Are you looking for an incredible opportunity to maximize your savings? Our exclusive promotional interest rate offer could be just what you need to give your finances a boost. With competitive rates designed to help your hard-earned money work even harder, you won't want to miss out on the benefits. Dive in and discover how this fantastic offer can enhance your financial futureâread more below!

Personalized Salutation

Promotional interest rates can significantly impact savings accounts or loan offers, such as 0.5% to 3% higher than standard rates. For specific financial institutions, these limited-time promotions often entice new customers in competitive markets like New York City or Los Angeles. Personal finance expert recommendations suggest comparing terms at multiple banks or credit unions to maximize returns on deposits or minimize costs on borrowing. Additionally, understanding how these promotional rates will transition after the introductory period is crucial for long-term financial planning.

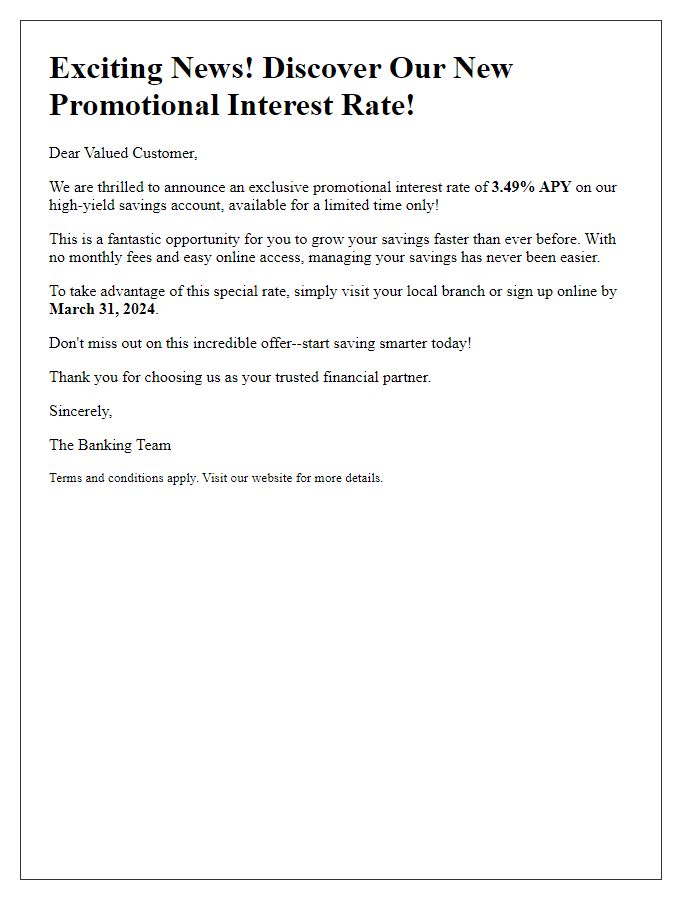

Clear and Engaging Opening Statement

Promotional interest rates can significantly boost savings and lower borrowing costs for customers seeking financial flexibility. For example, many banks offer limited-time rates around 3.5% APR (Annual Percentage Rate) on savings accounts or special promotions on personal loans, making it an ideal time for individuals to maximize their financial growth or reduce debt. Customers in metropolitan areas, such as New York City or Los Angeles, may find competitive offers that can lead to substantial savings over time, especially in high-demand markets where interest rates fluctuate. Customers should compare these enticing offers and evaluate the potential benefits to their financial portfolios.

Detailed Breakdown of Promotional Offer

Promotional interest rate offers can significantly impact personal finance management, particularly in the realm of mortgages or credit cards. For example, a limited-time promotional rate of 2.5% APR (Annual Percentage Rate) is offered on new home loans for the first year, providing substantial savings compared to standard rates averaging 4.5% during this period. This offer, available from major banks like Bank of America or Wells Fargo, applies to loans of up to $500,000, enabling homeowners to reduce monthly payments substantially. Additionally, no origination fees or prepayment penalties enhance the appeal, making it easier for borrowers to switch lenders or pay off loans early without financial repercussions. Eligibility criteria typically require a credit score above 700 and a debt-to-income ratio below 40%, ensuring that qualified applicants take advantage of these favorable conditions while positioning themselves for long-term financial benefits in fluctuating market environments.

Compelling Call-to-Action

Promotional interest rates attract consumers looking for better financial options, particularly in competitive banking environments. A compelling call-to-action encourages potential customers to seize limited-time offers, enhancing engagement. Banks often highlight specific percentages, such as 2.5% annual percentage rate (APR) for savings accounts or 1.9% APR for balance transfer credit cards, emphasizing potential savings over time. Prominent phrases like "Act Now" or "Limited Time Offer" create urgency, compelling individuals to respond quickly. Utilizing targeted marketing channels, such as email campaigns or social media advertisements, maximizes reach, ensuring the message resonates with audience demographics. The emphasis on financial empowerment through better rates can lead to increased conversions and customer loyalty.

Contact Information and Disclaimers

Promotional interest rates can entice customers looking to make investments or consolidate debt. Typically, financial institutions offer these rates for a limited time, often ranging from 0% to 5%, applicable to products like personal loans, credit cards, or mortgages. Consumers should be aware of terms such as the promotional period duration, which can last from 6 to 24 months, and potential fees associated with the service, including balance transfer fees up to 3% of the transferred amount. Additionally, the standard interest rate reverts after the promotional period ends, which can significantly increase monthly payments. Contact details for customer service, such as a phone number or email, should be clearly stated for inquiries, while disclaimers offering transparency on eligibility criteria, credit checks, and other legal conditions must be present to ensure compliance and customer understanding.

Comments