Hey there! If you've ever felt overwhelmed by the requirements for flood insurance, you're not alone. Many homeowners often wonder if they can bypass these regulations and what it means for their property. In this article, we'll break down the steps to apply for a flood insurance requirement waiver and what factors come into play. So, stick around to discover how you might qualify for a waiver and ease your insurance burden!

Property details and location.

Flood insurance waiver requests often require specific property details and location descriptions. For instance, a residence located at 123 Elm Street, Springfield, Illinois, could detail its proximity to the local river, which has not flood-affected the area in over 50 years. The property might include information about its elevation (e.g., situated 15 feet above the base flood elevation), construction materials (such as brick and concrete), and historical weather patterns that demonstrate minimal risk of flooding. Additionally, the surrounding infrastructure, like effective drainage systems or levees, can further establish the property's resilience to flooding, supporting the case for the waiver.

Current flood zone designation.

Current flood zone designations include areas categorized by FEMA (Federal Emergency Management Agency), such as Zone A, Zone V, and X, determining risk levels for flooding. Areas in Zone A are prone to inundation during 100-year floods (1% annual chance), while Zone V faces wave action risks. Zone X represents minimal flood risk, often depicting areas outside the 500-year floodplain. Obtaining a waiver for flood insurance can depend on updated flood zone delineations, elevation certificates, or structural improvements reducing flood vulnerability. Factors like local ordinances, building codes, and historical flood data also influence waiver eligibility, indicating a property's risk assessment within updated FEMA flood maps. Additionally, lending institutions often require proof of flood insurance based on these designations when securing home loans in designated high-risk areas.

Justification for waiver request.

Flood insurance requirement waivers can be essential for property owners, particularly when natural disaster risks are mitigated. Properties situated in low-risk flood zones, classified as Zone X according to FEMA's Flood Insurance Rate Map, demonstrate minimal flood exposure. Historical data shows that the area has not experienced significant flooding in over two decades, further justifying the request. Additionally, enhancements such as engineered drainage systems and elevated building structures contribute to lower flood risk. The absence of nearby waterways and the presence of adequate local infrastructure support the argument for waiver approval while ensuring community safety remains a priority.

Supporting documentation or evidence.

A flood insurance requirement waiver can be essential for property owners looking to manage costs related to mandatory insurance, particularly in lower-risk flood zones. Supporting documentation may include a government-issued flood zone determination letter from the Federal Emergency Management Agency (FEMA), indicating the property's designation, such as Zone X, which denotes areas with minimal flood risk. Additional records might consist of an updated elevation certificate, providing specific details about the building's elevation in relation to the Base Flood Elevation (BFE), ensuring compliance with local building codes. Furthermore, previous flood claims history should be documented to demonstrate the property's resilience against flooding events. Local climate data may also aid in justifying the waiver by outlining infrequent flooding events over several decades. All these elements collectively build a comprehensive case for the waiver request, reducing potentially unnecessary financial burdens on homeowners.

Contact information for follow-up.

Flood insurance waivers allow property owners, particularly in flood-prone areas such as New Orleans or Miami, to bypass mandatory insurance requirements imposed by lenders. Key factors influencing waiver approval include location history, previous flood events, and construction elevation within the Base Flood Elevation (BFE). Typically, homeowners provide detailed information about property assessments conducted by reputable firms like FEMA or local authorities. Additionally, comprehensive documentation illustrating flood mitigation efforts, such as levees or drainage systems, strengthens waiver requests. Follow-up contact information plays a crucial role in expediting the review process, ensuring timely responses from insurance agencies or financial institutions.

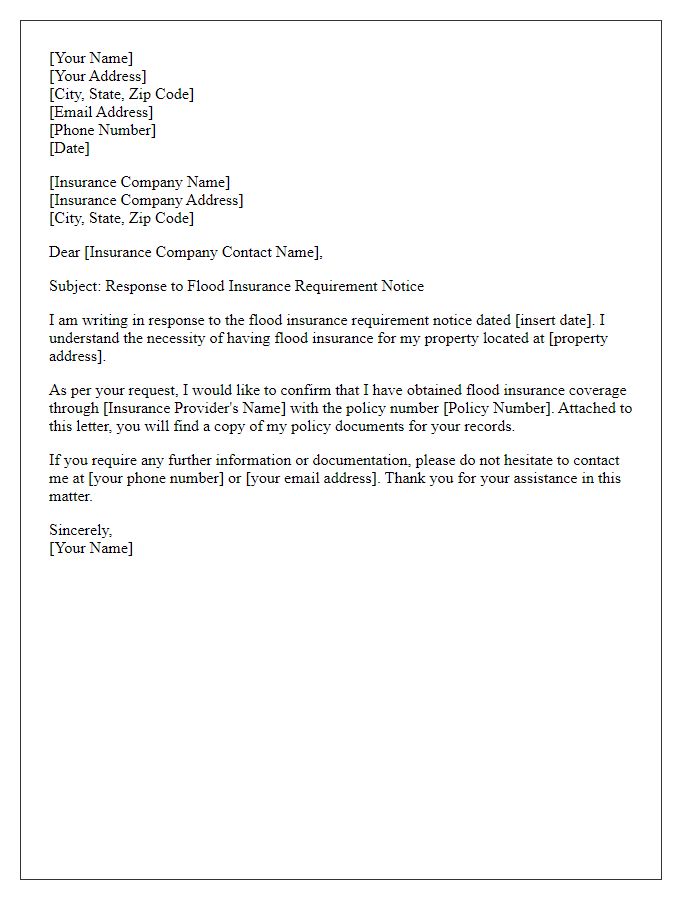

Letter Template For Flood Insurance Requirement Waiver Samples

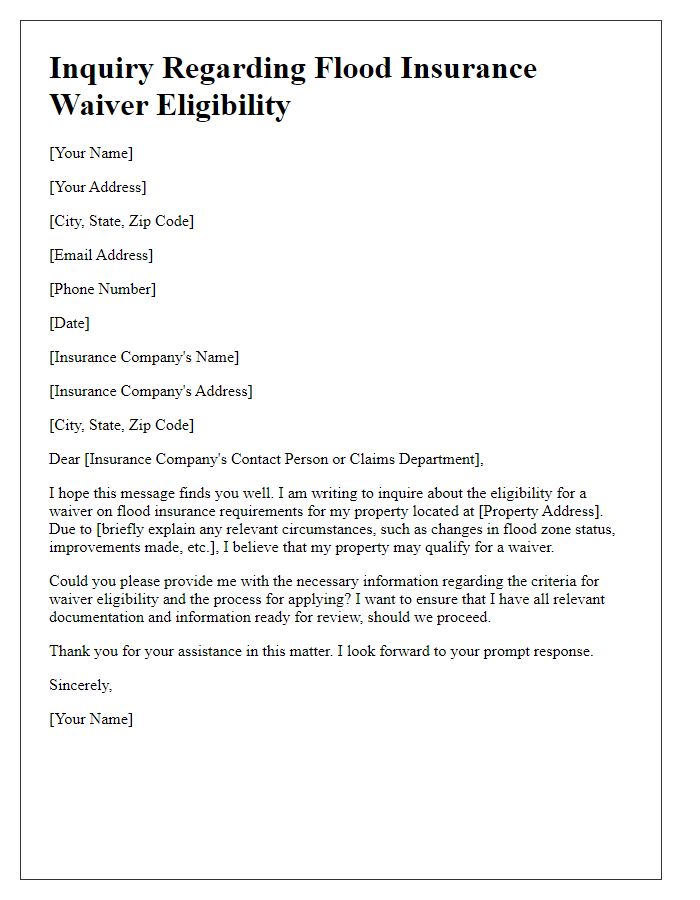

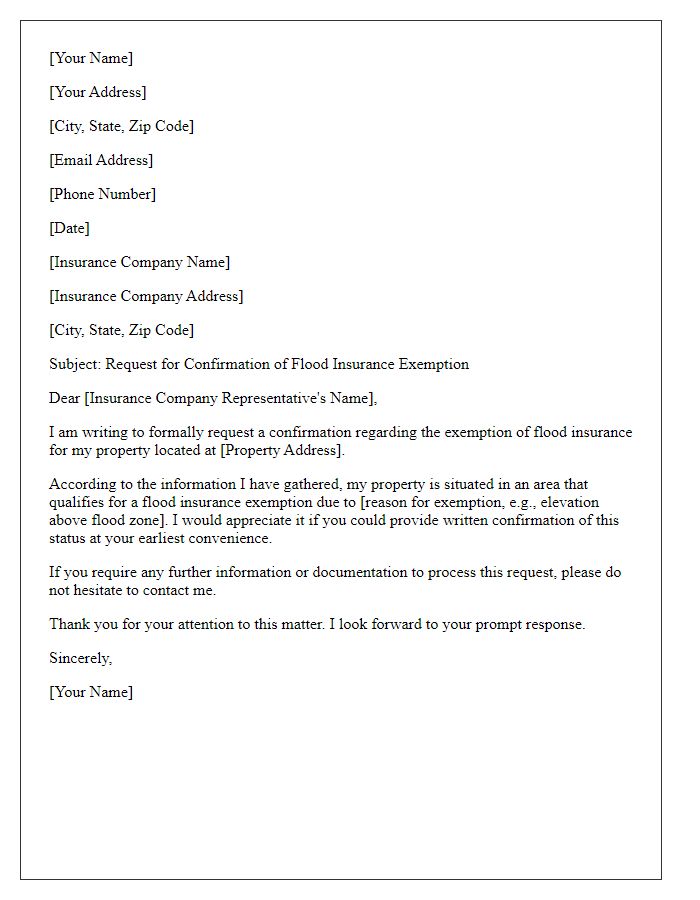

Letter template of inquiry regarding flood insurance waiver eligibility.

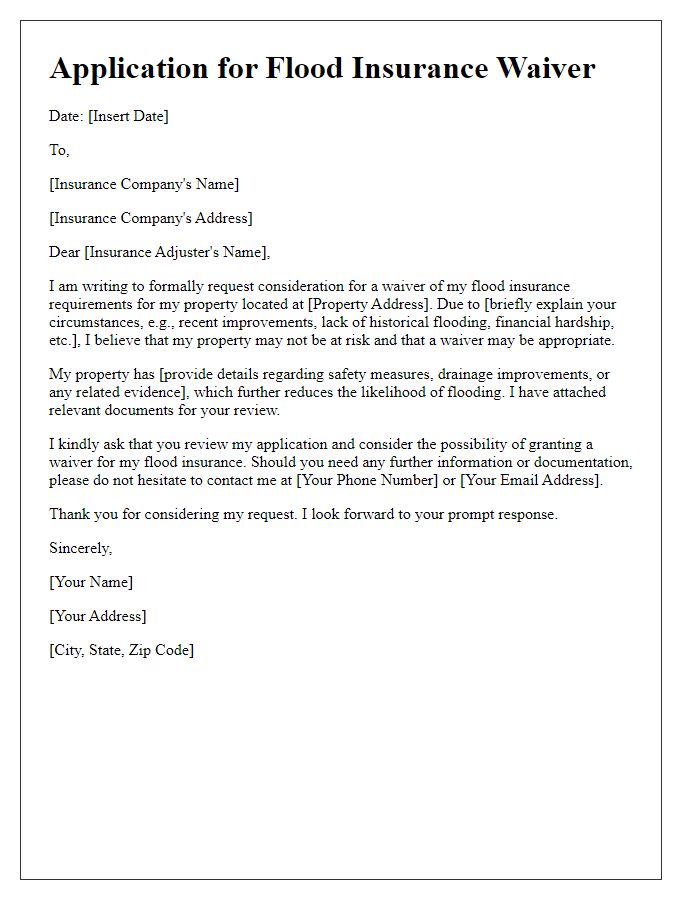

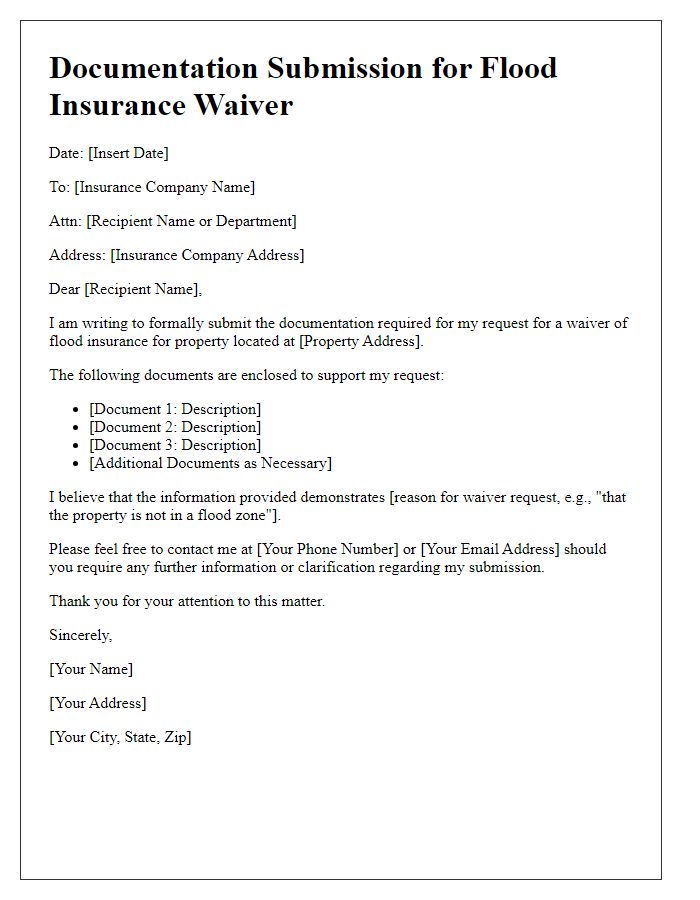

Letter template of application for flood insurance waiver consideration.

Comments