Are you feeling overwhelmed by the complexities of foreclosure and looking for a way to regain your financial footing? Understanding the redemption process can be a crucial step in reclaiming your property and securing your future. In this article, we'll guide you through the essentials of drafting an effective redemption foreclosure approval letter, ensuring you have all the necessary information at your fingertips. So, grab a cup of coffee and read on for valuable tips and insights!

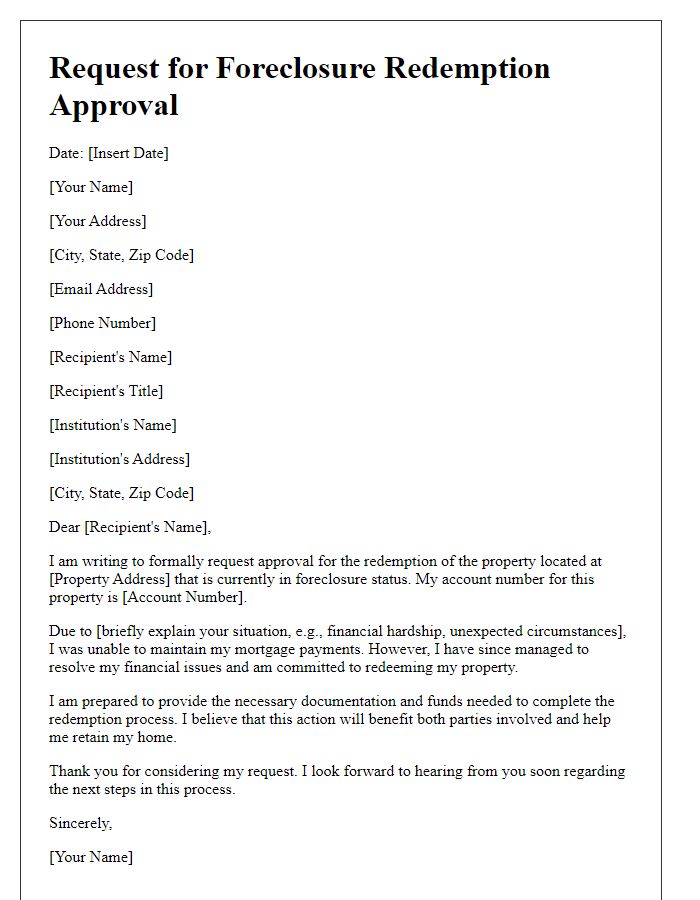

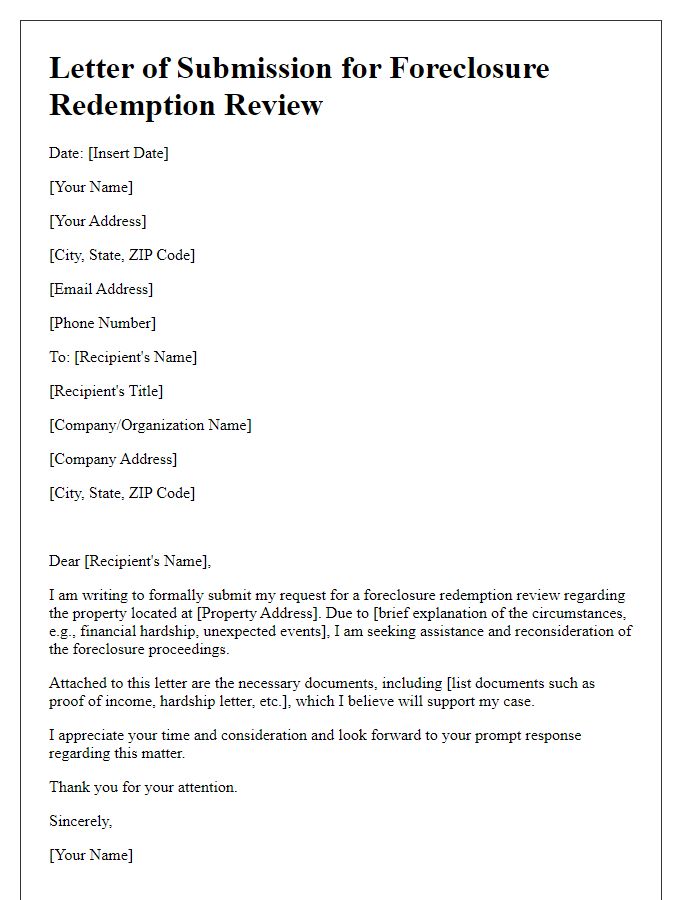

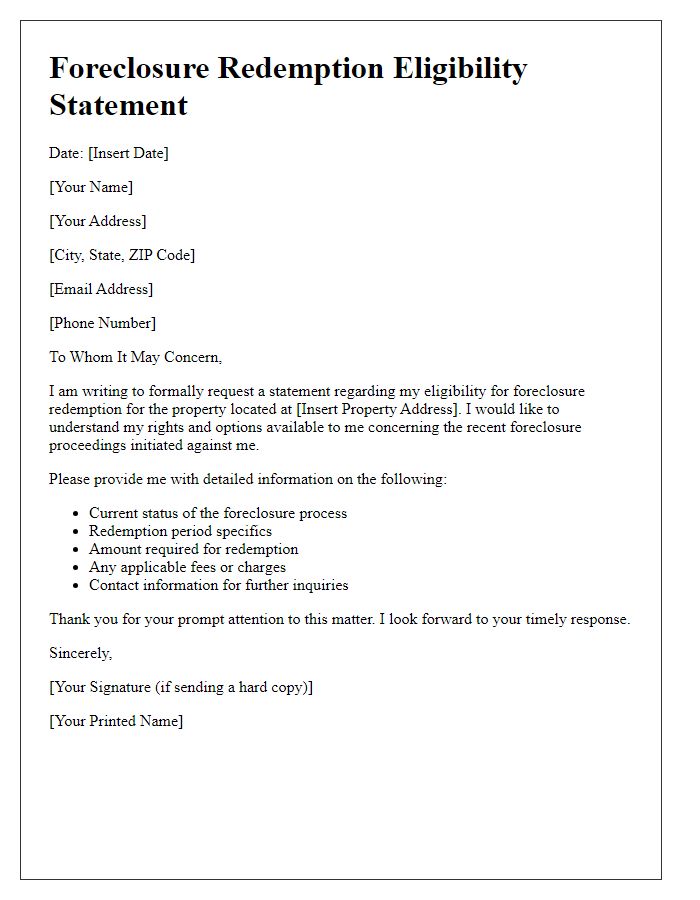

Borrower and Property Information

The redemption foreclosure approval process involves multiple steps, including verification of borrower identity and detailed property information. Borrower details such as full name, social security number, and contact information must be accurately documented to ensure proper identification. Property information should include the property's address, legal description, and unique identifiers like the parcel number (often required by county assessors). Additionally, specific details about loan numbers, outstanding balances, and dates of foreclosure proceedings play a crucial role in the approval process. These comprehensive records ensure that the redemption process adheres to legal standards and regulatory compliance in jurisdictions such as California or Florida, where foreclosure laws may significantly vary.

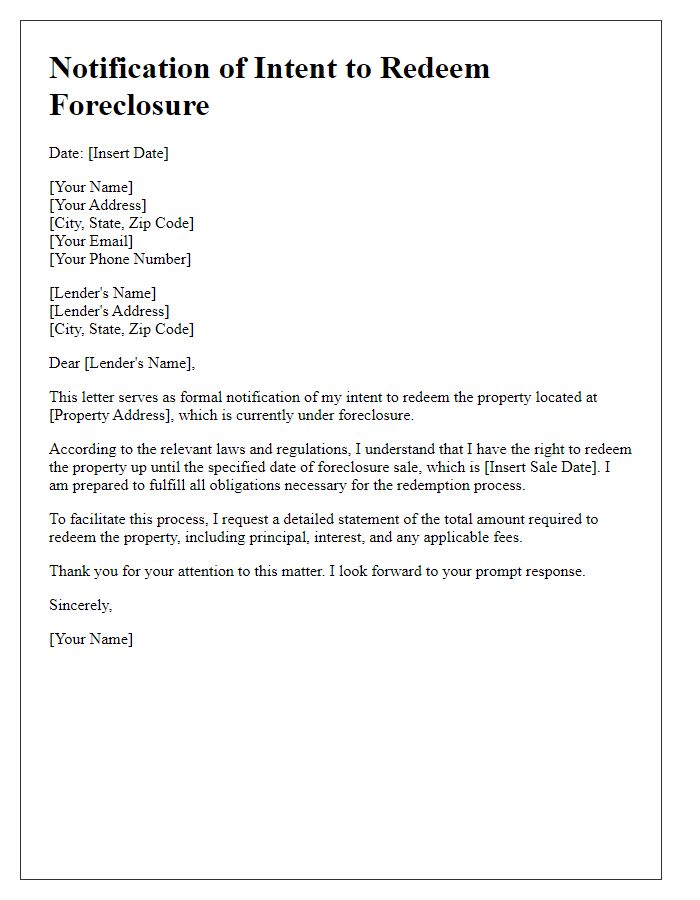

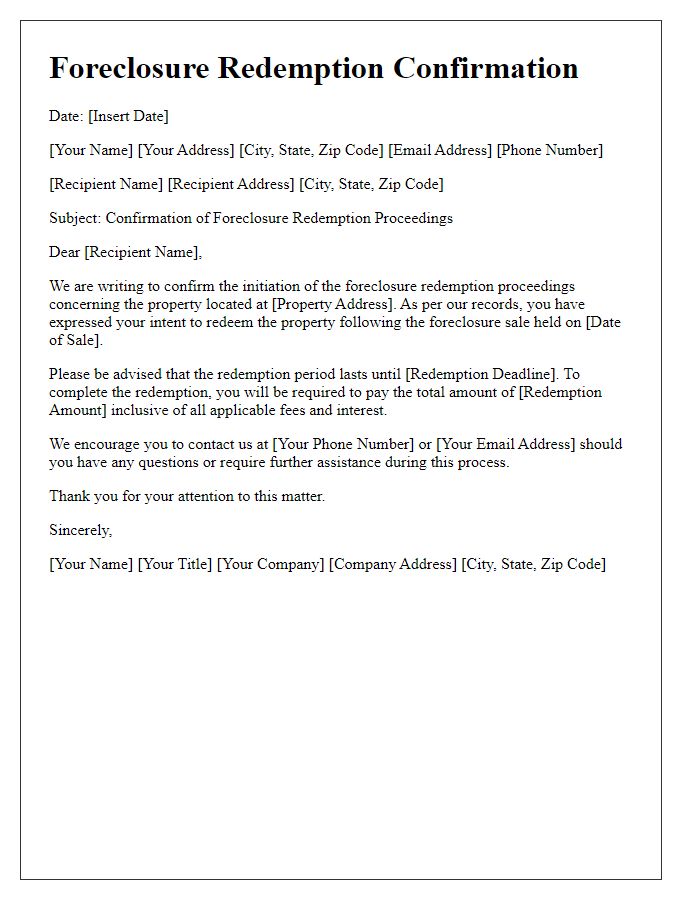

Redemption Amount and Terms

A redemption foreclosure approval outlines the specific redemption amount, which is the total sum required to reclaim property following a foreclosure event. This amount typically includes the outstanding principal balance of the mortgage, accrued interest, any late fees, and additional costs related to the foreclosure process itself. Redemption terms specify the timeline within which the borrower must pay this amount to restore ownership rights to the property in question. These terms may vary significantly based on state laws, with some jurisdictions allowing redemption periods of several months up to a year. Understanding the exact figures involved and the deadlines set forth by the foreclosure action is crucial for individuals seeking to navigate their options effectively and retain ownership of their home or property.

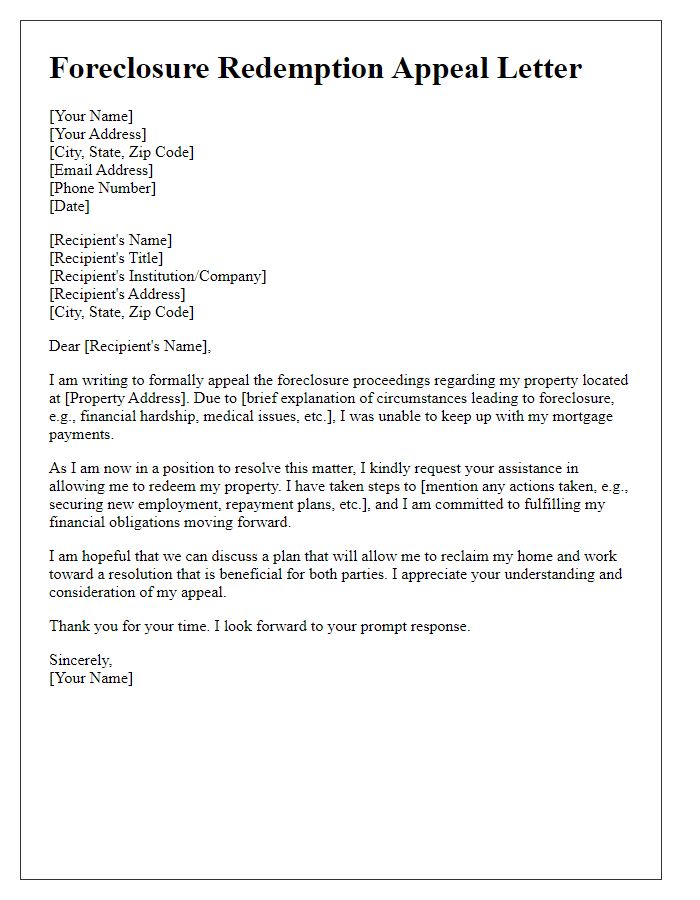

Timelines and Deadlines

Redemption foreclosure approval processes vary by state law and usually involve critical timelines. Property owners typically have a redemption period ranging from several months to a few years after a foreclosure sale, depending on local regulations. For example, states like Illinois offer up to two years for redemption, while others like Texas provide only a few days. Important deadlines include the initial notice of the foreclosure sale, which is often required to be posted between 21 days to 30 days prior to the sale. Upon the completion of the foreclosure auction, property owners must act swiftly, as the timeframe for redeeming the property can be quite limited. Adhering to these deadlines is essential to reclaim ownership, and missing even a single date can result in losing the property entirely.

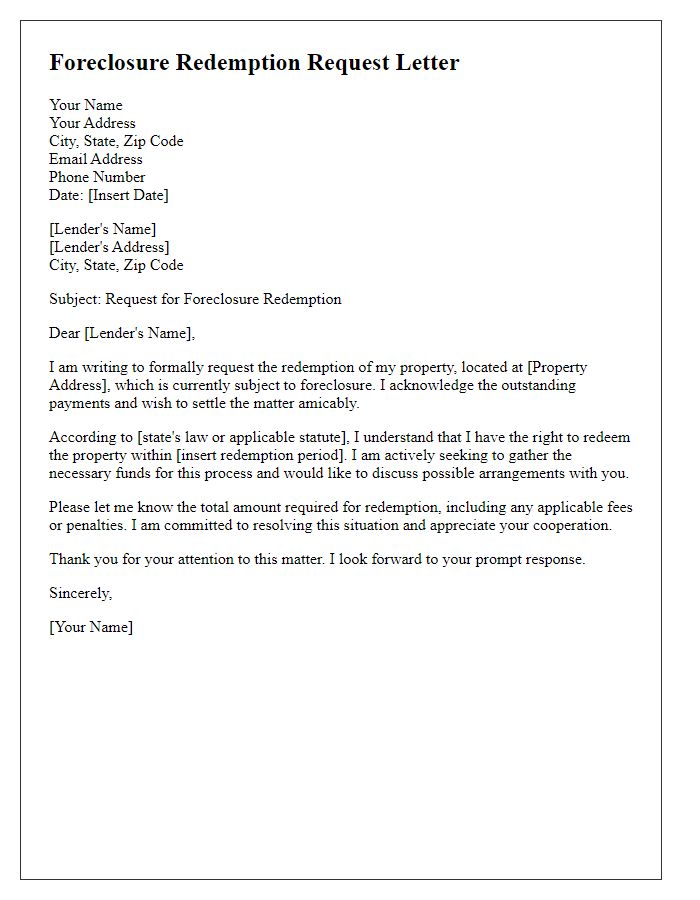

Instructions for Payment or Action

Redemption foreclosure is a legal process allowing mortgagors to reclaim property after foreclosure by paying off the owed amount. Timelines for redemption typically vary by jurisdiction; for example, in Texas, it may be 180 days post-foreclosure sale. Notifying the mortgage servicer promptly, often within a few days of receiving the foreclosure notice, is crucial. Payment must include the total amount due, including principal, interest, and any associated fees. Methods of payment usually accepted may include certified checks or wire transfers, depending on the lender's policy. Property address and mortgage account number must accompany all communications for clarity. Documentation confirming the redemption payment submission is vital for record-keeping.

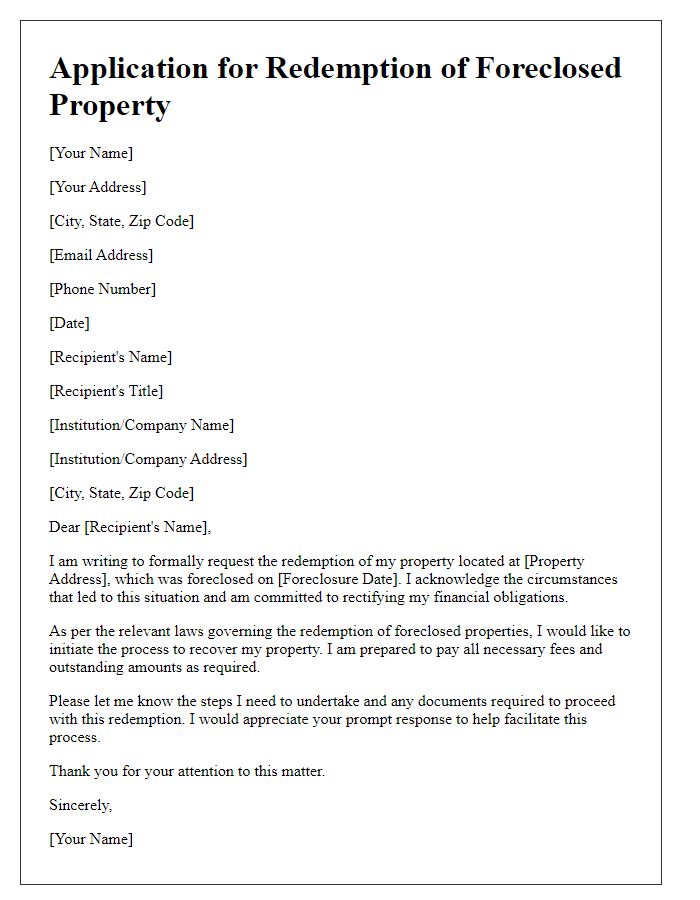

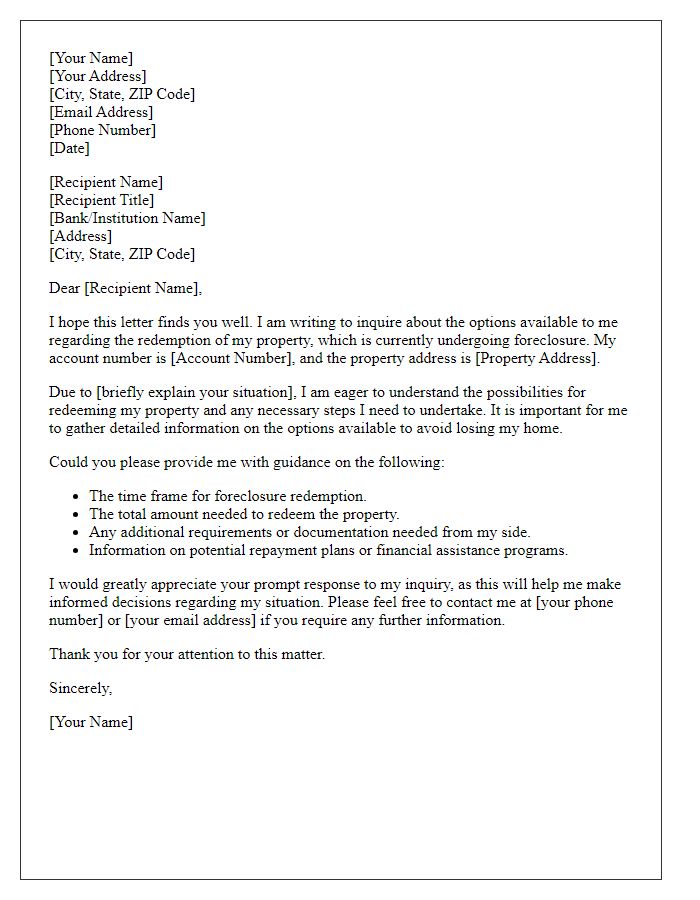

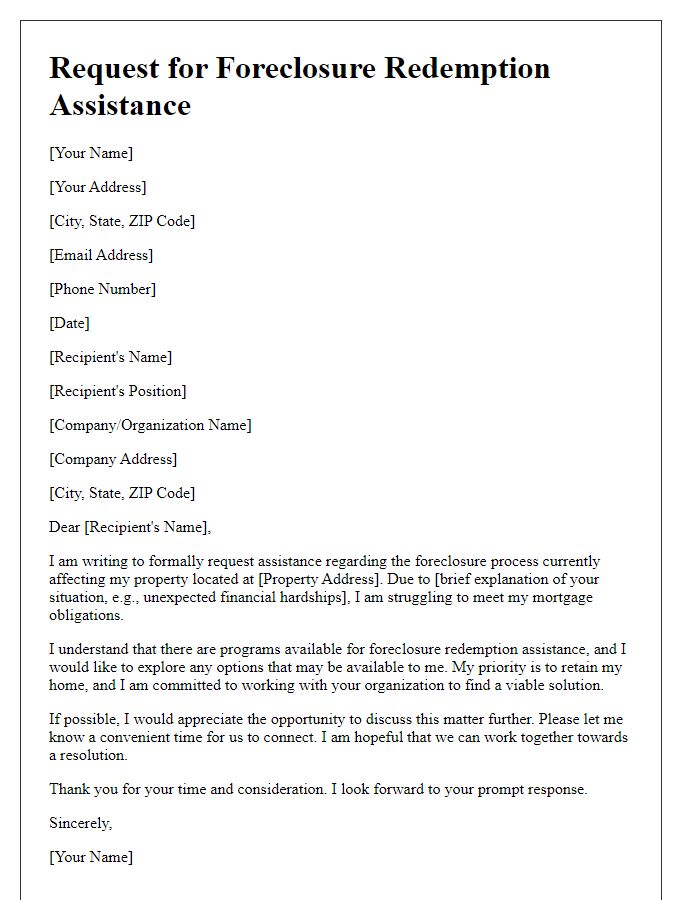

Contact Information for Assistance

Redemption foreclosure approval occurs when a property owner seeks to regain their property after a foreclosure process, typically within a certain time frame. This often involves paying off the outstanding balance, including interest and fees, to the lender, generally ranging from 90 to 120 days after the foreclosure sale, depending on state laws. The process may take place in various jurisdictions, such as California, Texas, or Florida, each with their own regulations and timelines. Homeowners facing foreclosure can seek assistance from organizations like the U.S. Department of Housing and Urban Development (HUD) or local housing counseling agencies, which can provide resources and guidance. It is imperative for homeowners to act quickly, gather necessary documents, and communicate effectively with their lender to facilitate the redemption process and avoid losing their property permanently.

Comments