Are you looking to simplify your financial life? Requesting a payoff statement is a crucial step in ensuring you're on the right track with your loans and debts. In this article, we'll guide you through the essentials of crafting a clear and effective letter to request your payoff statement. So, let's dive in and get you one step closer to financial freedom!

Contact Information

To secure a precise payoff statement for a loan or mortgage, it is essential to provide specific contact information to the lending institution. Key details include your full name, which helps identify your account accurately. Next, include the loan account number, typically found on monthly statements, as it directly links the request to your loan. Additionally, providing a reliable phone number enables swift communication in case of any inquiries or clarifications. Lastly, an email address offers a convenient channel for receiving the payoff statement promptly. All these elements are crucial for obtaining timely and accurate financial information.

Account Details

Payoff statements are essential documents detailing the final payment amount required to settle a debt, typically used for loans, mortgages, or credit accounts. Account details, including the account number, outstanding balance (which may involve various fees or interest rates), and payment terms (such as due dates or payoff duration), play a vital role in accurately determining the total payoff amount. This statement can often be requested from financial institutions, like banks or credit unions, and is usually needed during significant financial transactions such as refinancing or selling property.

Payoff Amount Request

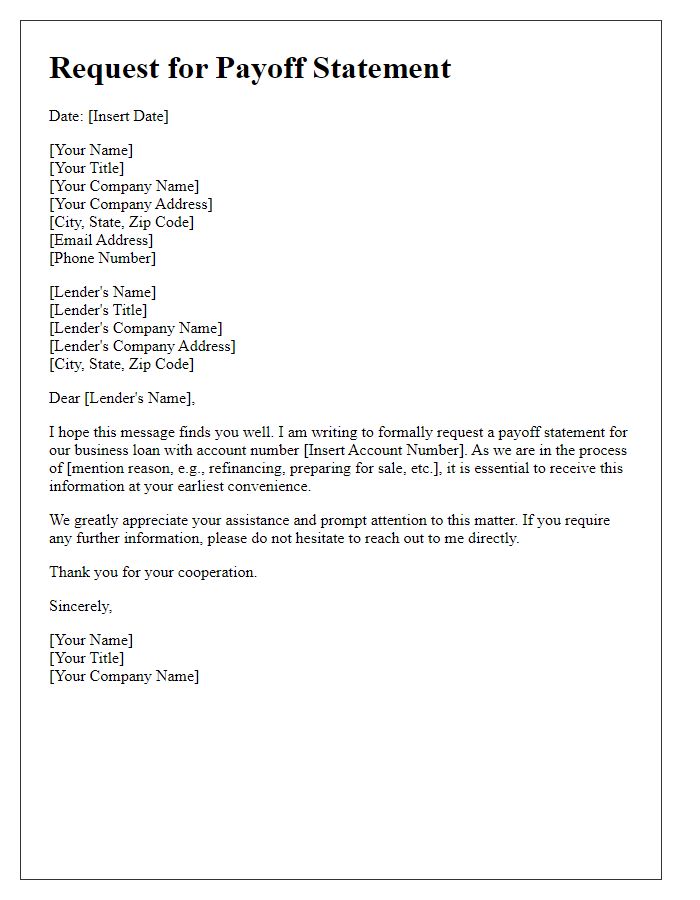

A payoff statement request, typically required by borrowers, seeks to obtain the exact amount needed to pay off a loan, including interest and fees. This statement is crucial during refinancing procedures or property sales. Borrowers usually send this request to lenders by specifying the loan number associated with the mortgage or personal loan, ensuring clarity. The payoff amount can change daily due to accrued interest, making timely communication essential. Additionally, including the borrower's account details (name, address, contact number) helps the lender process the request efficiently. Legal documents, such as a release form, may also be required to authorize the provision of this information.

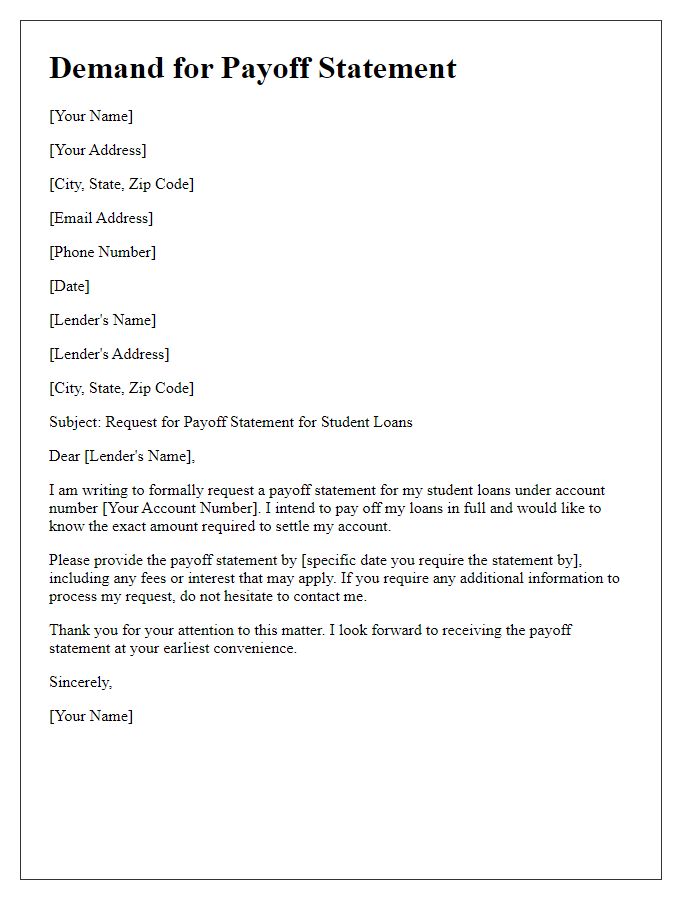

Deadline for Response

A payoff statement request serves as an important financial document, primarily utilized in real estate transactions, to indicate the total amount owed on a loan. This statement includes specific details such as principal balance, interest rate, and any additional fees. Financial institutions like banks or mortgage lenders typically process these requests. A deadline for response may be crucial, ensuring that the requesting party has the necessary information to complete a property sale or refinancing before a contractual deadline. Often, the urgency due to closing dates can affect the timing of responses, with a standard turnaround time ranging from 24 to 72 hours depending on the institution's policies.

Signature and Date

A payoff statement request should include relevant details such as the loan number, borrower's name, and the lender's contact information for an accurate response. The request should clearly state the purpose of the inquiry, specifying the date by which the statement is needed. Including a telephone number and email address can facilitate quicker communication. Ensure to include a signature line with space for the borrower's printed name and the date of the request to authenticate the document.

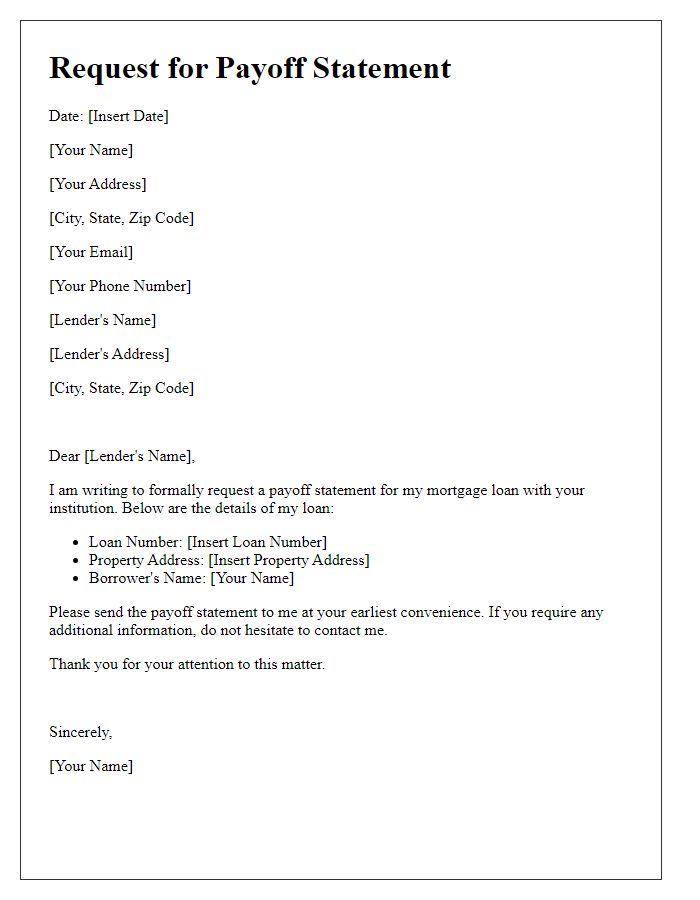

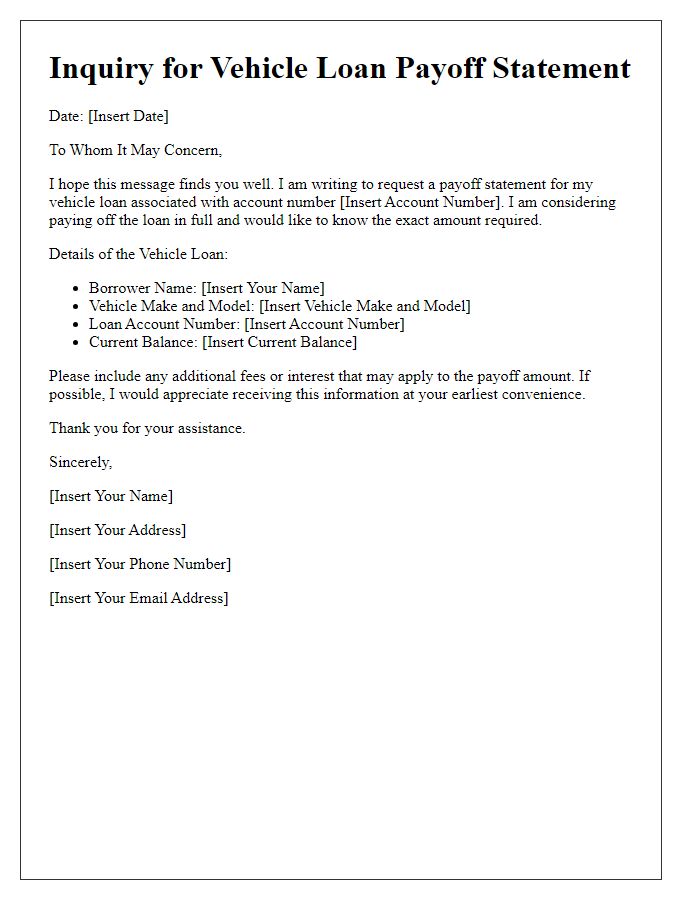

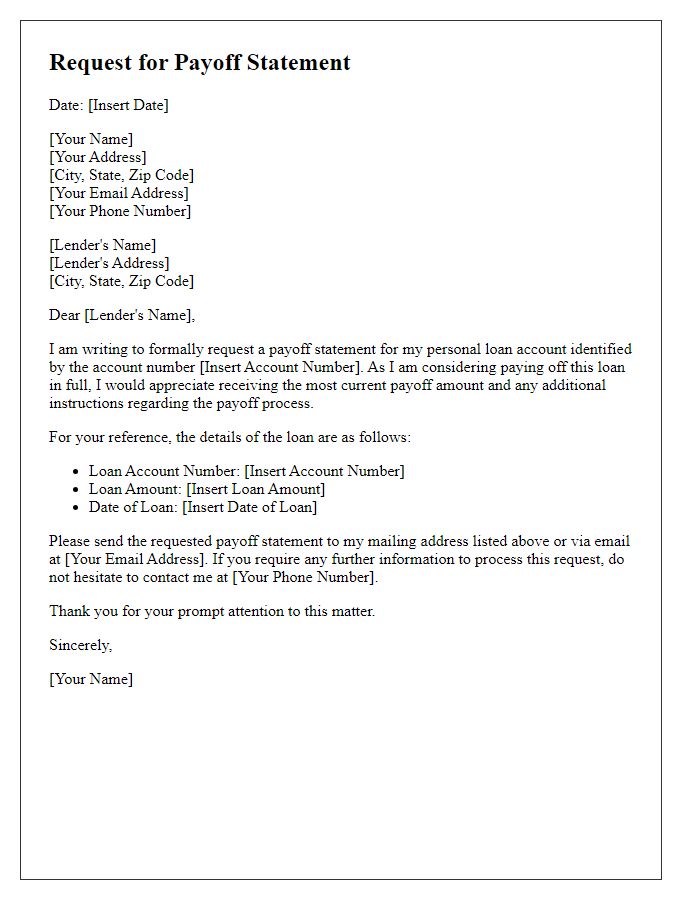

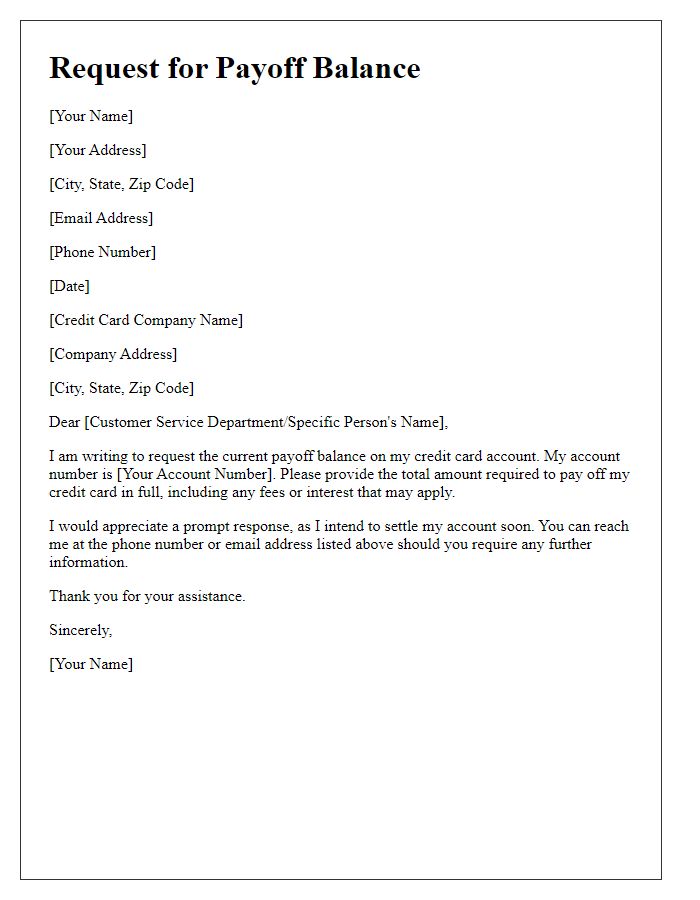

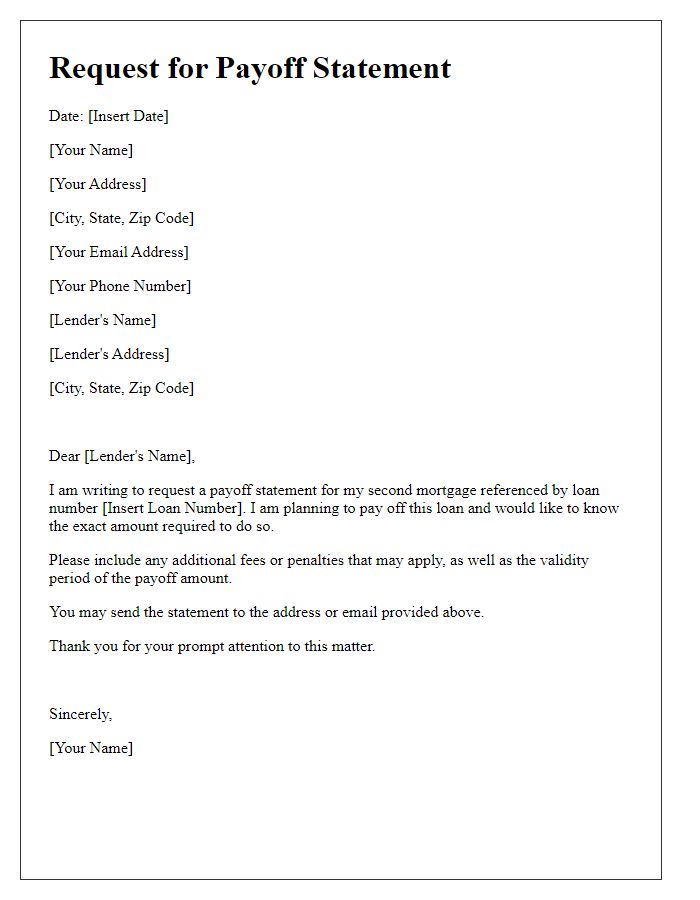

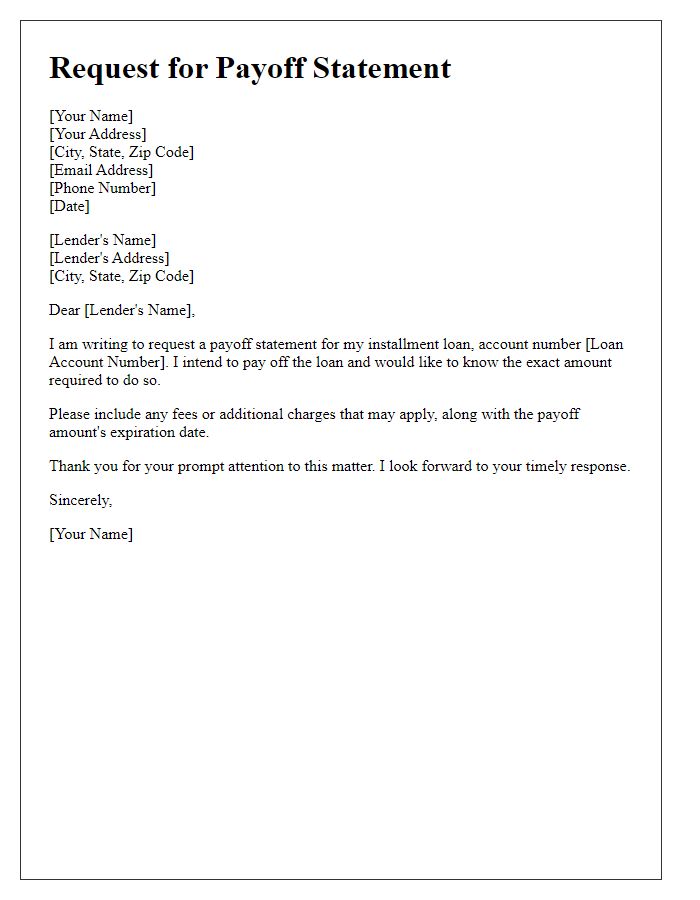

Letter Template For Payoff Statement Request Samples

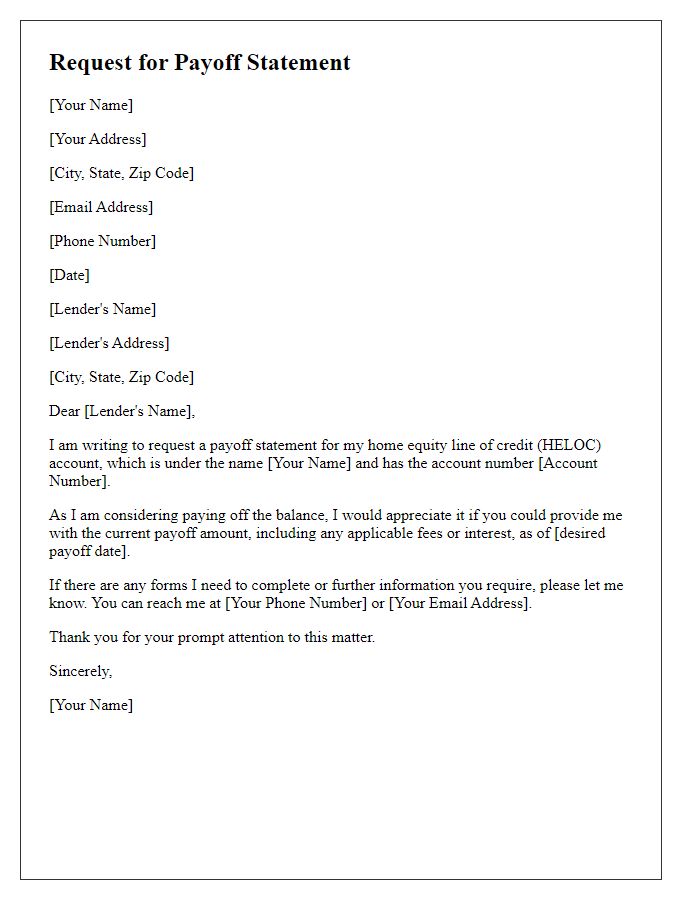

Letter template of request for a payoff statement related to a home equity line of credit.

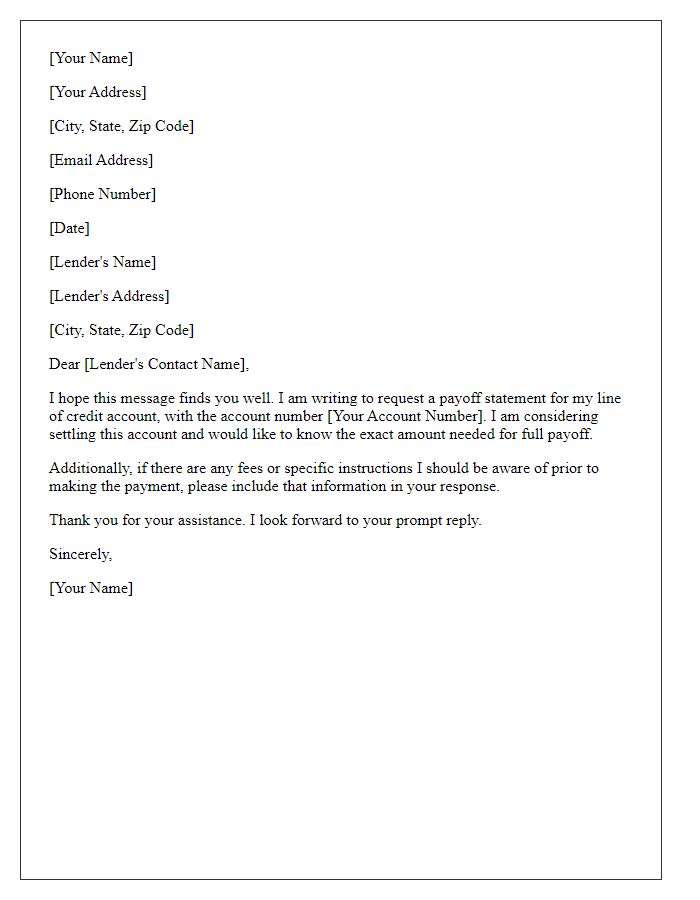

Letter template of inquiry for payoff statement pertaining to a line of credit.

Comments