Are you finding it challenging to keep up with your loan payments? A loan forbearance agreement might just be the solution you need to relieve some financial stress. This helpful arrangement allows you to temporarily pause or reduce your payments, giving you the breathing room to get back on your feet. If you're curious about how to draft a compelling letter to request forbearance, keep reading for a useful template and tips!

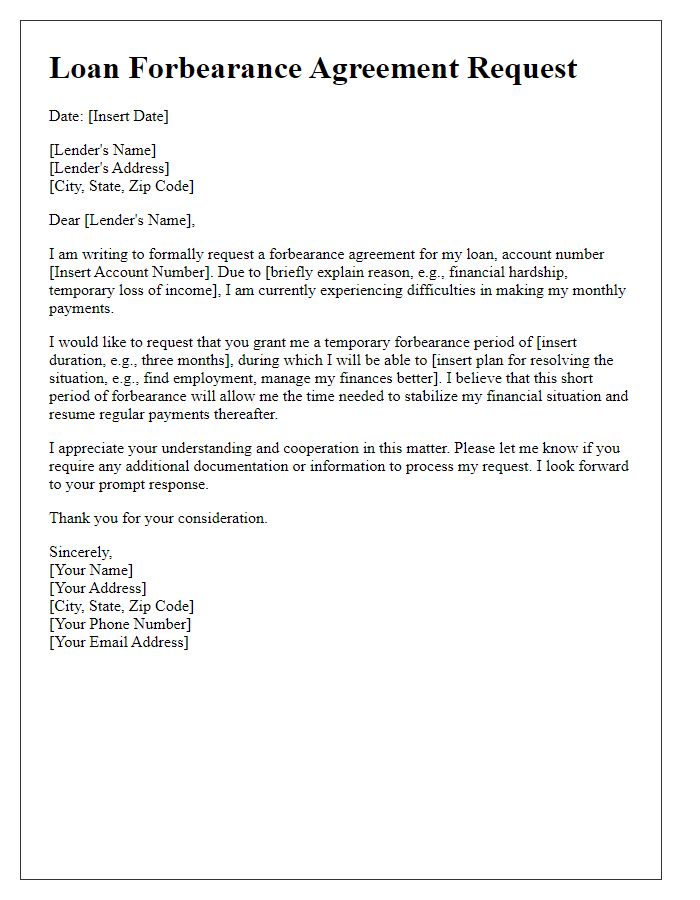

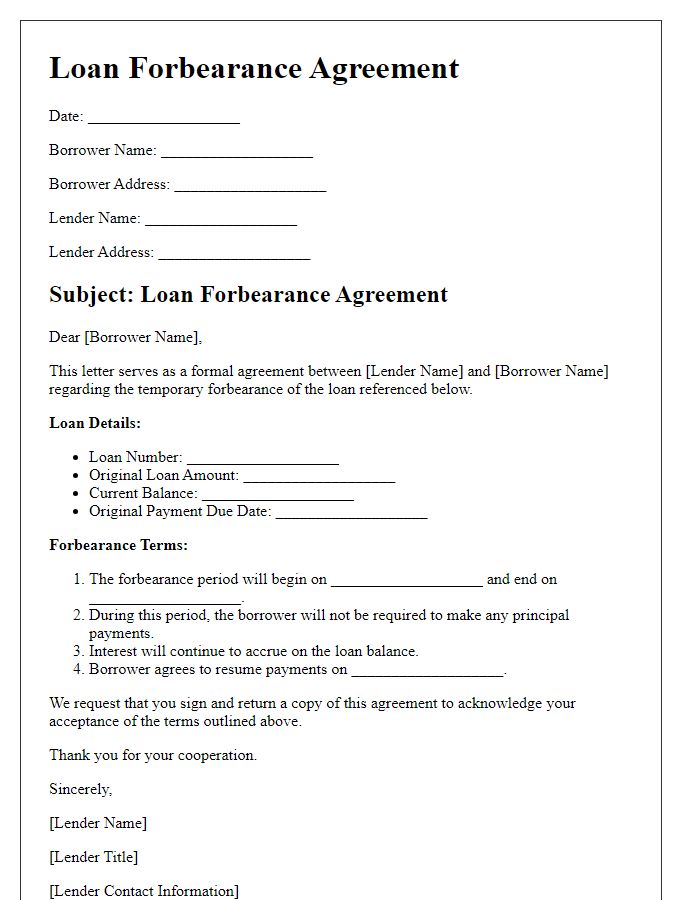

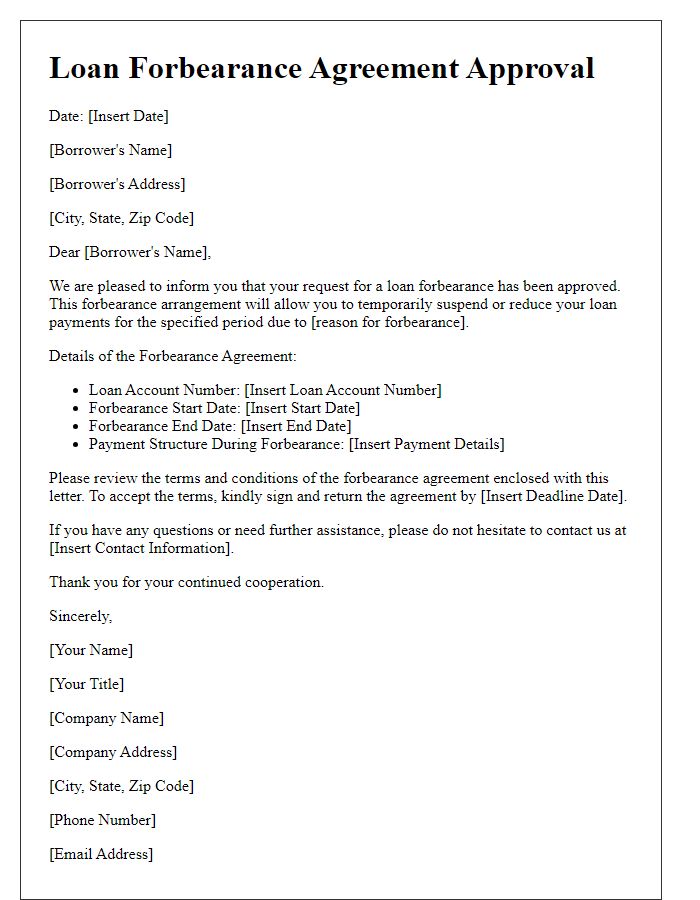

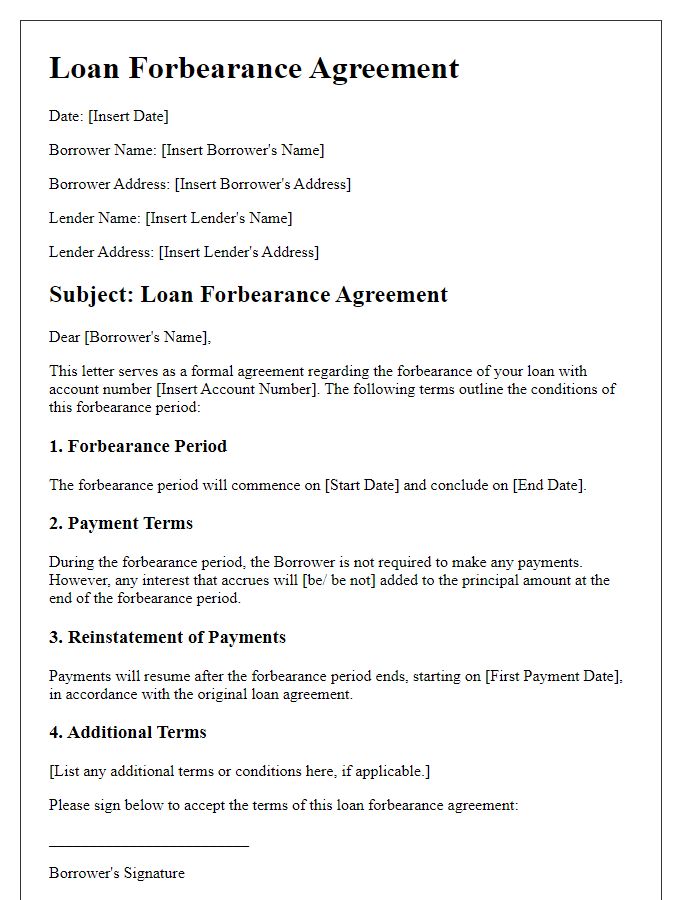

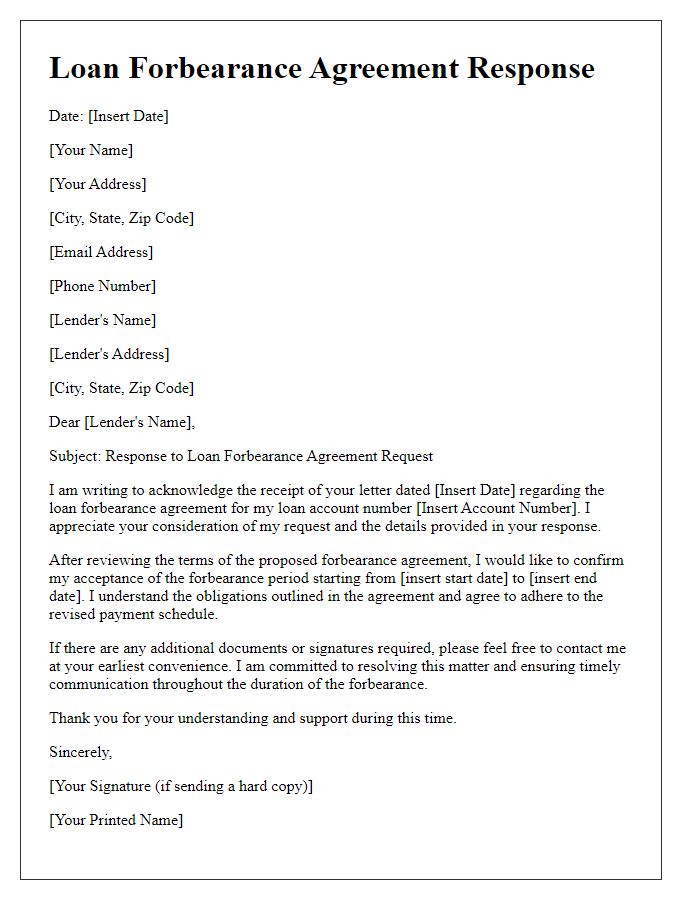

Borrower's full identification and contact information

A loan forbearance agreement is a crucial document that outlines the specific terms under which a borrower, who may be struggling financially, is allowed to temporarily postpone or reduce their loan payments. Essential information includes the borrower's full name, address, and contact information such as phone number and email address. The document must specify the loan details, including the lender's name, account number, and the specific type of loan, such as a mortgage or student loan. Dates related to the forbearance period, the amount of payment suspension, and any applicable fees or interest should be clearly defined. Additionally, this agreement might include conditions for reinstating regular payments and any potential impact on credit scores. This ensures that both parties have a mutual understanding of their roles and obligations during the forbearance period, typically lasting from 3 to 12 months, and sets a timeline for any required documentation.

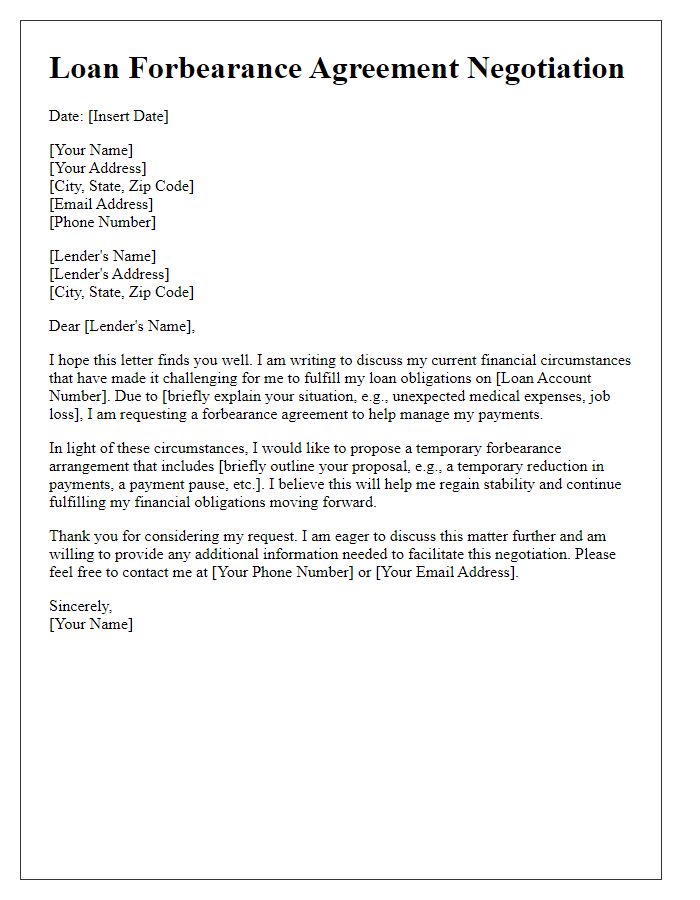

Detailed loan account information

A loan forbearance agreement is a crucial document for managing financial difficulties. It outlines the terms and conditions related to temporarily postponing or reducing loan payments. Key information should include the loan account number (unique identifier assigned by the lender), the principal amount (the original sum borrowed), interest rate (annual percentage charged on the remaining balance), monthly payment amount (the scheduled payment frequency), and due dates (the date payments are expected). Additionally, specify the type of loan (e.g., mortgage, student, personal), lender's name (the financial institution originating the loan), and borrower's details (individual or business name). Note the period of forbearance (the timeframe in which payments are adjusted), any applicable fees (charges associated with the forbearance), and the process for resuming regular payments (details on how payments will continue post-forbearance).

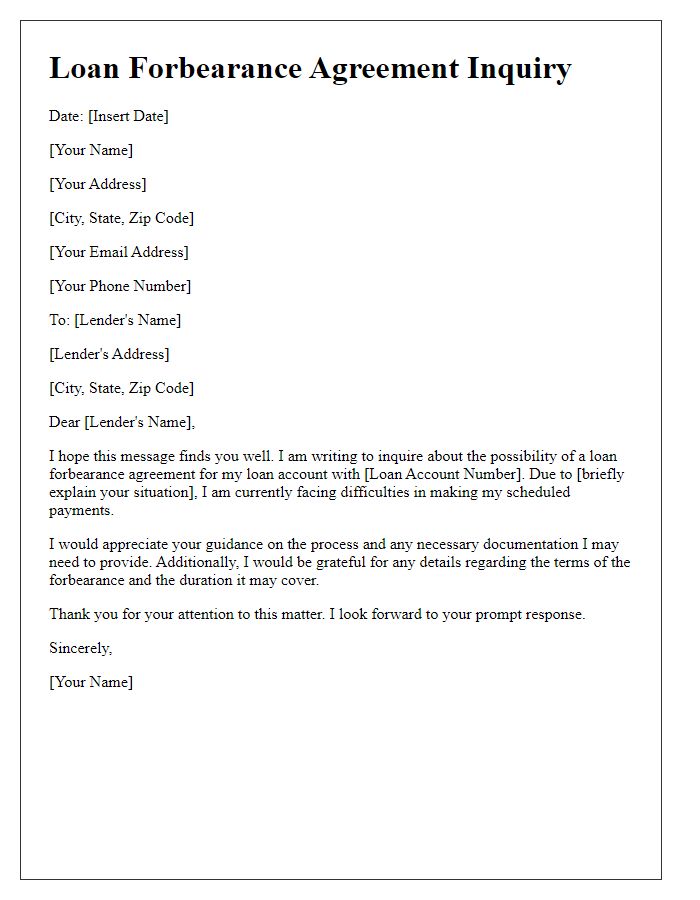

Reason for forbearance request

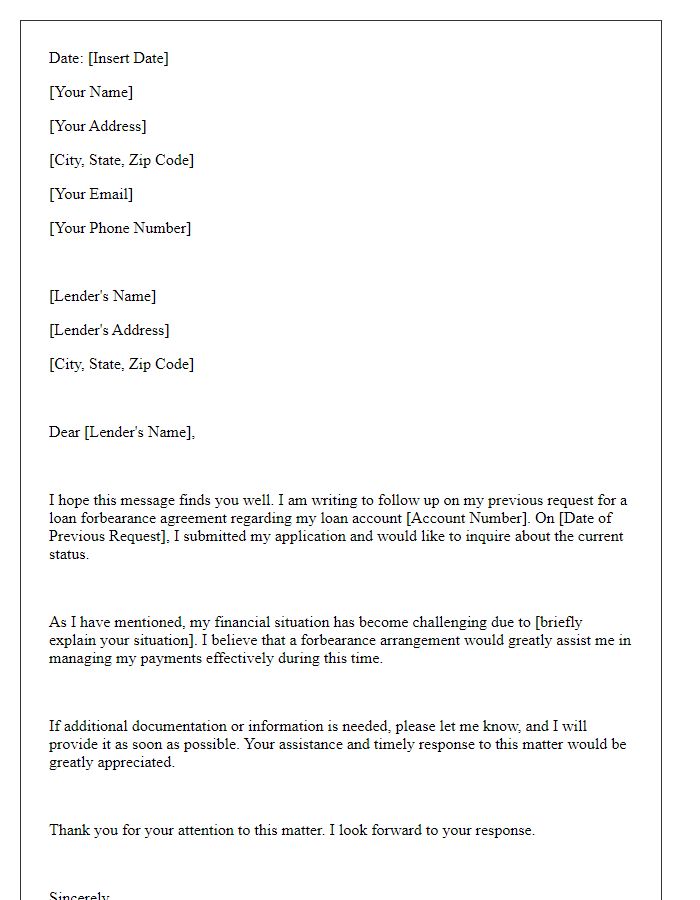

Borrowers often request forbearance agreements to manage their financial challenges. Common reasons include temporary job loss due to unforeseen events like the COVID-19 pandemic, significant medical expenses leading to financial strain, or natural disasters affecting income stability. In many cases, borrowers may also face unexpected life events such as divorce or family emergencies that disrupt their ability to make regular loan payments. Lenders typically assess the borrower's current financial situation, including income, expenses, and overall debt-to-income ratio, to determine eligibility for a forbearance agreement. Documentation may be required to support the forbearance request, such as pay stubs, bank statements, or letters from employers detailing changes in employment status. Understanding the specific terms of the forbearance agreement, such as duration and repayment options, is crucial for borrowers seeking relief during difficult financial times.

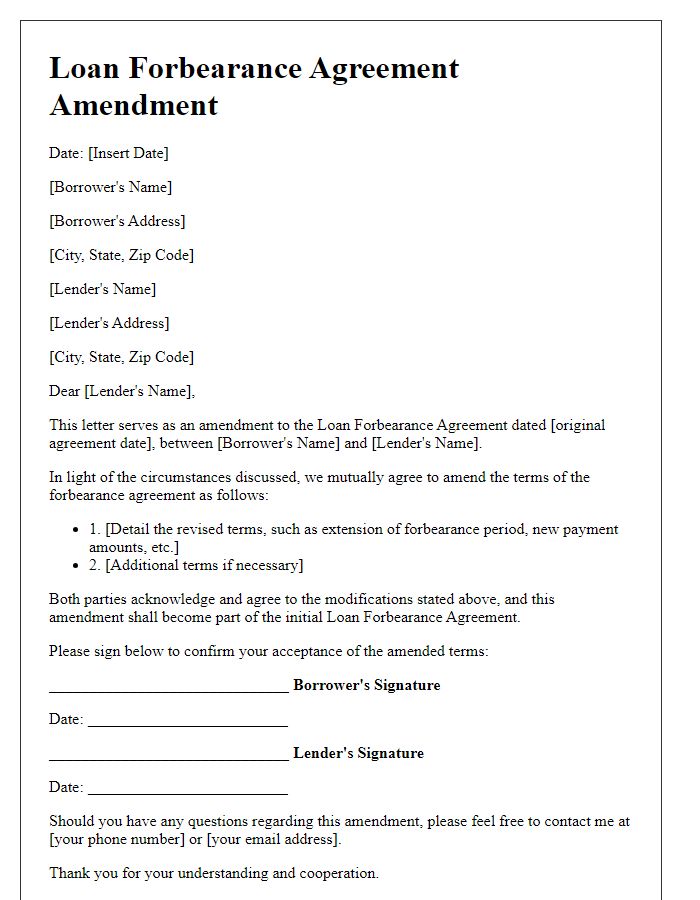

Proposed forbearance terms and timeline

Loan forbearance agreements can provide temporary relief to borrowers facing financial hardship. Common proposed forbearance terms include a suspension or reduction of monthly payments for a specific time frame, usually ranging from three to twelve months. Borrowers may agree to pay only interest or a percentage of the principal during this period. The proposed timeline should outline clear start and end dates, such as commencing on January 1, 2024, and concluding on December 31, 2024. The agreement should explain how the deferred amounts will be repaid, including options like extending the loan term or adjusting future payments after the forbearance period. Regular communication with the lender, such as monthly check-ins, ensures both parties remain informed about the borrower's financial situation throughout the forbearance duration.

Confirmation of understanding and signature space

A loan forbearance agreement represents a temporary postponement of loan payments, providing relief for borrowers facing financial hardship. This agreement typically highlights critical details, such as the duration of the forbearance period, outlined repayment terms post-forbearance, and any applicable interest accruals during this time. Borrowers and lenders must acknowledge their understanding of the terms, including specific conditions under which forbearance may be extended or terminated. A designated space for signatures ensures both parties formally agree to the outlined stipulations, reinforcing their commitment to uphold the terms set forth in this binding document.

Comments