Are you ready to unlock the potential of your home with a renovation project? Navigating the process of escrow release for renovations can sometimes feel overwhelming, but it doesn't have to be. With the right guidance and a clear understanding of the necessary steps, you can ensure that your funds are released smoothly and efficiently. So, let's dive into the essentials of securing your renovation escrow release and set you on the path to transforming your living space!

Project Details and Scope

Renovation projects in homes often require a meticulous escrow release process. The selected renovations might include kitchen upgrades (new countertops and energy-efficient appliances), bathroom remodels (modern fixtures and tile work), and structural improvements (roof replacement or foundation repairs). Each project segment necessitates detailed communication between contractors and property owners to ensure timely progress. Important milestones, such as inspections and approvals from local authorities or homeowner associations, can impact the release of escrow funds. Additionally, adherence to budgets (often ranging from 10% to 20% over projections) and timelines (with projects averaging three to six months) is crucial to facilitate the financial aspects of renovation completion. Homeowners must handle documentation meticulously to ensure compliance with overarching escrow agreements.

Contractor Information and Credentials

Renovation projects often require a detailed understanding of the contractor's qualifications and credentials, such as licenses and certifications. Registered contractors may hold a state license, ensuring compliance with local regulations. Credentials may include certifications from recognized bodies like the National Association of Home Builders (NAHB), confirming adherence to industry standards. Professionals might also carry insurance policies, including liability and worker's compensation coverage, safeguarding against potential accidents during the renovation process. Additionally, successful completion of previous projects can be documented through references or portfolios, reflecting the contractor's expertise and reliability in executing similar works. Understanding these details contributes significantly to the escrow release process, ensuring that funds are disbursed to a qualified entity.

Payment Terms and Conditions

Renovation projects often require careful financial planning, particularly regarding the release of escrow funds. In typical agreements, payment terms stipulate the conditions under which escrow funds, held for renovation work, can be released. These funds, often a portion of the total project cost, may be disbursed upon the completion of specific project milestones such as plumbing installations or electrical systems upgrades. Inspection reports from certified professionals, usually required after each completed phase, validate that the work meets contractual specifications. Moreover, terms often designate a specific percentage of work completion--commonly 20-30%--as a trigger for the release of funds. Failure to meet these criteria could result in delays, retention of funds, or legal disputes, stressing the importance of clear communication between all parties involved in the renovation process.

Inspection and Approval Process

Renovation projects often require careful oversight, particularly regarding the disbursement of escrow funds. An inspection and approval process typically involves a detailed evaluation of completed work against contractual agreements. Licensed inspectors, often hired by the homeowner or escrow company, assess the quality and completeness of renovations, checking for compliance with local building codes (specific regulations vary by city). After inspection, a formal approval is documented, enabling the release of funds from the escrow account designated for renovation expenses. Failure to meet satisfactory standards can result in withholding payments, necessitating additional corrective actions before fund disbursement. Timely inspections can expedite the process, ensuring that contractors receive payment promptly and homeowners achieve their desired property improvements efficiently.

Legal and Compliance Requirements

Renovations involving escrow release require adherence to specific legal and compliance frameworks, such as the Real Estate Settlement Procedures Act (RESPA) guiding financial transactions in the United States. Proper documentation, including contractor bids and detailed project scopes, must be collected to ensure transparency and protect all parties' rights. Escrow accounts, often held in trust by third-party institutions, facilitate the secure handling of funds during renovation phases, ensuring that released amounts align with completed work milestones. Regular inspections, mandated by local building codes, confirm adherence to safety and quality standards, preventing future liability issues. Timely communication with stakeholders, including contractors and property owners, ensures compliance with local regulations governing construction permits and inspections, fostering a smooth release process.

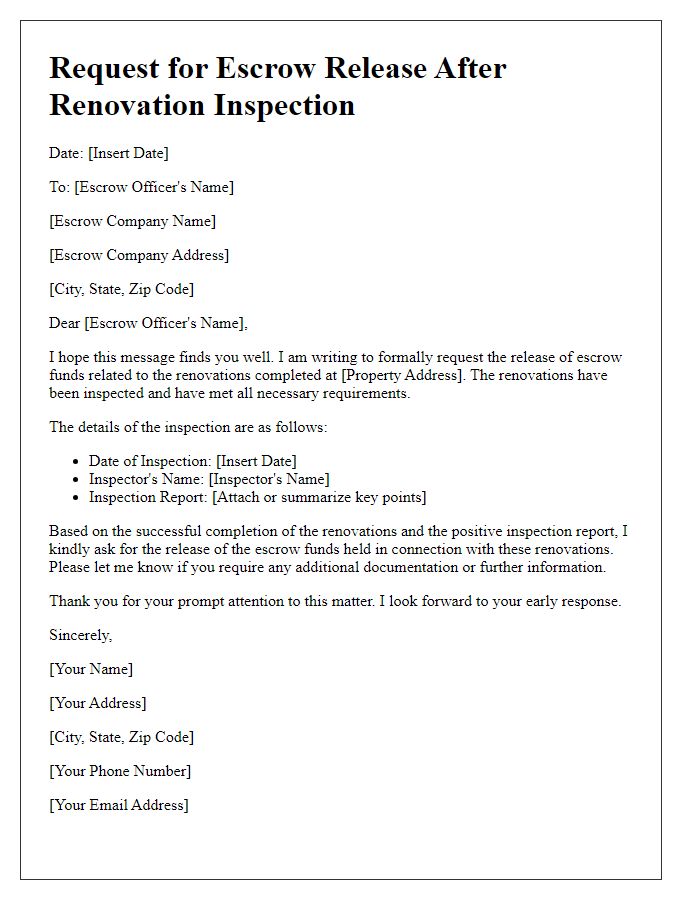

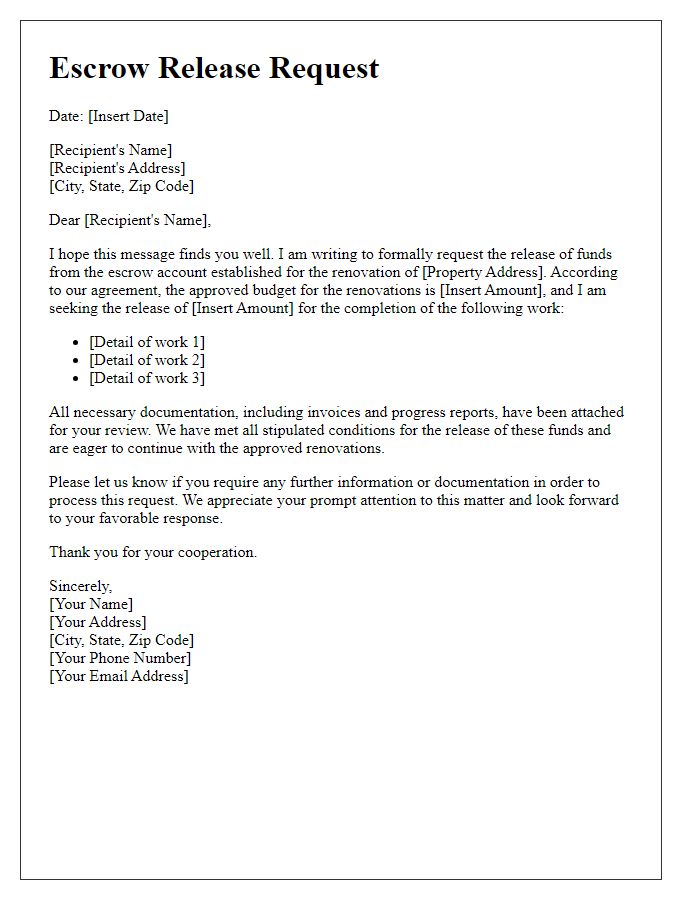

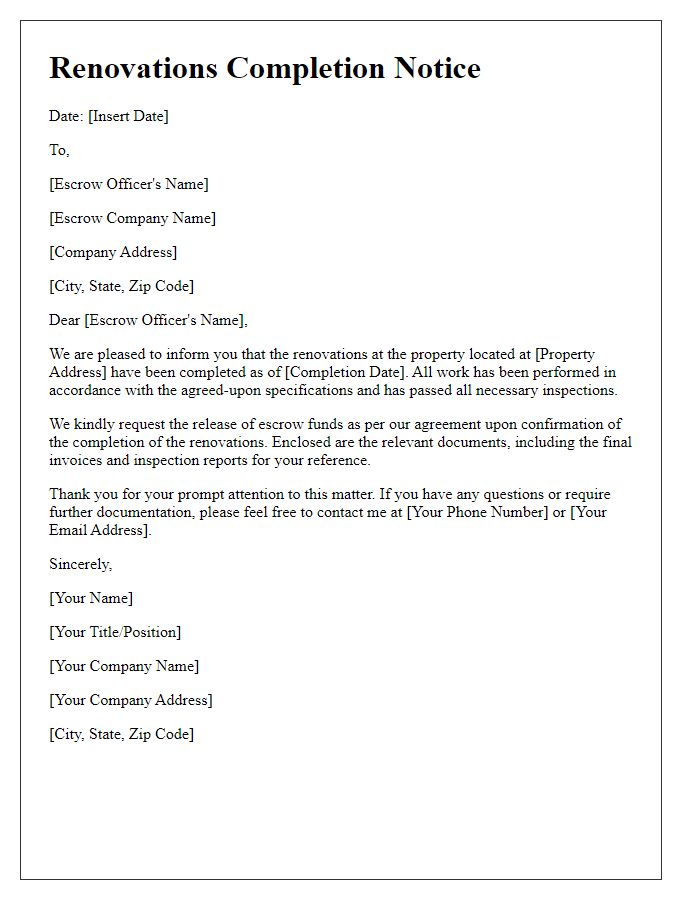

Letter Template For Renovations Escrow Release Samples

Letter template of request for escrow release after renovation inspection.

Comments