Are you feeling overwhelmed by multiple monthly payments and high interest rates? Debt consolidation could be the solution you need to simplify your finances and regain control. By combining your debts into a single loan with a lower interest rate, you not only reduce your monthly payments but also pave the way for a brighter financial future. Curious about how debt consolidation works and the benefits it can bring? Read on to discover how it can transform your financial landscape!

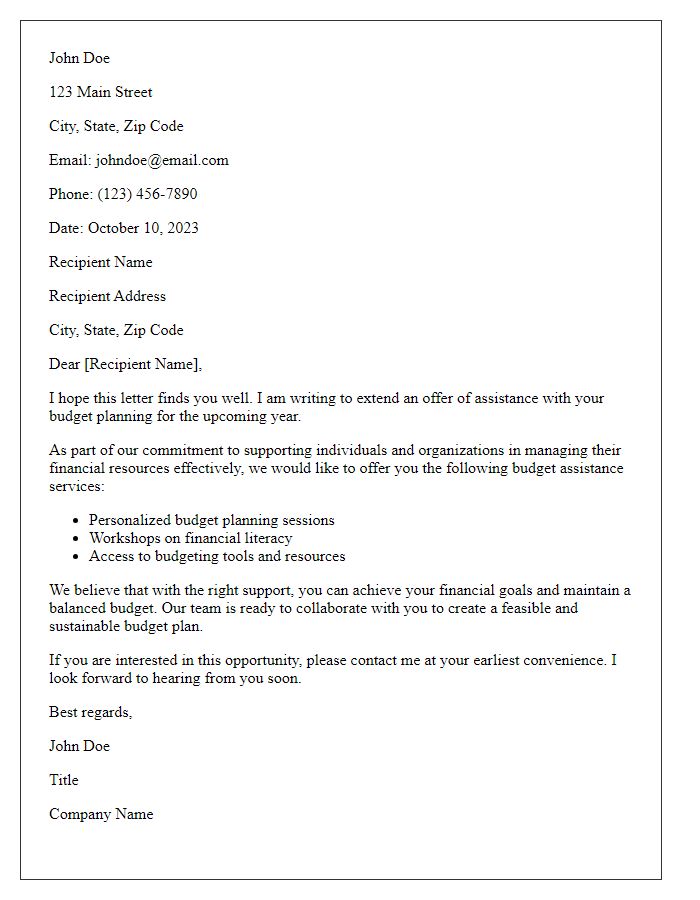

Personalization

Debt consolidation offers a strategic solution for individuals seeking financial relief from multiple debts, such as credit card balances (with average interest rates around 15-25%) and personal loans (which can vary significantly in terms of interest). This process enables borrowers to combine their existing obligations into a single loan, simplifying repayment with potentially lower interest rates, often between 6-10%, provided by lenders like credit unions or online financial institutions. Choosing a suitable consolidation method, such as a balance transfer credit card or a home equity loan (which allows access to home equity, currently averaging 75%, subject to appraisals), can significantly alleviate monthly payment stress, enhancing overall financial stability and paving the way for improved credit scores after consistent repayments.

Clarity and transparency

Debt consolidation offers can provide clarity and transparency for individuals burdened by multiple debts, such as personal loans, credit card balances, and medical bills. By consolidating these debts into a single loan, typically through a financial institution or credit union, borrowers can enjoy a more manageable repayment plan and potentially lower interest rates, reducing overall financial strain. In 2023, the average interest rate for personal loans hovers around 10.5%, compared to credit card rates that can exceed 20%. Effectively managing debt not only improves one's credit score over time but also simplifies financial management, allowing individuals to focus on budgeting and saving.

Interest rates and terms

Debt consolidation offers can significantly simplify financial management for individuals struggling with multiple loans or credit card debts. Consolidation loans typically feature lower interest rates (averaging between 4% to 8% depending on credit score) compared to credit card debts (which can exceed 20%). Borrowers can also benefit from fixed terms spanning 3 to 5 years, providing predictable monthly payments and reducing the risk of accumulating further debt. Additionally, reputable lenders or financial institutions can offer various repayment options, making the process more manageable for those seeking to regain financial stability. Understanding these key terms empowers individuals to make informed decisions regarding their debt relief strategies.

Benefits of consolidation

Debt consolidation offers a streamlined approach to managing multiple debts, reducing overall monthly payments, and potentially lowering interest rates. Individuals consolidating debts often experience improved financial clarity, as one fixed monthly payment replaces numerous variable payments. This method can enhance credit scores by decreasing credit utilization rates and ensuring timely payment on a consolidated loan. Additionally, debt consolidation programs, available through reputable agencies, often come with financial counseling, offering strategies to prevent future accrual of debt. Overall, pursuing debt consolidation can lead to significant savings and a more manageable path to financial stability.

Call to action and contact information

Debt consolidation services can greatly benefit individuals struggling with multiple high-interest debts, such as credit cards and personal loans. By consolidating these debts into a single, lower-interest loan, individuals can potentially reduce monthly payments and simplify their financial management. Companies offering debt consolidation, like National Debt Relief, often focus on assisting clients in negotiating better terms with creditors, aiming for reduced interest rates or settlements. Contact options typically include phone calls, emails, or online chat services for personalized consultations. Individuals seeking assistance should act promptly, as addressing debt issues early can lead to more favorable outcomes.

Comments