Are you looking for the perfect way to acknowledge an early payoff? Crafting a thoughtful letter can help convey your appreciation and excitement about a customer's financial responsibility. Acknowledging an early payoff not only strengthens your relationship with your clients but also reinforces the value of trust and punctuality in financial agreements. Ready to learn how to create an impactful letter template? Let's dive in!

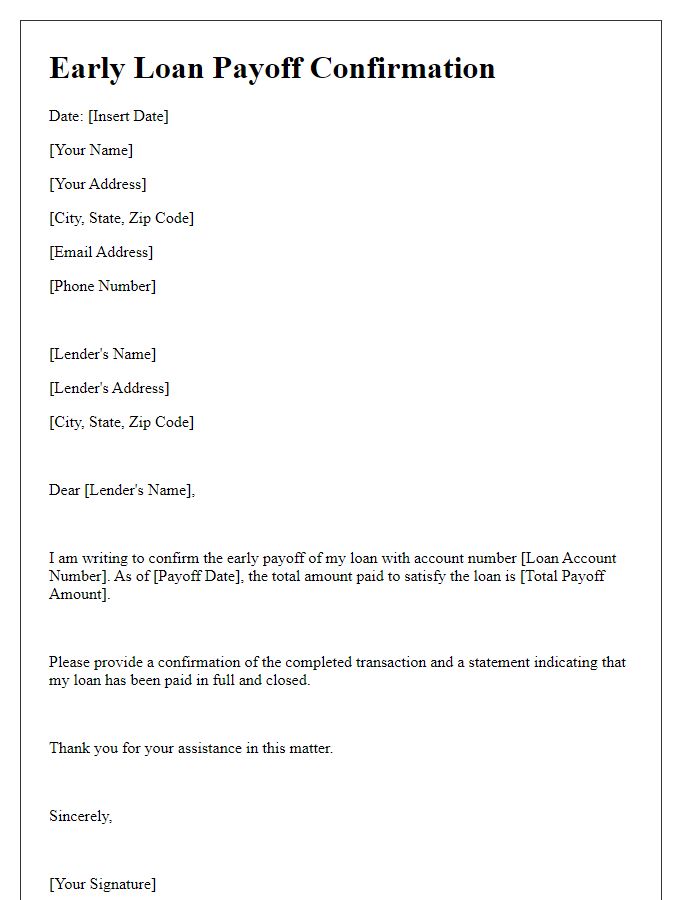

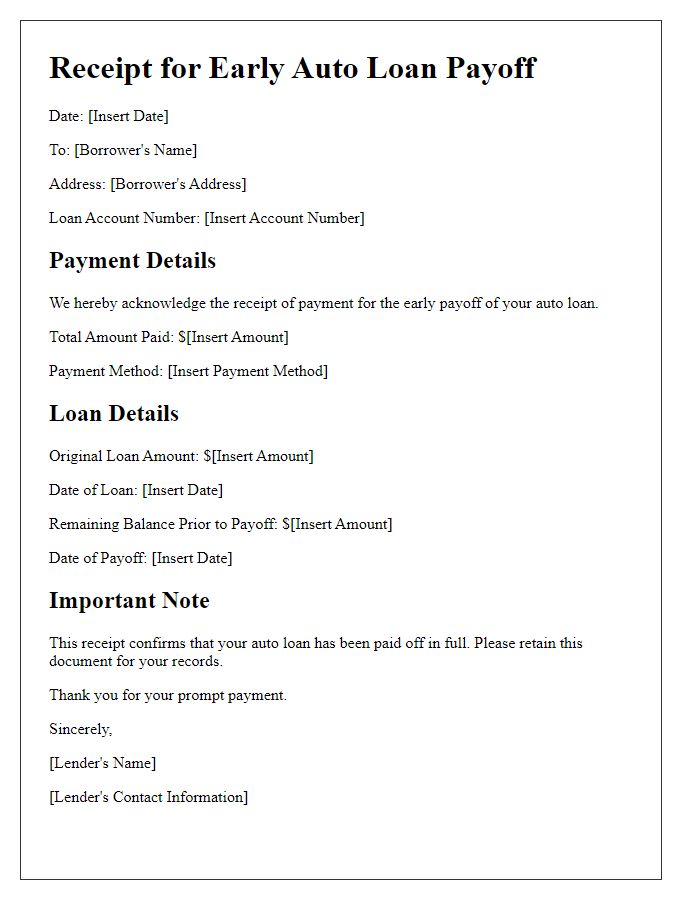

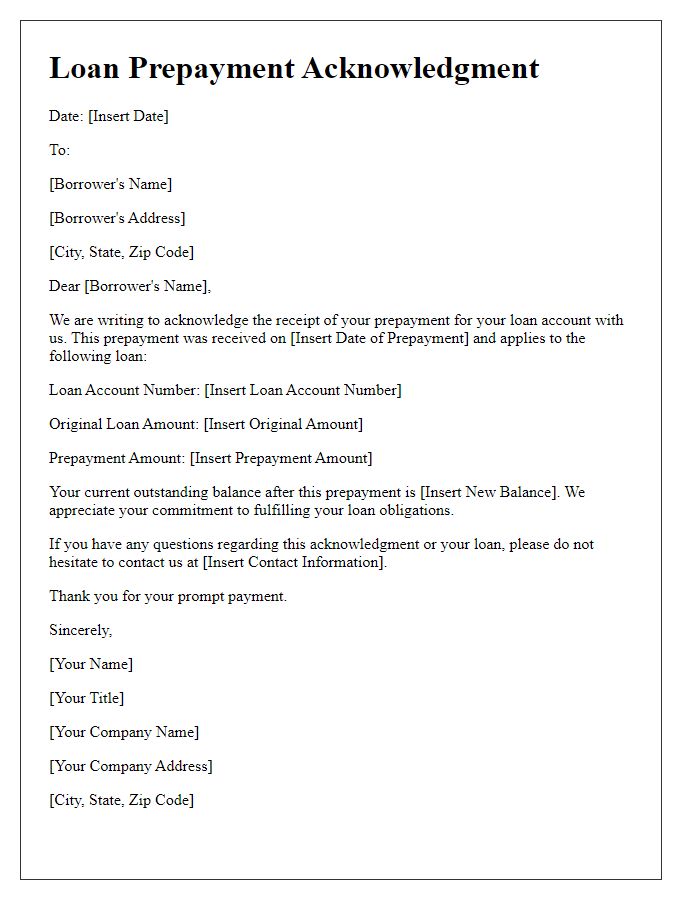

Clear Account Details

Early payoff of loans can significantly benefit borrowers, such as individuals dealing with personal or mortgage loans. Clear account details, including the loan number (usually a combination of letters and digits) and outstanding balance (often a specific amount in dollars), are crucial for processing the payoff efficiently. The payoff process may involve communication with financial institutions to confirm the remaining balance, including any applicable interest or fees, which can fluctuate based on specific terms outlined in loan agreements. Timely completion of this process can lead to a more favorable credit score, ultimately benefiting future borrowing opportunities, especially in the case of major banks like Wells Fargo or Bank of America.

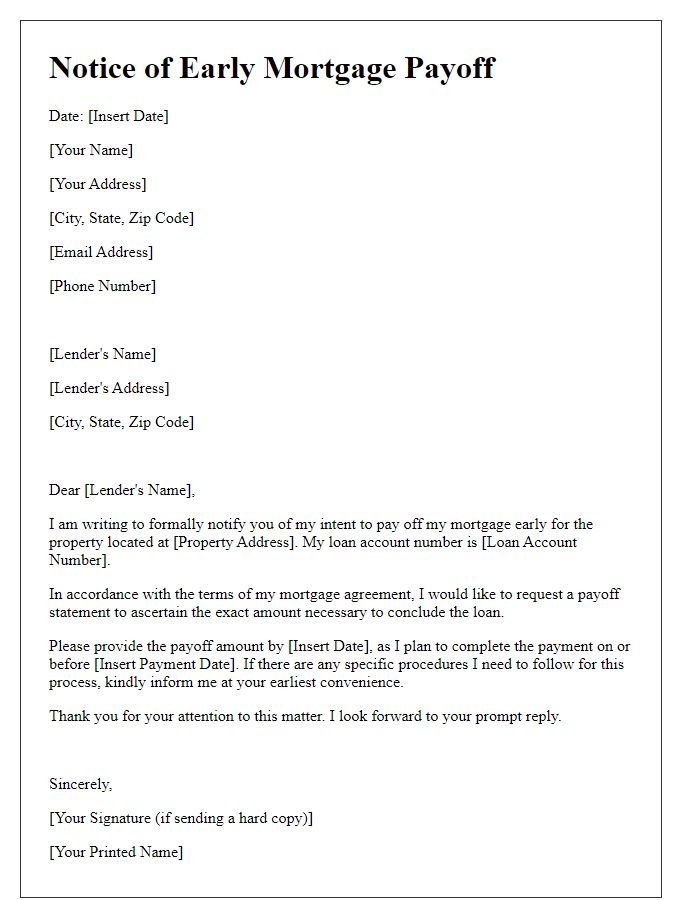

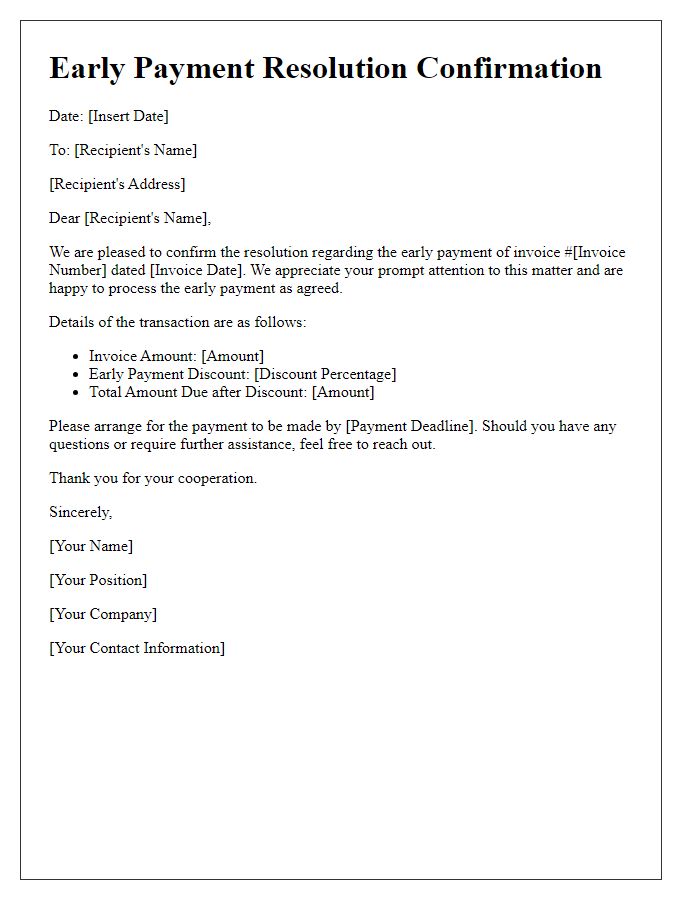

Acknowledgment of Payment Receipt

Early mortgage payoffs can significantly impact financial agreements. Receipt of a full payment (typically including principal and accrued interest) usually occurs within 30 days after the payoff date. This payment may include prepayment penalties depending on the loan terms from lenders like Bank of America or Wells Fargo. Acknowledgment letters typically specify the mortgage account number, payoff amount, and the final payment date, documenting the completion of the loan obligation. Clarity in these letters reduces confusion for both borrowers and lenders, ensuring all financial records align accurately. These documents may also serve as proof of cancellation for tax purposes, particularly in states with specific regulations regarding mortgage disclosures.

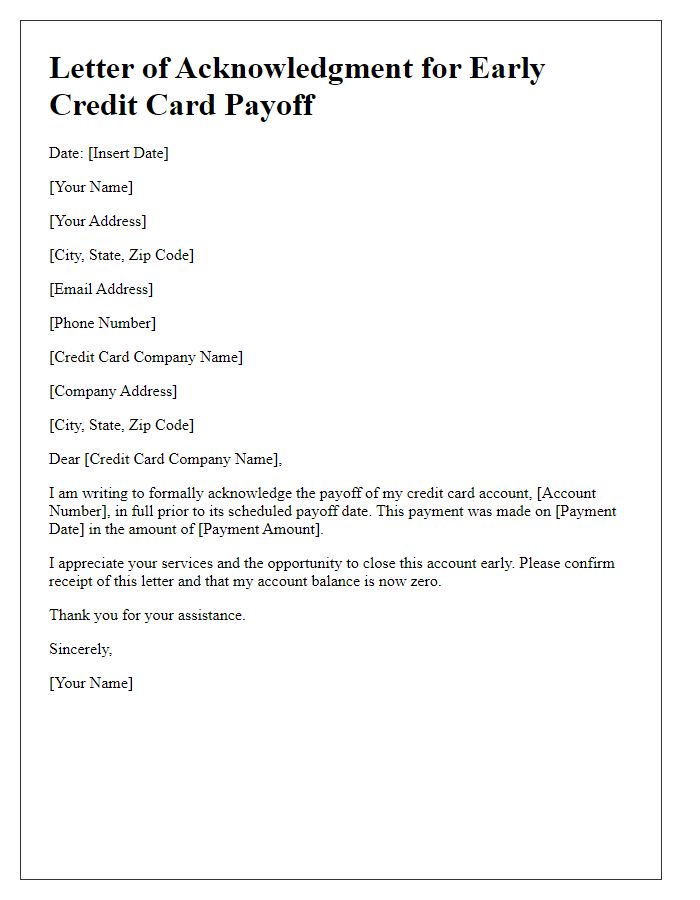

Confirmation of Fully Paid Status

Early payoff of loans, mortgages, or credit accounts signifies financial responsibility and commitment. Following the completion of payment, lenders typically issue documents confirming the fully paid status. This acknowledgment serves as an official record, which may include account details such as the principal amount, interest paid, and the date of final transaction. It is essential for borrowers to retain this statement for future reference, especially during credit checks or when applying for additional financing. Ensuring that all associated fees and conditions were satisfied provides peace of mind and strengthens creditworthiness.

Details of Overpayment or Refund (if applicable)

Early loan payoff can result in various financial adjustments, including potential overpayment or refunds. When a borrower, for example, pays off a mortgage loan with a principal balance of $250,000 before the agreed term, lenders must reassess remaining balances. If the borrower has made excess payments totaling $5,000, the lender will calculate outstanding interest accrued up to the payoff date, potentially resulting in a refund process. This procedure seeks to ensure financial transparency and accuracy in applying funds. Accurate documentation should present repayment timeline, final balance details, and any adjustments necessary for final account reconciliation.

Contact Information for Further Inquiries

Early payoff acknowledgment provides confirmation for loan settlement before the scheduled term. Lenders may include details such as loan number, payoff date, and remaining balance. A direct contact method may feature an email address and phone number for customer service representatives available Monday to Friday, 9 AM to 5 PM EST. Including a physical mailing address for documentation or formal inquiries enhances communication effectiveness, ensuring borrowers have access to complete and accurate information regarding their retired obligations.

Comments