Are you looking to establish your income source for a loan application, rental agreement, or another important financial transaction? A verification of income source letter can streamline the process and provide potential landlords or lenders with the assurance they need. This straightforward document outlines your earnings, ensuring clarity and transparency in your financial situation. Ready to learn how to craft a compelling letter that meets all the requirements? Keep reading for our step-by-step guide!

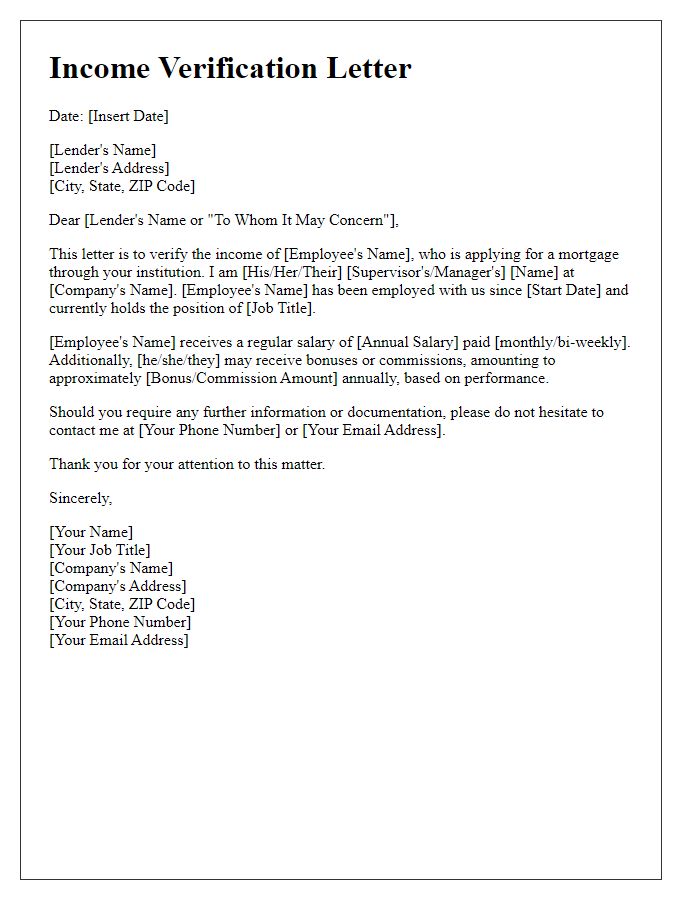

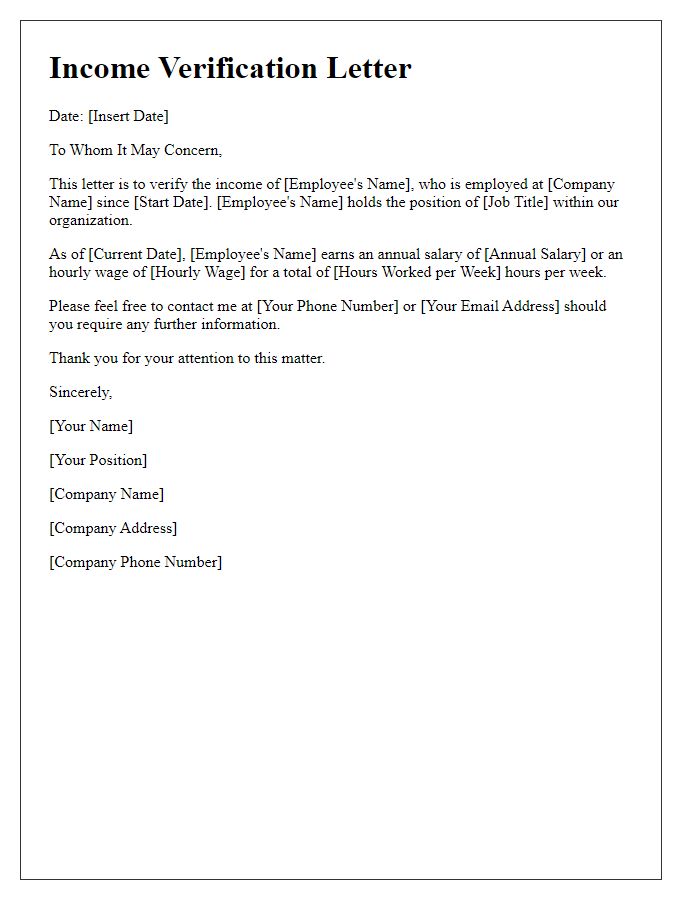

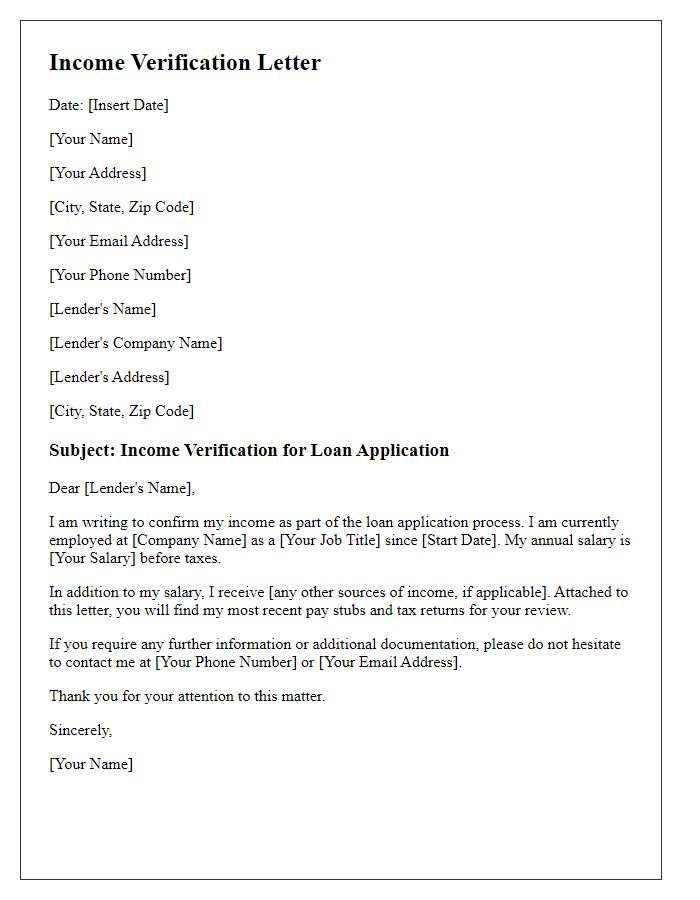

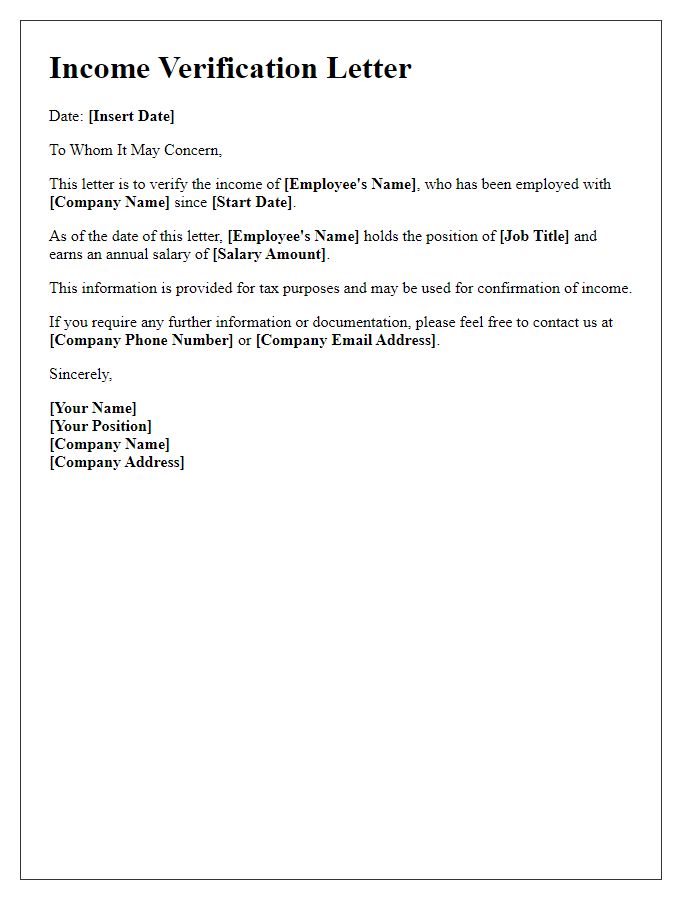

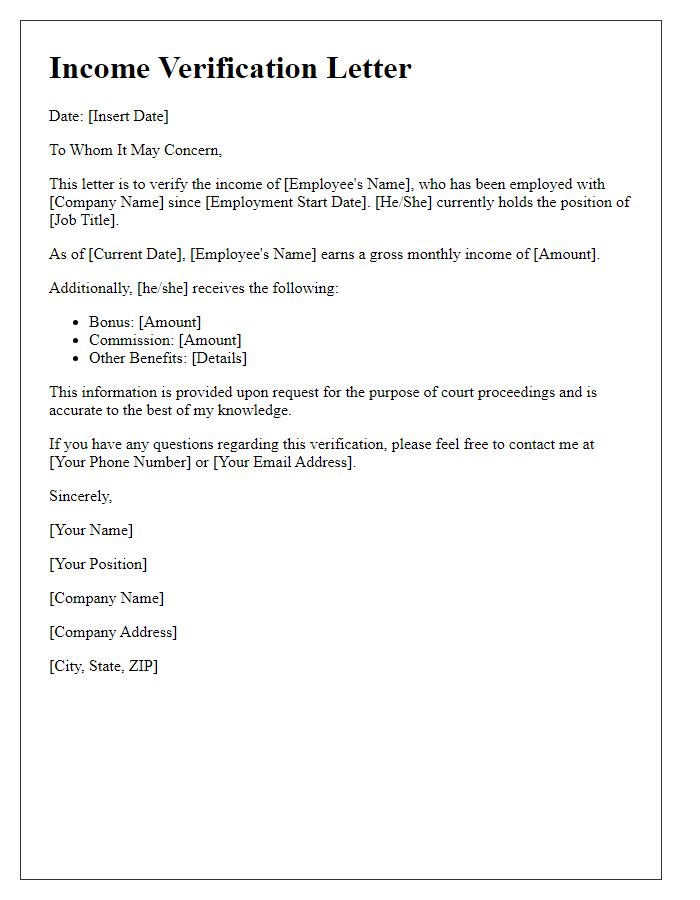

Header and Contact Information

Verification of income sources is crucial for various financial processes, such as loan applications or rental agreements. A verification letter typically includes essential details such as the letterhead from the employer (Company Name, Address, Phone Number) which authenticates the document. The date of issuance, positioned at the top, establishes the timeline of the verification process, ensuring that it aligns with current standards. The recipient's details should follow, including their name and address, which is relevant for targeted communication. Additionally, including the sender's title along with their signature can enhance the credibility of the letter and confirm the source of the income, which may pertain to salaries, bonuses, or other compensations recorded in the employer's financial documents.

Introduction and Purpose Statement

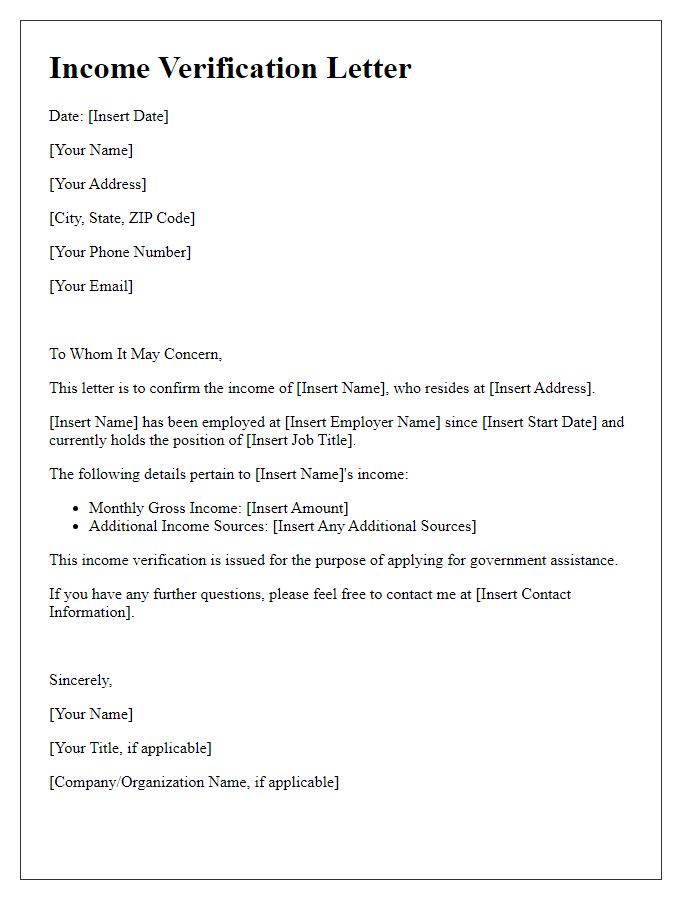

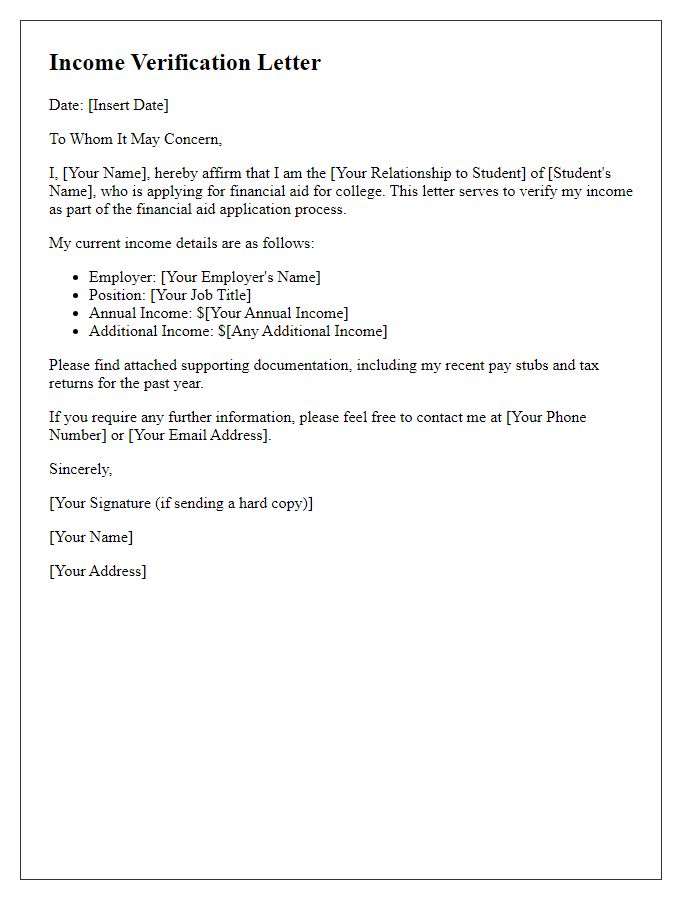

A verification of income source is a crucial document often required by financial institutions, landlords, and government entities to confirm a person's financial stability and capability to fulfill monetary obligations. This document serves to attest to the recurring income of an individual, detailing specific elements such as employment status, salary figures, and duration of employment. Various entities, including employers, banks, and regulatory agencies, utilize this verification process to ensure that applicants meet financial criteria for loans, rental agreements, and assistance programs. The accuracy and authenticity of the information provided are vital, as they form the basis for financial decisions impacting both parties involved.

Detailed Income Information

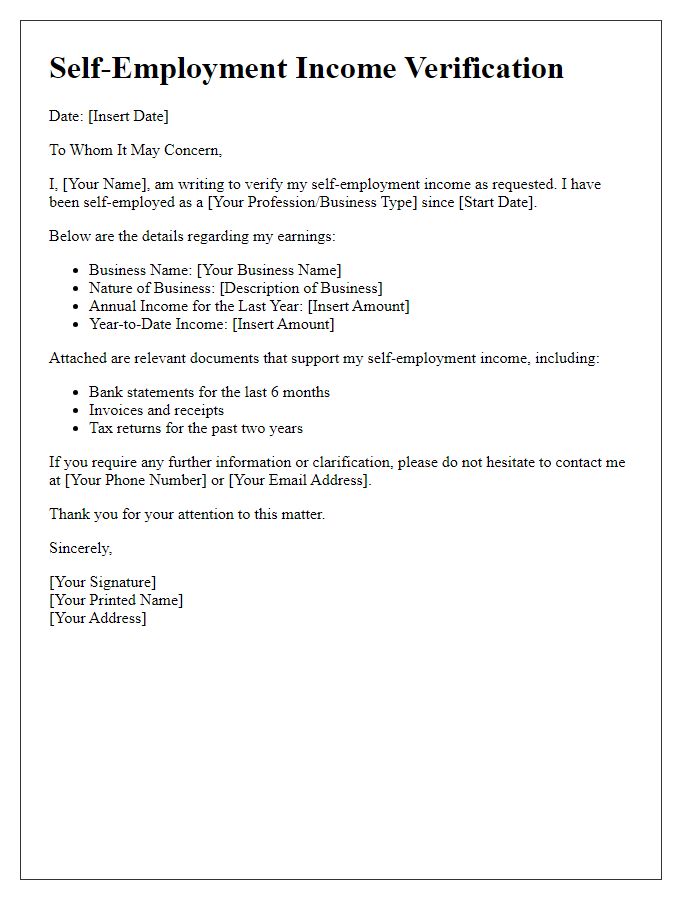

Verification of income source involves thorough documentation across various income streams, such as salaries, bonuses, and rental income. For employees, tax documents like W-2 forms from previous years (such as 2022) provide a clear indication of annual earnings, while pay stubs dated within the last month reflect current salary levels. Self-employed individuals can present profit and loss statements alongside two years of tax returns to substantiate their income. Rental income verification typically includes lease agreements, recent bank statements for deposit records, and proof of property ownership to confirm the consistent cash flow. All these elements contribute to a comprehensive overview of a person's financial stability, crucial for processes like mortgage applications or loan assessments.

Employer or Institution Verification

An official verification of income source document from an employer or institution serves to confirm an individual's earnings for purposes such as loan applications or rental agreements. Employers must include specific details, such as employee name, position held, employment start date, and annual salary figures, typically expressed in USD. Institutions like banks or educational organizations should provide similar verification including account details or scholarship amounts disbursed. The letter should be printed on company letterhead and signed by an authorized representative, completing necessary details for authenticity. Verification documents are essential for validating financial stability and credibility in financial transactions.

Closing and Signature

Verification of income source documents often require a formal closing statement that reinforces the credibility of the information provided. The closing statement should highlight the importance of the verification process and express willingness to provide further assistance or details if needed. A signature at the end serves to authenticate the document, normally accompanying the position title, organization name, and date for complete identification. Such verification plays a crucial role in financial transactions, housing applications, or loan approvals, ensuring all income sources are legitimate, reliable, and accurately represented.

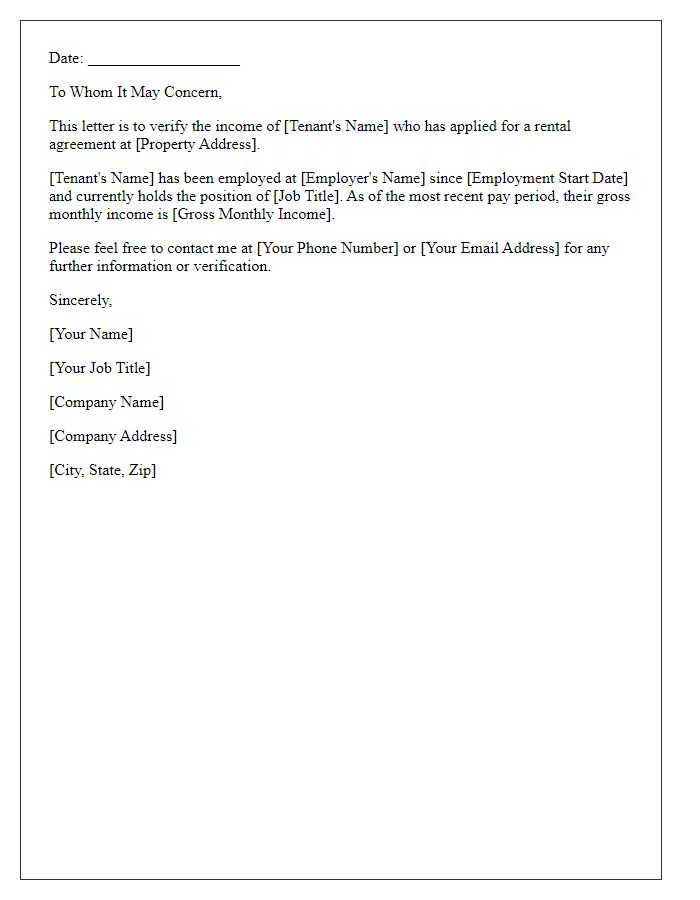

Letter Template For Verification Of Income Source Samples

Letter template of personal income verification for mortgage underwriting

Comments