Are you considering a change to your mortgage billing cycle? It's understandableâyou want a financial arrangement that suits your lifestyle and ensures ease in managing your payments. Making this adjustment can not only simplify your budgeting but also potentially save you money in the long run. So, if you're curious about how to initiate this process and what steps you need to take, keep reading for valuable insights!

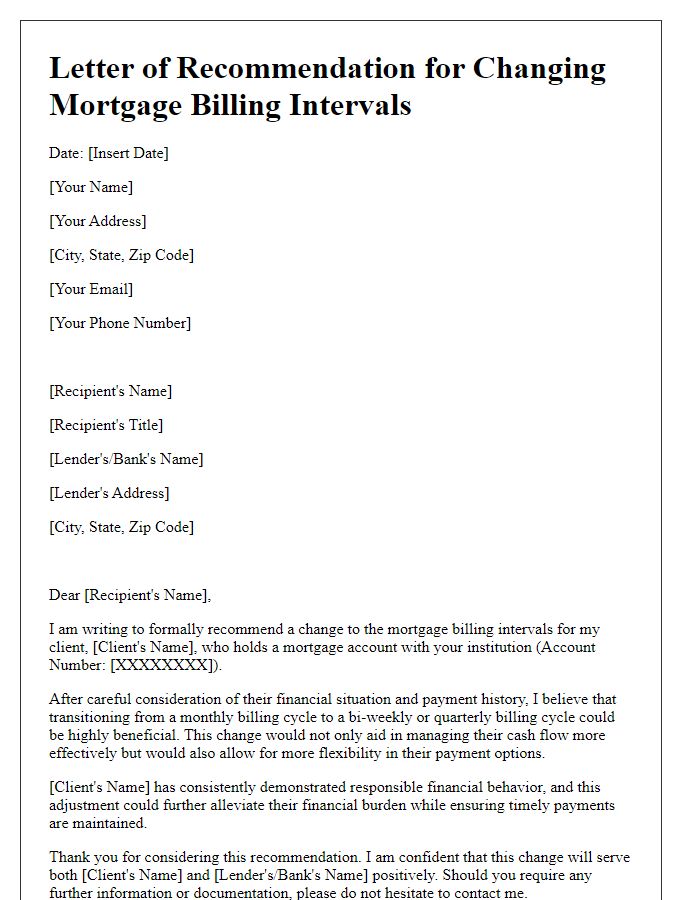

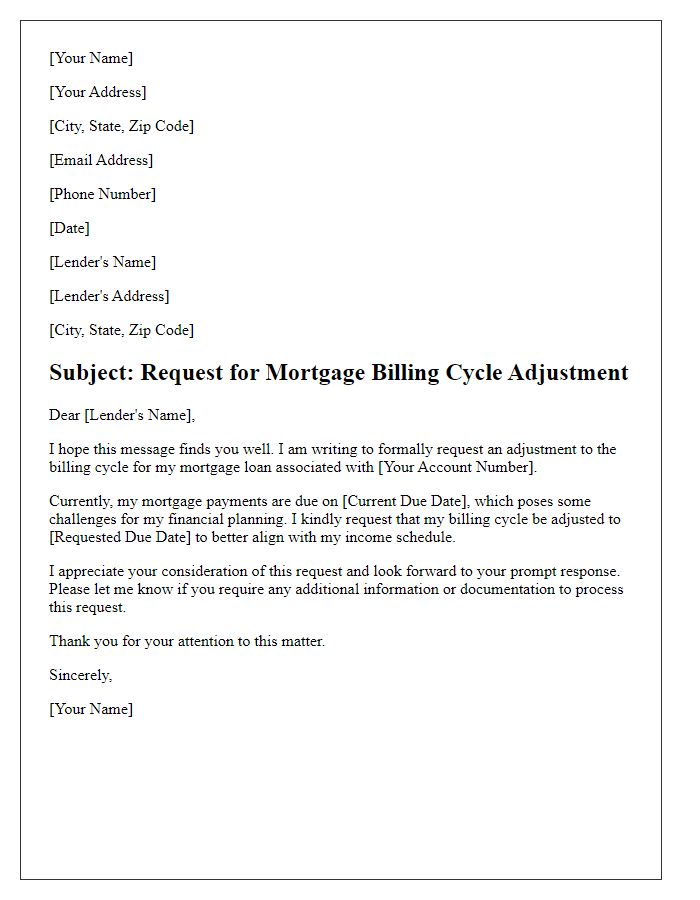

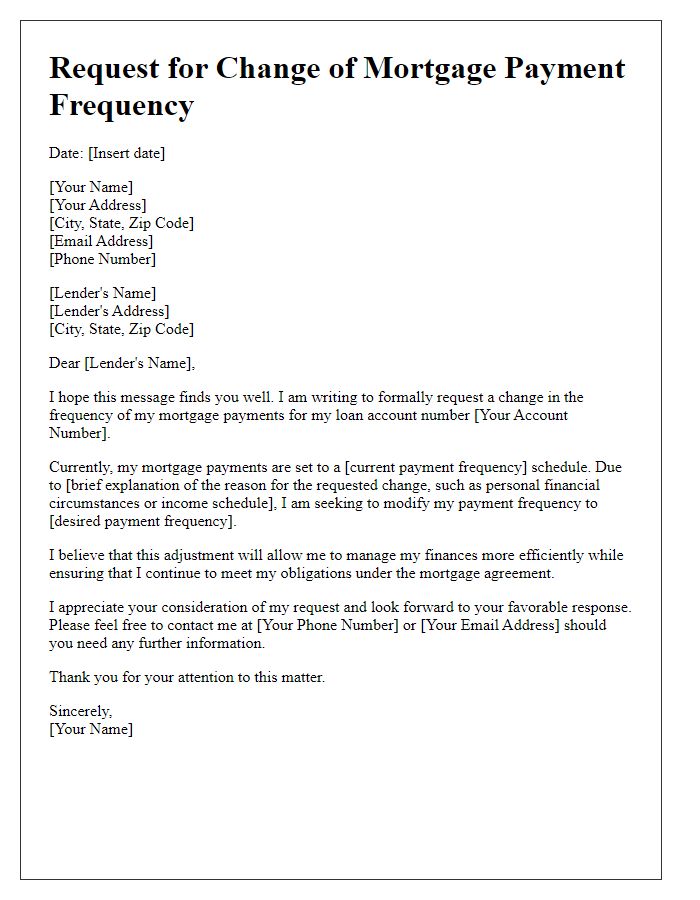

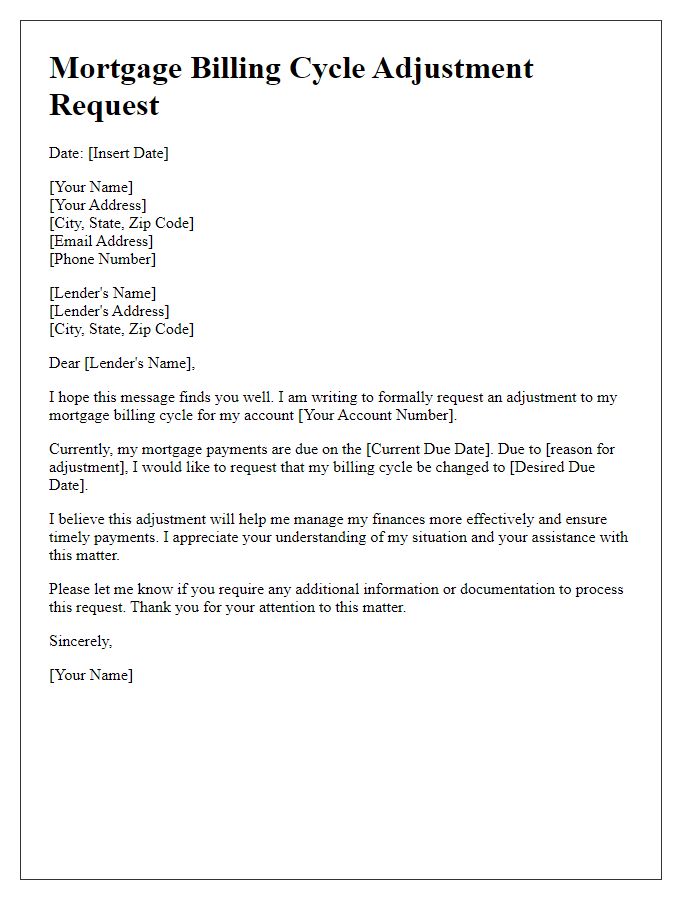

Salutation and Recipient Information

A mortgage billing cycle alteration can influence monthly financial management for homeowners. Adjusting the billing cycle can help align payments with income schedules, enhancing cash flow efficiency. For instance, a homeowner receiving biweekly pay might prefer a billing cycle that coincides with this schedule rather than a monthly cycle. Changing this cycle may involve notifying the mortgage service provider, typically a bank or financial institution, to execute the request. Homeowners should include account numbers, loan details, and desired adjustments in their communications. Proper documentation, including proof of income and authorization, can facilitate the alteration process, ensuring smooth transitions in billing practices.

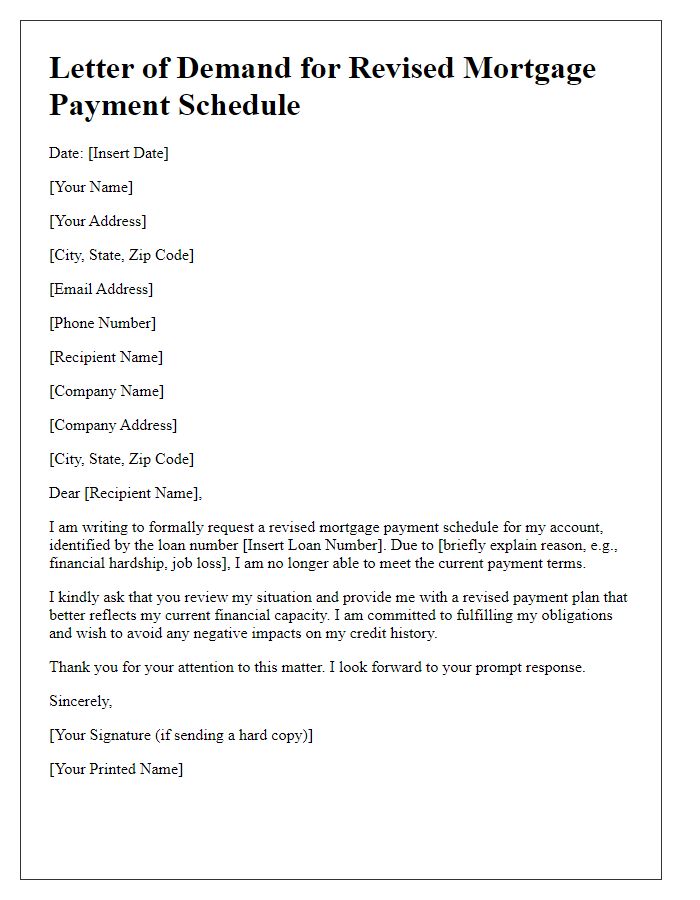

Request Statement and Reason

Mortgage billing cycles can significantly impact homeowners' financial planning, especially when adjustments are made to payment schedules. Many mortgage lenders, including large institutions like Wells Fargo and Chase, typically operate on a monthly billing cycle, requiring payments on the first of each month. However, homeowners may request alterations to align with personal financial circumstances, such as aligning payments with payday schedules, which can be beneficial for households living paycheck to paycheck. An adjustment may also help prevent missed payments, thereby avoiding late fees and credit score impacts. Homeowners are encouraged to formally request a statement detailing the current billing cycle and provide compelling reasons for the desired change, such as ensuring better cash flow management or accommodating fluctuating income patterns. Such requests should clearly communicate the benefits of the proposed changes and demonstrate a responsible approach to mortgage repayment.

Mortgage Account Details

Mortgage account details, including the account number, lender name, and property address, play a crucial role in the mortgage billing cycle alteration process. Typically, the account number serves as a unique identifier for tracking payments and managing terms of the loan. The lender name, such as Bank of America or Wells Fargo, represents the financial institution holding the mortgage, while the property address specifies the location tied to the loan agreement. Specific billing cycles can vary, with monthly payments generally due on the first of each month. Homeowners may request changes to their billing cycle to align with income schedules, such as bi-weekly paychecks, or to accommodate financial planning. Properly addressing the lender with accurate mortgage account details is essential for efficient processing of any requests for alterations.

Preferred Billing Cycle Dates

Mortgage billing cycles can significantly impact financial management for homeowners, especially when considering preferred billing dates. Many lenders operate with monthly billing cycles, typically set at the start or middle of the month. However, homeowners may wish to adjust these dates based on personal cash flow, aligning with income schedules. For instance, changing the mortgage payment date to coincide with payday can enhance budgeting effectiveness, leading to more timely payments. Homeowners often seek to establish billing cycles that align with key dates such as the 1st or 15th of the month. Such adjustments require contacting the mortgage lender to request changes, ensuring any alterations comply with the lender's policies. Ensuring these changes are documented and confirmed by the lender is vital for financial planning.

Gratitude and Contact Information

Mortgage billing cycles can significantly impact budgeting for homeowners, particularly for loans from institutions like Fannie Mae or Freddie Mac. Adjusting the billing cycle to a preferred time, such as aligning with monthly income dates, can enhance financial management. Homeowners often express gratitude towards mortgage servicers facilitating such changes, acknowledging improved cash flow and reduced stress. For any inquiries or requests regarding billing cycle adjustments, contacting customer service representatives becomes essential, typically accessible via dedicated phone lines or online portals during business hours, ensuring timely support for homeowners navigating this important financial decision.

Letter Template For Mortgage Billing Cycle Alteration Samples

Letter template of recommendation for changing mortgage billing intervals

Comments