Are you curious about how to effectively analyze your escrow account? Understanding the ins and outs of escrow accounts can save you time and money in the long run. In this article, we'll explore the essential components of a thorough escrow account analysis and how it can impact your financial planning. So, buckle up and read on to discover valuable insights that can enhance your financial decision-making!

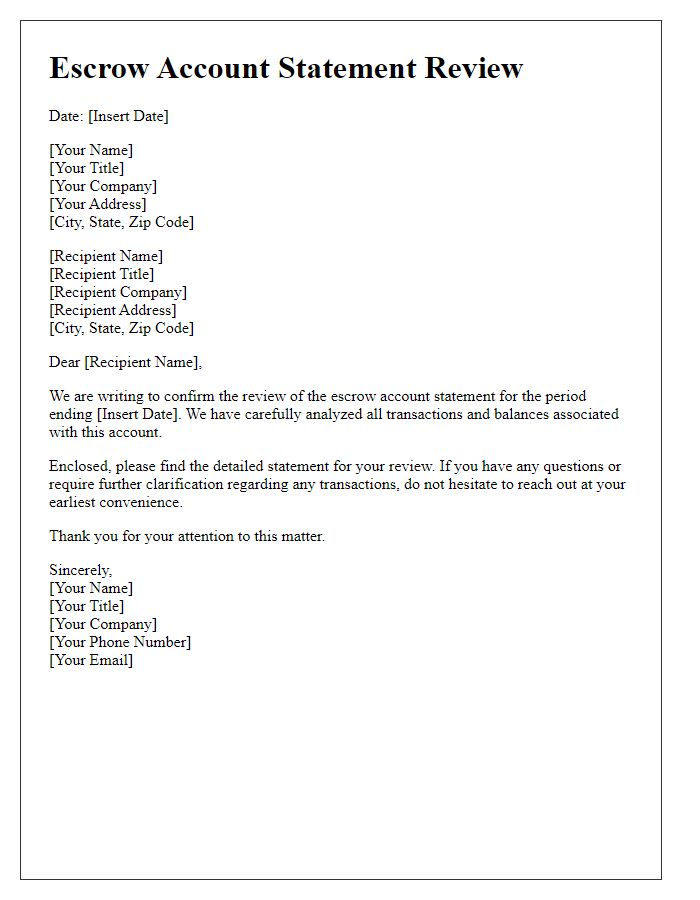

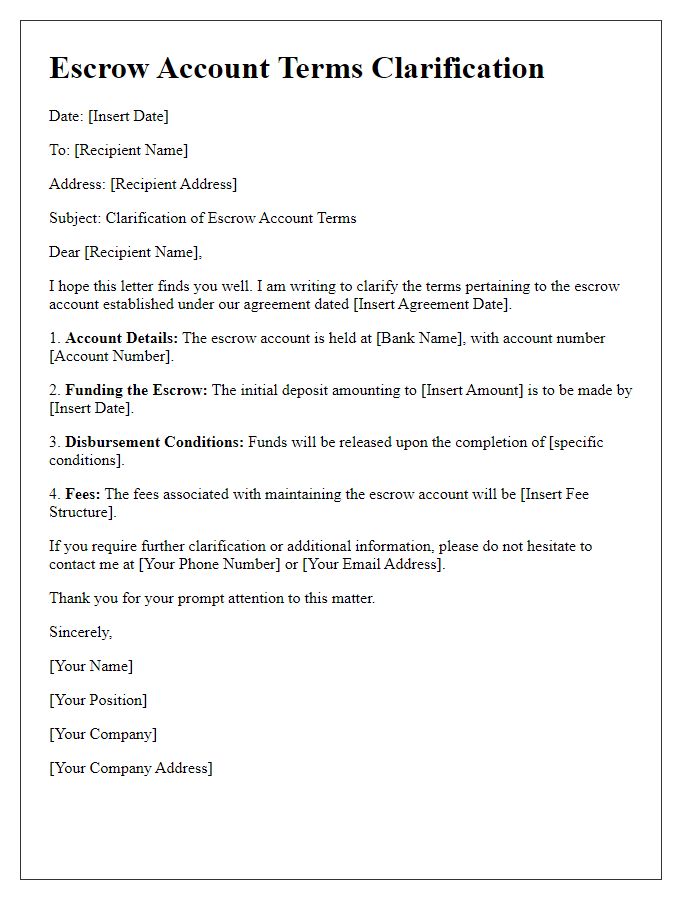

Clear Purpose Statement

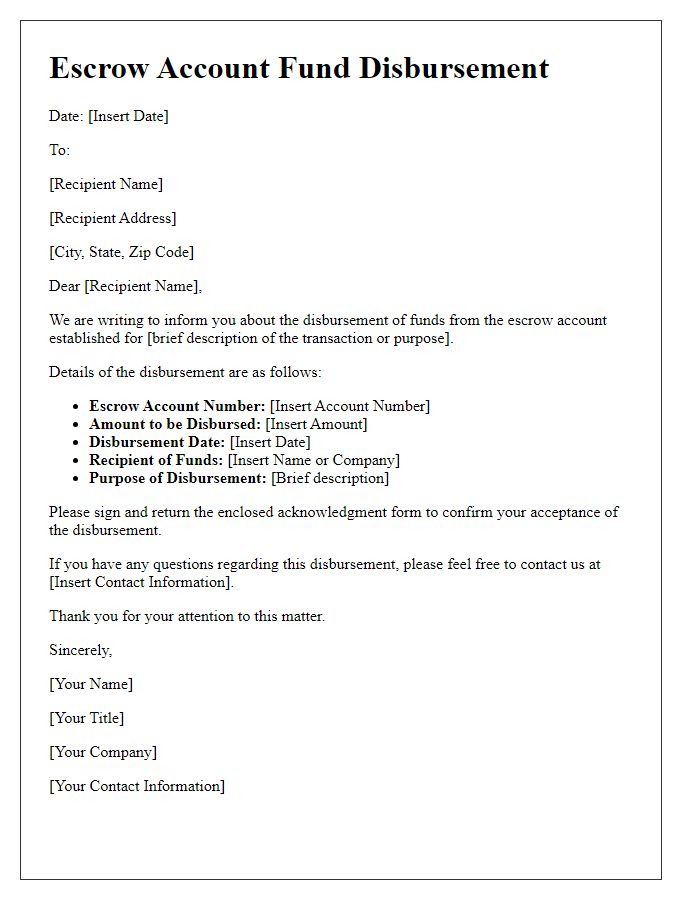

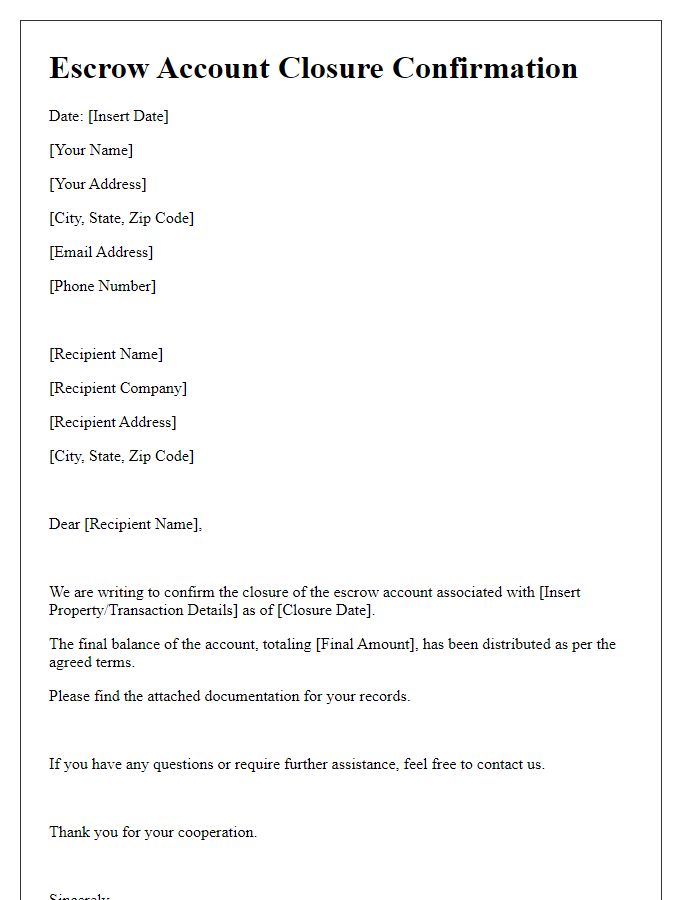

An escrow account analysis serves to ensure accurate management of funds held in trust during transactions, such as real estate purchases or legal settlements. This financial review examines the account's balance (typically ranging from thousands to millions of dollars), disbursements made (including property taxes, insurance premiums, and maintenance fees), and the timing of these transactions over a specified period (usually annually). The examination aims to prevent misappropriation of funds, assess compliance with contractual agreements, and verify the sufficiency of reserves to cover future obligations. Any discrepancies identified might lead to adjustments or further investigation. Analyzing these factors is crucial in maintaining transparency and accountability within the escrow process.

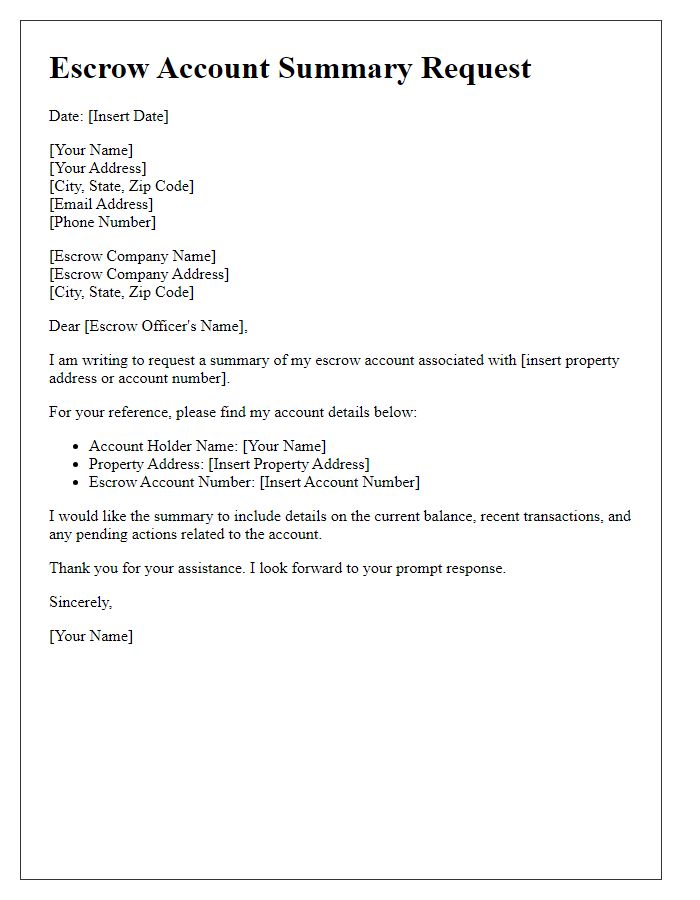

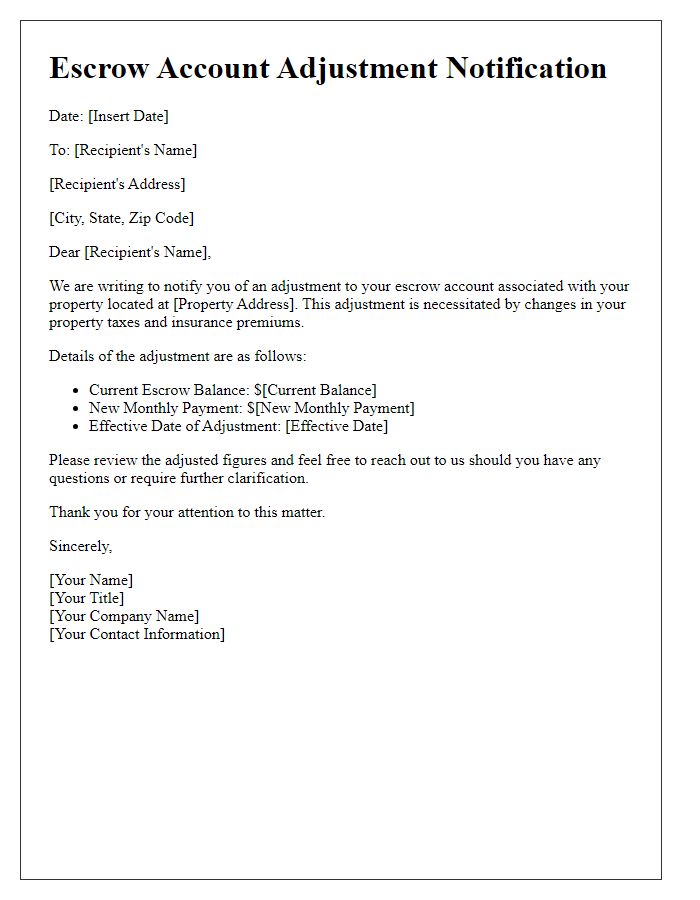

Account Details

An escrow account serves as a financial arrangement where a third party holds funds or assets on behalf of two parties involved in a transaction, typically real estate. This specialized account, often managed by a title company or an attorney, ensures that essential costs like property taxes, homeowners insurance, and mortgage payments are paid on time. The account accumulates funds collected monthly, with escrow analysis conducted annually to adjust for changes in property taxes or insurance premiums. Any surplus or deficiency identified during this analysis influences future monthly contributions, impacting the overall financial planning of the property owner. Maintaining an accurate record of these account details fosters transparency and financial accountability throughout the escrow process.

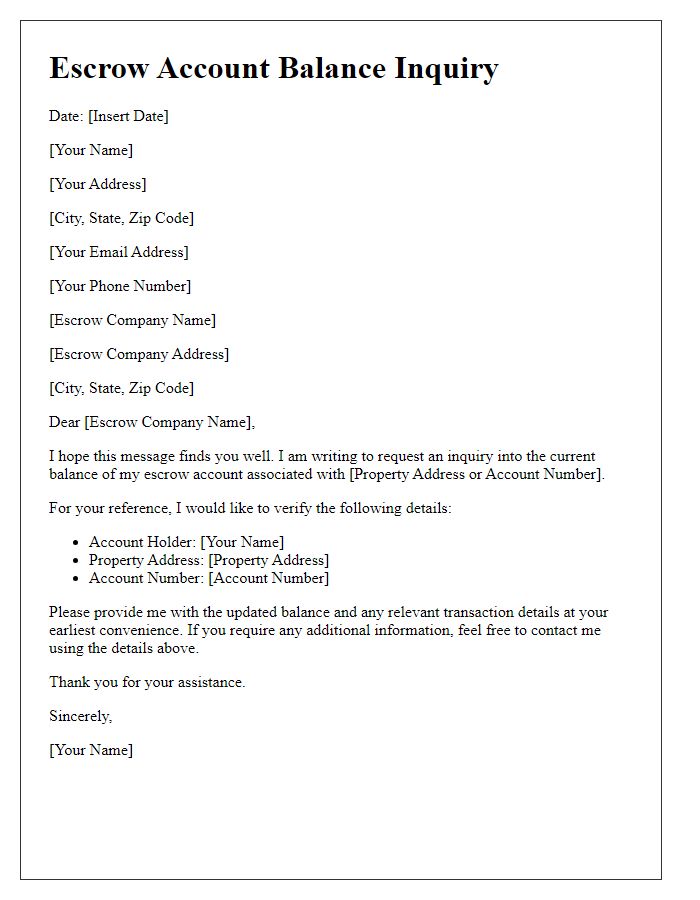

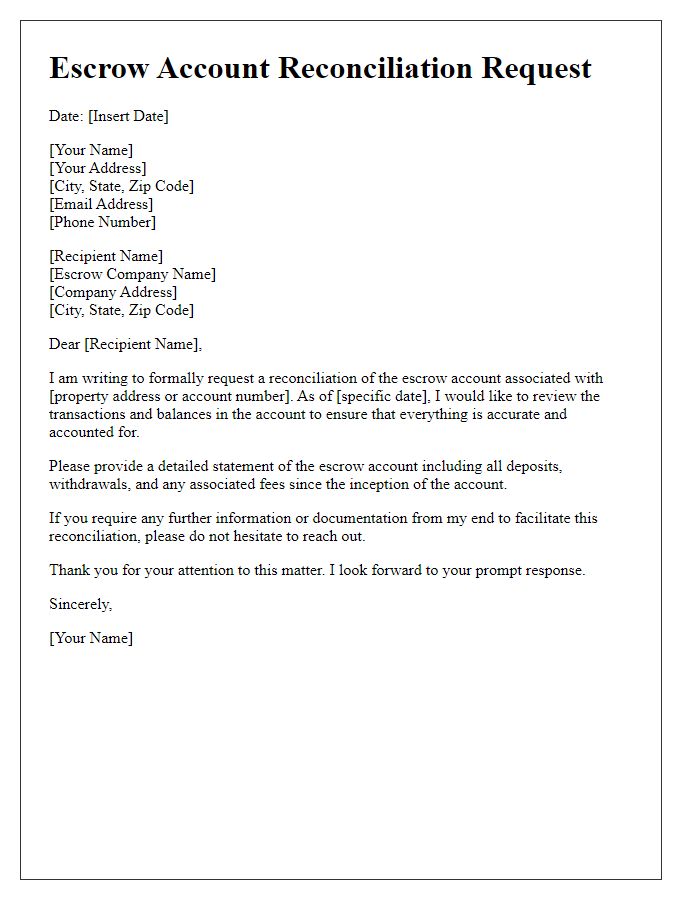

Transaction Summary

The escrow account analysis focuses on the transaction summary regarding real estate transactions. This detailed summary provides essential information about the buyer, seller, and the property in question, such as the purchase price (often several hundred thousand dollars), dates of the transaction (typically between January 1 and December 31 for a specific tax year), and deposit amounts held in escrow (generally 1-3% of the purchase price). Additional details include the escrow period (which may last from 30 to 90 days), any associated fees (such as title insurance and inspection costs averaging from $500 to $2,000), and the specific escrow company involved (for example, First American Title Company in California). Comprehensive analysis of these factors ensures transparency and trust between parties in real estate transactions, facilitating a smooth process to close the sale successfully.

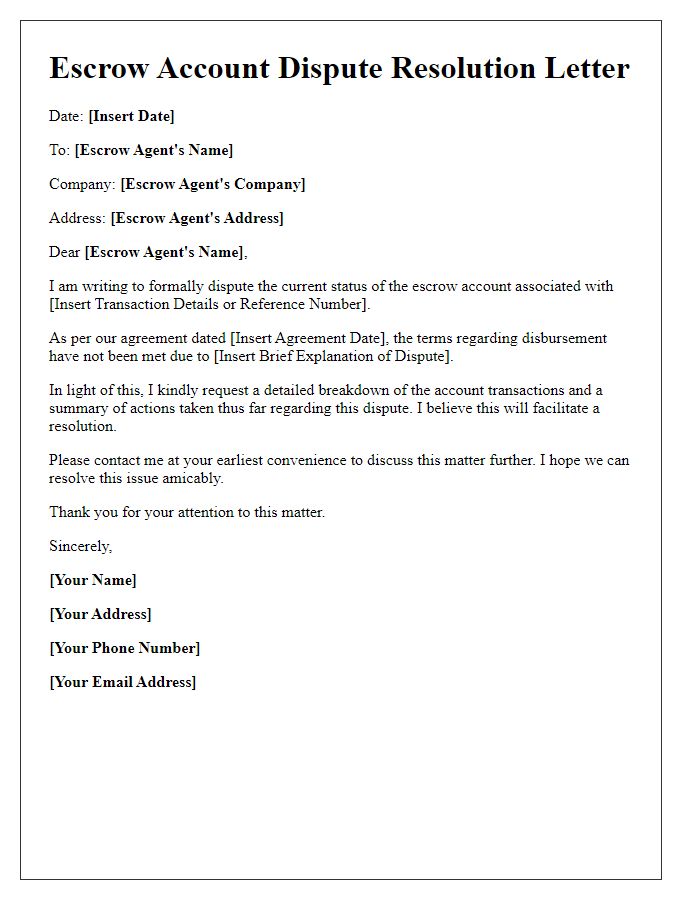

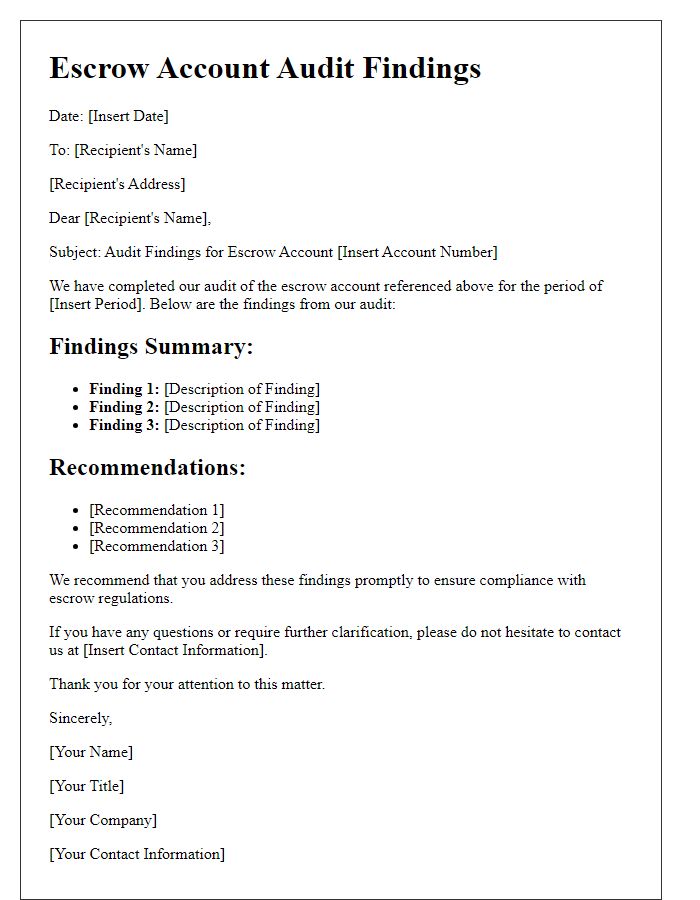

Compliance and Regulations

Escrow accounts, utilized in real estate transactions or legal settlements, require meticulous analysis for compliance with regulations set by authorities such as the Consumer Financial Protection Bureau (CFPB) and state-specific agencies. Regular audits examine critical elements including fund disbursement timelines, interest accrual (often mandated at specific rates), and record-keeping practices, ensuring transparency in transactions exceeding millions of dollars. Key compliance frameworks like the Real Estate Settlement Procedures Act (RESPA) outline necessary disclosures to consumers, safeguarding against potential violations. Any discrepancies in account management can lead to fines or legal challenges, emphasizing the importance of adherence to established protocols through comprehensive evaluations conducted quarterly or annually.

Contact Information

Escrow accounts serve critical roles in various transactions, particularly in real estate deals and contract settlements. These accounts, held by a neutral third party, facilitate the secure holding of funds until all conditions of an agreement are met. For instance, in a typical home purchase transaction in California, a buyer might deposit an earnest money amount, often ranging from 1% to 3% of the home's purchase price, into the escrow account, ensuring that these funds are safeguarded until the closing process is completed. This analysis involves reviewing the account's statement, tracking disbursements, and ensuring all parties--including the buyer, seller, and escrow agent--maintain clear communication regarding financial timelines and obligations to avoid disputes. Accurate and timely account analysis ensures the smooth transition of funds and compliance with contractual obligations, ultimately supporting the integrity of the transaction.

Comments