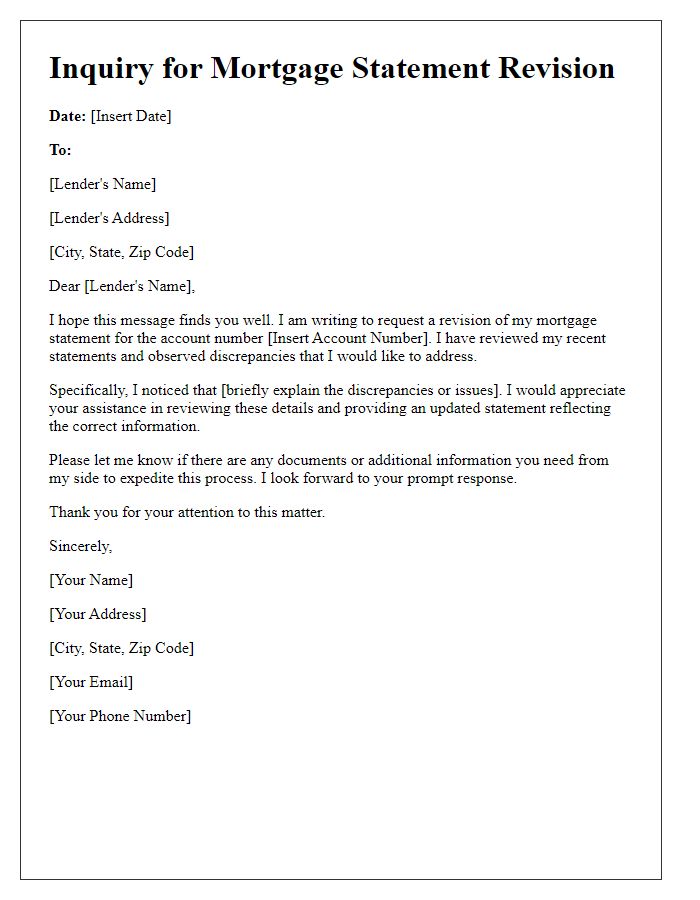

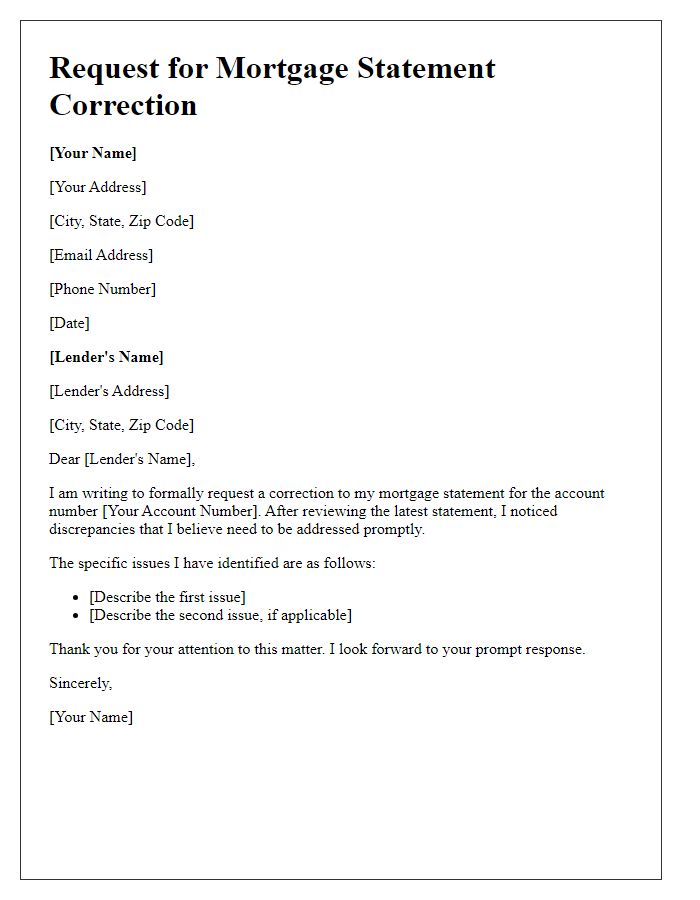

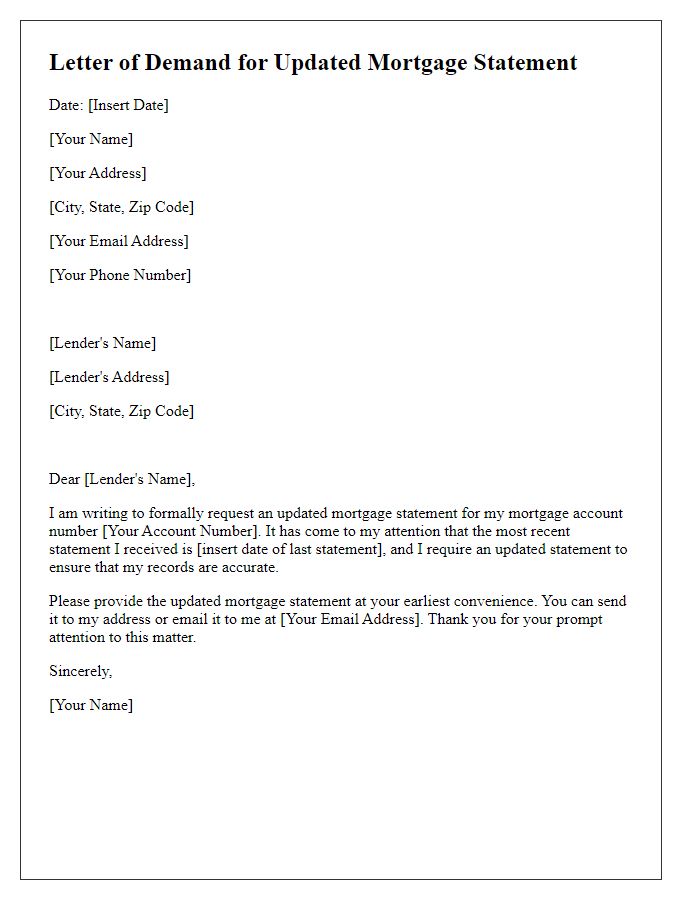

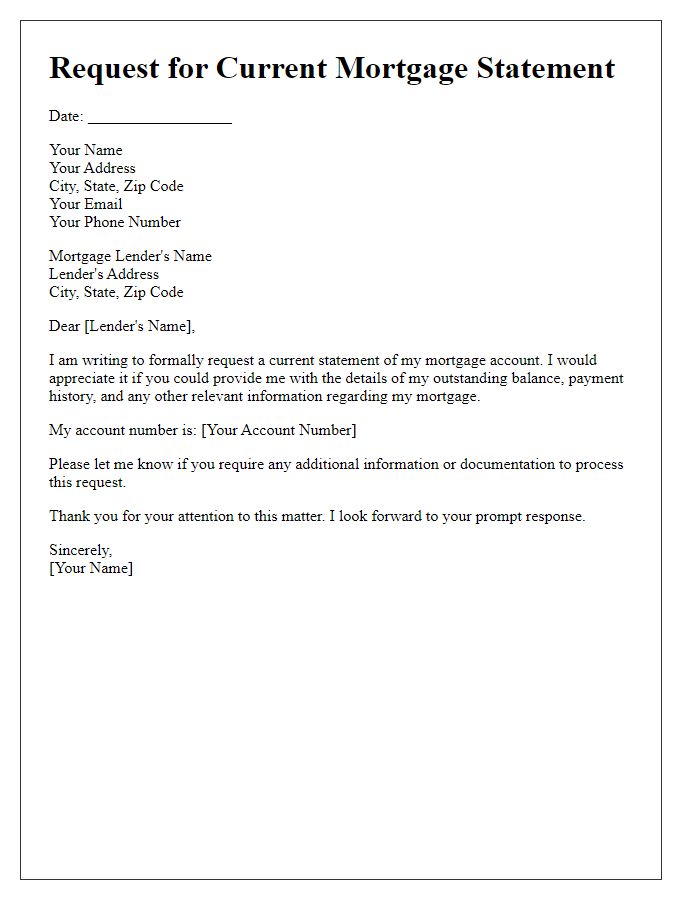

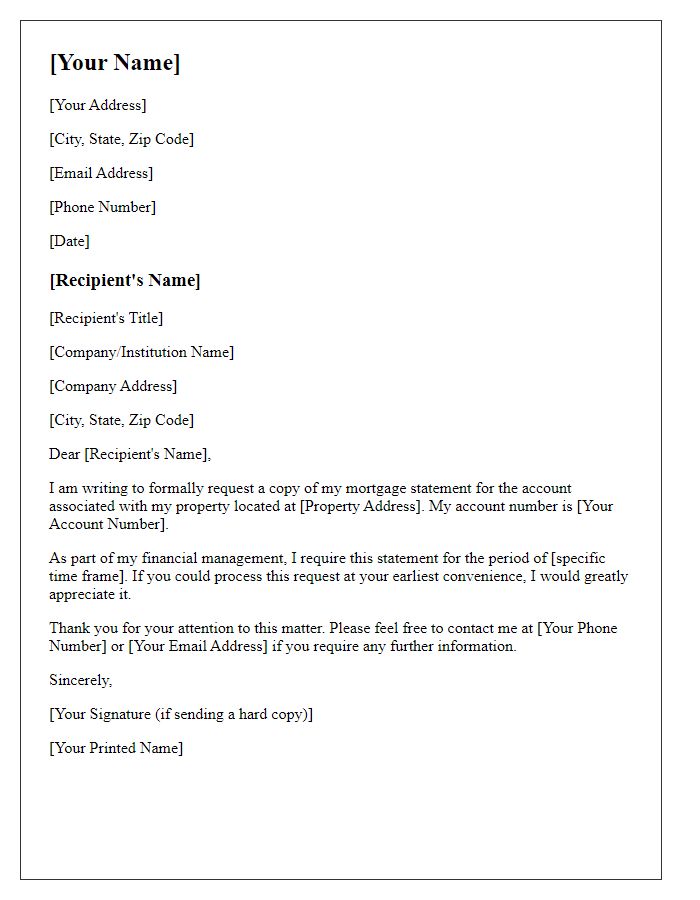

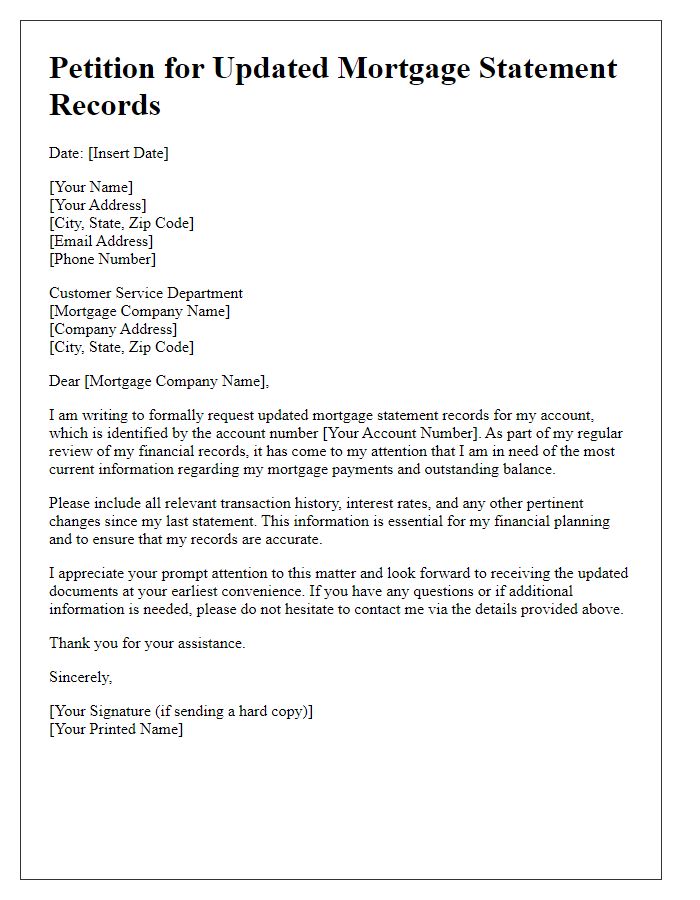

Borrower Information

Mortgage statements provide crucial insights into borrowers' financial responsibilities and payment history. Borrower information typically includes essential details such as full name, property address (including city and state), loan number, and contact information. This information enables financial institutions to accurately identify the account associated with the mortgage. Regular updates on mortgage statements are vital for tracking balance, interest accrued, payment schedules, and tax implications. Requesting a statement update may require specific identification, ensuring the integrity and security of sensitive financial data, which is critical for both borrowers and lenders.

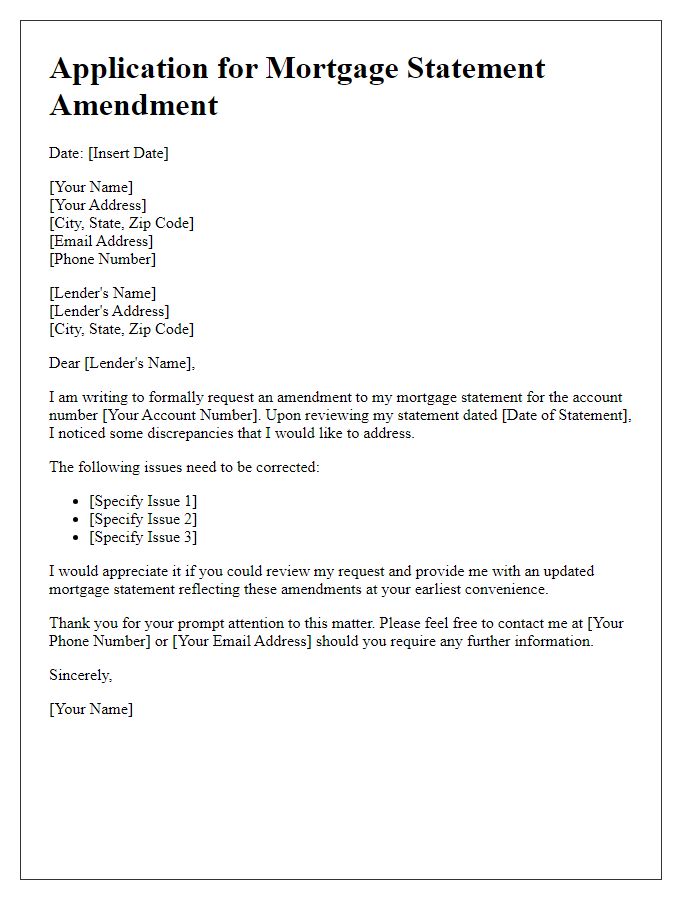

Loan Details

A mortgage statement update request requires clarity and precision regarding loan details. Homeowners often seek updated information on their mortgage loans, such as payment history, outstanding balance, and interest rate adjustments. Loan numbers, typically a 10-12 digit identifier, ensure accurate tracking of the specific mortgage account. The lender's name, such as Wells Fargo or Bank of America, along with the property address, provide context and location for the mortgage in question. Requesting this information can facilitate better personal finance management and assist in decisions related to refinancing or selling the property. Homeowners should ensure compliance with any required identification or authorization processes to expedite the response from their lender.

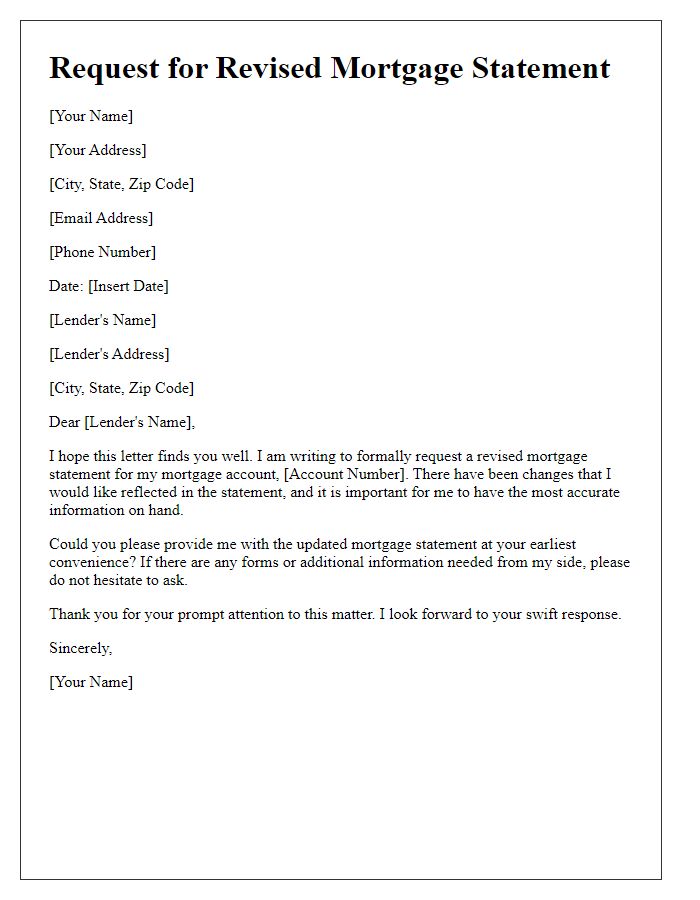

Request Description

A mortgage statement update provides essential financial transparency for homeowners managing their mortgage accounts, such as those with fixed-rate or adjustable-rate mortgages. Accurate updates (often required annually or when significant changes occur) detail the outstanding balance, interest rate adjustments, payment history, and escrow account status (pertaining to property taxes and homeowners' insurance). This information is crucial for financial planning, refinancing considerations, and tracking equity buildup. Homeowners typically request these updates from their lenders, including institutions like Bank of America or Wells Fargo, to ensure they have the most current information for budgeting and compliance with their mortgage agreements.

Justification and Purpose

Requesting a mortgage statement update is essential for maintaining accurate financial records. A current mortgage statement, which typically includes critical information such as the outstanding balance (often ranging in six figures), interest rate details (usually between 3% and 7%), and payment history (covering several months or years), allows homeowners to track their progress in paying down the loan. This document is useful for budgeting purposes and may be required when applying for refinancing options with lenders like Chase or Bank of America. Timely updates ensure that homeowners remain informed about their financial obligations and can plan for future expenses effectively. Additionally, accurate statements aid in preparing tax returns, particularly regarding mortgage interest deductions, and provide clarity in case of disputes over payment terms.

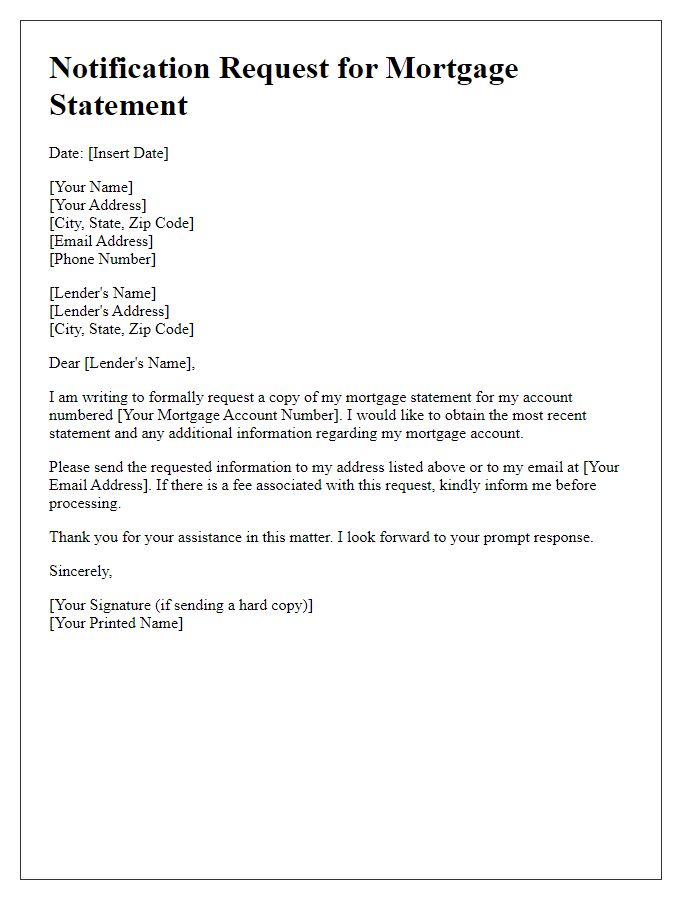

Contact Information

A mortgage statement update is crucial for understanding current loan balances, interest rates, and payment history. Financial institutions, such as banks or credit unions, provide personalized mortgage statements, typically on a monthly or quarterly basis. For example, a borrower may want to obtain a statement reflecting the most recent updates in their payment schedule or any changes in interest rate, particularly if they have refinanced their mortgage or adjusted payment terms. Accurate contact information, including the borrower's full name, loan number, and associated property address, is essential for the mortgage lender to locate the account efficiently and provide the requested information swiftly. Additionally, including a specific date for when the statement is required may expedite the processing time.

Comments