Are you feeling a bit overwhelmed by the tax return verification process? You're not alone! Navigating the ins and outs of tax returns can be confusing, especially when it comes to ensuring everything is in order for a smooth verification. Join us as we break down a helpful letter template that simplifies this process and ensures your request for tax return verification is clear and professionalâlet's dive in!

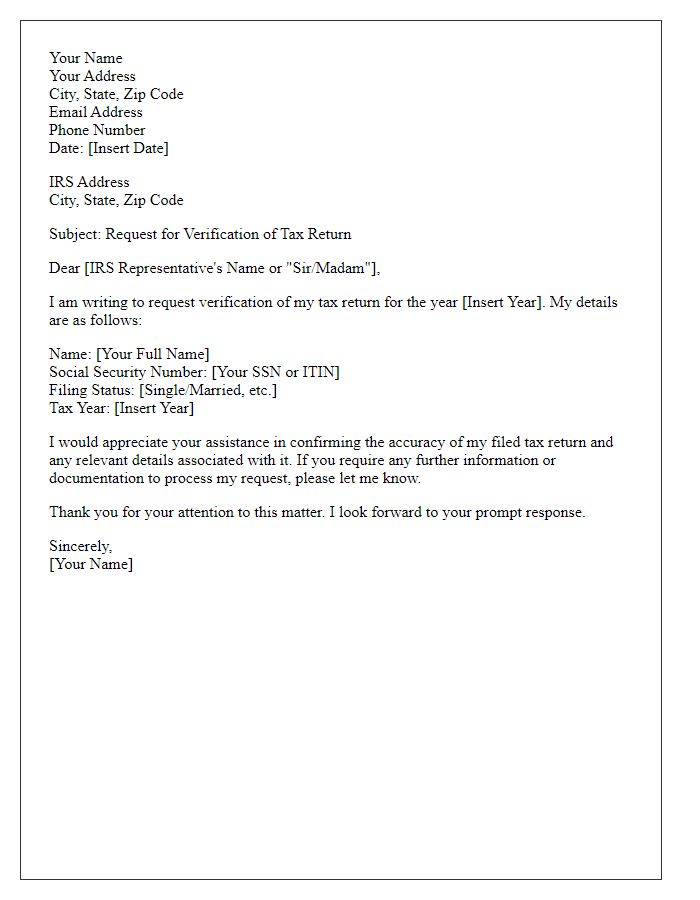

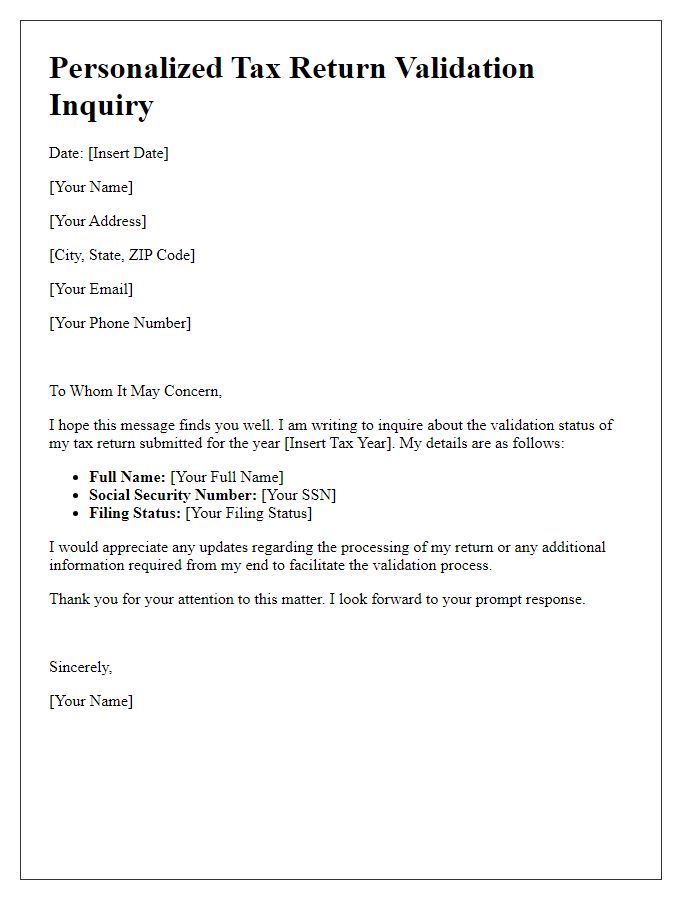

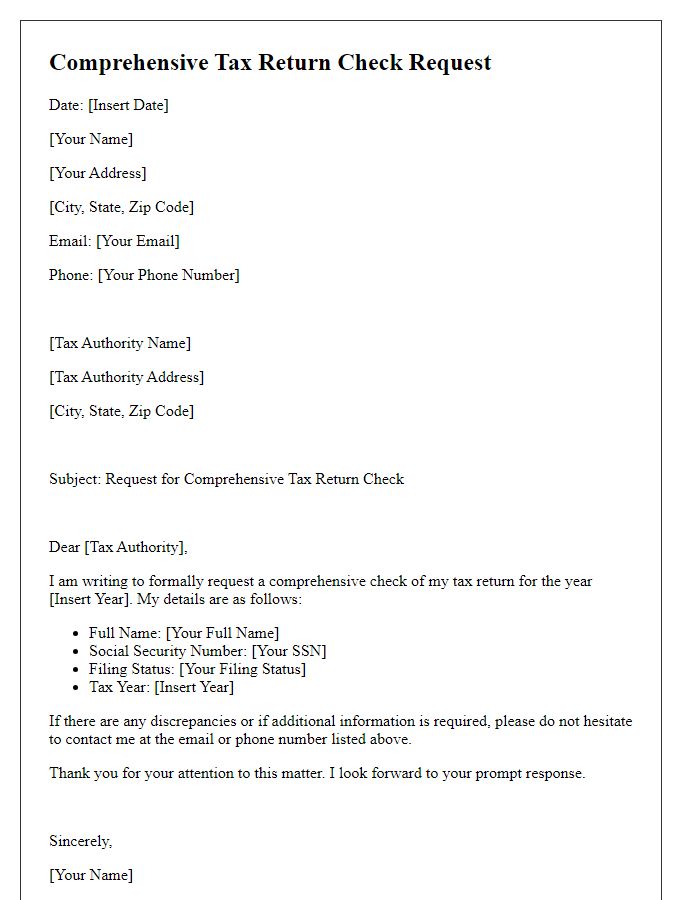

Clear taxpayer identification details.

A tax return verification request requires clear documentation detailing taxpayer identification information, including the Taxpayer Identification Number (TIN) which is crucial for IRS processing. Such documentation may also include the full legal name of the taxpayer, matching the name on the tax return, as discrepancies can lead to delays. The address associated with the taxpayer account should be current, reflecting the last-known residency, ensuring accurate communication. Additionally, any relevant tax years should be specified, which aids in the identification of the exact returns requiring verification. Proper authorization signatures may be necessary if third parties are involved in the verification process.

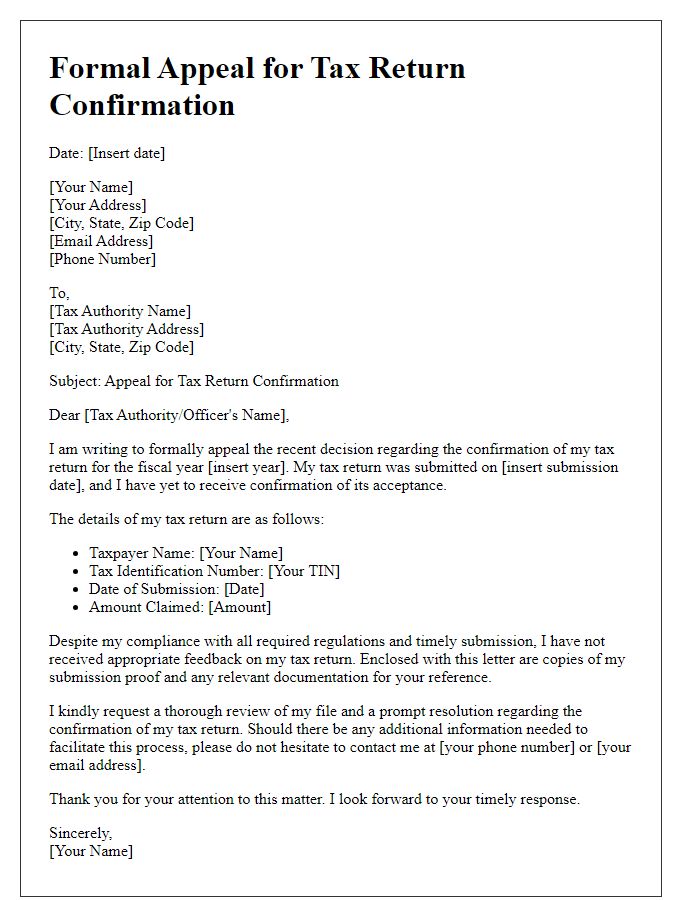

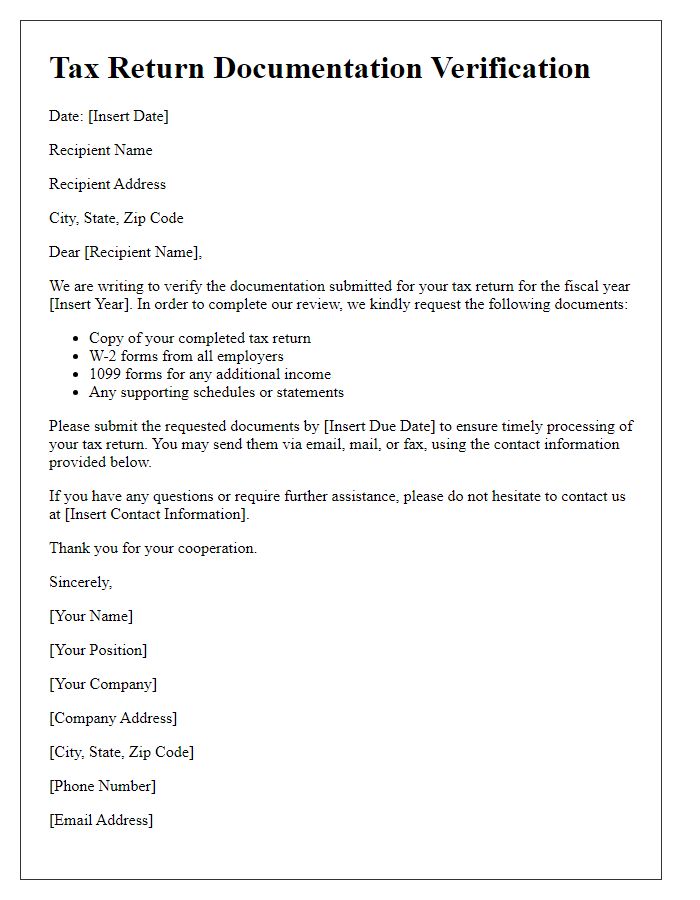

Specific request for verification documents.

Tax return verification requests require specific documentation to confirm income and deductions. Essential documents include Form 1040 (U.S. Individual Income Tax Return), W-2 forms from employers (documenting annual wages), and 1099 forms for other income sources. Additional documents such as receipts for itemized deductions (including charitable donations, medical expenses, and business expenses) may be necessary for a thorough review. The IRS requires verification within specific timelines, typically 30 days from the date of request to ensure compliance and avoid penalties. Providing accurate and complete information is crucial to expedite the verification process and prevent delays in processing future tax claims.

Precise contact information for follow-up.

Tax return verification requests often require clear and specific contact information for effective follow-up. Include your full name, which identifies you as the taxpayer. Provide your Social Security Number (SSN) or Tax Identification Number (TIN) for accurate linking of your request to your records. List your current mailing address including street name, city, state, and zip code, ensuring that communications arrive without delay. Add your phone number (landline or mobile) for direct queries, emphasizing the area code for regional identification. Lastly, include an email address for quick digital correspondence, specifying the preferred methods and times for follow-up to enhance response efficiency.

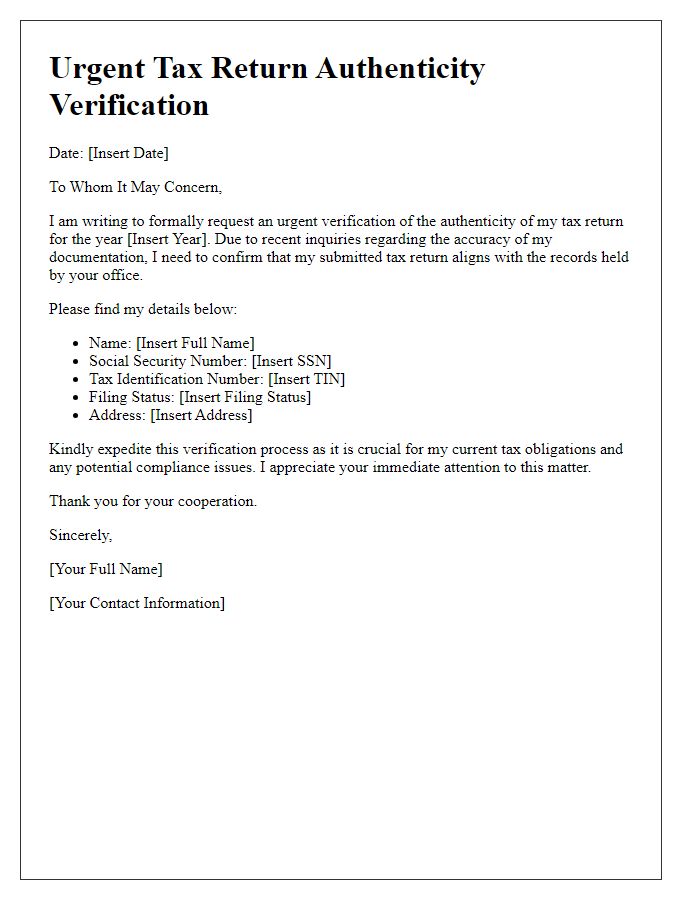

Deadline for response submission.

Tax return verification requests necessitate prompt attention due to the strict deadline (typically 30 days from receipt) for response submission. This verification process, required by tax authorities (such as the Internal Revenue Service in the United States, or HM Revenue and Customs in the United Kingdom), ensures accurate reporting of income, deductions, and credits, thus maintaining compliance. Detailed documentation, such as W-2 forms, 1099 statements, or itemized deductions, must accompany any claims. Failure to respond within the specified timeframe may result in penalties, delays in processing refunds, or further audits. Clear communication of these requirements is crucial for ensuring compliance and resolving discrepancies efficiently.

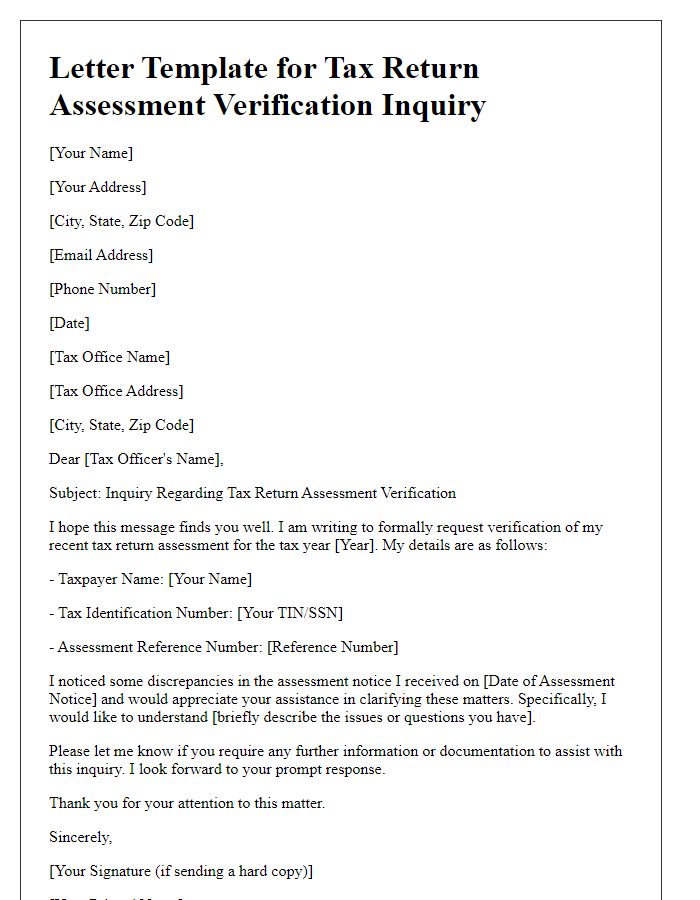

Signature of authorized person.

The verification of tax return documents is often required for ensuring accuracy and compliance with federal and state regulations. The signature of an authorized person, typically a designated representative or head of the accounting department, confirms the authenticity of the information provided in the tax filings. This signature may be necessary for submissions to the Internal Revenue Service (IRS) or state tax authorities. Accurate tax returns filed by individuals, corporations, or partnerships must be certified to avoid discrepancies during audits or inquiries.

Comments