Are you feeling overwhelmed by the threat of foreclosure? You're not alone, as many homeowners face this daunting challenge. However, there are effective options available to help you avoid losing your home, and our detailed guide will walk you through them. So, let's dive in and explore these possibilities together!

Personalized Borrower Information

Borrowers facing foreclosure may find relief through various avoidance options tailored to their unique situations. These options include loan modifications, which can adjust interest rates or extend loan terms to reduce monthly payments. For instance, a borrower with a $250,000 mortgage facing financial hardship may negotiate a modification that lowers their interest rate from 5% to 3%, significantly decreasing their monthly obligation. Another possibility is forbearance, providing temporary relief by pausing or reducing payments for a specified period. For example, a five-month forbearance could ease immediate financial strain. Additionally, short sales allow borrowers to sell properties for less than the mortgage balance with lender approval, preventing foreclosure and minimizing impact on credit scores. Properties in areas such as Detroit or Miami, where real estate prices have fluctuated, often benefit from this route. Engaging with nonprofit housing counseling services can also offer personalized assistance and resources tailored to individual circumstances, fostering a supportive pathway toward resolving financial difficulties.

Explanation of Financial Hardship

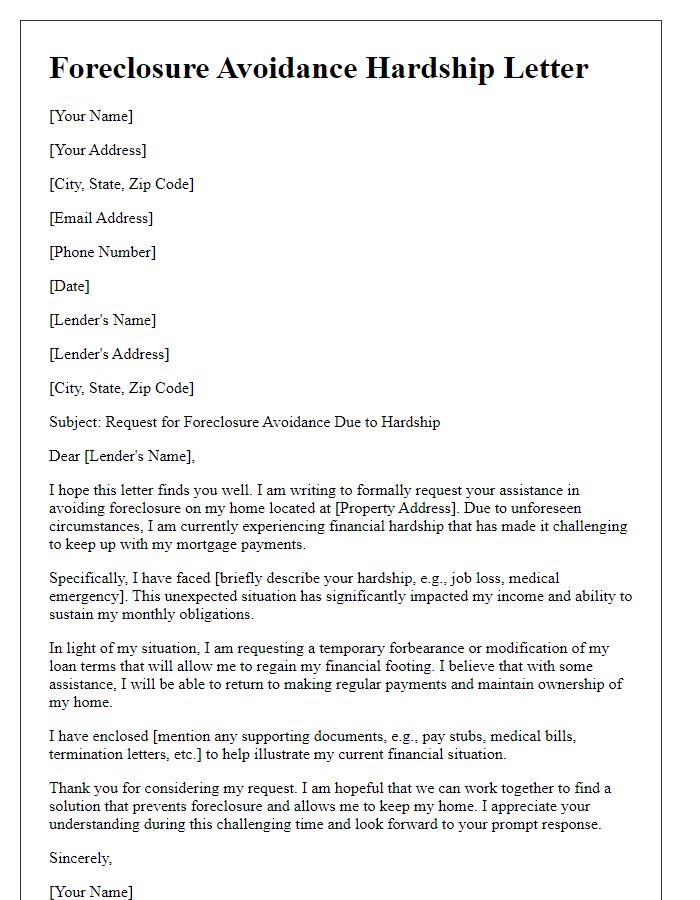

Financial hardship often results from unforeseen circumstances, impacting individuals' ability to meet mortgage obligations. Events such as job loss, medical emergencies, or significant repairs can strain finances. For instance, a sudden layoff from a job at a major corporation triggers immediate cash flow issues, leaving homeowners struggling to pay monthly installments. The median cost of living in a city (e.g., $2,500 per month) can further exacerbate the situation, especially when combined with extraordinary expenses. Additionally, the rising interest rates (currently averaging 6% nationally) can increase monthly payments, making it more challenging for families to manage their budgets. These factors contribute to a distressed financial state, prompting homeowners to seek foreclosure avoidance options to stabilize their situations.

Available Foreclosure Prevention Options

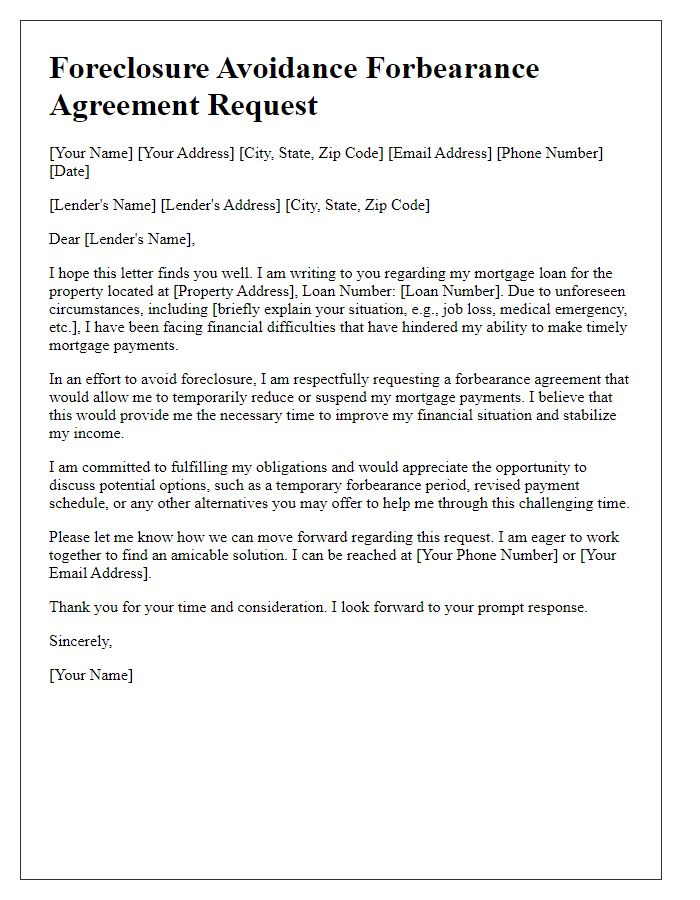

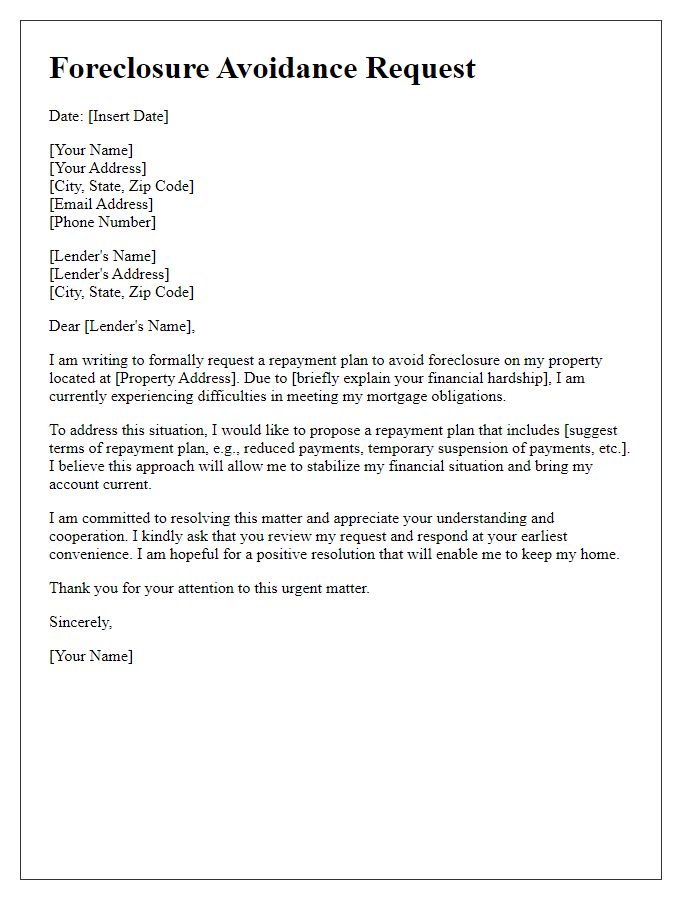

Homeowners facing foreclosure can explore various options to prevent losing their property. Loan modification programs, offered by lenders and government agencies like the Home Affordable Modification Program (HAMP), allow for adjustments to mortgage terms, potentially lowering monthly payments. Short sales involve selling the home for less than the mortgage balance, with lender approval, minimizing losses on both sides. Repayment plans enable borrowers to catch up on missed payments by adding a portion to future installments. Forbearance agreements provide temporary relief, allowing homeowners to pause or reduce payments during financial hardship, followed by a structured repayment plan. Additionally, programs from organizations like the U.S. Department of Housing and Urban Development (HUD) provide resources and counseling to assist homeowners in navigating these options effectively.

Instructions for Completing Forms

Foreclosure avoidance options provide individuals facing potential home loss with various alternatives, helping them retain their properties and stabilize their financial situations. Specific forms associated with these options, such as the mortgage assistance application, need accurate completion to ensure effective processing by lenders or non-profit organizations assisting borrowers. Individuals must gather pertinent documentation, including income verification, bank statements (usually covering the last two to three months), and details of monthly expenses to demonstrate economic hardship. Deadlines for submission may vary depending on state laws, often ranging from 30 to 90 days after receiving a foreclosure notice. Understanding available options, such as loan modification, repayment plans, or short sales, can significantly influence outcomes. Borrowers should consult resources from the U.S. Department of Housing and Urban Development (HUD) or local housing counseling agencies for further guidance and support.

Contact Information for Assistance

Foreclosure avoidance options are critical for homeowners facing financial distress. Many organizations offer assistance, such as the U.S. Department of Housing and Urban Development (HUD) with certified housing counselors available nationwide (over 2,000 offices). The Making Home Affordable program provides resources for modification and refinancing options, aimed to reduce monthly payments and prevent foreclosure. Local charities, such as the Salvation Army, can offer emergency financial assistance, while state-specific homeowner assistance programs provide grants and loans tailored to individual circumstances. Contacting a certified legal professional may also clarify foreclosure rights and options available in various states, such as California's Homeowner Bill of Rights, which protects homeowners from certain unfair foreclosure practices. Timely intervention, usually within 30 days of missed payments, can significantly improve the chances of successful resolution and home retention.

Letter Template For Foreclosure Avoidance Options Samples

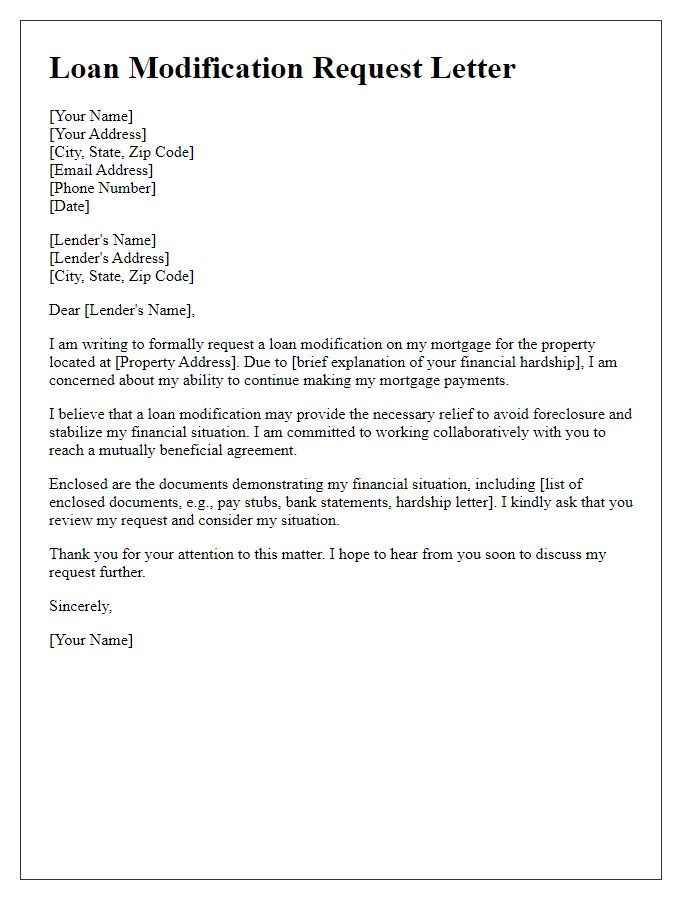

Letter template of foreclosure avoidance through loan modification request.

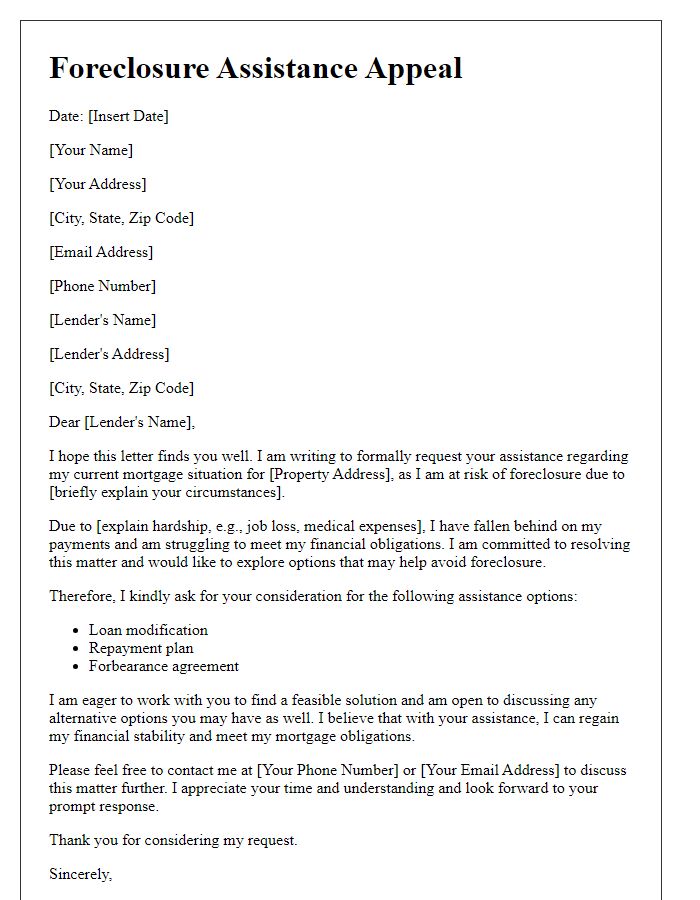

Letter template of foreclosure avoidance appealing to lender for assistance.

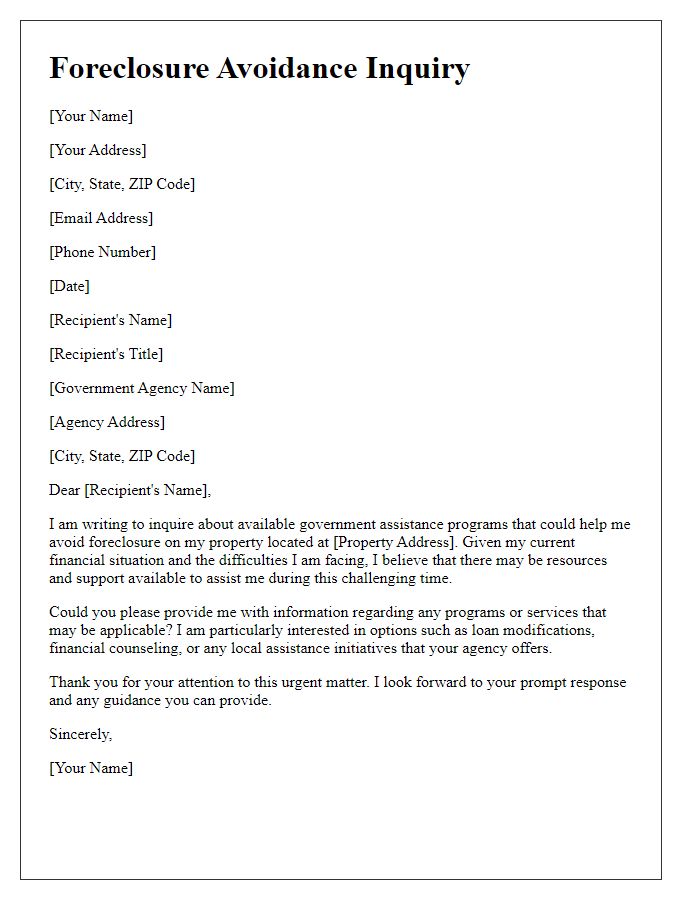

Letter template of foreclosure avoidance inquiring about government assistance programs.

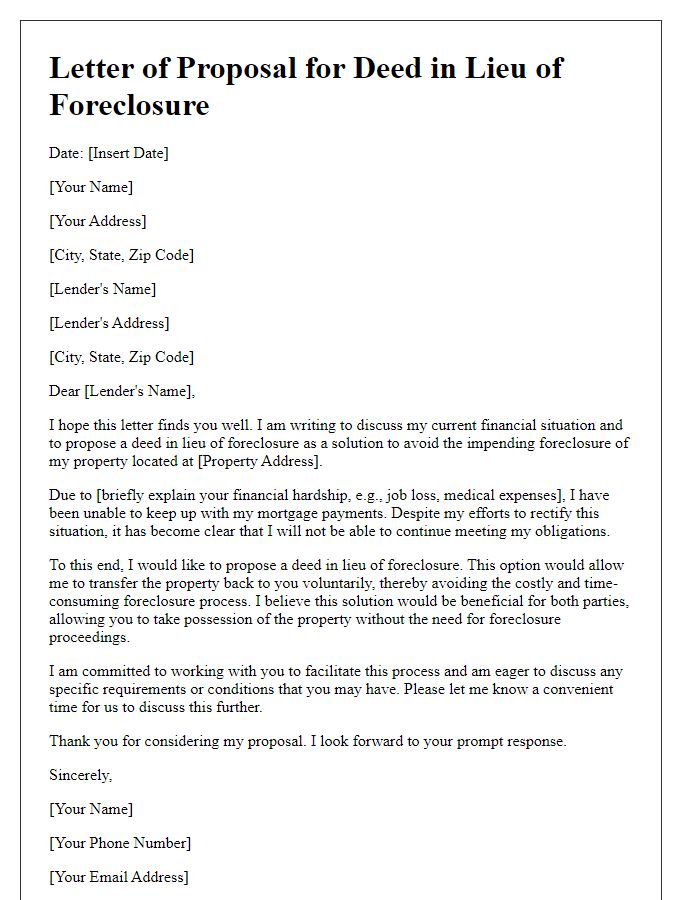

Letter template of foreclosure avoidance proposing a deed in lieu of foreclosure.

Comments