Are you navigating the complex world of mortgage policies and need to make some crucial corrections? Understanding the ins and outs of mortgage documentation can often be overwhelming, but a well-structured letter can simplify the process significantly. In this article, we'll guide you through crafting a clear and effective letter template for issuing mortgage policy corrections, ensuring you communicate your needs precisely. So, let's dive in and discover how to get it right the first time!

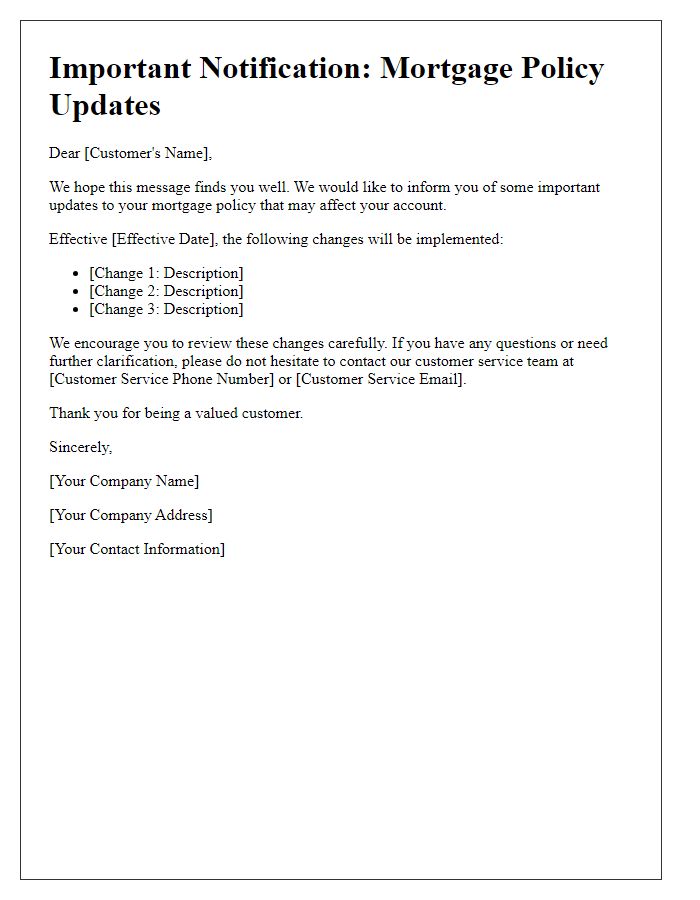

Clear Subject Line

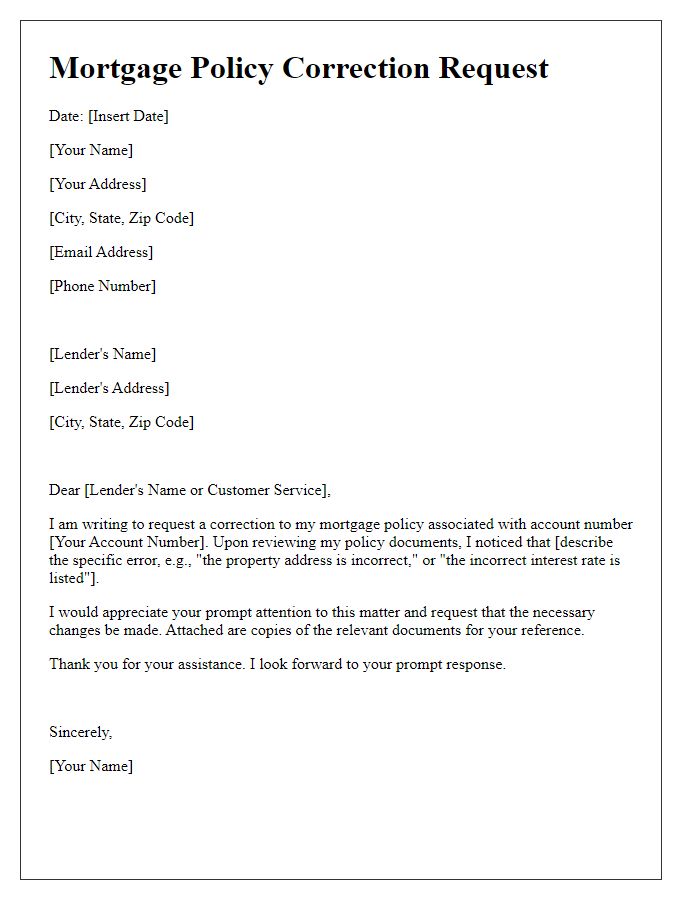

A clear subject line for issuing mortgage policy corrections could be "Mortgage Policy Correction Request - [Your Name] [Policy Number]." This subject highlights the purpose of the correspondence while including a personal identifier. The inclusion of the policy number ensures quick reference to the specific case, allowing for efficient processing by the recipient.

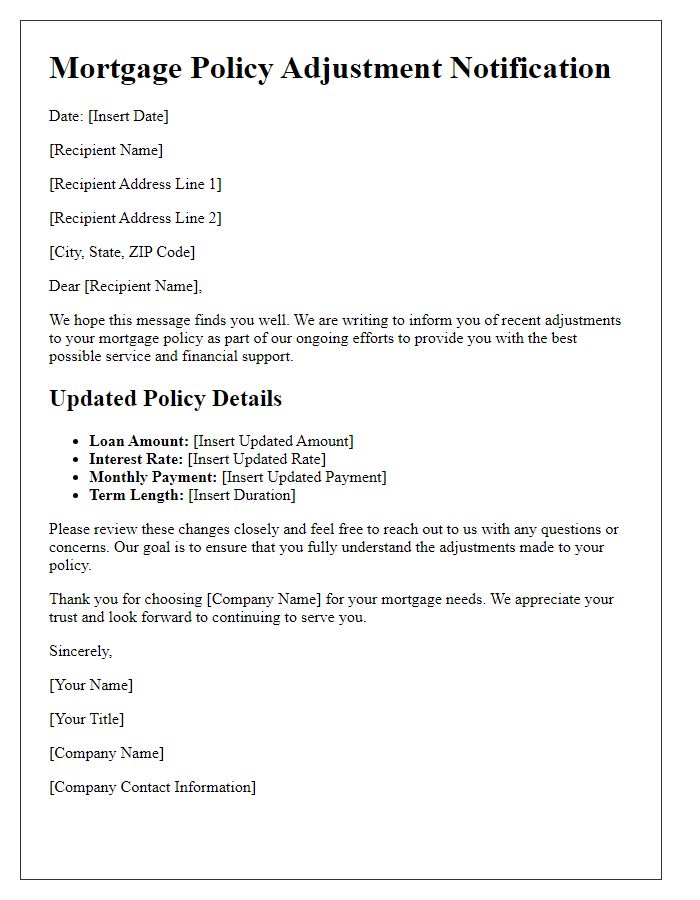

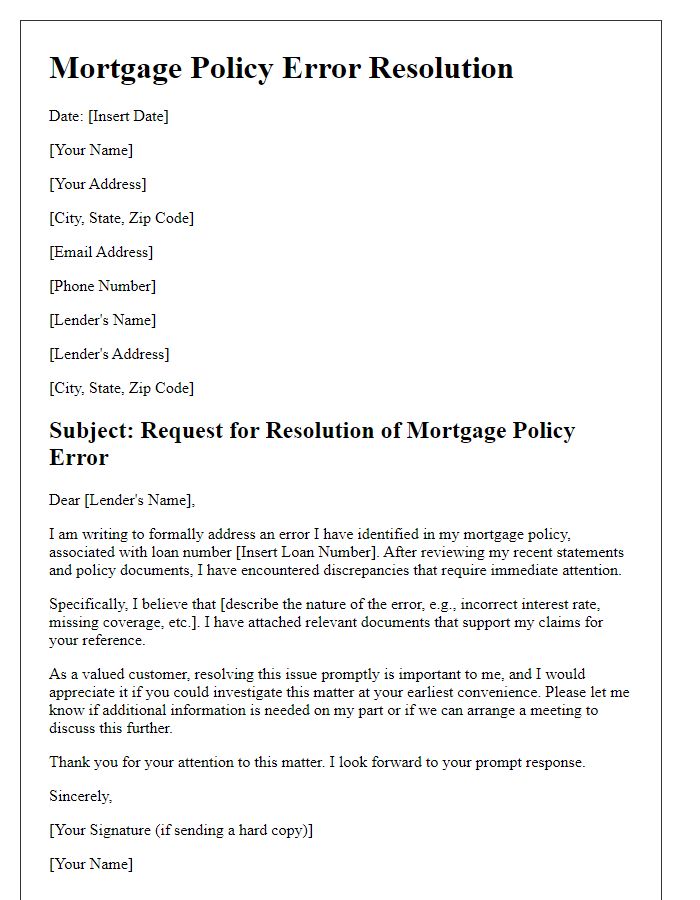

Accurate Policy Details

Issuing mortgage policy corrections ensures accurate policy details vital for homeowners and lenders. Mortgage policies include essential components such as interest rate, loan amount, and repayment terms. An accurate interest rate (e.g., 3.5% fixed for 30 years) affects monthly mortgage payments and overall cost. Loan amount discrepancies can lead to misunderstandings regarding financial commitments, impacting budgets and credit scores. Clarifying repayment terms, including start dates and amortization schedules, ensures all parties are aware of their obligations. Accurate policy details safeguard against legal disputes, foster trust, and provide peace of mind to stakeholders involved in real estate transactions.

Correction Explanation

When mortgage policies contain inaccuracies, timely corrections are essential to ensure compliance and clarity. For instance, if a borrower's name appears incorrectly on documents, this can lead to legal complications. Also, incorrect interest rates that deviate from the agreed terms can cause financial discrepancies affecting monthly payments. Inaccuracies in property descriptions can mislead stakeholders about collateral value and loan security. Clear and precise communication regarding these corrections is crucial to maintain trust between financial institutions and borrowers. Documenting discrepancies, providing corrective actions, and outlining the impact on future interactions are vital components of addressing mortgage policy corrections effectively.

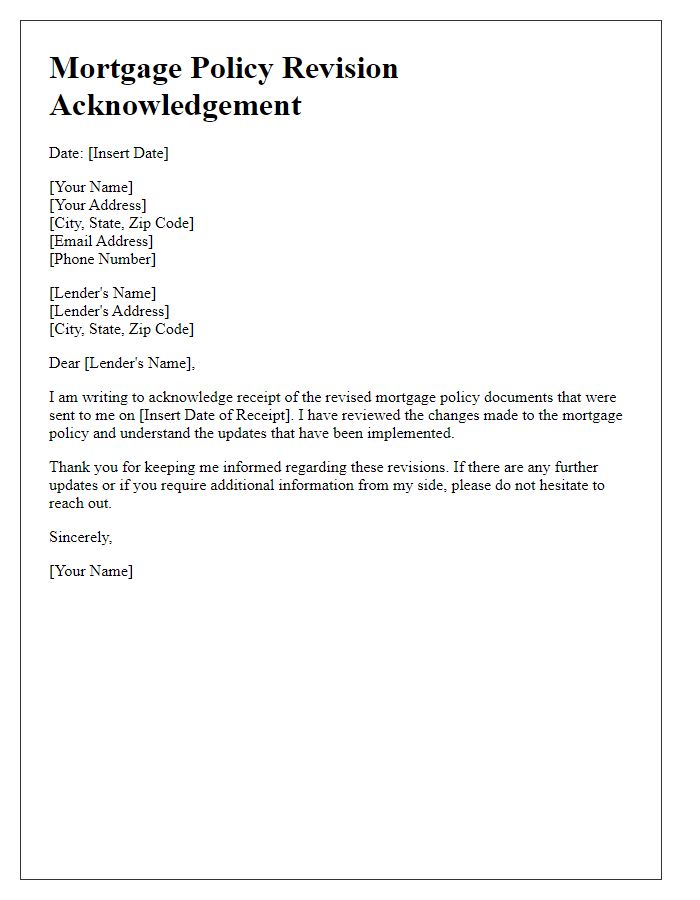

Contact Information

Issuing mortgage policy corrections requires accurate contact details to ensure effective communication. The document should include essential information such as the full name of the mortgage holder, the mortgage account number (found on official documentation), and the property address (including street name, city, state, and zip code). The primary contact number should be a mobile or home phone, and an email address must be provided for prompt digital correspondence. In addition, including a secondary contact method, such as an alternative phone number, can enhance communication efficiency. Other relevant details might include the date of the correction request submission and the specific nature of the policy corrections to facilitate quicker processing and prevent any delays in the adjustment of mortgage documents.

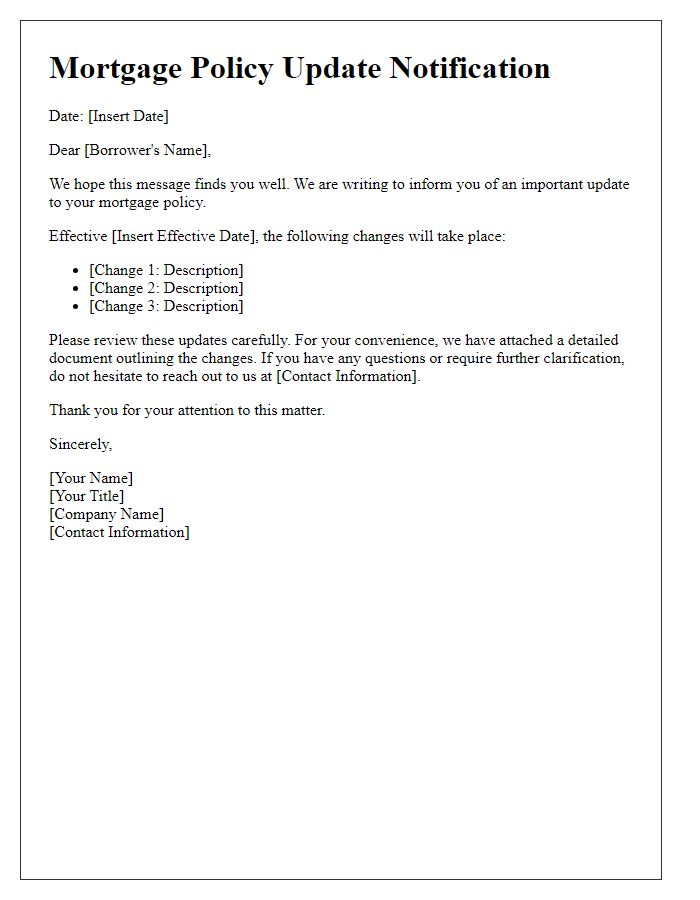

Professional Closure

In the dynamic landscape of financial services, issuing mortgage policy corrections ensures compliance and accuracy in lending practices. Institutions such as banks, credit unions, and mortgage companies regularly review documents to amend discrepancies, reflecting changes in borrower circumstances, interest rates, or regulatory requirements. The mortgage correction process typically involves revising critical elements, including loan amounts, property values, or borrower information, which are meticulously documented for transparency. Regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB), mandate these corrections to protect consumers and maintain market integrity. Prompt and precise issuance of these policy corrections is vital for upholding trust between lenders and borrowers, ultimately contributing to the overall stability of the housing market.

Comments