Are you facing the daunting task of filing a utilities lien against a property? Understanding the ins and outs of this process can be tough, but it's essential for protecting your interests and ensuring you receive what you're owed. In this article, we'll walk you through a comprehensive letter template that simplifies the process, allowing you to communicate effectively with property owners and relevant authorities. Join us as we explore the key points and best practices to make your lien filing smooth and successful!

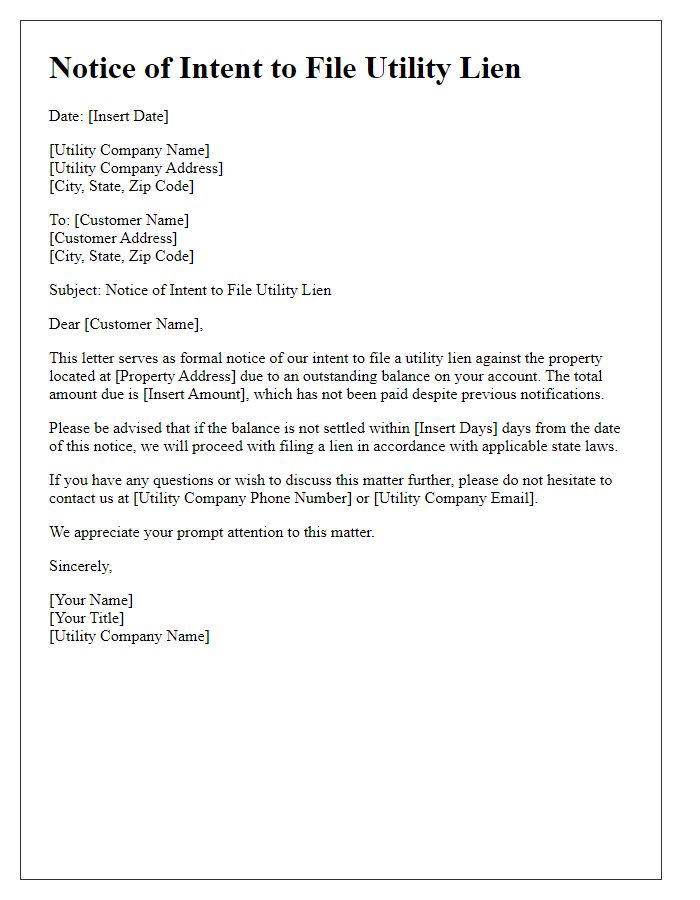

Legal Compliance Requirements

Utilities liens can legally attach to a property when charges for services provided, such as electricity, water, or gas, remain unpaid. In many jurisdictions, requirements for filing a utility lien include sending a formal notice of the delinquency to the property owner, which typically must be done within a specific timeframe, often 30 to 60 days from the date of non-payment. The notice should include critical details such as account numbers, service addresses, and the total overdue amount. Following the notice, utilities may file a lien with the local county recorder's office, where the property is located, which formally documents the claim against the real estate. The lien may also require exact legal descriptions of the property involved alongside compliance with local codes, which can vary significantly across states, including pertinent laws like California's Civil Code Section 8800 et seq. Additionally, lienholders should be aware of the property owner's right to dispute the lien in a court if they believe it is unjustified or improperly filed. Ensuring adherence to these legal requirements is essential for utilities in preserving their claims against properties and facilitating potential recoveries.

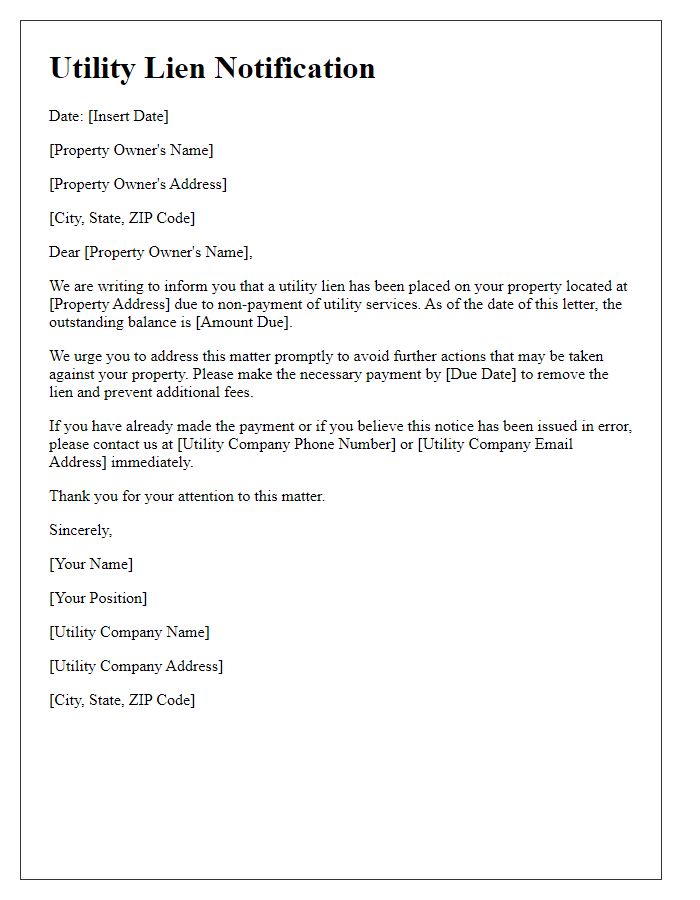

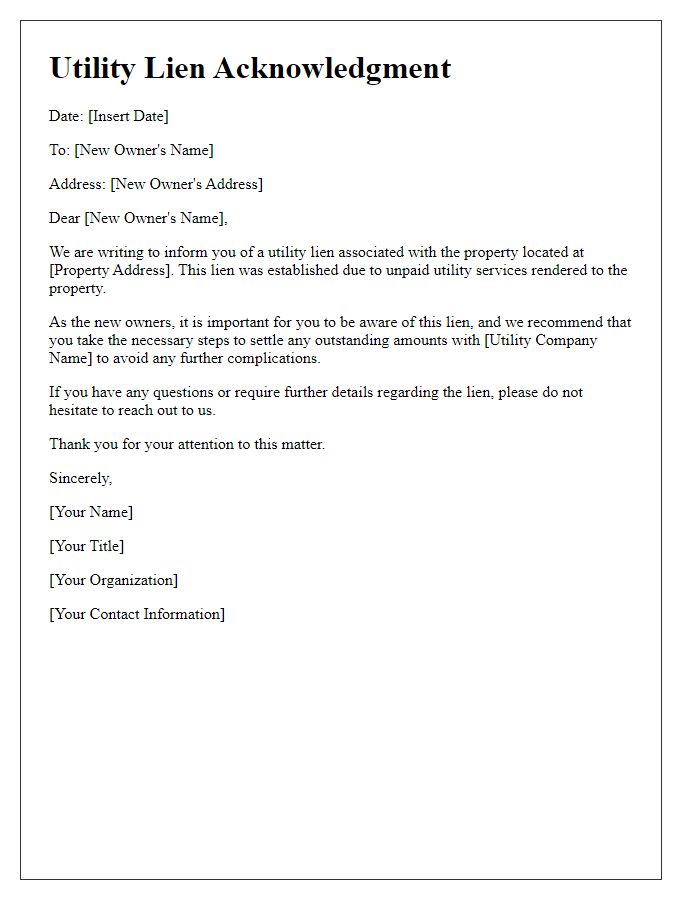

Precise Property and Owner Details

Utilities liens can occur when property owners fail to pay for essential services such as water, gas, or electricity. Properties (often residential or commercial real estate) located in municipalities (like San Francisco, New York City) can be affected by such liens if dues remain unpaid beyond a specific time frame, often 30 to 90 days. The property owner (individual or corporation) facing the lien must be accurately identified, including full name and address, to ensure legal documentation is correctly processed. Lien amounts may vary, reflecting unpaid bills, service charges, and sometimes attorney fees, potentially reaching thousands of dollars. Utility providers, such as local water authorities or energy companies, can initiate the lien process, resulting in public record filings that ultimately could impact property titles and sales. A precise understanding of local laws regarding lien enforcement is crucial for relevant authorities and property owners.

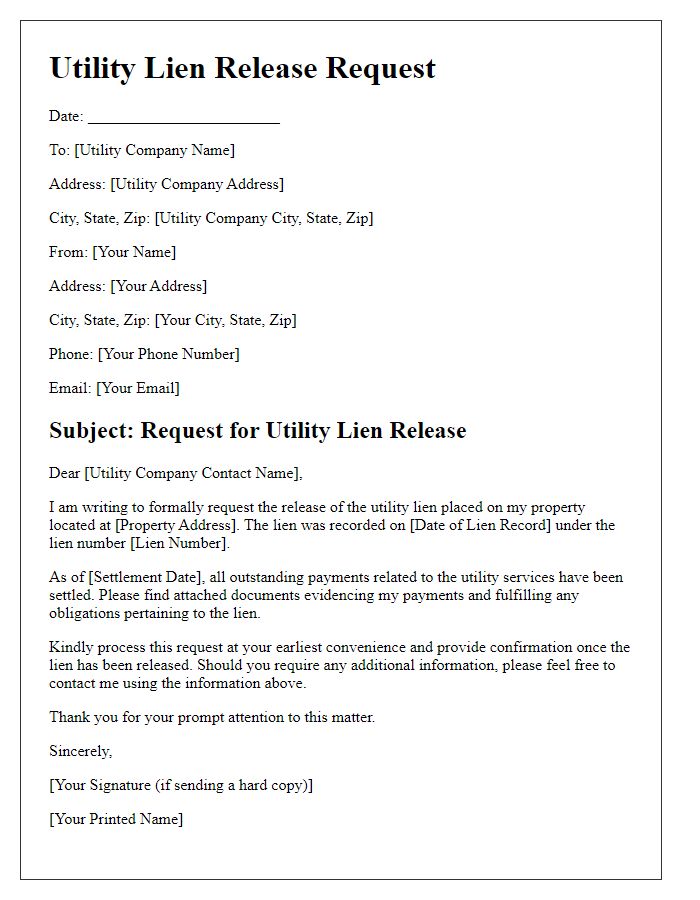

Specific Lien Amount and Justification

A utilities lien against property can arise when unpaid bills accumulate for essential services such as water, gas, or electricity. For instance, in a residential property located in Phoenix, Arizona, a homeowner may incur a specific lien amount due to an outstanding water service bill totaling $2,500, which remains unsettled after multiple notices. Justification for this lien stems from the failure to remit payment outlined in service agreements, where utility providers maintain the right to secure debts incurred for service provision. The filed lien would then establish priority in the claim against the property, ensuring that any future sale or refinancing addresses this outstanding balance, thereby allowing the utility company to recover owed amounts from the property proceeds.

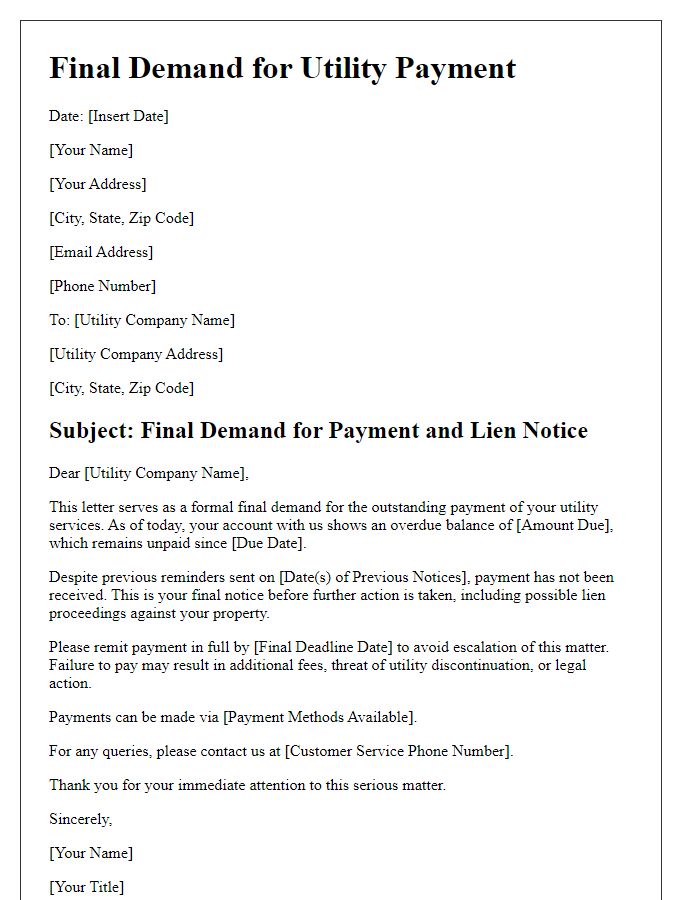

Clear Payment Instructions and Deadline

A utilities lien against property can impose significant financial repercussions for homeowners if payment is not made in accordance with municipal regulations. Timely payment of outstanding utility bills is crucial to prevent the filing of a lien, which can arise from unpaid amounts exceeding $100 within specific timeframes, often 30 to 60 days. Property owners must ensure their accounts are settled to avoid complications with local authorities, particularly in regions like Los Angeles, which strictly enforce lien regulations. Clear payment instructions typically include accepted payment methods such as credit cards, electronic funds transfers, or in-person payments at designated city offices. A mandated deadline for payment, often noted at 15 or 30 days after notification, provides homeowners with a finite window to resolve outstanding dues before a lien is officially recorded. Failure to comply can lead to property seizure or forced sales, necessitating immediate attention to any outstanding balance.

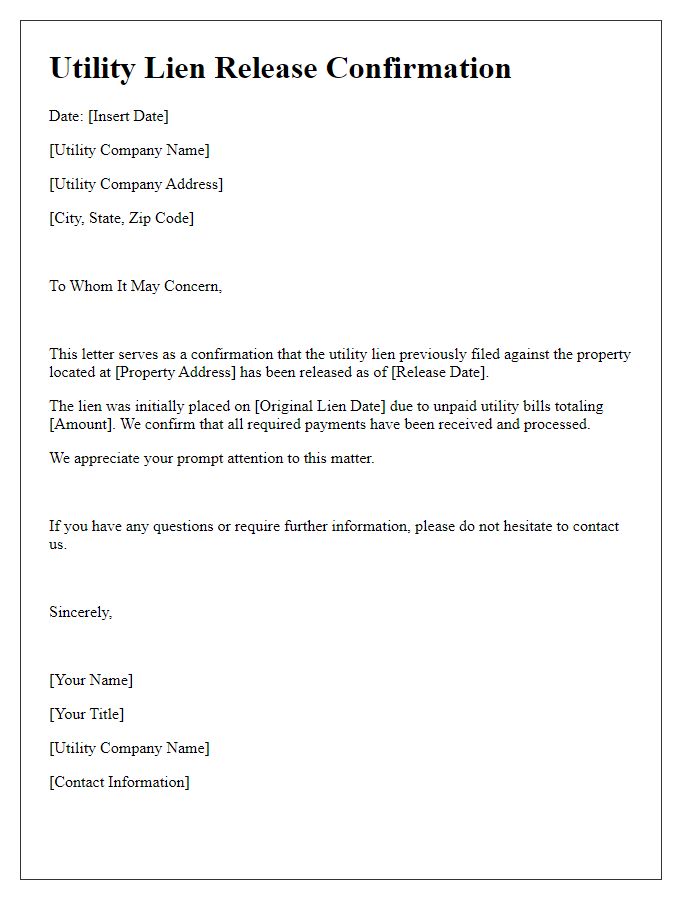

Contact Information for Dispute or Inquiry

A utilities lien arises when an unpaid utility bill leads to a legal claim against a property, including residential or commercial real estate. Property owners may face significant penalties, including foreclosure, if disputes are not addressed promptly. Communication with utility providers (like electricity, water, or gas companies) is critical for resolving issues. Accurate contact information such as relevant phone numbers (often available on the utility's official website), email addresses for customer service, and physical addresses of local offices can facilitate quicker resolutions. Documentation such as invoices and previous correspondence should be gathered for reference during disputes, ensuring that the property owner is well-prepared for discussions regarding the lien status. Legal consequences may escalate if this matter is neglected, possibly involving local government entities or third-party collection agencies.

Comments