Are you contemplating removing Private Mortgage Insurance (PMI) from your home loan? Understanding the PMI removal guidelines can significantly boost your financial freedom and lower your monthly payments. In this article, we'll break down the key steps you need to take to qualify for PMI cancellation and provide tips to streamline the process. Keep reading to discover how you can ease your mortgage burden and pave the way to a more affordable homeownership experience!

Loan-to-Value (LTV) Ratio

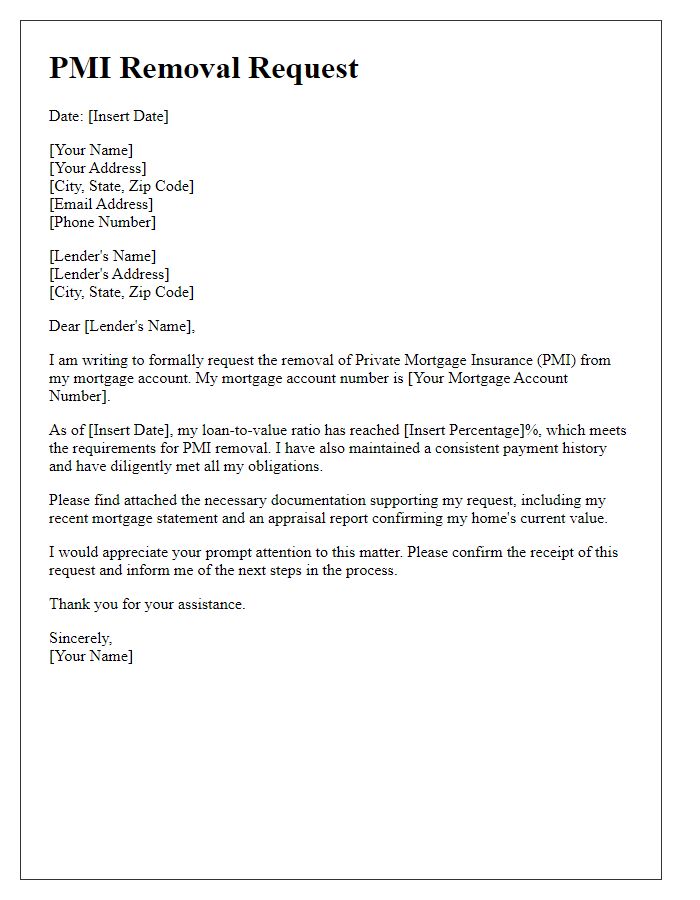

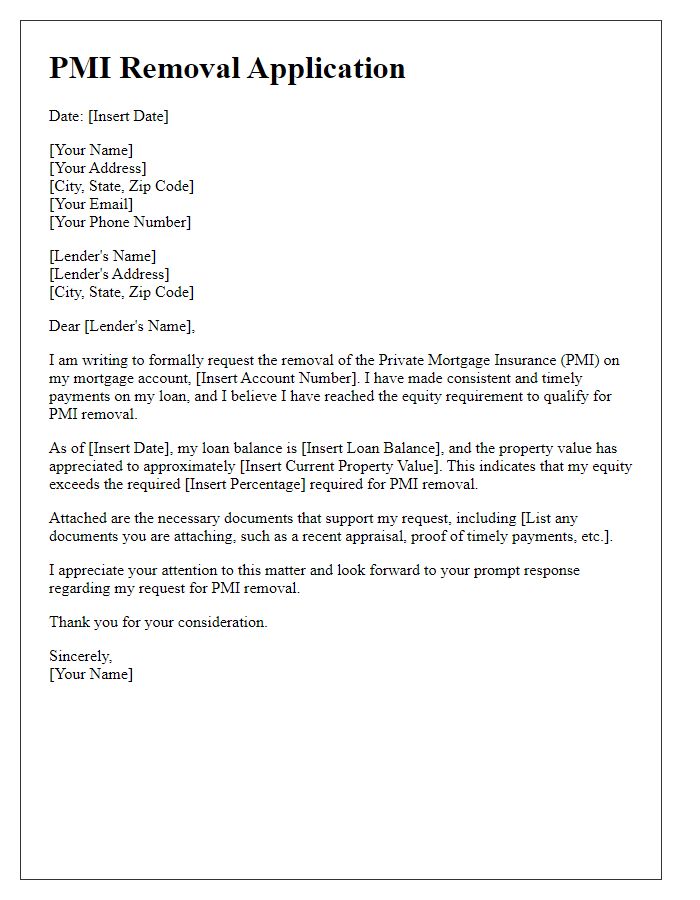

Private Mortgage Insurance (PMI) is typically required for borrowers whose Loan-to-Value (LTV) Ratio exceeds 80%. An LTV Ratio represents the ratio of the loan amount to the appraised value of the property. For instance, if a home is valued at $300,000 and the borrower has a loan of $270,000, the LTV Ratio would be 90%. To remove PMI, a borrower typically needs to reach an LTV Ratio of 80% or lower. This may involve a combination of regular mortgage payments, home appreciation, and potential refinancing options. Borrowers should regularly monitor their property values, which can be verified through local real estate sales or property appraisals. Additionally, fulfilling specific requirements from lenders, such as making timely payments over a certain period, ensures compliance with PMI removal guidelines.

Payment History

Payment history plays a crucial role in the removal of Private Mortgage Insurance (PMI) for homeowners with conventional loans, typically issued by lenders like Bank of America or Wells Fargo. Timely payments, often defined as on-time mortgage payments for at least 12 consecutive months, contribute significantly to the evaluation process. A favorable payment history, characterized by no late payments reported to credit bureaus such as Experian or TransUnion, can enhance a borrower's eligibility for PMI cancellation. Moreover, maintaining a loan-to-value (LTV) ratio of 80% or lower, achieving through consistent equity build-up via mortgage payments, accelerates PMI removal, increasing homeowners' financial benefits.

Property Appraisal

Property appraisal is a crucial step in the process of removing Private Mortgage Insurance (PMI), especially for homeowners aiming to reduce monthly payments and overall mortgage costs. Important aspects include determining the property's current market value, which must be assessed by a licensed appraiser using comparable sales data, local market trends, and property condition. Lenders typically require an appraisal if the homeowner believes their loan-to-value ratio has reached 80% (meaning the homeowner has at least 20% equity in the property). Furthermore, the appraisal must adhere to the guidelines established by the Homeowners Protection Act, ensuring compliance with federal regulations. The appraiser's comprehensive report not only influences PMI removal decisions but also impacts potential refinancing options for property owners.

Loan Type and Terms

Private Mortgage Insurance (PMI) removal guidelines are essential for homeowners seeking to reduce monthly expenses associated with conventional loans. Typically, PMI is required when the down payment is less than 20% of the property's purchase price, which in many cases can exceed thousands of dollars annually. Homeowners must maintain a loan-to-value (LTV) ratio below 80% for PMI cancellation; this generally occurs through increased property value, such as market appreciation or home renovations. Documentation, like an official appraisal reflecting current value and loan statements, is necessary to support the request for PMI removal. Lenders, such as Bank of America or Wells Fargo, often have specific requirements regarding the timeline and submission of the request, so understanding individual institutional processes is vital. Homeowners should continuously monitor property values and assess opportunities to eliminate PMI efficiently to maximize financial savings.

Servicer's Requirements

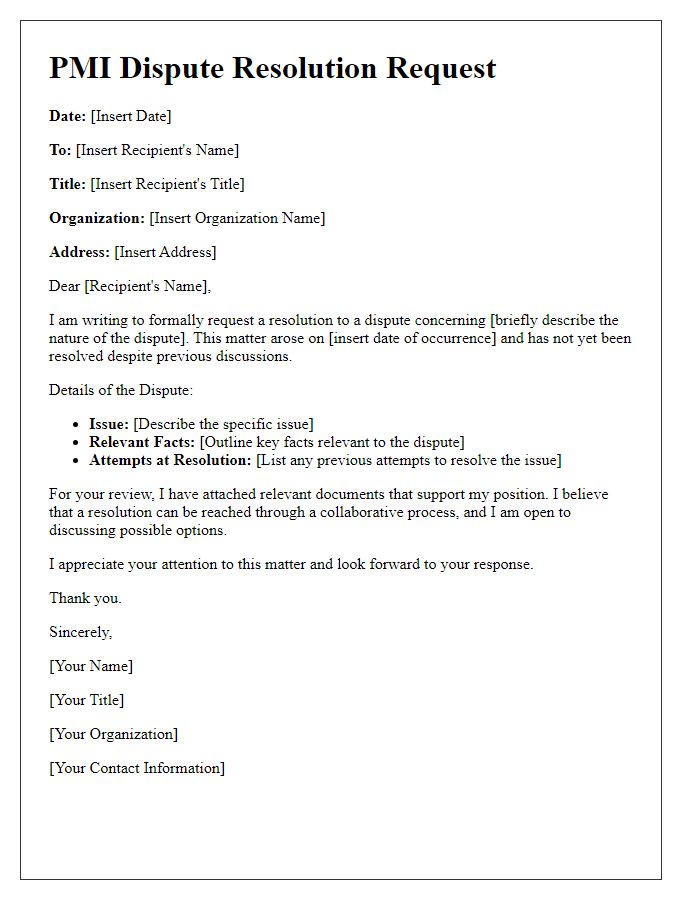

Private Mortgage Insurance (PMI) removal guidelines establish specific servicer requirements for borrowers seeking to eliminate this additional cost. The borrower must fulfill specific criteria, such as maintaining at least 20% equity in the property, based on the current appraised value. An appraisal conducted by a certified appraiser (typically licensed by the state) may be necessary to determine this value, especially in markets like California or New York, where property values can fluctuate significantly. Consistent and timely mortgage payments (with no late payments in the last 12 months) are critical for eligibility, demonstrating the borrower's reliability. Servicers must also provide clear communication detailing the borrower's rights and responsibilities regarding PMI removal, ensuring transparency throughout the process. Furthermore, any outstanding requests for documentation or additional requirements must be addressed promptly to facilitate an efficient PMI cancellation.

Comments