Welcome to our guide on adjustable rate confirmations! If you're considering an adjustable-rate mortgage or have recently taken one out, understanding the importance of confirmation letters is crucial. These letters provide clarity on interest rate changes and help you stay informed about your financial commitments. So, whether you're a homeowner or a prospective buyer, let's dive deeper into how these confirmations impact your journey and what you need to know moving forward!

Subject line and header

Adjustable Rate Confirmation documents detail important financial information regarding loans, specifically the fluctuation of interest rates based on a specific index. Commonly, these loans may reference the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR), impacting monthly mortgage payments. The confirmation often includes the current interest rate, the adjustment frequency, and terms related to rate caps and floors. Borrowers need to understand how rate changes could affect their long-term financial planning, especially in fluctuating economic conditions, such as inflation indicators or central bank interest rate changes.

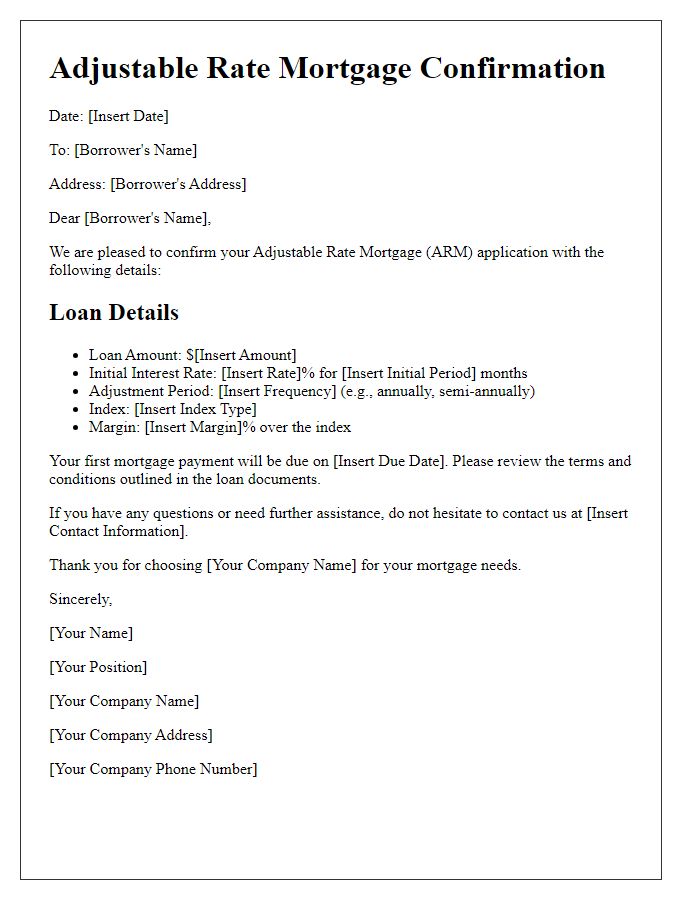

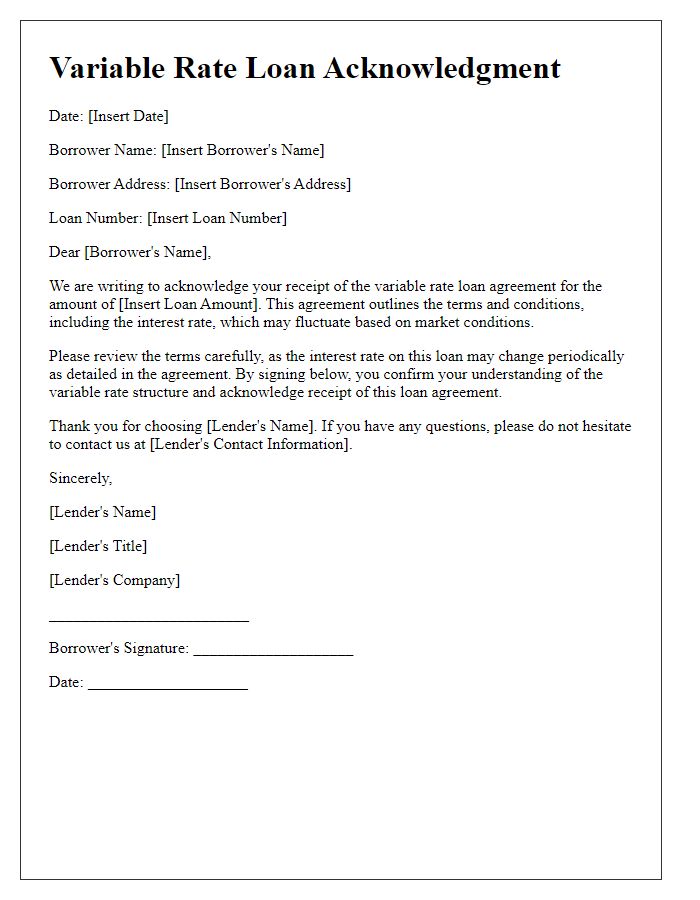

Borrower details and account information

Adjustable rate confirmation documents are critical in the mortgage process, detailing borrowers' identities, loan specifications, and interest rate terms. Key elements include borrower's full name, address, loan account number, and the loan's adjustable interest rate structure, which may be tied to a specific index such as the LIBOR or SOFR. These documents provide critical details regarding adjustment periods, such as annual or semi-annual rate changes, and caps on interest rate increases, ensuring borrowers are well-informed of potential payment fluctuations. Additionally, the confirmation includes the loan's origination date, the amortization schedule, and necessary disclosure information pertinent to the terms of the adjustable rate mortgage (ARM) agreement, offering transparency and clarity in the borrowing process.

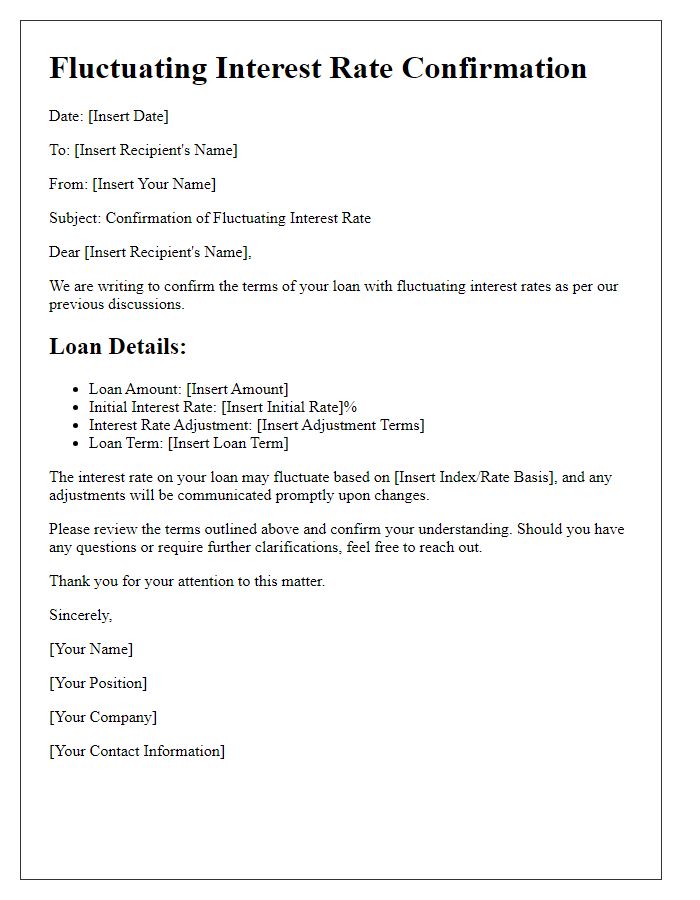

Loan terms and adjustment specifics

Adjustable-rate mortgages (ARMs) often involve detailed terms and conditions that outline how interest rates can change over time. Specifics like initial fixed-rate periods (usually ranging from 3 to 10 years), adjustment intervals (typically annually), and a specific index (such as the LIBOR or the Constant Maturity Treasury) can greatly influence monthly payment calculations. Caps on interest rate adjustments (like the lifetime cap, which may limit total increases to 5% over the life of the loan), and periodic caps (limiting how much the rate can increase at each adjustment, often one or two percentage points), provide borrowers with some level of predictability. Understanding these provisions is essential for maintaining financial stability and making informed decisions about refinancing or adjusting budgets over time.

Explanation of rate change and calculation method

Adjustable rate mortgages (ARMs) are subject to periodic interest rate adjustments based on underlying financial indices, which can lead to changes in monthly payments. For instance, a 30-year ARM may be linked to the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR). When the specified adjustment period arrives, typically annually after an initial fixed-rate period, the lender will recalculate the interest rate based on current index values and add a predetermined margin. For example, if the margin is 2% and the index rate is 3%, the new interest rate would be 5%. Borrowers should anticipate fluctuations in their monthly payment amounts, influenced by these adjustments that reflect economic conditions and market trends. Detailed documentation of these changes, along with calculations, is crucial for informed financial planning.

Contact information for inquiries and assistance

Adjustable rate mortgages (ARMs) often include terms that can significantly impact monthly payments. Affected borrowers may seek clarification about their loan terms. Contact information for inquiries and assistance can streamline communication. Essential details include company name, customer service phone number (typically available 8 AM to 8 PM ET), email address, and website link for real-time chat support. Personal account managers may also be designated for specific accounts, ensuring expedited service. Maintaining clear communication channels is vital for addressing concerns regarding rate adjustments and payment calculations effectively.

Comments