Have you ever found yourself scrambling to understand an escrow shortage? It can feel overwhelming when you receive that unexpected notice, but don't worryâyou're not alone in this predicament. In this article, we'll break down what an escrow shortage means and how it can impact your finances. Stick around to learn more about your options and steps you can take to address the issue effectively!

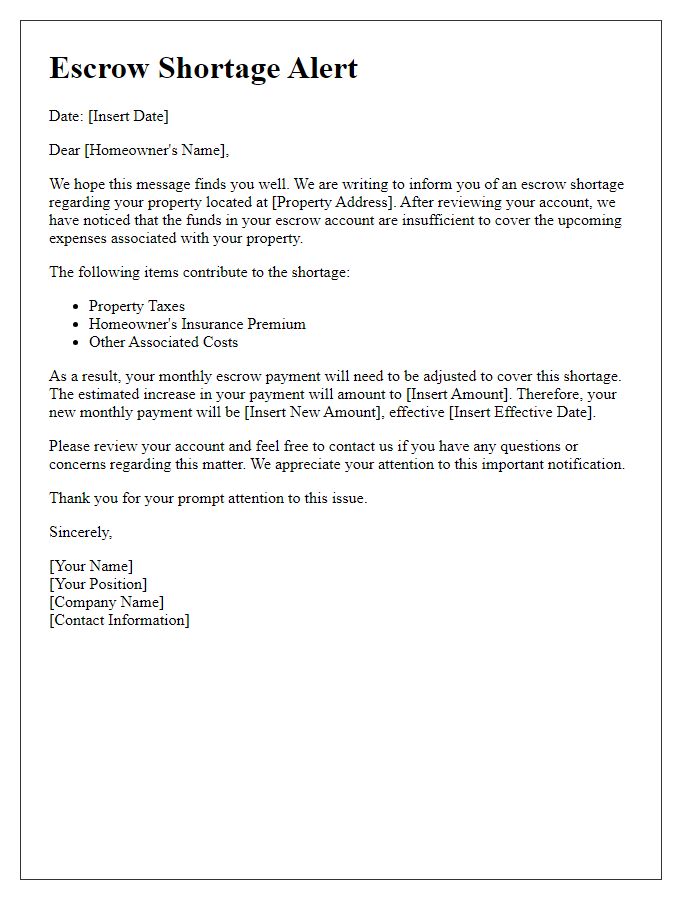

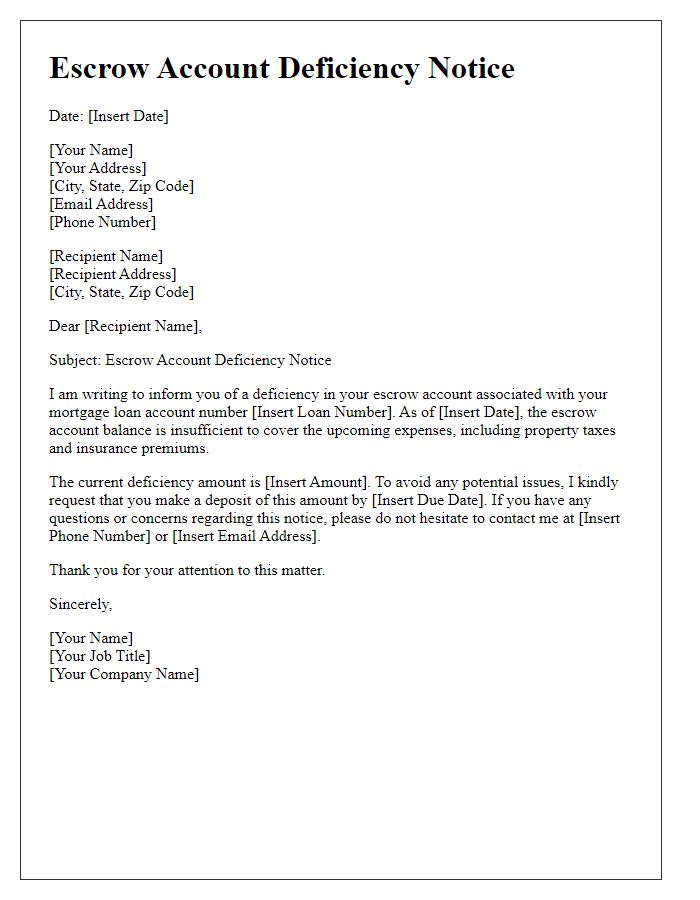

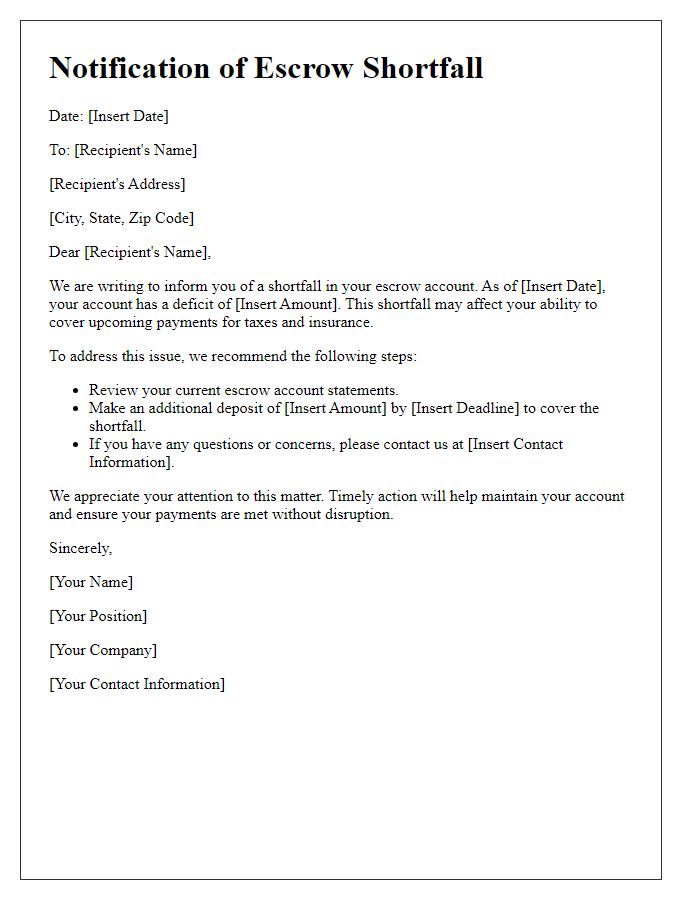

Clear Subject Line

Homeowners may face escrow shortages, which occur when the balance in an escrow account is insufficient to cover property taxes or homeowner's insurance premiums. These shortages can lead to unexpected bills and possible payment adjustments. In some states, homeowners may receive a notification detailing the specific deficit in their escrow account, often including figures for upcoming tax due dates and insurance costs. Property owners should review their escrow payment schedule, considering factors like rising property taxes or insurance rates that may contribute to the shortage. Adjustments to monthly mortgage payments can help address this issue, ensuring that future obligations are met without financial strain.

Recipient's Personalization

Escrow shortages can occur when actual property taxes or insurance premiums exceed the estimated amounts included in monthly mortgage payments. Notifications typically sent to homeowners detail the discrepancies noted during annual escrow analysis, which can affect the monthly payment amount. The event of notification emphasizes the need for prompted adjustments to maintain adequate escrow balances, usually totaling around 1/12 of anticipated annual expenses. For instance, a shortage of $300 means an increase in monthly payments by $25, ensuring the account is funded properly. It is crucial for homeowners to understand the implications of such shortages on housing expenses, and take prompt action to address adjustments accordingly.

Explanation of Shortage

Escrow shortage notifications indicate a gap in the funds required for property-related expenses. Such shortages often arise from changes in property taxes, which may increase due to local government assessments in municipalities like San Francisco or Los Angeles. Additional factors include fluctuations in homeowner's insurance premiums, with average costs reaching around $1,500 annually, and any unexpected expenses related to property maintenance or improvements. These shortfalls can lead to a lack of adequate funding to cover upcoming mortgage insurance or tax payments, potentially resulting in penalties or late fees. Notably, effective communication from the escrow company, such as through a detailed written notice, ensures homeowners remain informed about their financial obligations and the rationale behind any changes in their escrow accounts.

Payment Instructions

Escrow shortages can lead to issues with property tax and insurance payments, particularly in mortgage agreements. Homeowners may receive notifications from lenders regarding underfunded escrow accounts that require attention. For instance, a shortage of $500 in an escrow account for property taxes can result in increased monthly payments for the following year to cover the deficit. The lender will often provide payment instructions outlining how to rectify the shortage, specifying methods such as direct bank transfers or checks. Clear communication is essential in these notifications to ensure homeowners understand the urgency and process for resolving the escrow issues.

Contact Information for Assistance

Escrow shortages often arise when property taxes or insurance premiums increase beyond estimates, leading to potential funding gaps in mortgage accounts. Homeowners should expect notifications detailing current escrow balances, upcoming payment adjustments, and necessary actions needed to resolve shortages. For assistance, it's essential to provide clear contact information, including customer service numbers, dedicated email addresses, and office hours, ensuring homeowners can easily reach knowledgeable representatives. Addressing these concerns promptly can help maintain continuous payment schedules, avoid potential penalties, and ensure the protection of the property.

Comments